How Technology is Driving B2B in Global Payment Forward

Author:XTransfer2025.04.28B2B in Global Payment

Technology has transformed how businesses manage payments, particularly in the B2B in Global Payment sector. Digital payment solutions now address inefficiencies, enhance security, and support global scalability. For instance, the global B2B digital payment market reached $7.5 trillion in 2023, with a projected growth rate of 17% annually through 2032. This shift highlights the importance of adopting a robust digital payments strategy. As a leader in innovation, XTransfer empowers you to embrace digitization with secure, efficient, and scalable solutions tailored to your needs. By leveraging technology, you can stay competitive and thrive in the evolving global economy.

The Shift from Traditional to Digital Payments

Inefficiencies of traditional B2B payment methods

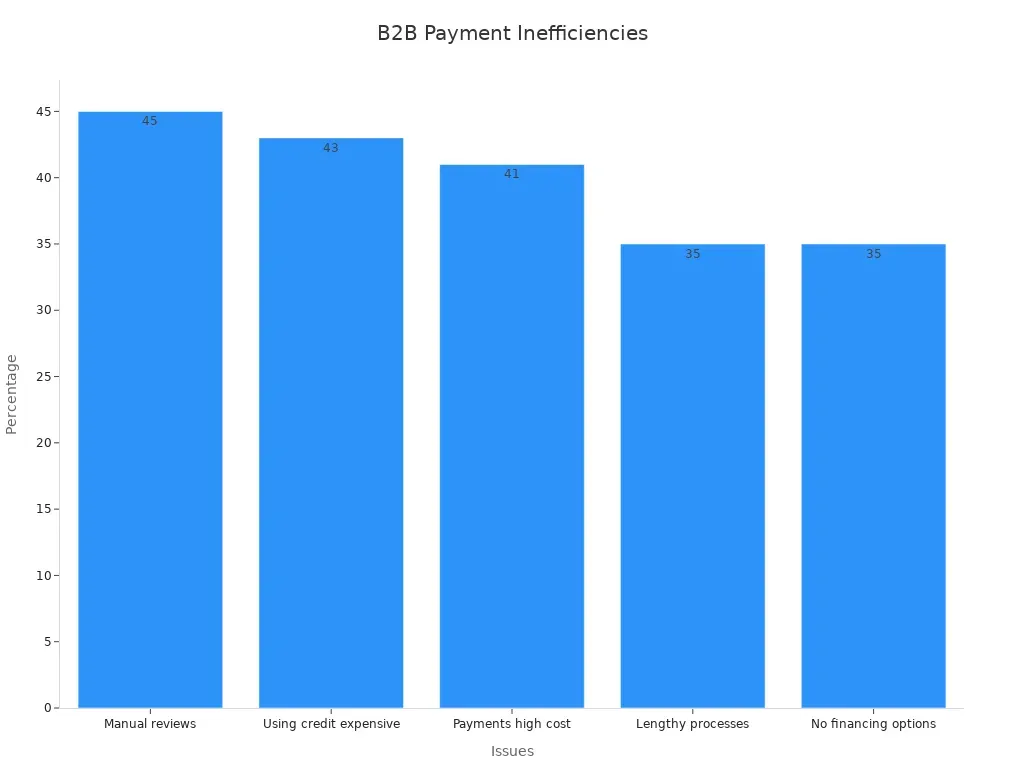

Traditional B2B payment methods often create bottlenecks that hinder business efficiency. Manual reviews account for 45% of delays, while the high cost of credit usage affects 43% of businesses. Lengthy processes and limited financing options each impact 35% of companies. These inefficiencies slow down payment cycles and increase operational costs.

Cross-border transactions face additional challenges. Businesses often deal with wire transfer fees, foreign transaction fees, and multiple intermediaries. These factors complicate payment processing and erode profit margins. Paper-based methods, such as checks, further exacerbate delays, as they can take days to clear or even get lost. These issues highlight the urgent need for digitizing B2B payments.

The role of digitization in addressing payment challenges

Digitization has emerged as a game-changer for B2B payments. By automating repetitive tasks, it reduces manual errors and accelerates payment cycles. Digital solutions also enhance cross-border payment capabilities, enabling faster and more cost-effective international transactions. For example, compliance-driven software simplifies the complexities of e-invoicing regulations, ensuring businesses meet global standards.

Innovative payment solutions, such as digital wallets and blockchain-based platforms, are driving the adoption of digital payments. These technologies improve transparency, reduce costs, and offer secure alternatives to traditional methods. As a result, businesses can focus on strategic growth rather than administrative hurdles.

