Why SWIFT Code Matters in International Transactions 2025

Author:XTransfer2025.06.16 transactions

SWIFT codes play a vital role in ensuring secure and efficient cross-border payments. These unique identifiers enable banks to process transactions with speed and precision. Over 11,000 institutions globally rely on SWIFT, exchanging over 44 million messages daily. Nearly 90% of international transactions now reach recipient banks within an hour, highlighting the importance of SWIFT codes in accurate routing of funds. Without them, the global financial system would struggle to maintain reliability and standardization. Whether you're sending or receiving money internationally, SWIFT codes ensure smooth and timely processing of payments.

What Is a SWIFT Code?

Definition and Importance of SWIFT Codes

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique alphanumeric identifier assigned to financial institutions worldwide. It acts as a digital address, ensuring that funds are routed accurately to the intended bank during international transactions. This system is essential for maintaining the reliability and efficiency of global banking.

SWIFT codes play a critical role in reducing errors in money transfers. By standardizing bank identification, they minimize the risk of funds being misdirected. Additionally, these codes enhance transaction speed by enabling banks to quickly identify the correct path for payments. They also support regulatory compliance, which is vital for anti-money laundering checks and other financial regulations. With over 11,000 member institutions exchanging millions of messages daily, SWIFT codes have become indispensable in the world of international finance.

Did you know? SWIFT codes not only ensure accurate routing of funds but also enhance security in financial communications, making cross-border transactions more reliable.

Structure and Components of a SWIFT Code

A SWIFT code consists of 8 to 11 characters, each serving a specific purpose. Understanding its structure helps you appreciate its role in international banking. Here's a breakdown:

|

Component |

Description |

|

Bank Code (A) |

The first four characters representing the unique identifier for the financial institution. |

|

Country Code (B) |

The next two characters indicating the country where the bank is located, based on ISO standards. |

|

Location Code (C) |

Two characters identifying the specific branch or office of the financial institution (optional). |

|

Branch Code (D) |

The last three characters specifying a particular branch or department within the financial institution (optional). |

This standardized format ensures global compatibility, reducing errors and expediting the processing of cross-border transactions. It also simplifies compliance with financial regulations, adding an extra layer of security to international payments.

Role of SWIFT Codes in International Transactions

SWIFT codes are the backbone of international transactions. They ensure that money reaches the correct bank without errors. When you initiate a payment, the SWIFT code identifies the receiving institution globally. Upon receiving the SWIFT message, the designated bank processes the transaction based on the provided instructions. The actual settlement of funds occurs through correspondent banking relationships.

The introduction of standardized formats like BIC and IBAN by SWIFT revolutionized international finance. These formats created a common language for financial institutions, significantly reducing communication errors. This innovation enhanced trust among global participants, solidifying SWIFT's position as the standard for interbank communication.

How SWIFT Codes Work

The SWIFT Network and Its Functionality

The SWIFT network connects over 11,000 financial institutions across more than 200 countries. It acts as a global network that enables secure communication between banks. When you send money internationally, SWIFT ensures that your transaction details reach the recipient bank accurately. This network doesn’t transfer money directly. Instead, it sends standardized messages that instruct banks on how to process payments. These messages include essential details like the sender’s and receiver’s account information, the amount, and the purpose of the transaction.

SWIFT’s reliability stems from its robust infrastructure. It uses advanced encryption to protect sensitive data, ensuring that your transactions remain secure. By standardizing communication, the SWIFT network eliminates confusion and reduces errors, making it the backbone of international banking.

How SWIFT Codes Facilitate International Payments

SWIFT codes streamline international payments by acting as unique identifiers for banks. When you initiate a transaction, the SWIFT code ensures that the payment reaches the correct financial institution. This process minimizes delays and errors, saving you time and money. The system also supports compliance with global regulations, which is crucial for preventing fraud and money laundering.

The scale of transactions facilitated by SWIFT codes is staggering. Every day, trillions of dollars move across borders through this system. In 1979, SWIFT processed 10 million financial messages in an entire year. By May 2021, it handled an average of 42.3 million messages daily, reflecting its growing importance in global finance. These numbers highlight how SWIFT codes have revolutionized international payments, making them faster and more reliable.

