From Sheep to Silicon: The Economic Backbone of the NZD Currency

Author:XTransfer2025.08.19NZD

The nzd currency has a special base. New Zealand’s economy used to depend a lot on sheep farming and dairy. Now, technology, services, and tourism are important for the new zealand dollar. The table below shows how the economy has changed:

|

Sector |

Percentage of GDP |

|

Agriculture, fishing, forestry, and mining |

8% |

|

Services (including tourism) |

75% |

|

Industry |

17% |

Exports are still very important for the dollar, especially farm goods. The Reserve Bank of New Zealand watches the exchange rate closely. It reacts to inflation and changes in world trade. These actions help keep the nzd steady and support its value in world markets.

Highlights

-

The New Zealand dollar (NZD) is strong because of many sectors like agriculture, technology, and tourism. Dairy and farm exports are a big part of New Zealand’s income. These exports also affect the NZD’s value a lot. The Reserve Bank of New Zealand sets interest rates. This helps keep inflation steady and supports the NZD. China is New Zealand’s biggest trading partner. So, changes in China’s economy can quickly impact the NZD. Global market trends and people’s trust also change the NZD’s exchange rate and stability.

NZD Currency and Economic Foundations

The NZD currency is the money used in New Zealand. It is very important for the country’s economy. People use it to buy and sell things. It also shows that the economy is stable. The NZD is one of the top ten traded currencies in the world. This is because New Zealand trades a lot with other countries. The value of the NZD often changes with the economy. It goes up or down when world demand or prices change.

New Zealand’s economy has a few main parts. Services are the biggest part and give most people jobs. Manufacturing and the primary sector are also important. The primary sector includes agriculture, forestry, and mining. New Zealand sells many things to other countries. Farm products, technology, and services are the main exports. The NZD stays strong because the economy is made up of many different parts.

Role of Agriculture

Agriculture is a big part of New Zealand’s economy. It gives jobs to about 15% of workers. It makes up 11% of the country’s GDP. Food and fiber make almost 80% of export money. Livestock farming, like dairy and sheep, brings in about 60% of export money. Horticulture and forestry each give about 15%. This sector helps people in rural areas. It also helps keep the NZD valuable.