How XTransfer simplifies global transactions for SMEs

XTransfer revolutionizes global transactions for SMEs by addressing the inefficiencies of traditional methods. Unlike conventional platforms that involve multiple intermediaries, XTransfer streamlines the process, reducing delays and costs. Its transparent fee structure ensures businesses retain more of their profit margins.

With AI-driven compliance and automation, XTransfer ensures secure and efficient payment processing. Its global multi-currency accounts and competitive FX rates empower SMEs to scale their operations seamlessly. By leveraging innovation, XTransfer makes digitizing B2B payments accessible and effective for businesses worldwide.

Key Technologies Driving Digital Transformation in B2B Payments

AI for fraud detection and payment optimization

Artificial Intelligence (AI) is reshaping the digital B2B payments ecosystem by enhancing security and efficiency. You can rely on AI to analyze vast amounts of payment data, identify risks, and optimize financial processes. For example, AI-powered systems detect unusual patterns in transactions, helping you prevent fraud before it occurs. This proactive approach ensures secure gateways for your business.

AI also improves payment processing by reducing manual errors. Machine learning models, as highlighted by Checkout.com, enhance global payment security and minimize chargeback risks. J.P. Morgan's use of AI-powered language models has reduced account validation rejection rates by 15-20%, lowering fraud levels and improving customer satisfaction. These advancements demonstrate how AI fosters trust and strengthens business relationships.

By adopting AI-driven solutions, you can streamline B2B payments, improve data accuracy, and gain valuable financial insights. This technology not only safeguards your transactions but also empowers you to make informed decisions, ensuring your business stays competitive in the fintech revolution.

Blockchain for secure and transparent transactions

Blockchain technology is revolutionizing the way businesses handle payments by offering unmatched security and transparency. Each transaction is recorded on an immutable ledger, ensuring that no data can be altered or deleted. This feature guarantees the integrity of your payment records and fosters trust among all parties involved.

Transparency is another key advantage of blockchain. Every transaction is visible on a shared ledger, allowing you and your partners to access the same information simultaneously. This openness reduces the risk of fraud and promotes fairness in business dealings. Cryptographic techniques further enhance security, making it nearly impossible for unauthorized parties to tamper with your data.

By integrating blockchain into your payment platforms, you can create a secure and transparent ecosystem for your business. This technology not only protects your transactions but also strengthens your relationships with partners by promoting accountability and trust.

Automation for streamlining workflows

Automation plays a crucial role in the digital transformation of B2B payments. Automated payment platforms eliminate manual processes, reducing errors and speeding up transactions. This efficiency allows you to focus on strategic growth rather than administrative tasks.

The benefits of automation are evident in key metrics. Automated systems reduce payment processing time, lower error rates, and improve end-user satisfaction. For instance, businesses that adopt automated B2B payment solutions report 41% greater savings per sourcing project. These platforms also provide fast, secure, and traceable transactions, ensuring a seamless experience for you and your customers.

By leveraging automation, you can simplify workflows, enhance operational efficiency, and deliver exceptional customer experiences. This technology is essential for staying competitive in the evolving digital B2B payments ecosystem.

Cloud-based platforms for real-time global payments

Cloud-based platforms have become essential for enabling real-time global payments. These platforms allow you to process transactions instantly, regardless of geographical boundaries. By leveraging cloud technology, businesses can access scalable and secure solutions that support seamless payment processing. This innovation eliminates the delays and inefficiencies associated with traditional methods, ensuring faster and more reliable transactions.

The adoption of cloud-based platforms has transformed the digital transformation of payment ecosystems. For example, Walmart partnered with Fiserv to introduce real-time payments for online shoppers. This initiative allows customers to make instant payments directly from their bank accounts. Similarly, Mastercard launched a real-time payment solution in South Africa, enabling same-day payouts for merchants. Small and medium-sized enterprises (SMEs) have also embraced these platforms to address cash flow challenges and improve operational efficiency.

Cloud-based payment platforms also provide real-time insights into transactions. This feature helps you monitor and manage your cash flow effectively. Additionally, these platforms integrate advanced security measures, such as encryption and tokenization, to protect sensitive data. By adopting cloud-based solutions, you can streamline global transactions, reduce costs, and enhance customer satisfaction.

