CZK to USD Exchange Rate and Its Effects on Trade Partnerships

Author:XTransfer2025-04-24

The value of the Czech koruna (CZK) compared to the U.S. dollar (USD) is important for trade between the Czech Republic and the United States. When the CZK to USD rate changes, it affects international trade. A strong koruna makes Czech goods more expensive for Americans, so they buy less. A weaker koruna makes Czech goods cheaper, so Americans buy more. These changes affect trade and the economy in both countries.

It is important to handle currency risks in global trade. You can protect your money by staying updated, using tools like forward contracts, and trading with different markets. Knowing the CZK to USD exchange rate helps you deal with changes and find chances in global trade.

How Is the CZK to USD Exchange Rate Determined?

Knowing how the CZK to USD rate is set helps you understand trade and money decisions. Many things affect this rate, like supply and demand, central bank actions, and global market feelings.

Supply and Demand Dynamics

Why currency demand matters

The value of a currency depends on how much people want it. If investors and businesses need the Czech koruna (CZK) for trade or investment, its value goes up compared to the USD. But if more people want the USD, the CZK loses value. For example, when the Czech Republic sells goods to the U.S., Americans exchange USD for CZK, raising demand for the koruna. This demand changes the CZK/USD rate.

Trade between the Czech Republic and the U.S.

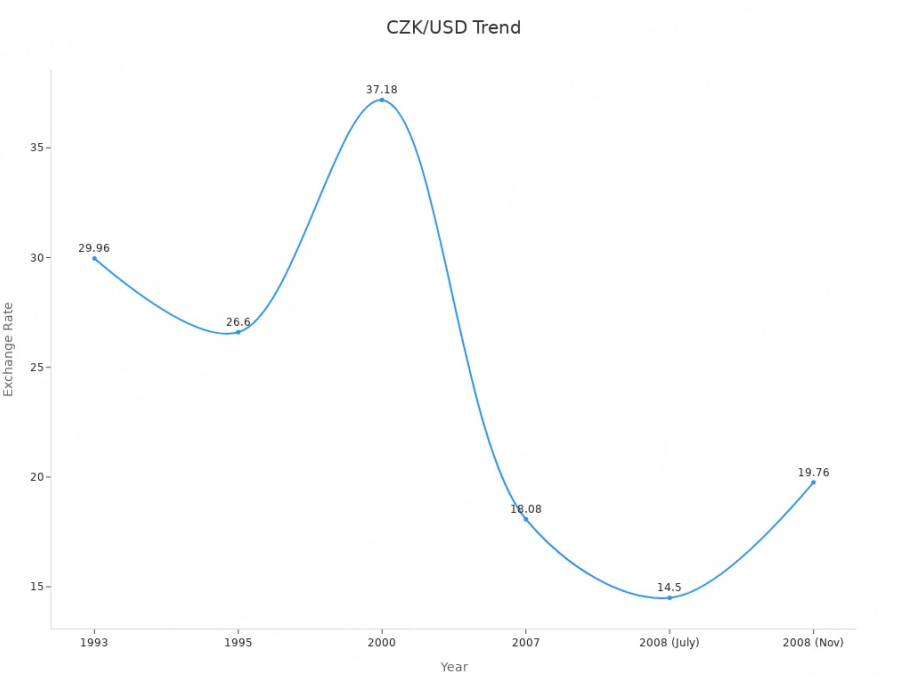

Trade levels between the two countries also change the exchange rate. More Czech exports to the U.S. make the CZK stronger. More imports from the U.S. increase demand for the USD. Past data shows how trade has changed the exchange rate over time.

Central Bank Policies

Czech National Bank's role in the CZK

The Czech National Bank (CNB) helps control the CZK's value. It changes interest rates and uses money policies to manage the economy. Higher interest rates attract foreign investors, making the CZK stronger against the USD.

Federal Reserve's role in the USD

The Federal Reserve (Fed) affects the USD with its money policies too. When the Fed raises interest rates, the USD becomes more valuable. This makes Czech goods costlier for Americans, changing the CZK/USD rate.

Global Market Sentiment

How investor confidence affects the CZK/USD rate

What investors think about the Czech economy matters. If they feel good, they invest in the CZK, making it stronger. If they worry, they choose the USD, which is seen as safer.

