The Role of Fedwire in Modernizing U.S. Payments Systems

Author:XTransfer2025.05.26FEDWIRE

The Federal Reserve’s plan to expand Fedwire’s operating hours marks a pivotal moment for the U.S. payment system. This change will allow real-time, large-value payments to function seamlessly in a 24/7 economy. Businesses and banks will benefit from faster transaction settlements, reducing delays and improving cash flow.

Real-time payments accounted for 266.2 billion transactions globally in 2023, showcasing the growing demand for instant fund transfers. As more businesses and consumers adopt digital payment solutions, Fedwire’s modernization will ensure the U.S. payment system remains competitive and efficient.

Fedwire's Current Role in the U.S. Payment System

Overview of Fedwire's operations and purpose

Fedwire plays a critical role in the U.S. financial system by facilitating large-dollar payments between banks and other financial institutions. It is the largest large-value payments system in the country, ensuring the secure and efficient transfer of funds. You can think of it as the backbone of high-value transactions, supporting the economy's daily operations.

The system processes a significant number of transactions annually, with billions of dollars moving through it each day. The table below highlights Fedwire's operational data over recent years:

These figures demonstrate the system's importance in handling large-dollar payments and its steady growth in volume and value.

Key stakeholders and their reliance on Fedwire

Banks, businesses, and government entities rely heavily on Fedwire to process high-value transactions. Its ability to settle payments in real-time ensures that funds are available immediately, which is crucial for maintaining liquidity and meeting financial obligations.

You benefit from this system indirectly when your bank uses it to settle payments on your behalf. Whether it's a business transferring millions of dollars or a government agency disbursing funds, Fedwire ensures these transactions happen securely and efficiently.

Current operating hours and their limitations

Currently, Fedwire operates on a limited schedule, which restricts its ability to support a 24/7 economy. The system is available Monday through Friday, with operating hours typically ending in the evening. This schedule creates challenges for businesses and financial institutions that operate across different time zones or need to settle payments outside of regular hours.

The timing of Fedwire funds transfers has also shifted, with a growing concentration of activity in the late afternoon. This trend reflects the increasing value of payments and the settlement patterns of private institutions. However, these limitations can delay critical transactions, impacting cash flow and operational efficiency.

Expanding Fedwire's operating hours will address these challenges, enabling you to benefit from faster and more flexible payment options.

Expanding Fedwire Operating Hours: What It Means

Details of the proposed expansion

The Federal Reserve plans to extend Fedwire's operating hours to meet the growing demand for faster and more flexible payments. This expansion will shift the system to a 22x7x365 schedule, meaning it will operate 22 hours a day, every day of the year. By doing so, the system will better support the needs of a modern, round-the-clock economy.

This change offers several benefits. It reduces credit risk by narrowing the time gaps between payment obligations. It also enhances operational efficiency, allowing businesses and banks to settle transactions more quickly. For example, weekend interbank lending markets could become more viable, fostering innovation in large-value payments. Additionally, the extended hours will improve cross-border payment efficiency by overlapping with other global payment systems.

This phased approach ensures a smoother transition while minimizing operational risks. It also provides an opportunity to evaluate the system's performance before considering full 24/7 clearing.

Alignment with ISO 20022 and global payment standards

The Federal Reserve's decision to align Fedwire with ISO 20022 reflects its commitment to modernizing the U.S. payments system. ISO 20022 is a global standard for financial messaging that promotes interoperability and efficiency. By adopting this standard, Fedwire will enable seamless transactions both domestically and internationally.

Many major payment markets have already transitioned to ISO 20022. Without this alignment, the U.S. risks falling behind, potentially making its payment systems appear outdated. The new standard will also enhance existing processes, such as bank-to-bank wire transfers, by enabling immediate and irrevocable clearing. This improvement will allow you to experience faster and more reliable transactions.

This alignment not only supports the current expansion but also lays the groundwork for future innovations in the U.S. payments system.

Timeline and milestones for implementation

The Federal Reserve has outlined a clear timeline for implementing the expanded operating hours. The process will occur in phases to ensure a smooth transition. Initial steps include system upgrades and stakeholder consultations. These efforts will address potential impacts on smaller financial institutions and ensure that all participants are prepared for the changes.

Key milestones include testing the system's ability to handle extended hours and training staff to manage round-the-clock operations. The Federal Reserve will also gather feedback from stakeholders to refine the implementation process. This collaborative approach ensures that the expansion meets the needs of all users while maintaining the safety and reliability of the system.

The lessons learned during this phased rollout will inform future developments, such as the potential shift to full 24/7 clearing. By taking a gradual approach, the Federal Reserve minimizes risks and maximizes the benefits of the expanded operating hours.

Benefits of Expanding Operating Times

Faster settlement times and improved efficiency

Expanding Fedwire's operating hours will significantly enhance the speed and efficiency of payment settlements. You will experience quicker transaction processing, which reduces delays and improves cash flow. This improvement is especially critical for businesses that rely on timely payments to maintain operations and meet financial obligations.

Several real-world examples highlight how faster settlement times can transform efficiency:

-

XYZ Insurance Company reduced its average claims processing time by 30% after implementing an advanced claims management system.