Xtransfer’s use of AI and automation for efficiency

XTransfer leverages AI and automation to redefine efficiency in B2B payments. Its AI-driven systems analyze vast amounts of data to detect potential risks and ensure compliance with global regulations. This proactive approach minimizes fraud and enhances the security of your transactions. By automating repetitive tasks, XTransfer reduces manual errors and accelerates payment cycles, allowing you to focus on strategic growth.

XTransfer’s global multi-currency accounts further enhance efficiency. These accounts support over 20 currencies, enabling you to manage international transactions seamlessly. The platform also offers competitive FX rates, ensuring cost-effective cross-border payments. By integrating AI and automation, XTransfer creates a robust ecosystem that simplifies global transactions and empowers your business to thrive in the fintech revolution.

Benefits of Digitization for B2B Payments

Faster payment cycles and improved cash flow

Digitizing B2B payments accelerates payment cycles, helping businesses maintain healthy cash flow. Traditional methods, such as checks, often delay transactions due to manual processing and bank clearing times. In contrast, digital payment solutions enable real-time transactions, ensuring funds are transferred instantly. This speed reduces Days Sales Outstanding (DSO) and enhances liquidity, allowing you to manage your finances more effectively.

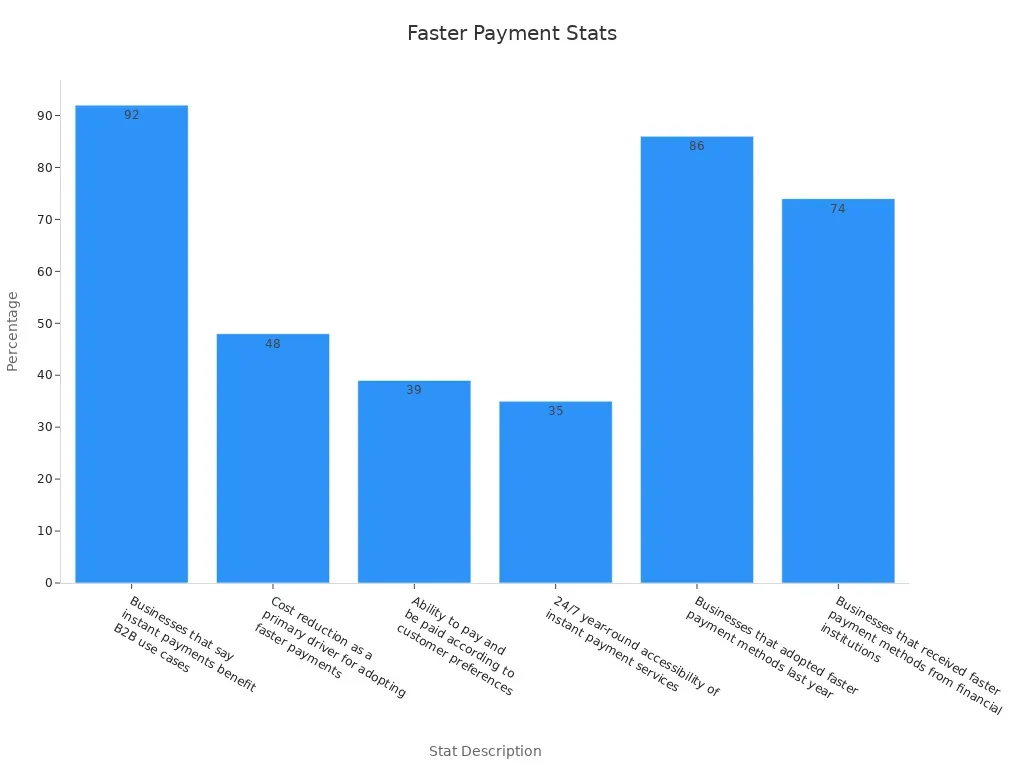

The benefits of faster payments are evident in recent statistics:

Digital payments also improve cash flow efficiency by automating processes like reconciliation and reporting. This automation reduces manual errors and provides real-time visibility into transactions. With better oversight, you can avoid late fees, take advantage of early payment discounts, and strengthen supplier relationships. These improvements make digitizing B2B payments a critical step in modernizing your financial operations.

Enhanced security and fraud prevention

Security is a top priority in B2B payments, and digitization offers advanced tools to protect your transactions. Technologies like blockchain, artificial intelligence (AI), and virtual cards enhance security by reducing fraud risks and ensuring data integrity. Blockchain, for example, creates an immutable ledger for transactions, making it nearly impossible for unauthorized changes to occur. This transparency fosters trust and accountability in your payment processes.