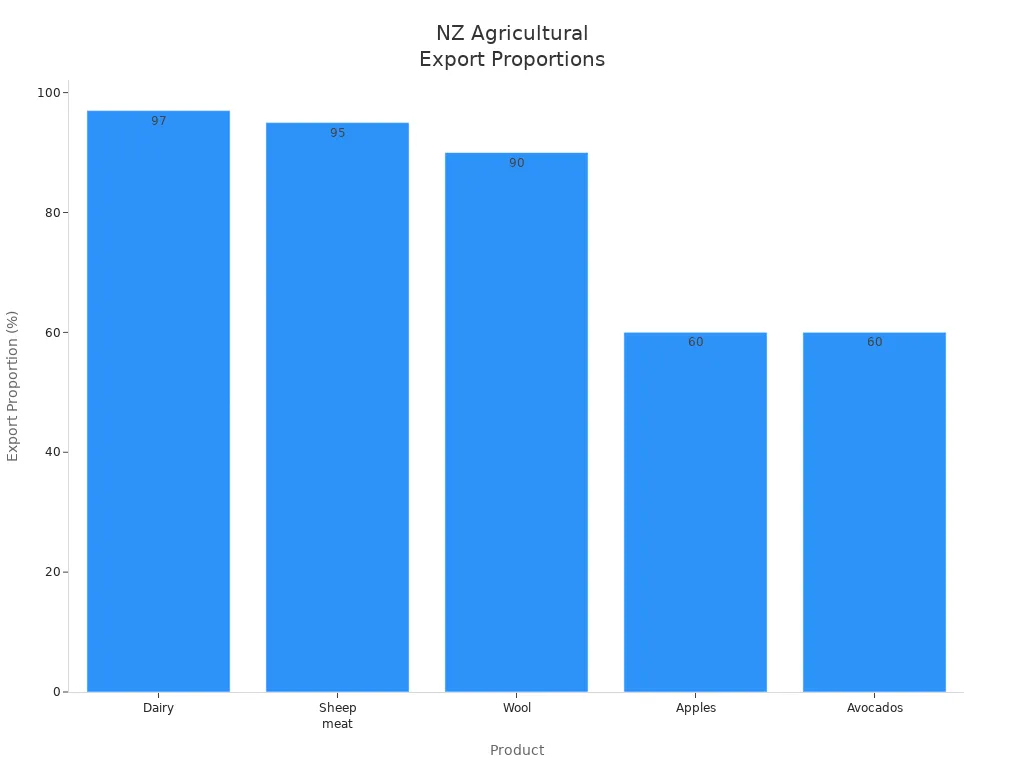

Most farm goods are sent to other countries. For example, 97% of dairy, 95% of sheep meat, and 90% of wool are exported. Kiwifruit and apples are also big exports. Over 60% of these fruits are sold overseas. The table below shows how much of each product is exported:

|

Agricultural Product |

Export Proportion |

|

Dairy |

97% |

|

Sheep meat |

95% |

|

Wool |

90% |

|

Kiwifruit |

$2,302 million |

|

Apples |

60% |

|

Avocados |

60% |

Because so much is exported, the NZD changes when world demand or prices change. If other countries buy more, the NZD gets stronger. This helps the whole economy.

Export Impact

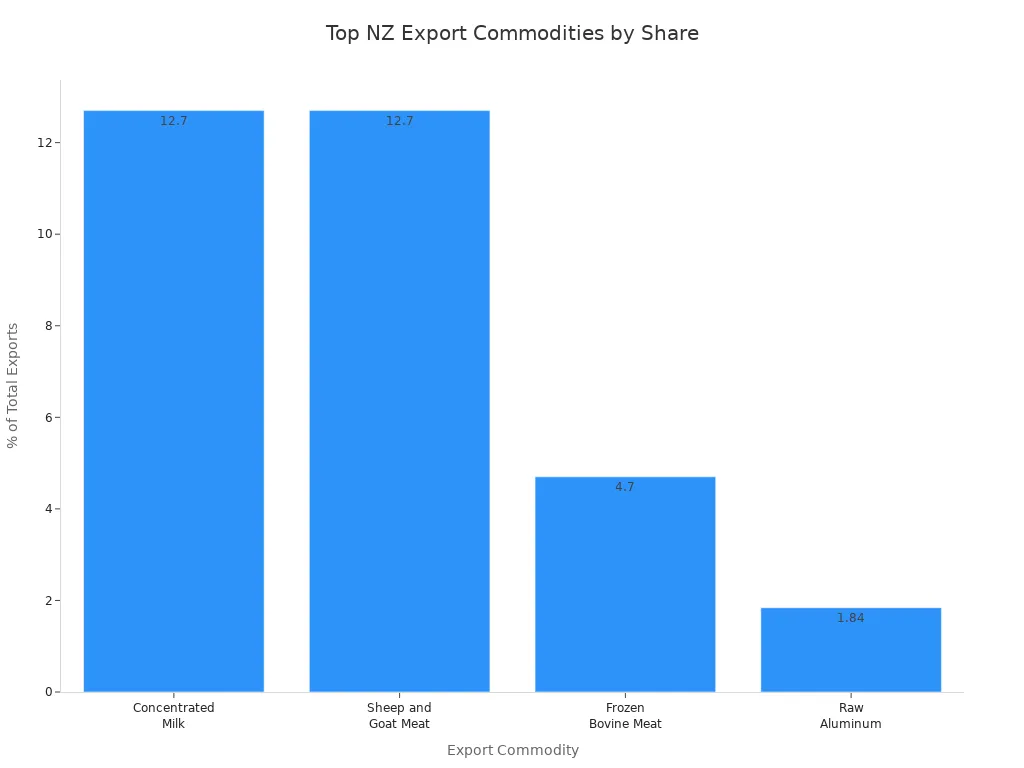

Exports are very important for the NZD and the economy. New Zealand sells many things to other countries. Farm products are the biggest exports. Dairy alone is 35% of all goods sold overseas. This is worth over US$10 billion. Other top exports are concentrated milk, sheep and goat meat, butter, rough wood, and frozen bovine meat. The table below shows how much these exports are worth:

|

Export Commodity |

Export Value (USD) |

% of Total Exports |

|

Concentrated Milk |

$5 billion |

12.7% |

|

Sheep and Goat Meat |

$2.7 billion |

12.7% |

|

Butter |

$2.6 billion |

N/A |

|

Rough Wood |

$2.5 billion |

N/A |

|

Frozen Bovine Meat |

$1.9 billion |

4.7% |

|

Raw Aluminum |

$736 million |

1.84% |

The NZD gets stronger when exports do well. This makes it cheaper to buy things from other countries. It also helps the economy grow. But if the NZD changes a lot, it can make imports cost more. This can change what businesses and shoppers do.

The NZD/USD exchange rate is about 0.5960 USD (July 2025). In the last year, the NZD went up a little. But in the last few months, it got a bit weaker. The table below shows these changes:

|

Currency Pair |

Current Rate (approx.) |

Recent Change |

12-Month Change |

Historical Context |

|

NZD/USD |

0.5960 USD |

+0.10% daily, -2.28% past month |

+0.15% past 12 months |

All-time high 1.49 USD in 1973 |

Experts think the NZD will stay about the same soon. This is because the world economy is still unsure. How well exports do will matter a lot.

Traditional Sectors of the New Zealand Dollar

Livestock and Dairy

Livestock and dairy have been important for the New Zealand dollar for many years. Dairy brings in the most money from exports. In 2011, dairy exports were about $13 billion. The next year, they grew to $14.6 billion because milk production was strong and markets were good. Whole milk powder exports grew fast and made up 37% of dairy export money. China became the biggest buyer, taking 17% of all dairy exports, or $2.1 billion. New Zealand now sells more whole milk powder to other countries than anyone else. About 31% of these exports go to China.

The livestock industry is important in New Zealand, but it makes less export money than dairy. Companies like PGG Wrightson are big in this market. The industry has had problems. There are fewer animals now, and bad weather has hurt farms. But more people want dairy cows, which helps a little. Livestock wholesaling does not add much to exports compared to dairy.

World dairy prices are very important for the NZD. When prices drop, like the 6.9% fall in July 2024, farmers get paid less. This means less export money and a weaker trade balance. A weak trade balance can make the NZD go down. When world dairy prices go up, export money grows. This makes the NZD stronger and helps the economy.

Commodity Exports

Commodity exports are still very important for the NZD. Dairy is the biggest, but meat and wool matter too. The New Zealand dollar changes fast when world demand for these goods changes. Big buyers like China and Australia buy a lot of dairy, meat, and wool. This strong demand connects the NZD’s value to how much is sold and at what price.

-

New Zealand sells more milk products to other countries than any other country.

-

Meat and wool exports also help the NZD.

-

If China and Asia do well, they buy more from New Zealand.

-

Higher interest rates in New Zealand can bring in investors and help the dollar.

Commodity prices go up and down and change the NZD over time. When world prices for dairy and farm goods rise, the NZD often gets stronger. If prices fall, the dollar can get weaker and the trade balance can suffer. Studies show that changes in farm prices explain a lot of how the NZD moves over time. The New Zealand dollar is not as affected by changes in industrial goods as the Australian dollar. This is because people always want New Zealand’s farm exports. This keeps the NZD steady even when other markets slow down.

Modern Economic Drivers

Technology and Innovation

New Zealand’s technology sector is now very important. In 2024, it made NZ$17.95 billion in revenue. This was a 7.7% increase from last year. Offshore revenue was NZ$13.52 billion and grew fast in Europe. Fintech is the top part of tech. It made NZ$2.88 billion and grew by 32% each year. Tech is now the third biggest export sector. It brings in over NZ$8.7 billion every year. This helps the nzd because software and digital services bring in foreign money.

