Understanding Bail-Ins and Their Impact on Global Business

Author:XTransfer2025.04.15Bail in

A bail-in serves as a method to rescue failing banks by requiring creditors and depositors to absorb the losses rather than relying on taxpayers. Within the European Union, the bail-in approach is used to manage risks associated with massive banks, often referred to as "too big to fail." By mandating shareholders and creditors to cover losses, sometimes amounting to $55 billion, the bail-in mechanism helps maintain the stability of the financial system. This process is crucial for safeguarding global business and preserving trust in banks.

Highlights

-

A bail-in saves struggling banks by making creditors and owners take losses. This keeps taxpayers from paying the costs.

-

Bail-ins work by fixing problems inside the bank. They make sure banks handle risks without needing government money.

-

Knowing local bail-in rules is important for businesses. It helps them avoid risks and protect their money during bank troubles.

-

Bail-ins can make people lose trust in banks. Customers might take out their money or choose safer banks after a crisis.

-

Big companies should use many banks to avoid losing too much if one bank has a bail-in.

What Is a Bail-In?

Definition and Key Features

A bail-in is a way to save a failing bank. It works by making the bank's creditors, shareholders, and sometimes depositors take on the losses. This means taxpayers don’t have to pay for the bank's problems. The people connected to the bank help it recover, which saves public money.

Bail-ins focus on fixing the bank from the inside. They also stop big problems from spreading to other banks. Unlike bailouts, where governments step in, bail-ins follow set rules. For example, the Bank Recovery and Resolution Directive (BRRD) was made in 2014. It gives clear steps for using bail-ins in the European Union. These rules make sure the process is fair and clear.

How Bail-Ins Work

Bail-ins turn a bank’s debts into ownership shares. This means bonds, shares, or deposits lose value to cover losses. For example, bondholders might get shares instead of their money back. Uninsured depositors might lose part of their savings.

The goal is to protect small depositors and insured accounts. Bigger creditors and shareholders usually lose more money. This way, regular customers are less affected, and the bank can keep running. Leaders try to balance fairness and stability during these tough times.

Examples of Bail-Ins in Practice

In 2013, Cyprus used a bail-in to fix its banking crisis. The government, with help from the EU and IMF, made bondholders and uninsured depositors take losses. This helped rebuild the banking system and bring back stability.

Data shows how bail-ins affect families. About 55% of households lost money, and 28% had uninsured deposits reduced. Even 44% of families moved their money, even if they didn’t lose anything. This shows how bail-ins can shake trust in banks.

Over time, surveys show one-third of families avoid keeping money in local banks after a bail-in. This shows how bail-ins can change how people feel about banks for a long time.

Bail-Ins vs. Bailouts

Key Differences Between Bail-Ins and Bailouts

When banks face trouble, leaders pick bail-ins or bailouts. A bailout uses taxpayer money to save the bank. A bail-in makes creditors and shareholders pay for the losses. This way, public money is safe, and the bank keeps running.

Here’s a table showing the main differences:

Why Bail-Ins Are Gaining Preference

Bail-ins are now more popular for fixing bank problems. Rules like the Dodd-Frank Act in the U.S. and Basel III reforms support this. These rules aim to stop taxpayer-funded bailouts and make banks stronger.

The FDIC supports bail-ins as a fair solution. Leaders see them as a way to keep banks responsible and avoid big crashes. This change helps build a safer banking system worldwide.

Legal and International Frameworks for Bail-Ins

The Dodd-Frank Act and Bail-Ins in the U.S.

The Dodd-Frank Act helps guide how bail-ins work in the U.S. This law was created after the 2008 financial crisis. It stops banks from using taxpayer money to fix their problems. Instead, banks must plan for failures without government help. These "living wills" explain how banks will handle their losses. This makes sure bail-ins happen smoothly and protect the economy.

In Harris County, Texas, new rules capped misdemeanor bail at $100. This change improved pretrial release rates from 60% to 87%. It also slightly lowered new crime rates. This shows that clear rules can improve results, even in banking.

Basel III and Global Banking Regulations

Basel III rules help keep banks stable worldwide. These rules make banks save more money to handle losses. One tool is contingent convertible bonds (CoCos). CoCos turn into shares if a bank's capital drops too low. This gives banks extra money and avoids using taxpayer funds.

In Europe, CoCos count toward important bank capital requirements. This makes banks stronger and encourages careful decisions. But some say CoCos look at past risks, not future ones. Even with this issue, Basel III is key to keeping banks safe globally.

Regional Variations in Bail-In Policies

Bail-in rules differ by region due to local needs. In Europe, banks must prepare documents for quick bail-ins. This helps during financial crises. These rules also change how investors act. For example, investors now want higher returns on risky bonds.