-

Fraud detection algorithms decreased fraudulent claims by 20%, enabling quicker settlements for legitimate claims.

-

Improved communication and data analytics increased claims settlement efficiency by 15%.

These examples demonstrate how operational enhancements can lead to measurable improvements in efficiency. With Fedwire's extended hours, you can expect similar benefits, such as reduced bottlenecks and smoother financial operations.

Enhanced global competitiveness of U.S. payment systems

The expansion of Fedwire's operating hours will position the U.S. payment system as a global leader. In today's interconnected economy, countries with advanced payment infrastructures attract more international business. By aligning with global standards and offering extended hours, the U.S. can remain competitive on the world stage.

Weekend and holiday operating hours will also allow U.S. businesses to engage more effectively with international markets. For example, overlapping operating hours with other countries' payment systems will streamline cross-border transactions. This alignment reduces delays caused by time zone differences, making it easier for you to conduct business globally.

Furthermore, the implementation of ISO 20022 ensures that Fedwire meets international standards for financial messaging. This standard promotes interoperability, enabling seamless transactions across borders. As a result, you will benefit from faster, more reliable international payments, enhancing your ability to compete in the global marketplace.

Increased flexibility for businesses and consumers

The extended operating hours will provide you with greater flexibility in managing your finances. Businesses will no longer need to wait for the next business day to settle payments, especially during weekends or holidays. This flexibility improves cash flow management and allows you to respond more quickly to financial needs.

Research shows that flexibility positively impacts productivity and satisfaction. For example:

-

Lack of flexibility reduces employee engagement and productivity.

-

Flexible scheduling options improve job retention and overall satisfaction.

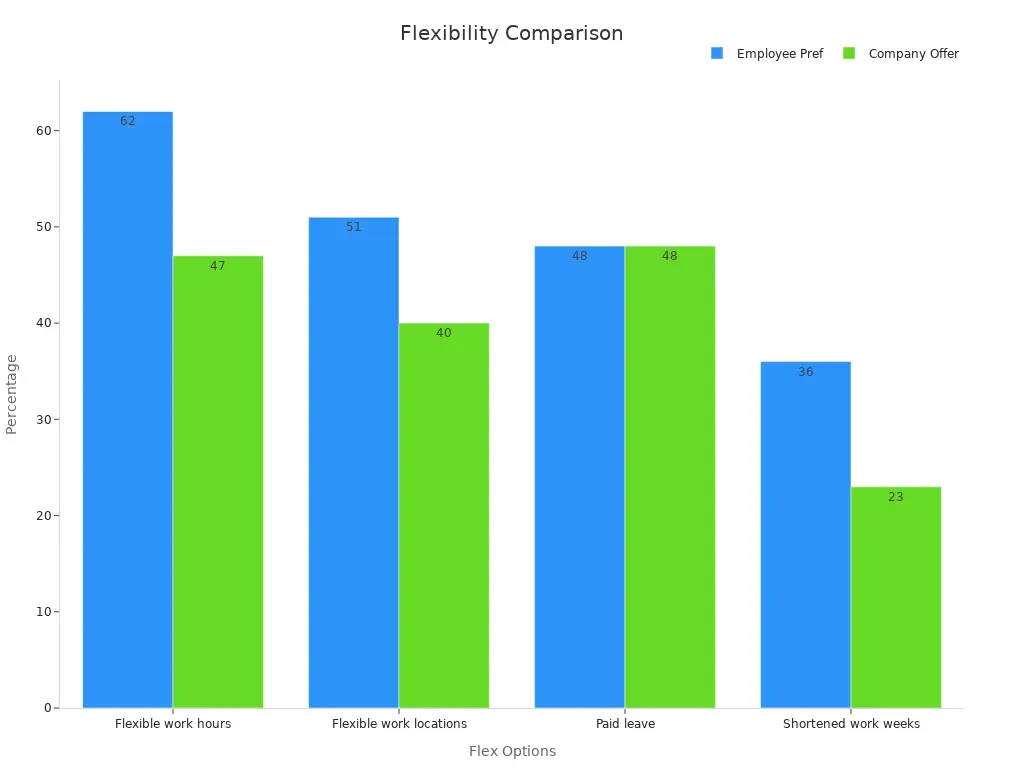

The following table highlights the gap between employee preferences and company offerings for flexibility:

This data underscores the importance of flexibility in meeting the needs of both businesses and consumers. With Fedwire's expanded hours, you will have more control over your financial transactions, whether you're managing payroll, paying suppliers, or transferring funds for personal use.

Weekend settlement options will further enhance this flexibility. You will no longer face delays caused by traditional banking schedules, allowing you to make payments and access funds when you need them most. This change represents a significant step forward in creating a payment system that works for everyone, every day of the year.

Challenges of Expanding Operating Hours

Operational costs and staffing implications

Expanding Fedwire's operating hours will increase operational costs for financial institutions. You may notice that banks and payment processors will need to invest in additional resources to support extended schedules. These resources include hiring more staff, upgrading technology, and maintaining infrastructure for longer periods.