The information and communication technology sector is also growing. In early 2025, it was worth US$19.8 billion. Cloud services, artificial intelligence, and the Internet of Things help it grow. Healthtech made NZ$3.1 billion. Software as a Service is now 8.2% of the market. Tech exports may reach NZ$14 billion by mid-2025. The government helps this sector with money and new rules. These things help the nzd by making exports more varied. This means New Zealand does not have to rely only on old sectors.

New Zealand works on advanced research like quantum science and superconductors. This creates good jobs and new ways to export. These new ideas bring in foreign investors. They help the nzd by making the economy stronger when the world changes.

-

New Zealand's tech sector revenue (2024): NZ$17.95 billion

-

Offshore revenue: NZ$13.52 billion

-

Fintech revenue: NZ$2.88 billion (32% CAGR)

-

ICT market value (2025): US$19.8 billion

-

Tech exports (2025 projection): NZ$14 billion

Tourism Sector

Tourism is still very important for the nzd and the economy. In the year ending March 2019, tourism gave NZ$16.2 billion to GDP. This was 5.8% of the total. Tourism also added NZ$9.8 billion in other ways. International tourists spent about NZ$12 billion. This was 17.1% of New Zealand’s export earnings. Tourism gives jobs to almost 188,000 people. That is 7.5% of all workers.

|

Aspect |

Value (NZD) |

Percentage/Notes |

|

Direct contribution to GDP |

16.2 billion |

5.8% of GDP (year ended March 2019) |

|

Indirect contribution to GDP |

9.8 billion |

4.3% of GDP |

|

Total tourism contribution |

34 billion |

As of 2017, including all tourism |

|

International tourist spending |

~12 billion |

17.1% of export earnings |

|

Employment supported |

188,000 full-time jobs |

7.5% of workforce (2016 data) |

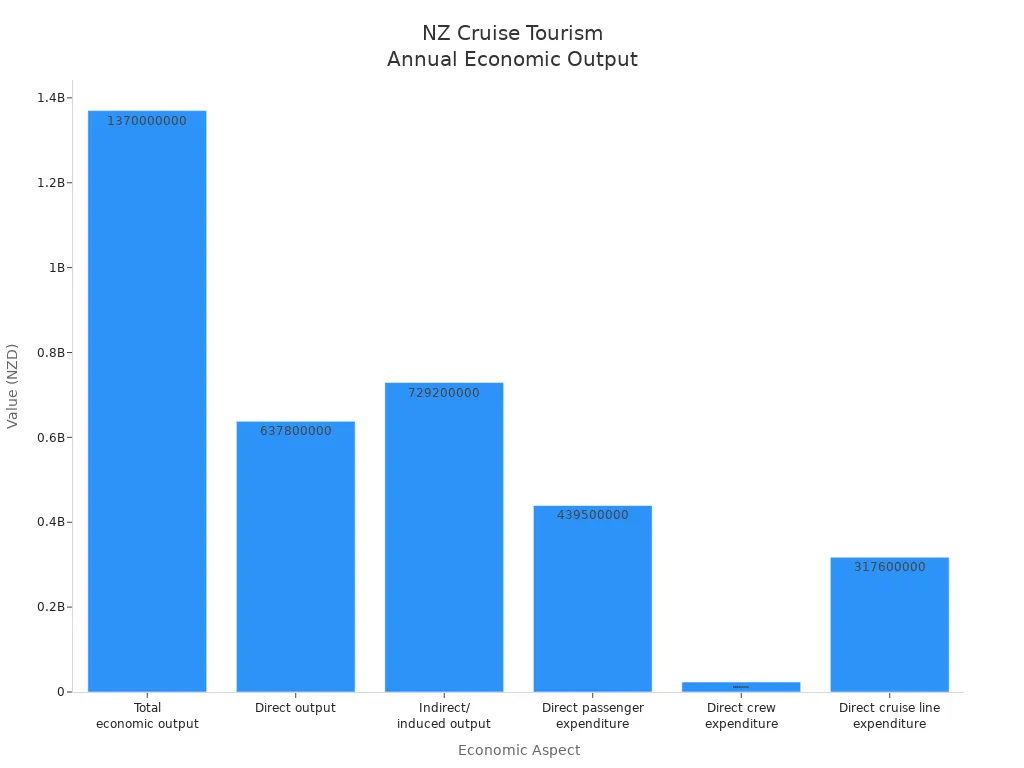

Cruise tourism also helps the economy. It made NZ$1.37 billion in total output. It gave almost 10,000 jobs and NZ$425.9 million in wages. Passengers spent NZ$439.5 million directly.