AI algorithms further strengthen security by analyzing transaction data in real time. These systems detect unusual patterns and anomalies, allowing you to prevent fraud before it happens. Virtual cards add another layer of protection with features like single-use functionality, immediate deactivation, and specific merchant restrictions. These tools ensure that your payments remain secure, even in a rapidly evolving digital landscape.

By adopting these technologies, you can safeguard your business against fraud and unauthorized access. Enhanced security not only protects your financial assets but also builds confidence among your partners and clients, strengthening your business relationships.

Cost savings and operational efficiency

Digitization transforms B2B payments by reducing costs and improving operational efficiency. Traditional payment methods often involve high processing fees, reliance on paper-based systems, and time-consuming manual tasks. Digital payment solutions eliminate these inefficiencies, allowing you to save time and money.

Automated systems streamline payment processing, reconciliation, and reporting. This automation reduces the need for manual intervention, lowering the risk of errors and speeding up transactions. Real-time payment confirmation ensures accuracy, while digital formats provide better control over spending. These features enable you to allocate resources more effectively and focus on strategic growth.

Digital payments also enhance customer satisfaction by providing seamless and efficient experiences. Faster processing times, fewer errors, and real-time visibility into transactions create a positive impression, fostering loyalty and trust. By embracing digitization, you can achieve significant cost savings and operational improvements, positioning your business for long-term success.

Better customer relationships through seamless experiences

Building strong customer relationships is essential for long-term success in B2B payments. Digitization plays a pivotal role in creating seamless experiences that foster trust and loyalty. When you adopt digital payments, you eliminate the delays and errors associated with traditional methods. This efficiency ensures that your clients receive payments on time, enhancing their satisfaction.

Real-time payment processing is another game-changer. It allows you to meet the expectations of modern businesses that demand speed and accuracy. For example, when your partners receive instant confirmations of transactions, they gain confidence in your reliability. This transparency strengthens your reputation and encourages repeat business.

Streamlined B2B payments also improve communication. Digital platforms provide real-time updates and detailed transaction histories. These features reduce misunderstandings and disputes, making your interactions with clients smoother. By offering a hassle-free payment experience, you position yourself as a dependable partner in the fintech revolution.

Note: A seamless payment process not only improves customer satisfaction but also sets you apart in a competitive market. It shows your commitment to innovation and efficiency.

Xtransfer’s competitive FX rates and global reach

XTransfer empowers your business to thrive in the global market with its competitive FX rates and extensive reach. Managing cross-border transactions can be challenging, especially when dealing with fluctuating exchange rates. XTransfer simplifies this process by offering rates that help you save money on international payments. These savings directly impact your bottom line, allowing you to allocate resources more effectively.

The platform supports over 20 currencies, enabling you to conduct business in multiple markets without complications. Whether you are paying suppliers in Europe or receiving payments from clients in Asia, XTransfer ensures smooth transactions. Its global multi-currency accounts eliminate the need for multiple banking relationships, reducing complexity and enhancing cash flow efficiency.

XTransfer’s presence in over 200 markets and partnerships with major banks like JPMorgan and Deutsche Bank further enhance its reliability. These collaborations ensure secure and efficient payment processing, giving you peace of mind. With financial licenses in key regions, XTransfer complies with global regulations, making it a trusted choice for businesses worldwide.

Callout: By leveraging XTransfer’s global reach and competitive FX rates, you can expand your operations confidently and focus on strategic growth.

Overcoming Challenges in Adopting Digital Payment Solutions

Addressing resistance to change within organizations

Adopting digital payment solutions often faces resistance from within organizations. Employees accustomed to traditional methods may hesitate to embrace new systems. This reluctance stems from a lack of familiarity or fear of increased complexity. To overcome this, you should prioritize clear communication and training. Explain the benefits of digital payments, such as faster processing and improved security, to help your team understand its value.

Resistance can also arise from concerns about integration complexities. Merging new payment systems with existing software may seem daunting. You can address this by choosing platforms that offer seamless integration and user-friendly interfaces. Additionally, involving employees in the decision-making process fosters a sense of ownership, making them more likely to support the transition.

Ensuring compliance with global regulations

Compliance with global regulations is essential when implementing digital payment solutions. Adhering to standards like PCI DSS, GDPR, and KYC/AML ensures secure transactions and protects sensitive data. These regulations also help prevent fraud and maintain trust with your customers.

In 2024, digital payments are expected to reach $11.53 trillion. This growth underscores the importance of compliance in safeguarding consumer data and fostering confidence in your business. By staying updated on regulatory requirements, you can avoid penalties and build a reputation for reliability in the b2b payments ecosystem.