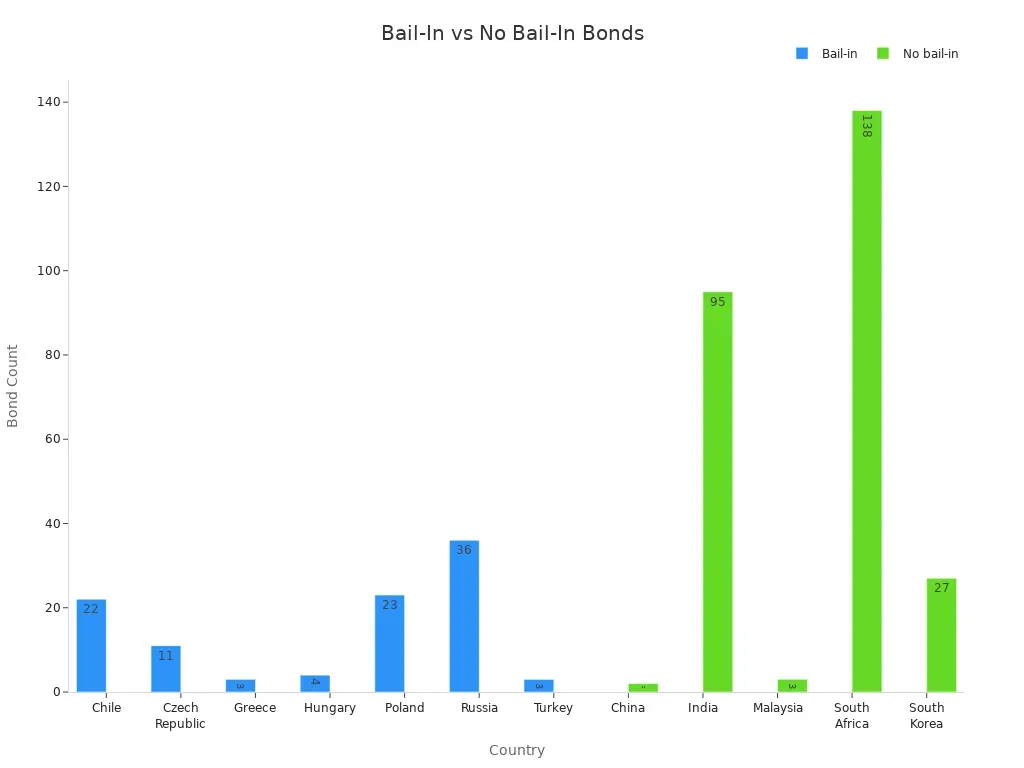

A study shows how bonds differ across countries. Places like Chile and Poland with bail-in rules see bond prices change. Countries like China and India without these rules show different trends.

Challenges and Controversies of Bail-Ins

Impact on Multinational Corporations

Bail-ins can greatly affect big global companies. If a bank uses a bail-in, companies with large deposits or investments may lose money. This can hurt their cash flow and daily operations. For example, a company depending on a bank for loans might find those funds cut or unavailable during a crisis. This could make the company look for other funding, often at higher costs.

Also, multinational companies work in many countries with different bail-in rules. This adds uncertainty. They must check the risks of each bank they use and change their financial plans. Spreading out banking relationships can lower the risk of losing money in a bail-in.

Transparency and Public Trust

Trust is important for bail-ins to work well. Clear communication helps people feel safe about their money. If banks and regulators don’t explain things clearly, people may panic. This can hurt trust in the banking system. In Cyprus in 2013, many people took their money out of banks. They feared losing more money, which hurt the economy. To stop this, rules must be clear, and people need to know their money is safe.

Risks to Financial Stability

Bail-ins protect taxpayers but can also create new risks. Problems like debt, cash shortages, and complex systems can arise. Complicated bank setups make bail-ins harder to predict. Connected banks can pass problems to each other, making crises worse. Experts found ways issues spread, like selling assets quickly or sharing risks. If not handled well, bail-ins can harm the stability they aim to protect.

Implications of Bail-Ins for Global Business

Effects on Banking and Credit

Bail-ins affect banks and how much they can lend. When a bank uses a bail-in, it might lose customer and investor trust. This can mean fewer deposits and higher borrowing costs for the bank. The bank might then lend less to people and businesses.

A study of Portugal’s Banco Espírito Santo showed banks involved in a bail-in cut lending by 5.78% for every one standard deviation increase in exposure. Businesses borrowed from safer banks but paid more. Small businesses saw a 2.3% drop in investment and 0.6% fewer jobs. This shows how bail-ins can hurt the economy, affecting both companies and workers.

Long-Term Global Financial Implications

Over time, bail-ins change how the global financial system works. They push banks to be safer and save more money. This lowers the chance of future crises. But bail-ins can also hurt trust in banks. People may worry about losing savings and prefer smaller banks or other financial options.

For global companies, bail-ins highlight the need for good risk planning. You should watch your banks’ financial health and learn about local bail-in rules. This helps you prepare for problems and protect your business.

Bail-ins help save struggling banks by making creditors and shareholders handle losses. This keeps taxpayers safe and makes banks take responsibility. Bail-ins are important for keeping banks steady and protecting global businesses.

FAQ

What is the main purpose of a bail-in?

A bail-in helps a failing bank by making creditors and shareholders take losses. This keeps taxpayers from paying and allows the bank to keep running.

Related content