Tourism brings in foreign money. This helps keep the nzd steady. When more people visit, they need more nzd. This helps the currency and keeps the economy balanced, even if other sectors have problems.

Monetary Policy of the Reserve Bank of New Zealand

The Reserve Bank of New Zealand helps control the NZD and the country’s economy. The Bank uses different tools to do this. The most important tool is the Official Cash Rate (OCR). When the Bank changes the OCR, it can affect how people spend, save, and invest. These changes can make the NZD go up or down. They also help the economy grow or slow down.

Interest Rates

The Reserve Bank picks the OCR to help set interest rates. If the Bank raises the OCR, banks pay more for savings and charge more for loans. People then save more money and spend less. This helps stop prices from rising too fast. Higher rates also bring in foreign investors who want better returns. This can make the NZD stronger. A strong NZD makes it cheaper to buy things from other countries. This helps keep prices steady.

If the Bank lowers the OCR, it is easier to borrow money and saving is less rewarding. People and businesses spend and invest more. This can help the economy grow. But lower rates can make the NZD weaker. This means buying from other countries costs more. The Bank changes the OCR to keep the economy balanced and prices steady.

Inflation and Growth

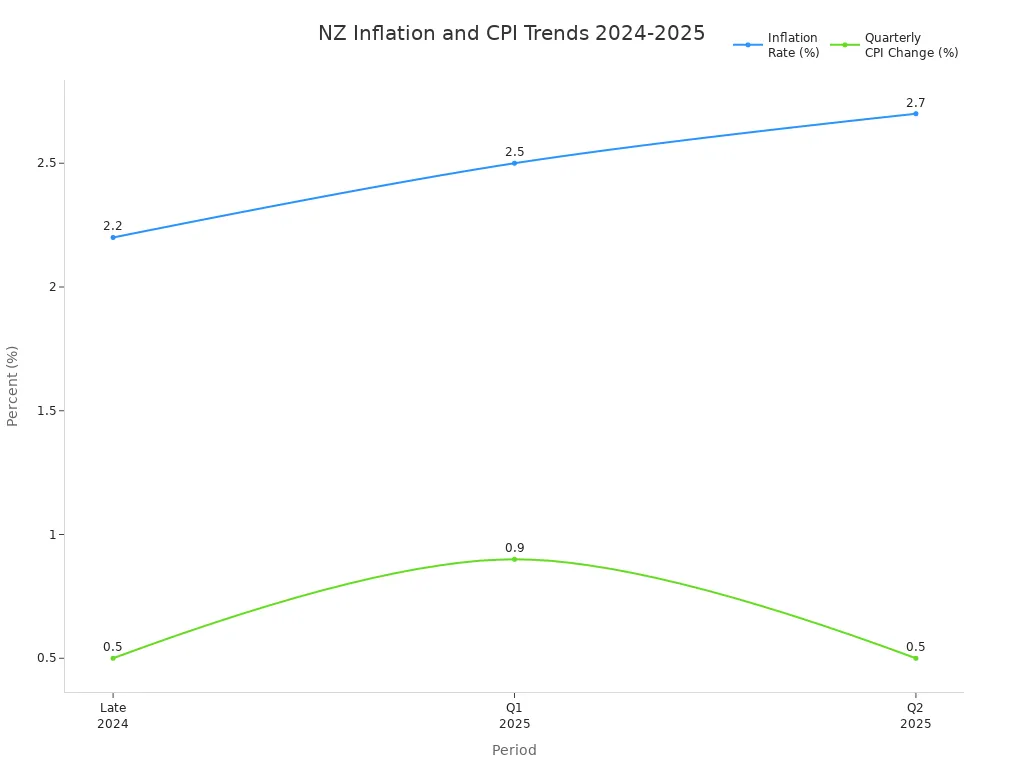

The Reserve Bank watches inflation and other signs of the economy. Inflation is how much prices go up over time. The Bank tries to keep inflation close to 2%. If prices rise too fast, the Bank may raise the OCR to slow spending. If prices rise too slowly, the Bank may lower the OCR to help growth.