Geopolitical events and currency value

Politics also affect the CZK/USD rate. A stable Czech Republic attracts investors, boosting the CZK. But global problems can make the USD stronger. For example, during the 2008 crisis, the USD gained value against many currencies, including the CZK.

|

Indicator |

Effect on Exchange Rate |

|---|---|

|

Inflation Rates |

High inflation lowers a currency's value. |

|

Gross Domestic Product |

Strong GDP growth makes a currency stronger. |

|

Employment Data |

Good job numbers increase consumer confidence. |

|

Balance of Payments |

A surplus raises value; a deficit lowers it. |

By learning these factors, you can predict changes in the CZK to USD rate and how they affect trade and investments.

Key Factors That Change the CZK/USD Exchange Rate

Knowing what changes the CZK/USD rate helps in trade. Things like government rules, trade levels, and world events all affect the currency's value.

Government Rules

Money rules in the Czech Republic and the U.S.

Rules about money in both countries change the CZK/USD rate. The Czech National Bank (CNB) and the Federal Reserve (Fed) make decisions to keep their economies steady. High inflation in the Czech Republic lowers the CZK's value, making it less popular. But a calm political scene in the Czech Republic makes the CZK stronger.

|

Factor |

What It Means |

|---|---|

|

Inflation |

High inflation makes the CZK weaker and less wanted. |

|

Political Stability |

A calm government makes people trust and value the CZK more. |

|

Interest Rates |

Higher rates in the Czech Republic bring in foreign investors. |

How interest rates change the exchange rate

Interest rates in the Czech Republic and the U.S. matter a lot. Higher rates in the Czech Republic attract investors, raising demand for the CZK. But when U.S. rates go up, the USD becomes more appealing, changing the rate.

Trade Levels

Trade between the Czech Republic and the U.S.

How much the two countries trade affects the CZK/USD rate. If the Czech Republic sells more than it buys, the CZK gets stronger. But if it buys more than it sells, the CZK weakens because more USD is needed.

How trade changes the CZK/USD rate

When the CZK loses value, Czech goods become cheaper, boosting sales. But if the CZK gains value, Czech goods cost more, lowering sales. Trade levels change how much foreign money is needed, which shifts the CZK/USD rate.

World Events

Global money problems and currencies

Big money problems around the world can shake up currencies. During these times, investors might trade a lot, causing trouble for smaller economies like the Czech Republic. This can make the CZK/USD rate unstable.

How world politics affect the CZK/USD rate

World politics also change the CZK/USD rate. For example, the Russia-Ukraine war showed how events can upset markets. During the war, money markets became risky, causing big changes. This proves that world events can strongly impact currencies and trade.

Implications of Exchange Rate Changes on Trade

Changes in the exchange rate between the Czech koruna (CZK) and the U.S. dollar (USD) greatly affect trade. These shifts change the costs of exports, imports, and trade balances. They also impact how competitive businesses are in both countries.

Effects on Exports

Problems for Czech exporters with a strong CZK

A strong CZK makes things harder for Czech exporters. When the CZK's value rises compared to the USD, Czech goods cost more for Americans. This lowers demand for Czech products in the U.S., reducing export earnings. For example, during COVID-19, the CZK got stronger as investors looked for safer currencies. This made Czech goods less competitive worldwide. Also, foreign investments can strengthen the CZK, making it harder for exporters to keep their prices low.

Benefits for U.S. importers with a weaker CZK

A weaker CZK is good for U.S. importers. When the CZK loses value, Czech goods become cheaper for American companies. This allows U.S. importers to buy more Czech products at lower prices. Industries like manufacturing and retail benefit because they save money on imports, which boosts profits.

Effects on Imports

Higher costs for Czech businesses buying from the U.S.

Czech businesses pay more when the USD gets stronger. A strong USD raises the price of American goods for Czech importers. This makes it costlier for Czech companies to buy materials, machines, or products from the U.S. For instance, when the USD is very strong, Czech businesses may struggle to stay profitable due to higher import costs.

Advantages for U.S. exporters selling to the Czech Republic

For U.S. exporters, a strong USD can be helpful when selling to the Czech Republic. Czech companies may still buy high-quality American goods, even if they cost more. This is especially true in industries like technology and medicine. A strong USD gives U.S. exporters a chance to grow their market in the Czech Republic.

Trade Balances and Business Competitiveness

How exchange rate changes affect trade gaps

Exchange rate changes directly impact trade gaps and economic strength. When the CZK weakens, Czech exports become cheaper and more competitive, which can lower trade gaps with the U.S. But a strong CZK can shrink trade surpluses as imports grow and exports drop. These changes affect the economies of both nations.