Staffing challenges will also arise. Employees will need to work in shifts to ensure round-the-clock operations. This adjustment could lead to higher payroll expenses and potential employee burnout. Smaller institutions may struggle to recruit and retain skilled workers for these extended hours.

Cybersecurity risks and necessary safeguards

Longer operating hours increase the risk of cyberattacks. With systems running nearly continuously, you may wonder how institutions will protect sensitive financial data. Cybercriminals often exploit vulnerabilities during off-peak hours, making robust security measures essential.

To address these risks, institutions will need to implement advanced safeguards. These include real-time monitoring, multi-factor authentication, and regular system updates. You can expect financial institutions to invest heavily in cybersecurity training for their staff. This training ensures that employees can identify and respond to potential threats quickly.

Concerns from smaller financial institutions

Smaller banks and credit unions may face unique challenges. Unlike larger institutions, they often lack the resources to adapt quickly to extended operating hours. You might see some of these organizations struggling to upgrade their systems or hire additional staff.

These limitations could create disparities in service quality. Larger institutions may gain a competitive edge, leaving smaller ones at a disadvantage. To address this, the Federal Reserve could offer support programs. These programs would help smaller institutions transition smoothly and ensure that you receive consistent service regardless of your bank's size.

Implementation and Broader Implications

Steps for gradual adoption and stakeholder feedback

The Federal Reserve has outlined a phased approach to expanding Fedwire's operating hours. This strategy ensures a smooth transition while addressing concerns from stakeholders like credit unions and smaller financial institutions. You can expect the following steps to guide the process:

-

Conducting additional outreach to gather feedback from banks, credit unions, and other participants.

-

Implementing a gradual rollout to test demand and manage operational costs effectively.

-

Addressing staffing challenges, particularly for weekend and holiday operations, to ensure readiness.

The Federal Reserve Board of Governors has emphasized the importance of stakeholder input. For example, they plan to align this expansion with the ISO 20022 migration scheduled for March 2025. This alignment allows institutions to adapt to both changes simultaneously, reducing disruptions and ensuring a seamless transition.

Long-term impact on the U.S. financial ecosystem

The expanded Fedwire services will reshape the U.S. financial landscape. You will likely see improved access to payment systems, especially for underserved populations. This change could reduce fees for lower-income households, encouraging greater economic participation.

Key benefits include:

-

Enhanced liquidity management for banks, reducing the need for pre-funding accounts.

-

Lower risks of payment failures, ensuring more reliable transactions.

-

Increased financial inclusion, allowing more individuals and businesses to engage in the economy.

Just-in-time liquidity management will also transform how banks operate. By reducing the need to pre-fund accounts, banks can allocate resources more efficiently. This improvement strengthens the overall reliability of the payment system, benefiting you as a consumer or business owner.

How Fedwire's expansion supports future payment innovations

The modernization of Fedwire lays the groundwork for future innovations in payment systems. A recent report by Datos revealed that 63% of U.S. businesses plan to adopt ISO 20022. This shift reflects a growing demand for automated payables and receivables, which Fedwire's enhancements will support.

The global migration to ISO 20022, expected to handle 80% of high-value payments by 2025, underscores the importance of interoperability. By aligning with this standard, Fedwire ensures compliance and fosters seamless cross-border transactions. These advancements will enable you to benefit from faster, more efficient payment solutions, whether you're conducting business locally or internationally.

Fedwire's modernization not only addresses current demands but also prepares the U.S. payment system for future challenges and opportunities. You can expect a more innovative, inclusive, and globally competitive financial ecosystem.

Fedwire's expanded operating hours will transform the U.S. payment system into a more modern and efficient network. You will benefit from faster transactions, reduced liquidity needs, and greater access to innovative payment solutions. The table below highlights the key advantages:

This shift positions the U.S. as a leader in global payments, paving the way for a truly 24/7 economy that meets your needs anytime, anywhere.

FAQ

What is Fedwire, and why is it important?

Fedwire is a real-time gross settlement system operated by the Federal Reserve. It processes large-value payments securely and efficiently. You rely on it indirectly when banks settle transactions on your behalf, ensuring smooth financial operations across the U.S. economy.

How will expanded operating hours benefit you?

The extended hours will allow faster payments, even on weekends and holidays. You can settle transactions more flexibly, improving cash flow and reducing delays. This change supports a 24/7 economy, making financial operations more convenient for businesses and consumers.

Will smaller banks struggle with this change?

Smaller banks may face challenges like higher costs and staffing needs. However, the Federal Reserve plans to support these institutions during the transition. This ensures you receive consistent service, regardless of your bank’s size.

How does ISO 20022 improve Fedwire?

ISO 20022 is a global messaging standard that enhances payment efficiency and interoperability. By adopting it, Fedwire enables faster, seamless transactions domestically and internationally. You benefit from improved reliability and compatibility with global payment systems.

Are there risks with longer operating hours?

Longer hours increase cybersecurity risks. Financial institutions must implement advanced safeguards like real-time monitoring and multi-factor authentication. These measures protect your financial data and ensure secure transactions in an always-on payment system.

Related content