Lately, New Zealand’s inflation has stayed steady compared to other rich countries. Most price increases come from things like rent and building costs.

|

Period |

Inflation Rate (%) |

Key Drivers |

Quarterly CPI Change (%) |

Notes on Currency Impact |

|

Late 2024 |

2.2 |

Rents, rates, construction costs |

0.5 |

No direct link to NZD |

|

Q1 2025 |

2.5 |

Rents, rates, construction costs |

0.9 |

NZD rebounded as USD softened |

|

Q2 2025 |

2.7 |

Rates, rents, electricity prices |

0.5 |

Inflation below expectations |

The Reserve Bank also looks at other signs to help guide its choices. These include:

-

Inflation numbers

-

Business confidence

-

Building permits

-

Jobs data

-

House prices

-

World economic news

-

Local government spending

By checking these things, the Bank can change the OCR to help the economy stay strong and steady. The Reserve Bank’s monetary policy is very important for the NZD and New Zealand’s future.

Trade and Global Influences on NZD

China as a Trading Partner

China is New Zealand’s biggest trading partner. The two countries have traded more since 2008. That year, they signed a Free Trade Agreement. In recent years, China bought almost 29% of New Zealand’s exports. Most exports to China are dairy, meat, wood, and fruit. The table below shows how trade with China changed:

|

Year/Period |

Export Value to China (NZ$ billion) |

Percentage of Total Exports |

Key Event/Notes |

|---|---|---|---|

|

2008 |

N/A |

N/A |

Free Trade Agreement signed |

|

2019 |

15.3 |

24% |

China became top export destination |

|

2023 |

16.0 |

29% |

China remains top export partner |

China’s need for New Zealand goods changes the exchange rate. If China’s economy slows down or inflation drops, it buys less from New Zealand. This makes the nzd/usd exchange rate go down. When China buys less, the new zealand dollar gets weaker. Trade problems or tariffs can also hurt the dollar. The foreign exchange market reacts fast to news from China.

Global Market Trends

The new zealand dollar is affected by more than just China. Big world currencies like the USD and AUD matter a lot for the exchange rate. When the US dollar gets stronger, the nzd/usd rate usually drops. For example, after the Reserve Bank of New Zealand kept its rate the same, the nzd/usd rate fell to 0.5977. Later, it went back up as the market changed. The AUD also affects the NZD, especially when prices for goods change.

The foreign exchange market pays close attention to world news. Changes in interest rates, risk, and prices for goods all move currencies. The new zealand dollar reacts to these changes. When world markets are unsure, the dollar can change a lot.

-

The nzd/usd exchange rate shows both local and world economic effects.

-

Market trends and trade shape the value of the new zealand dollar.

-

Currency changes show how New Zealand is linked to the world.

Financial Markets and NZX

Capital Market Role

The New Zealand Exchange, or NZX, is very important in New Zealand’s money system. It is the main place where companies sell shares and bonds to get money. This helps companies grow and helps the new zealand dollar. The NZX has things like exchange-traded funds, KiwiSaver, and wealth management. These help people and companies save and invest for later.

The NZX helps big parts of the economy, like dairy, by giving market data and research. This information helps companies make good decisions. The exchange has strong rules and good leaders. These rules help investors trust the market. In 2019, companies got NZ$8.5 billion in shares and NZ$6.3 billion in loans from the NZX. This money helps the economy and keeps the new zealand dollar steady.

The NZX does not set the dollar’s value, but it helps money move well in the market. This helps keep the new zealand dollar strong.

Market Forces Since 1985

Since 1985, the new zealand dollar’s value changes with supply and demand. Traders watch the NZX and other signs to know when to buy or sell. Many use hedging and currency hedging to stay safe from big changes. Companies that sell things overseas use currency hedging to lower risk. Farmers and exporters use hedging to keep prices steady and protect their money.