Real-world examples of trade affected by the CZK/USD rate

The effects of exchange rate changes on trade can be seen worldwide. Countries like Brazil and India have faced big currency swings, which hurt their exports and growth. Developed areas, like the Eurozone, dealt with similar problems during the 2008 financial crisis. The Bank for International Settlements shows that high currency swings often happen during uncertain times. These examples show how exchange rates can shape trade between countries like the Czech Republic and the U.S.

|

Region |

Effects of Exchange Rate Changes |

|---|---|

|

Emerging Markets |

Countries like Brazil and India faced big currency swings, hurting exports and growth. |

|

Developed Economies |

The Eurozone's response to the 2008 crisis shows how exchange rates affect stability. |

|

Statistical Trends |

Data shows high currency swings often match uncertain economic times. |

By understanding these changes, you can see how the CZK/USD rate affects trade and competitiveness. Staying informed helps you handle the challenges and find opportunities in currency changes.

Strategies to Handle Exchange Rate Risks

Dealing with exchange rate risks is important for global trade. Using smart methods can protect your money and keep things steady.

Hedging Tools

How forward contracts and futures help avoid losses

Forward contracts and futures are useful for handling currency changes. A forward contract lets you set a fixed rate for future deals. This way, you know exactly how much money you'll get or pay, no matter what happens to the market. Futures work in a similar way but are traded on exchanges and follow set rules. Both tools help you avoid losing money when the dollar or koruna changes value.

Using currency options for safety

Currency options give you choices while managing risks. They let you exchange money at a set rate if you want to, but you don’t have to. This is helpful if you think the dollar or koruna might change value soon. For example, if you expect the dollar to get stronger, an option can lock in a good rate while keeping your options open.

Diversification Strategies

Trading with many countries to lower risks

Depending on one country for trade can be risky. By selling and buying in different countries, you can spread out the effects of currency changes. If the dollar and koruna rates become less favorable, other markets can still provide steady income. Diversifying trade helps reduce risks and keeps your business earning money.

Using multi-currency accounts for easier transactions

Multi-currency accounts make handling different currencies simple. These accounts let you keep money in currencies like the dollar and koruna. This reduces the need to exchange money often, which can be expensive if rates are bad. It also helps you choose the best currency for your deals, saving money.

Staying Updated

Watching live exchange rates with tools like XTransfer

Keeping track of live exchange rates is key to smart decisions. Platforms like XTransfer show accurate and quick updates on dollar and koruna rates. Watching these changes helps you plan better and avoid losing money.

Getting advice from financial experts

Financial experts can guide you on handling currency risks. They explain how rate changes affect your business and suggest helpful strategies. Whether it’s using hedging tools or trading in many markets, expert advice helps you make the best choices and stay financially strong.

By following these methods, you can handle currency changes and keep your finances safe.

Knowing the CZK to USD exchange rate is key for global trade. Things like supply, demand, and bank rules affect this rate. World events also play a big role in its changes. These shifts impact trade prices, business success, and the economy. Staying updated helps you handle risks and find chances to grow. Tools like XTransfer show live USD rates, helping you plan better. Manage currency changes wisely to keep your business and money safe.

FAQ

What is the CZK to USD exchange rate?

The CZK to USD rate shows how much one koruna equals in dollars. It changes due to trade, bank rules, and world events.

Why does the exchange rate matter for businesses?

The exchange rate changes import and export costs. A strong koruna makes Czech goods pricey abroad, while a weak koruna lowers costs for buyers.

How can you predict exchange rate changes?

Watch things like interest rates, inflation, and trade levels. Knowing about global events and bank decisions also helps you guess changes.

What tools help manage exchange rate risks?

Tools like forward contracts and currency options are helpful. They lock in rates or protect against bad changes, keeping money safe.

How do global events impact the CZK/USD rate?

Big events like crises or conflicts cause uncertainty. This often makes the dollar stronger, while smaller currencies like the koruna weaken.

Can individuals benefit from exchange rate changes?

Yes, travelers and investors can gain. A strong dollar means cheaper trips to the Czech Republic, while a weak koruna makes Czech investments better.

How does inflation affect the CZK/USD exchange rate?

High inflation in the Czech Republic weakens the koruna against the dollar. Low inflation or stable times make the koruna stronger.

Why should you diversify trade markets?

Relying on one market is risky with rate changes. Trading with many countries spreads risks and keeps things steady.