Real-World Examples of SWIFT Code Usage

Imagine you’re a business owner in the United States paying a supplier in Germany. You’ll need the supplier’s SWIFT code to ensure the payment reaches their bank. Without it, the transaction could fail or get delayed. Similarly, if you’re sending money to a family member abroad, the SWIFT code ensures that the funds arrive at the correct destination.

Large corporations also rely on SWIFT codes for cross-border transactions. For instance, multinational companies use them to pay employees in different countries or settle invoices with international vendors. These examples show how SWIFT codes simplify complex financial operations, making them essential for both individuals and businesses.

Why SWIFT Codes Are Essential

Enhancing Security in International Transactions

SWIFT codes play a critical role in securing international financial transactions. When you use a SWIFT code, it ensures that your payment instructions are transmitted through a highly encrypted network. This encryption protects sensitive data, such as account numbers and transaction details, from unauthorized access. SWIFT’s end-to-end encryption safeguards your financial information, reducing the risk of fraud and cyberattacks.

The SWIFT network also integrates compliance checks into its messaging system. These checks help banks verify the legitimacy of transactions, ensuring adherence to global regulations. For example, anti-money laundering protocols are embedded within SWIFT’s processes, adding an extra layer of security to cross-border payments. By using SWIFT codes, you can trust that your financial transactions are not only accurate but also secure.

Ensuring Accuracy and Efficiency in Payments

Accuracy and efficiency are vital in international payments, and SWIFT codes excel in both areas. When you initiate a transaction, the SWIFT code ensures that your payment reaches the correct financial institution without errors. This precision reduces the likelihood of failed payments, saving you time and money.

SWIFT codes also enhance efficiency by enabling straight-through processing. Payments data validation tools, such as Bankers Almanac® Payments, correct and enrich payment information, ensuring fewer errors and faster routing of instructions. The system’s deep coverage of 190 domestic payment networks, including emerging markets, allows efficient payments worldwide. Validation against a database of over 65,000 financial institutions ensures accuracy across 200 clearing systems. A global team of data analysts maintains up-to-date payment data in 20 languages, further reducing errors in international transactions.

Here’s a table summarizing how SWIFT codes improve accuracy and efficiency:

|

Evidence Description |

Key Benefit |

|

Payments data validation tools help eliminate costly failed payments. |

Higher straight-through processing rates. |

|

Bankers Almanac® Payments corrects and enriches payment information. |

Fewer errors and more efficient routing of payment instructions. |

|

Access to a deep coverage of 190 domestic payment networks, including emerging markets. |

Enables efficient payments worldwide, including to IBAN and non-IBAN accounts. |

|

Validation of payment details against a database of over 65,000 financial institutions. |

Ensures accuracy in payment processing across 200 clearing systems. |

|

Global team of data analysts maintains up-to-date payments data across 20 languages. |

Enhances the reliability of payment information and reduces errors in international transactions. |

By leveraging SWIFT codes, you can experience faster and more reliable financial transactions, whether for personal or business purposes.

Importance of SWIFT Code in Global Standardization

Global standardization is essential for seamless international transactions, and SWIFT codes are at the heart of this effort. These codes use standardized messaging formats, simplifying complex routing processes. When you use a SWIFT code, it ensures that your payment instructions are universally understood, reducing errors and speeding up processing times.

SWIFT’s integrated compliance checks also contribute to global standardization. These checks increase transparency, helping banks meet regulatory requirements across different countries. Additionally, SWIFT codes enhance security through end-to-end encryption, protecting sensitive data during financial transactions.

Here’s a table illustrating how SWIFT codes address global standardization challenges:

|

Challenge |

SWIFT Solution |

Outcome |

|

Complex Routing |

Standardized messaging formats |

Reduced errors and faster processing |

|

Regulatory Compliance |

Integrated compliance checks |

Increased transparency |

|

Security Risks |

End-to-end encryption |

Enhanced data security |

The importance of SWIFT codes for businesses cannot be overstated. They provide a reliable framework for international financial transactions, enabling businesses to operate efficiently across borders. Whether you’re managing payments for an international business or handling cross-border payments for personal needs, SWIFT codes ensure that your transactions are secure, accurate, and standardized.

