Understanding SWIFT Code: A Comprehensive Guide

Author:XTransfer2024-06-06

What is a SWIFT Code?

A SWIFT code, also known as a Business Identifier Code (BIC), is a standard format for Business Identifier Codes used to identify banks and financial institutions globally. Each SWIFT code is assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) organization, which facilitates secure and standardized communication between financial institutions globally.

A SWIFT code comprises 8 or 11 characters and uniquely identifies the bank's name, country, and sometimes the specific branch. In this way, it can identify the country, bank, and branch to which an account is registered. International wire transfers and other financial transactions make use of this code to carry out their processes.

A SWIFT code is an essential tool for international transactions, as it accurately identifies the bank and branch involved in the transfer.

How does a SWIFT Code work?

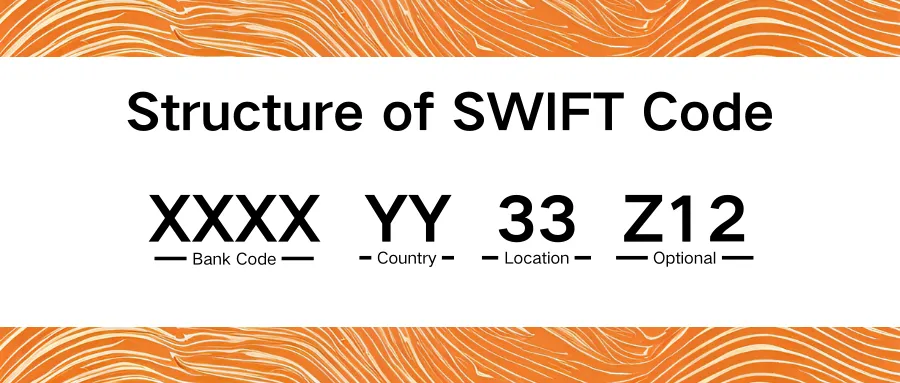

A SWIFT code is structured as follows:

· The first four characters (letters) represent the bank code. For instance, 'CITI' refers to Citibank.

· The following two characters (letters) specify the country code. In our example, 'US' stands for the United States.

· The subsequent two characters can be a mix of letters and digits and indicate the location within the country, typically a city. '33' in our example denotes New York.

· The final three characters, which are optional and can be a combination of letters and digits, indicate a specific branch or office of the bank. 'XXX' is often used when the branch code is optional or not specified.

To illustrate this, let's consider the SWIFT code 'CITIUS33XXX':

· 'CITI' - Bank Code (Citibank)

· 'US' - Country Code (United States)

· '33' - Location Code (New York)

· 'XXX' - Branch Code (Optional)

This structure ensures accurate identification of the bank's name, location, and sometimes branch, thereby facilitating the correct processing of international transfers.

When is a SWIFT Code needed?

SWIFT codes are critical for several reasons:

· International Money Transfers: When you send money internationally, you need the SWIFT code of the recipient's bank. Without it, it's impossible to process the transaction.

· Banks Identification: SWIFT codes provide unique identification for each bank involved in an international transaction. This helps other banks and financial institutions identify the correct bank during transactions.

· Secure Transactions: SWIFT codes add an extra layer of security to international transactions. It helps prevent fraud and errors, ensuring your money reaches its right destination.

· Speed and Efficiency: The SWIFT network streamlines and standardizes international banking communication, which makes transactions quicker and more efficient.

· Communication: Besides transactions, banks also use the SWIFT system to exchange critical financial messages.

In essence, SWIFT codes are a crucial part of the global banking system, ensuring that international transactions are secure, efficient, and accurate.

How to Find Your SWIFT Code

Finding your bank's SWIFT code is typically straightforward. Here are a few methods you can use:

· Check Your Bank's Website: Most banks list their SWIFT code on their website. You can often find it in the "Contact Us" or "Help" section.

· Bank Statement: Look at a bank statement. Some banks print their SWIFT code on their statements.

· Contact Your Bank: You can always call or visit your bank and ask for the SWIFT code directly. Customer service will be able to provide this information.

· Use an Online SWIFT Code Lookup Tool: There are online resources, like SWIFT Code Search, where you can look up the SWIFT code for most banks.

Always double-check the SWIFT code before making an international transfer to ensure your money reaches the right destination.

SWIFT Code and IBAN

You're likely to encounter both SWIFT codes and IBAN when conducting international banking transactions. While they might seem similar, they serve different purposes in the banking world. Let's delve into what each of them stands for and how they function.

What is an IBAN?

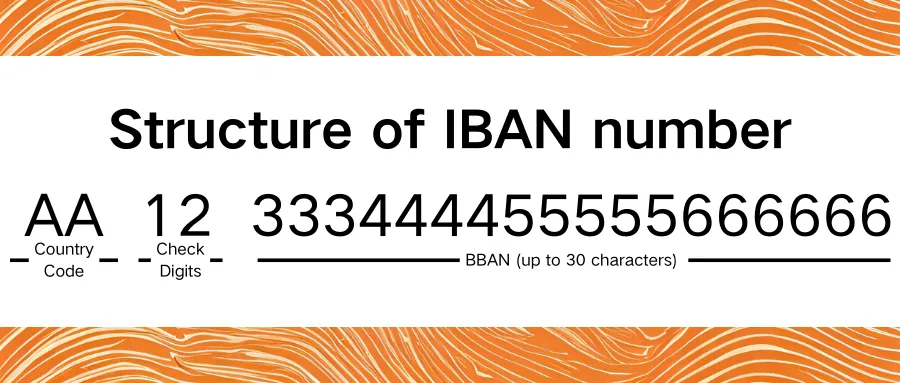

The International Bank Account Number (IBAN) is an internationally standardized account number code that can serve to promote the communication and processing of cross-border transactions as well as reduce the risks of transcription errors.

An IBAN is made up of 34 alphanumeric characters at most, including:

· A two-letter country code

· Two check digits

· A Basic Bank Account Number (BBAN) that provides information on domestic bank account numbers, branch identifiers, and potential routing information.

The Key Differences

While both SWIFT codes and IBANs are used to identify banks and accounts for international transactions, they serve different purposes:

· SWIFT Code: Identifies a specific bank during an international transaction, ensuring the money is sent to the correct bank.

· IBAN: Identifies an individual account involved in the international transaction, ensuring the money goes to the correct account.

In other words, the SWIFT code can route the money to the proper bank for international transfers. The IBAN can then direct the funds to the proper bank account.

Both the SWIFT code and the IBAN are necessary to complete international wire transfers. As a developer, understanding these banking terms can be crucial when creating applications that deal with financial transactions or banking integrations.

Conclusion

In the world of international finance, SWIFT codes play an essential role. They ensure that money transfers reach the correct destination and add more security to transactions. By understanding SWIFT codes, you can navigate the global financial system with confidence.

Remember, always double-check the SWIFT code before making an international money transfer. This small action can ensure you avoid any potential errors or delays in your transaction.

In the face of the turbulent changes in the world of finance, it is significant to stay informed. Keep up with the latest trends and developments to make the most of your money.