Transaction Account Basics You Should Know

Author:XTransfer2025.04.27Transaction account

A transaction account is your go-to tool for managing day-to-day transactions. It’s the kind of consumer bank account that makes life easier by letting you deposit your paycheck, pay bills, or shop with a debit card. Did you know that in 2022, over 41% of account holders used peer-to-peer payments regularly? With features like direct deposits and digital banking, a checking account is essential for keeping your finances organized.

How a Transaction Account Differs from Other Accounts

Transaction Accounts vs. Savings Accounts

You might wonder how a transaction account stacks up against a savings account. The biggest difference lies in how you use them. A transaction account is designed for your daily financial needs. You can deposit and withdraw money as often as you like without worrying about penalties. On the other hand, savings accounts are meant to help you grow your money over time. They usually come with withdrawal limits and may charge fees if you exceed them.

Here’s a quick comparison to make things clearer:

So, if you’re looking for flexibility, a transaction account is your best bet. But if earning interest is your goal, a savings account might be the way to go.

Transaction Accounts vs. Investment Accounts

Investment accounts are all about growing your wealth. They let you buy stocks, bonds, or mutual funds. Unlike a checking account, they aren’t built for everyday use. You can’t use them to pay bills or shop online. Plus, accessing your money can take time since you might need to sell investments first.

A transaction account, however, gives you instant access to your funds. It’s perfect for managing your daily expenses, while an investment account is better for long-term financial goals.

Transaction Accounts vs. Certificates of Deposit (CDs)

Certificates of Deposit, or CDs, are another option for saving money. But they work very differently from a transaction account. When you open a CD, you agree to lock your money away for a set period. In return, you earn a fixed interest rate. If you withdraw early, you’ll face penalties.

A transaction account doesn’t have these restrictions. You can use your money whenever you need it. CDs are great for saving, but they don’t offer the flexibility you get with a transaction account.

Key Features of a Transaction Account

Instant Access to Funds

A transaction account gives you immediate access to your money whenever you need it. Whether you're paying for groceries, transferring money to a friend, or withdrawing cash from an ATM, you can do it instantly. This flexibility makes managing your daily expenses much easier compared to other account types.

Unlimited Transactions

Unlike savings accounts, which often limit the number of withdrawals you can make, a transaction account allows unlimited transactions. You can make as many deposits, withdrawals, and transfers as you need without worrying about penalties. This feature is especially useful for handling frequent payments like rent, utilities, or online shopping.

Here are some common types of transactions you can perform with a checking account:

-

ATM withdrawals

-

In-person withdrawals at a bank branch

-

Online transfers and bill payments

-

Phone requests for check disbursements

-

Mail or courier withdrawal requests

This level of freedom ensures your financial activities remain seamless and stress-free.

Debit Card and ATM Access

Your transaction account typically comes with a debit card, giving you the power to make purchases and withdraw cash on the go. Debit cards are widely accepted, making them a convenient tool for everyday spending. Plus, many banks offer perks like exclusive card designs or discounts with certain brands.

With these features, managing your money becomes not only efficient but also secure.

Online and Mobile Banking

In today’s digital age, online and mobile banking are must-haves. A transaction account lets you check your balance, transfer money, and pay bills—all from your smartphone or computer. These tools save you time and eliminate the need to visit a bank branch.