Consequences of Incorrect or Missing SWIFT Codes

Transaction Delays and Failures

Incorrect or missing swift codes can lead to significant delays in processing international wire transfers. When a bank cannot identify the correct recipient institution, the transaction may be held for manual review. This process can take days or even weeks, disrupting time-sensitive payments. For businesses, such delays can strain relationships with suppliers or partners. For individuals, it can cause stress when sending urgent funds to family or friends abroad.

Failures in transactions are another common consequence. If the swift code provided does not match any registered financial institution, the payment may be rejected outright. In such cases, the sender must reinitiate the process, which adds to the overall costs and duration of swift transfers.

Additional Costs and Fees

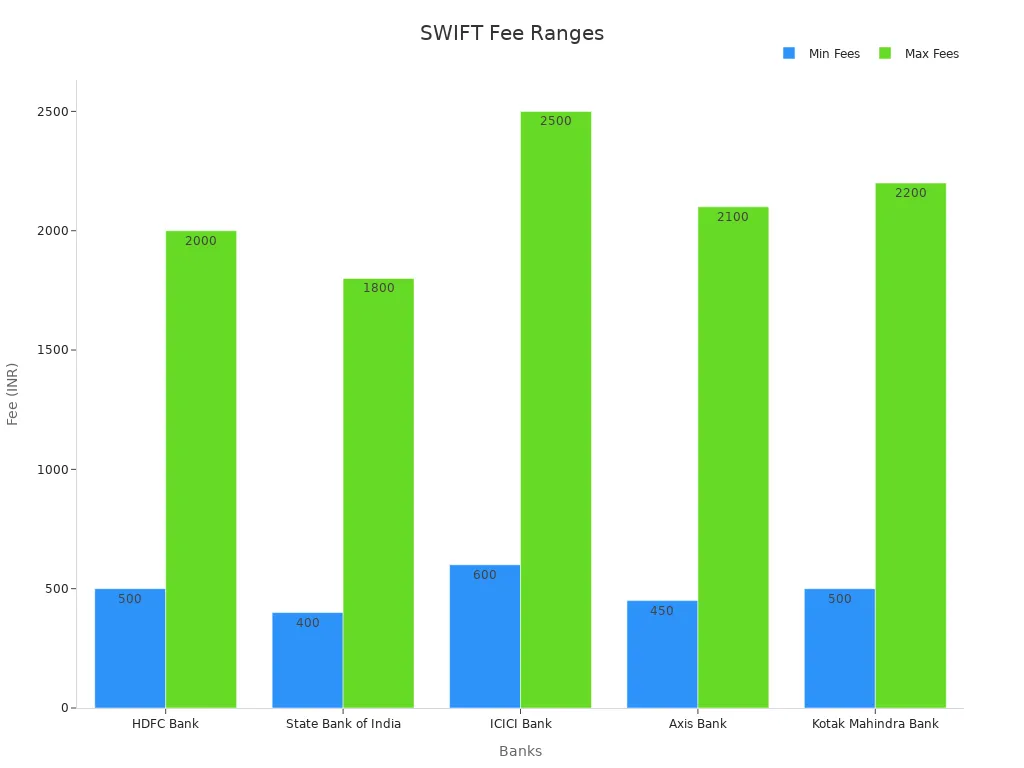

Errors in swift codes often result in additional fees. Banks may charge penalties for failed or returned transactions. Furthermore, reprocessing a payment requires extra administrative work, which increases the overall costs. The table below highlights the range of swift-related charges across various banks:

|

Bank |

SWIFT Charge (INR) Range |

Notes |

|

HDFC Bank |

500 - 2000 |

Fees vary based on transaction amount and destination. |

|

State Bank of India |

400 - 1800 |

Charges may differ for different types of accounts. |

|

ICICI Bank |

600 - 2500 |

Higher fees may apply for urgent transfers or large sums. |

|

Axis Bank |

450 - 2100 |

Additional fees may apply for currency conversion. |

|

Kotak Mahindra Bank |

500 - 2200 |

Fees are subject to change based on bank policies. |

These costs can quickly add up, especially for frequent cross-border transactions. Ensuring the accuracy of swift codes helps you avoid unnecessary expenses.

