Our story

- XTransfer was founded in 2017 when banks were reluctant to provide cross-border payment solution to SMEs due to compliance concerns and system constraint. SMEs had difficulties in getting access to bank services, and paid hefty fees for international money transfer and FX conversion with yet poor service.

- In order to make financial services simple, affordable and accessible to SMEs, XTransfer has built a global multi-currency settlement network along with a data-based, automated, internet-powered, and intelligent risk management infrastructure. XTransfer provides SMEs with the same level of cross-border financial services as large multinational corporations.

Our story

- XTransfer was founded in 2017 when banks were reluctant to provide cross-border payment solution to SMEs due to compliance concerns and system constraint. SMEs had difficulties in getting access to bank services, and paid hefty fees for international money transfer and FX conversion with yet poor service.

- In order to make financial services simple, affordable and accessible to SMEs, XTransfer has built a global multi-currency settlement network along with a data-based, automated, internet-powered, and intelligent risk management infrastructure. XTransfer provides SMEs with the same level of cross-border financial services as large multinational corporations.

Our mission

Making SME financial services simple and accessible

Company milestones

By working with world-renowned banks and financial institutions, XTransfer has set up an integrated global multi-currency settlement platform, as well as a data-based, automated, Internet-powered and intelligent anti-money laundering risk management infrastructure centered on serving SMEs.

XTransfer connects large financial institutions with SMEs at home and abroad through technology so that SMEs may enjoy the same level of cross-border financial services as large multinational groups.

Our investors

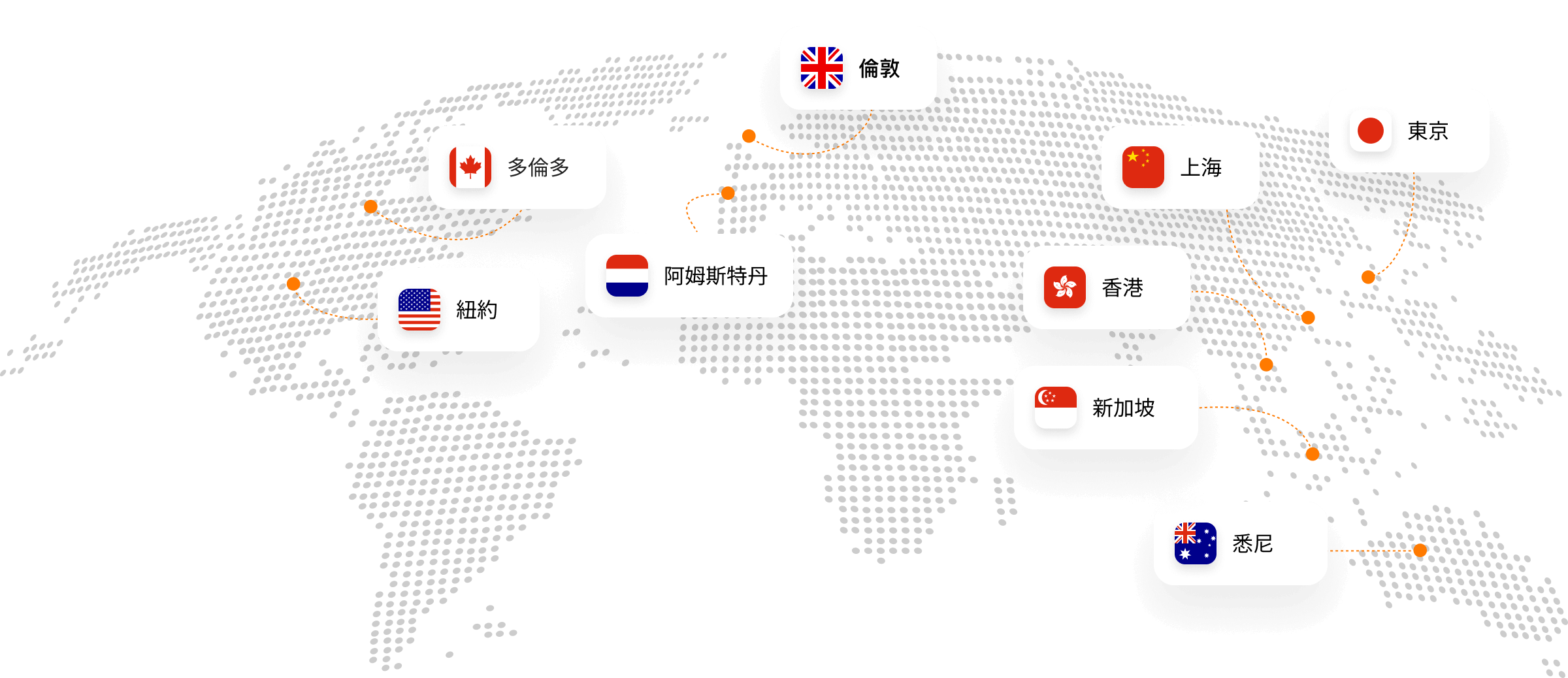

Our global footprint

XTransfer has offices in 14 countries and regions to provide professional local services.