What Is Value-Added Tax VAT A Comprehensive Definition

Author:XTransfer2025.05.26Value-Added Tax (VAT)

Value-added tax (VAT) is a consumption tax applied to the increase in value at each stage of production or distribution. Governments worldwide rely on this tax to generate significant revenue. Its importance continues to grow as more countries adopt it. For example:

-

Angola, Bahrain, and the United Arab Emirates recently implemented VAT systems.

-

Bhutan, Kuwait, and Qatar plan to introduce VAT soon, highlighting its expanding role in global economies.

Ultimately, the end consumer bears the cost of value-added tax, as businesses pass it along in product or service prices. This makes VAT a vital part of modern taxation systems.

How VAT Works

Input and Output VAT

Understanding input and output VAT is essential to grasp how value-added tax operates. Input VAT refers to the tax you pay on goods or services purchased for your business. Output VAT, on the other hand, is the tax you collect when selling goods or services. The difference between these two determines your VAT liability. If your input VAT exceeds your output VAT, you can claim a refund. Conversely, if your output VAT is higher, you owe the difference to the tax authorities.

The relationship between input and output VAT reflects supply-demand dynamics in various industries. For example, manufacturers often face higher input VAT due to raw material costs, while retailers focus on output VAT as part of their pricing strategies.

The VAT Chain Explained

The VAT chain illustrates how value-added tax is applied at each stage of production and distribution. This process ensures that VAT is collected incrementally, based on the value added at each step. Here's how it works:

-

Initial Stage: Manufacturer/Supplier to Retailer

You, as a manufacturer, incur VAT on raw materials and labor. When selling goods to a retailer, you charge VAT, known as output VAT. -

Middle Stage: Retailer to Wholesaler/Distributor

The retailer adds a margin to the goods and charges VAT on this added value. The VAT collected includes both the manufacturer's output VAT and the retailer's own VAT. -

Final Stage: Retailer to End Consumer

When the consumer purchases the goods, VAT is applied again. The consumer pays the full VAT amount, which includes all the VAT collected throughout the chain.

This step-by-step process ensures that VAT is distributed fairly across all stages, with the end consumer bearing the final cost.

Examples of How VAT Works

Real-world examples help clarify how VAT functions in practice. Consider the following:

For instance, in France, VAT was first introduced in 1948 and has since become a cornerstone of its tax system. Globally, VAT contributes approximately one-fourth of total tax revenue, showcasing its importance in modern economies. These examples highlight how VAT systems operate across different regions and industries.

Key Features of Value-Added Tax

Taxable Activities and Transactions

Value-added tax applies to a wide range of activities and transactions. These include the sale of goods, provision of services, and imports. VAT systems often classify taxable activities based on industry and transaction type. For example, Germany uses VAT return data to analyze taxable activities across 778 industries. This classification ensures accurate reporting and compliance.

Understanding these classifications helps businesses identify their VAT obligations and avoid penalties.

VAT Rates: Standard and Reduced

VAT rates and structures vary across countries. Most jurisdictions apply a standard rate to general goods and services, while reduced rates target essential items like food or medicine. For instance, New Zealand has a standard VAT rate of 15%, while Australia applies a 10% rate. Reduced rates aim to make necessities more affordable for consumers.

These differences in VAT rates reflect each country's economic priorities and social policies.

Compliance and Reporting Requirements

Compliance with VAT regulations requires businesses to follow strict reporting guidelines. Automation plays a key role in simplifying this process. Technology reduces errors by automating data entry and calculations. It also ensures accurate VAT reporting and helps businesses stay updated with regulatory changes.

-

Automation of Processes: Technology automates repetitive tasks like data entry and reporting.

-

Accuracy and Compliance: Software ensures correct VAT calculations and compliance with regulations.

-

Centralized Data Management: Centralized systems simplify tracking VAT obligations and audits.

By adopting these measures, businesses can streamline their VAT processes and avoid penalties.

Value-Added Tax vs. Sales Tax

Differences in Tax Collection

You might wonder how value added tax (VAT) differs from sales tax in terms of collection. The key distinction lies in the stages at which these taxes are applied. VAT is collected at every stage of production and distribution, while sales tax is only charged at the final point of sale. This difference impacts how businesses handle their tax obligations.

For example, consider the purchase of jeans priced at $50 or €50:

With VAT, businesses remit taxes incrementally, based on the value added at each stage. This self-enforcing mechanism ensures transparency but requires more detailed record-keeping. Sales tax, on the other hand, simplifies collection by focusing solely on the final transaction. However, it lacks the multi-stage accountability that VAT provides.

Impact on Businesses and Consumers

The impact of VAT and sales tax on businesses and consumers varies significantly. VAT creates a neutral environment for investment choices because it applies uniformly across all stages of production. Sales tax, however, can distort consumer behavior by incentivizing certain purchases over others.