Risks of Misrouted Payments

Incorrect swift codes can also lead to misrouted payments. In such cases, funds may be sent to the wrong bank or account. Retrieving these funds can be a lengthy and complex process, often requiring legal intervention. This risk not only increases the costs and duration of swift transfers but also jeopardizes the security of your money.

For businesses, misrouted payments can disrupt supply chains and damage reputations. For individuals, it can mean losing access to critical funds. Always double-check swift codes to ensure your transactions reach the intended destination securely and efficiently.

How to Find and Use a SWIFT Code

Using XTransfer to Locate SWIFT Codes

Finding the correct SWIFT code is crucial for successful international transactions. XTransfer simplifies this process by providing a reliable platform to search for SWIFT codes of banks worldwide. You can access the platform to locate the SWIFT code for any financial institution, ensuring accuracy in your transactions. The user-friendly interface allows you to search by bank name, country, or branch, making it easy to find the information you need. By using XTransfer, you reduce the risk of errors and delays in your payments.

Steps to Use SWIFT Codes in Transactions

Using SWIFT codes in financial transactions involves a straightforward process. Follow these steps to ensure smooth and secure payments:

-

Confirm the recipient's SWIFT code. Each financial institution participating in SWIFT has a unique code consisting of eight or eleven characters.

-

Verify the recipient's bank details, including the account number and name, to avoid errors.

-

Initiate the payment through your preferred method. You can visit a bank branch or use online banking services.

-

Provide the SWIFT code along with the payment details. This ensures the funds are directed to the correct bank.

-

The payment is processed through a network of correspondent banks, which work together to transfer the funds securely to the recipient's bank.

By following these steps, you ensure that your international payment methods are efficient and error-free.

Tips for Avoiding Common Errors with SWIFT Codes

Mistakes in SWIFT codes can lead to delays, additional fees, or misrouted payments. To avoid these issues, double-check the SWIFT code before initiating a transaction. Ensure that the code matches the recipient's bank and branch. If you're unsure, use a trusted platform like XTransfer to verify the information. Always confirm the recipient's account details, as errors in these can also disrupt the payment process. By taking these precautions, you minimize risks and ensure your transactions are completed smoothly.

SWIFT codes are vital for international transactions, ensuring that payment instructions reach the correct financial institution securely and efficiently. They connect over 11,000 financial institutions across more than 200 countries, making them a cornerstone of global banking. Unlike IBANs, which identify specific accounts, SWIFT codes identify banks or branches, enabling seamless communication between institutions.

These codes play a key role in global payments by facilitating secure and accurate fund transfers. Whether you're managing cross-border trade or sending money to loved ones, using the correct SWIFT code prevents errors, delays, and misrouted payments. Platforms like XTransfer simplify the process of finding and using SWIFT codes, making international transactions more accessible and reliable for everyone.

FAQ

What is the difference between a SWIFT code and an IBAN?

A SWIFT code identifies a specific bank or branch, while an IBAN identifies an individual account. You use a SWIFT code for routing payments internationally and an IBAN for ensuring the funds reach the correct account.

Can you use a SWIFT code for domestic transactions?

No, SWIFT codes are primarily for international transactions. Domestic payments typically use local bank codes or routing numbers specific to the country’s banking system.

How do you verify a SWIFT code?

You can verify a SWIFT code by using platforms like XTransfer. Enter the bank name, country, or branch to confirm the code’s accuracy before initiating a transaction.

Is a SWIFT code mandatory for all international payments?

Yes, most international payments require a SWIFT code. It ensures the funds reach the correct bank securely and efficiently, minimizing errors or delays.

What happens if you enter the wrong SWIFT code?

Entering the wrong SWIFT code can lead to transaction delays, additional fees, or misrouted payments. Always double-check the code before submitting your payment details.

Related content