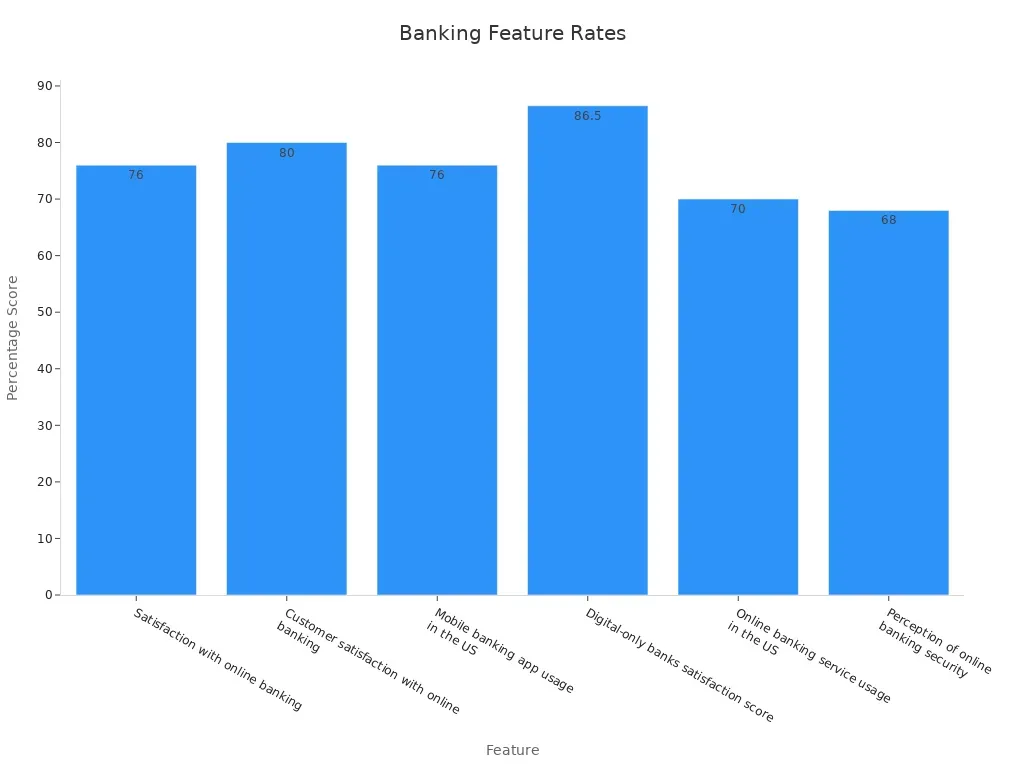

Here’s what the numbers say about online and mobile banking:

These stats highlight how essential digital banking has become for modern financial management.

Overdraft Protection

Overdraft protection is a lifesaver when unexpected expenses arise. If you accidentally spend more than what’s in your account, this feature covers the difference, preventing declined transactions or hefty fees. Many banks now offer overdraft fee waivers or grace periods, saving consumers billions annually.

By choosing a transaction account with overdraft protection, you can avoid financial hiccups and maintain peace of mind.

Common Fees for Transaction Accounts

When you open a transaction account, it’s important to understand the fees that might come with it. These fees can vary depending on the bank and the type of account you choose. Let’s break down the most common ones.

Monthly Maintenance Fees

Some banks charge a monthly maintenance fee just for keeping your account open. These fees can range from $5 to $15 per month. However, many banks waive this fee if you meet certain requirements, like maintaining a minimum balance or setting up direct deposits.

For example, if you pay a $2.37 fee biweekly over a school year, it adds up to $42.66 annually. That’s about 7.9% of what you might spend on school lunches in a year. On the other hand, paying the same fee only three times a year would cost just $7.11. Understanding these fees can help you avoid unnecessary costs.

Overdraft and Insufficient Funds Fees

Overdraft and insufficient funds (NSF) fees occur when you spend more money than you have in your account. These fees can be costly, often ranging from $25 to $35 per transaction. In 2022, overdraft and NSF fees generated $9.9 billion in revenue for banks. Financially vulnerable households were hit the hardest, accounting for over $6 billion of these fees.

Here are some key insights about overdraft and NSF fees:

-

17% of households with checking accounts reported paying these fees in 2022.

-

Financially vulnerable individuals experienced overdrafts at a much higher rate (46%) compared to financially healthy households (4%).

-

Accounts with low average daily balances (below $500) are 20 times more likely to incur NSF fees than those with higher balances.

Understanding how these fees work can help you avoid them and save money.