For consumers, VAT often results in higher prices because businesses pass the tax burden along the supply chain. Sales tax, being applied only at the point of sale, may seem simpler but can lead to uneven pricing due to varying rates across regions. Businesses operating under VAT systems face stricter compliance requirements, including detailed reporting and audits. Sales tax systems, while less complex, can create challenges for companies operating in multiple states or localities due to inconsistent regulations.

Global Adoption Trends

Globally, VAT has gained widespread adoption, with many countries preferring it over sales tax due to its efficiency and revenue-generating potential. Here are some notable trends:

-

The average standard VAT rate in OECD countries is 19.3%.

-

The OECD average tax base ratio is 54%.

-

New Zealand has a VAT base covering nearly 100% of total consumption.

-

Luxembourg and Estonia have tax base ratios of 78% and 73%, respectively.

-

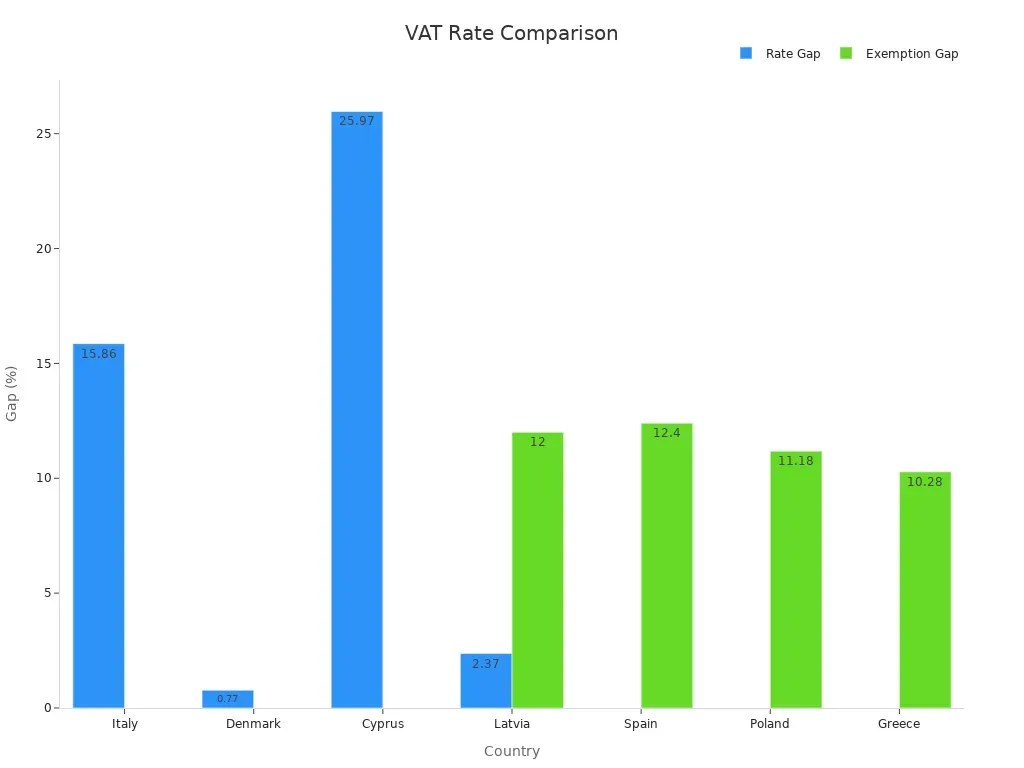

In 2020, the average actionable VAT policy gap in the EU was 16.4%, indicating potential revenue loss from reduced rates and exemptions.

These statistics highlight the global preference for VAT systems, which offer a broader tax base and more consistent revenue streams. Sales tax, by contrast, remains limited to specific regions, such as the United States, where state and local governments set varying rates. This patchwork approach complicates compliance for businesses and reduces overall efficiency.

VAT systems also provide a self-enforcing mechanism that minimizes fraud and errors. However, they require significant administrative effort, including accurate record-keeping and reporting. Sales tax systems, while simpler, lack the multi-stage accountability that VAT offers, making them less effective in preventing tax evasion.

Benefits and Challenges of VAT

Advantages of VAT Systems

VAT systems offer several benefits that make them a preferred choice for governments worldwide. One major advantage is their self-enforcing nature. Businesses must report both input and output VAT, which encourages accurate reporting and reduces tax evasion. This mechanism ensures that governments can mobilize revenue efficiently. Additionally, VAT systems apply to every stage of production and distribution, creating a steady and reliable revenue stream for governments. This consistency helps fund public services and infrastructure.

Another benefit is the neutrality of VAT. It does not distort business decisions since it applies uniformly across industries. Unlike sales tax, VAT does not favor one type of consumption over another. This neutrality promotes fair competition and encourages investment. Moreover, VAT systems are easier to administer in cross-border trade compared to other tax systems, as they follow standardized rules in many regions.