Choosing the right digital payment platform

Selecting the right digital payment platform is crucial for your business. Start by understanding your customers' preferences. Research their favored payment methods, such as digital wallets or bank transfers, to ensure your platform meets their needs. Offering diverse options enhances customer satisfaction and broadens your market reach.

Security should be a top priority. Choose platforms that comply with standards like PCI DSS and use encryption to protect transactions. Evaluate the cost and convenience of each option, balancing transaction fees with the benefits provided. Investing in modern technology, such as APIs, can further enhance your payment processing and improve the overall customer experience.

Tip: A well-chosen platform not only simplifies payments but also strengthens your position in the competitive b2b landscape.

Preparing for future innovations in B2B payments

The future of B2B payments is set to be shaped by groundbreaking innovations. Emerging technologies promise to enhance security, improve efficiency, and create seamless payment experiences. As the global B2B payments market grows from USD 889,436.03 million in 2022 to a projected USD 1,877,171.0 million by 2028, businesses must prepare to adapt. This growth, driven by a compound annual growth rate (CAGR) of 13.26%, highlights the importance of staying ahead in the evolving landscape.

Key innovations expected to transform B2B payments include:

These advancements will redefine how businesses handle payments. For example, blockchain ensures secure and transparent transactions, while biometric authentication adds an extra layer of security. Real-time payment systems enable instant processing, helping businesses maintain better cash flow. By embracing these technologies, you can position your business for success in the rapidly evolving B2B ecosystem.

Note: Innovations in AI, blockchain, and biometrics will not only enhance security but also improve convenience, making them essential for the future of B2B payments.

How Xtransfer supports businesses in navigating challenges

Xtransfer plays a pivotal role in helping businesses overcome challenges during digital payment adoption. Its platform is designed to simplify cross-border payments for small and medium enterprises (SMEs). By introducing new payment methods and forming partnerships with local financial institutions, Xtransfer ensures a flexible and efficient payment experience. These features make it easier for businesses to manage international transactions.

Xtransfer also leverages advanced data analytics to provide valuable insights. These tools help you monitor transactions, identify trends, and make informed decisions. The platform’s AI-driven compliance system ensures adherence to global regulations, reducing the risk of penalties. This proactive approach allows you to focus on growth without worrying about compliance complexities.

With its global reach, Xtransfer supports over 200 markets and offers multi-currency accounts in more than 20 currencies. This eliminates the need for multiple banking relationships, streamlining your operations. Competitive FX rates further enhance cost efficiency, enabling you to save money on international payments. By addressing these challenges, Xtransfer empowers your business to thrive in the competitive B2B payments landscape.

Technology is reshaping the b2b in global payment landscape, creating opportunities for growth, efficiency, and global expansion. The market value of cross-border B2B payments grew from USD 27 trillion in 2020 to USD 35 trillion by 2022, showcasing the transformative power of digital payment solutions. Businesses adopting digitization can overcome inefficiencies, enhance transparency, and improve competitiveness. For example, 72% of SMEs now use web-based platforms, while 58% report increased cross-border transactions.

XTransfer leads this transformation by offering tailored solutions for SMEs. Its innovative platform simplifies global transactions, ensuring secure, fast, and cost-effective payments. Embracing digitization is no longer optional. It is essential for businesses aiming to thrive in the modern economy.

FAQ

What are B2B payments?

B2B payments refer to transactions between two businesses. These payments often involve large sums and require secure, efficient methods. Digital solutions streamline these processes, ensuring faster and more reliable transactions.

How does digitization improve B2B payment processes?

Digitization automates repetitive tasks, reduces errors, and accelerates payment cycles. It also enhances security and transparency, making cross-border transactions faster and more cost-effective for businesses.

Why is security important in B2B payments?

Security ensures that your transactions remain safe from fraud and unauthorized access. Advanced technologies like AI and blockchain protect sensitive data, fostering trust and reliability in your payment processes.

How can XTransfer help with global payments?

XTransfer simplifies global payments by offering multi-currency accounts, competitive FX rates, and secure transactions. Its AI-driven compliance system ensures adherence to global regulations, making cross-border payments seamless for your business.

What are the benefits of adopting digital payment solutions?

Digital payment solutions offer faster transactions, improved cash flow, enhanced security, and cost savings. They also provide real-time insights, helping you make informed financial decisions and strengthen customer relationships.

Related content