More people use currency hedging as the market grows. The NZX gives tools and information to help with hedging and currency hedging. This helps traders and companies stay safe when the dollar goes up or down. The market has grown since 1985, making the new zealand dollar more steady and trusted in the world.

Risks to NZD Stability

Political and Economic Shocks

Political and economic shocks can change the NZD rate fast. The New Zealand dollar reacts to things that happen in the country and around the world. For example, the Asian financial crisis in 1997-1998 made the exchange rate fall a lot. This crisis caused a recession and made the dollar move up and down more. Changes in world prices for things like dairy or meat also matter. When these prices drop, the exchange rate usually gets weaker. Bad weather, like droughts, can hurt farming and make the rate change.

|

Major Shocks Causing NZD Volatility |

Explanation |

|

International Commodity Price Shocks |

New Zealand sells a lot to other countries, so price changes move the exchange rate. |

|

Climate Shocks |

Weather can hurt farming and change the rate. |

|

International Financial Market Shocks |

Big world events can move the exchange rate, but not as much as price shocks. |

|

Asian Financial Crisis (1997-1998) |

This crisis made the exchange rate fall and caused a recession. |

|

Monetary Policy and Exchange Rate Volatility |

Big changes in policy can make the rate move a lot. |

The Reserve Bank watches these risks all the time. It changes the official cash rate to help keep things steady. Fast changes in the exchange rate can make imports cost more or hurt people who sell things overseas.

Market Sentiment

How people feel about the market affects the NZD rate a lot. When people feel good, the rate often goes up. If people worry, the rate can fall. In early 2025, the Westpac Consumer Survey showed people felt less confident, dropping from 97.5 to 89.2. The NZD/USD rate went down to about 0.5800. This shows the rate can change fast when news comes out.

|

Aspect |

Evidence & Impact on NZD |

|

Consumer Confidence |

The index dropped, so the exchange rate got weaker. |

|

NZD/USD Movement |

The rate fell to 0.5800 after confidence dropped. |

|

Market Context |

The US dollar stayed strong, so the NZD stayed low. |

|

Broader Risk Sentiment |

The NZD gets stronger when things are good, but weaker when people worry. |

|

Underlying Factors |

Trade problems and higher living costs change the rate. |

Stock market moves also change the exchange rate. When US stocks go up, the NZD often gets stronger. If risk goes up, the rate can fall quickly. Carry trades can make the dollar rise when times are good, but if people stop, the rate can drop fast. The exchange rate shows how both local and world moods matter. This is why keeping things steady is important for New Zealand’s economy.

The new zealand dollar is based on farming and new technology. People know the exchange rate changes with dairy prices and tourism. It also changes with what happens in the world. Investors look at what the Reserve Bank does. They also watch China’s and Australia’s economies. The new zealand dollar might change as technology gets better and trade changes. People should watch the exchange rate, interest rates, and world news. This helps them guess what will happen to the new zealand dollar.

-

Key things to watch:

-

Dairy prices and tourism

-

What the Reserve Bank of New Zealand does

-

How China and Australia’s economies are doing

-

How people feel about risk and trade balances

-

Differences in interest rates and prices for goods

-

FAQ

What makes the New Zealand dollar (NZD) unique?

The NZD stands out because New Zealand relies on agriculture, tourism, and technology. The Reserve Bank manages the currency with strong policies. The NZD also ranks among the world’s most traded currencies.

How do dairy prices affect the NZD?

Dairy exports bring in a large share of New Zealand’s income. When global dairy prices rise, the NZD often gets stronger. If prices fall, the NZD can weaken.

Why does China matter for the NZD?

China buys many New Zealand goods, especially dairy and meat. Changes in China’s economy or demand can quickly move the NZD exchange rate.

How does the Reserve Bank of New Zealand support the NZD?

What risks can make the NZD unstable?

-

Commodity price drops

-

Bad weather hurting farms

-

Global financial crises

-

Changes in market confidence

These risks can cause the NZD to move up or down quickly.

Related content