ATM and Foreign Transaction Fees

Using ATMs outside your bank’s network or making purchases abroad can lead to additional fees. ATM fees typically range from $2 to $5 per transaction, while foreign transaction fees add 1% to 3% to the cost of each purchase. Some banks also charge currency conversion fees, which can increase the total cost by 3% to 12%.

Here’s what you should know about these fees:

-

Foreign transaction fees apply to purchases made abroad or with foreign merchants.

-

Withdrawals from foreign ATMs may include extra charges beyond the ATM’s own fees.

-

Some banks offer fee waivers or fee-free cards for specific customers.

If you travel often, consider choosing a bank that minimizes these fees or offers reimbursement for out-of-network ATM charges.

Types of Transaction Accounts

When it comes to managing your money, not all transaction accounts are the same. Different types of transaction accounts cater to unique needs, whether you're a student, a business owner, or someone looking for extra perks. Let’s explore the options.

Standard Transaction Accounts

A standard transaction account is the most common type. It’s perfect for everyday banking needs like paying bills, shopping, or receiving your paycheck. These accounts usually come with basic features such as a debit card, online banking, and unlimited transactions. They’re straightforward and easy to use, making them a great choice if you want a no-frills option for managing your daily finances.

Premium Transaction Accounts

If you’re looking for extra benefits, a premium transaction account might be worth considering. These accounts often come with perks like higher withdrawal limits, waived fees, and exclusive rewards programs. Some banks even offer personalized customer service or travel benefits. While these accounts may have higher monthly fees, the added features can make them a good fit if you want more value from your banking experience.

Student Transaction Accounts

Student transaction accounts are designed with young adults in mind. They often come with lower fees, no minimum balance requirements, and easy access to mobile banking. These features make them ideal for managing a student budget. Did you know that mobile money accounts have a 94.4% adoption rate among students, compared to 77.8% for traditional bank accounts? Students also value accessibility (47.2%) and ease of use (30.6%) when choosing their accounts.

If you’re a student, this type of account can help you stay on top of your finances without breaking the bank.

Business Transaction Accounts

For business owners, a dedicated business transaction account is essential. These accounts help you keep personal and business finances separate, which is crucial for legal protection and tax preparation. They also make it easier to track deductible expenses and maintain financial organization.

Here’s how a business account can benefit you:

-

It enhances your professional credibility with clients and vendors.

-

You can accept credit card payments, meeting customer expectations and boosting sales.

-

It helps you build a business credit profile, which is vital for securing loans or financing.

Whether you’re running a small startup or a large company, a business transaction account can simplify your financial management and support your growth.

FDIC Guarantee and Its Importance

What is FDIC Insurance?

FDIC insurance is like a safety net for your money. It’s a guarantee provided by the Federal Deposit Insurance Corporation (FDIC) to protect your deposits in case your bank fails. This insurance covers various types of accounts, including checking, savings, and certificates of deposit (CDs). Since its creation in 1934, the FDIC has ensured that no depositor has ever lost insured funds. That’s a pretty solid track record, don’t you think?

Here’s a quick breakdown of what FDIC insurance covers:

This protection ensures your money is safe, even during uncertain times.

How FDIC Protects Your Money

The FDIC steps in when a bank fails. It acts as a receiver, ensuring you can access your insured deposits quickly. For example, if your bank closes, the FDIC either transfers your account to another bank or pays you directly. This process prevents financial chaos and gives you peace of mind.

Here’s how the FDIC works during bank failures:

-

Insures deposits up to $250,000 per depositor, per ownership category.

-

Protects funds in checking, savings, and other eligible accounts.

-

Manages failed banks to ensure depositors don’t lose their money.

Recent events, like the collapse of Signature Bank, show how FDIC insurance prevents panic and protects depositors from losing their hard-earned money.

Coverage Limits and What’s Included

FDIC insurance has clear limits. It covers up to $250,000 per depositor, per ownership category, at each insured bank. This means you’re protected for multiple accounts at different banks, as long as each bank is FDIC-insured.