Common Challenges in VAT Implementation

Despite its advantages, implementing VAT comes with challenges. Tax evasion remains a significant issue. Fraud schemes, such as carousel fraud and false invoicing, can lead to substantial revenue losses. Cross-border transactions also complicate VAT management due to varying regulations. Businesses often struggle to comply with these differences, risking penalties.

Administrative costs pose another challenge. Governments and businesses must invest in technology and training to ensure compliance. Small businesses, in particular, may find these costs burdensome. Additionally, determining appropriate VAT rates can create economic disparities. High rates may reduce consumer purchasing power, affecting overall economic activity.

Economic Implications of VAT

VAT has both short-term and long-term economic effects. In the short term, higher VAT rates can reduce profitability for businesses. For example, a 10% VAT increase in Saudi Arabia led to a 2.16% drop in average profitability for firms. However, in the long term, VAT benefit governments by increasing revenue. This revenue can be reinvested into the economy, potentially improving business profitability and public services.

The German experience with VAT highlights its potential during economic crises. By stimulating activity, VAT can support recovery efforts. Research also shows that VAT increases do not necessarily burden low-income groups, making it an equitable tax option. However, VAT can cause economic volatility, especially when rates change suddenly. This volatility affects corporate finances, unemployment, and tax revenue.

VAT Registration and Compliance

Registration Requirements

VAT registration requirements vary across jurisdictions, but they generally depend on your business's turnover, activities, and compliance costs. If your taxable turnover exceeds a specific threshold, you must register for VAT. For example, many countries set this threshold at $85,000 or its equivalent. Certain business activities, such as importing goods or providing services internationally, may also trigger VAT registration regardless of turnover.

To register, you need to prepare documentation that outlines your business activities and financial details. This includes invoices, contracts, and proof of identity. VAT online registration simplifies this process, allowing you to submit applications directly to tax authorities. Once registered, you must stay updated on your VAT duties, including filing VAT returns and making VAT payments on time.

Filing and Payment Processes

Once registered, you must file VAT returns regularly. These returns detail your input and output VAT, helping tax authorities calculate your VAT liability. Filing deadlines vary by country, but most require monthly or quarterly submissions. VAT online registration platforms often include tools to automate this process, reducing errors and saving time.

VAT payment is another critical aspect of compliance. You must pay the difference between your output VAT and input VAT to the authorities. Late payments can result in penalties, so timely submission is essential. Small businesses often face higher compliance costs, which can lead to challenges in meeting these obligations. Using automated systems can help you manage VAT payments efficiently.

Penalties for Non-Compliance

Failing to comply with VAT regulations can lead to significant penalties. If you don’t register for VAT when required, authorities may impose fines of up to £400 per month. Late filing of VAT returns can result in penalties of up to £300, depending on the delay and the size of your business. Late VAT payments incur additional fines, which can reach £1,000 for every £10,000 owed. Providing inaccurate information on VAT returns may lead to penalties of up to 30% of the tax owed.

These penalties underscore the importance of understanding VAT registration requirements and maintaining compliance. By using VAT online registration tools and automating filing processes, you can avoid these costly mistakes.

Value-added tax (VAT) is a consumption tax applied at every stage of production and distribution, ensuring a steady revenue stream for governments. Its key features, such as neutrality and multi-stage collection, make it a reliable and fair taxation system. Understanding VAT helps you manage compliance, avoid penalties, and make informed financial decisions.

Future trends highlight the growing role of digital transformation in VAT systems. For example, the ViDA Directive in the EU aims to modernize VAT reporting with real-time data and mandatory e-invoicing. This initiative addresses inefficiencies and fraud, which caused a VAT gap of EUR 89 billion in 2022. As consumption taxes continue to rise in importance globally, businesses must adapt to these changes to remain competitive.

By embracing digital tools and staying updated on cross-border VAT regulations, you can navigate the evolving tax landscape effectively.

FAQ

What is the purpose of VAT?

VAT generates revenue for governments by taxing the value added to goods and services at each stage of production. You, as a consumer, ultimately pay this tax when purchasing products or services.

Who is responsible for paying VAT?

Businesses collect VAT from consumers and remit it to tax authorities. You, as a consumer, pay VAT indirectly when buying goods or services.

How does VAT differ from sales tax?

VAT applies at every stage of production and distribution. Sales tax, however, is only charged at the final sale. You experience VAT as part of the product price, while sales tax is added at checkout.

Are all goods and services subject to VAT?

No, some goods and services are exempt or taxed at reduced rates. Essentials like food or medicine often have lower VAT rates to reduce your financial burden.

Can businesses claim back VAT?

Yes, businesses can reclaim VAT paid on purchases used for their operations. This process, called input VAT deduction, helps reduce their overall tax liability.

Related content