If you have more than $250,000 in one account, consider spreading your funds across different banks or ownership categories to maximize your coverage. With FDIC insurance, your money stays safe, no matter what happens to your bank.

Tips for Choosing the Right Transaction Account

Choosing the right transaction account can feel overwhelming with so many options out there. But don’t worry—breaking it down into a few simple steps can make the process much easier. Here’s how you can find the perfect account for your needs.

Evaluate Your Financial Needs

Start by thinking about how you’ll use your account. Are you looking for an account to handle everyday expenses, or do you need something more specialized, like a student or business account? Your financial habits play a big role in determining the best fit.

Ask yourself these questions:

-

How often do you plan to make transactions?

-

Do you need overdraft protection or access to international ATMs?

-

Are you comfortable maintaining a minimum balance to avoid fees?

For example, if you’re a student, you might prioritize low fees and mobile banking. If you’re running a business, you’ll want an account that separates personal and business finances while offering features like credit card payment acceptance.

Compare Fees and Features

Not all accounts are created equal, especially when it comes to fees. Some banks charge monthly maintenance fees, while others offer free accounts if you meet certain conditions. Understanding the fee structure can save you money in the long run.

Here’s a quick comparison of common fee structures:

When comparing accounts, look beyond fees. Consider features like mobile banking, ATM access, and rewards programs. For example, younger generations like Gen Z and Millennials tend to pay higher fees on average ($19.13 and $15.55, respectively) compared to older generations like Baby Boomers ($2.21). This highlights the importance of finding an account that aligns with your spending habits.

Consider Accessibility and Customer Support

Accessibility and customer support can make or break your banking experience. You want an account that’s easy to manage and backed by reliable support when you need help.

Here are some key factors to evaluate:

-

Customer Satisfaction (CSAT): Measures how happy customers are with their support experience.

-

Support Performance Score: Combines response time, resolution time, and CSAT into one metric.

-

Average Time to Close Issues: Tracks how quickly problems are resolved, showing the efficiency of customer service.

-

Client Survey Score: Reflects customer feedback on the bank’s overall performance.

If you value quick problem resolution, look for banks with high support performance scores. Some banks also offer 24/7 customer service or dedicated support for premium account holders. These features can save you time and reduce stress when issues arise.

Look for Additional Perks or Benefits

Finally, don’t forget to check for extra perks. Many banks offer rewards programs, cashback on purchases, or fee waivers for certain transactions. These benefits can add significant value to your account.

Here are some perks to look out for:

-

Sign-up bonuses: Some banks offer cash bonuses when you open a new account.

-

Fee waivers: Look for accounts that waive ATM or foreign transaction fees.

-

Rewards programs: Earn points or cashback for using your debit card.

-

Exclusive benefits: Premium accounts may include perks like travel insurance or higher withdrawal limits.

These extras might seem small, but they can make a big difference over time. For example, if you travel frequently, an account with no foreign transaction fees could save you hundreds of dollars annually.

By following these tips, you’ll be well on your way to finding a transaction account that fits your lifestyle and financial goals.

A transaction account is your financial hub for daily activities, offering features like instant access, unlimited transactions, and digital banking. Choosing the right account simplifies your money management. Think about your needs, compare options, and pick one that fits your lifestyle. The right choice keeps your finances stress-free and organized.

FAQ

What’s the difference between a transaction account and a savings account?

A transaction account is for daily spending, while a savings account helps you grow your money. Savings accounts often have withdrawal limits, unlike transaction accounts.

Can I open multiple transaction accounts?

Yes, you can open multiple accounts. Many people use separate accounts for personal and business finances or to manage specific expenses like travel or bills.

Are transaction accounts safe?

Absolutely! Most transaction accounts are FDIC-insured, protecting your money up to $250,000 per depositor, per bank. This ensures your funds are secure even if the bank fails.

Related content