Mastering Foreign Exchange Rules and Declarations

Author:XTransfer2025.05.23Foreign Exchange Administration Declaration Code

Understanding foreign exchange administration rules in 2025 is essential for navigating the complexities of global financial transactions. These rules ensure you can mitigate risks effectively while fostering trust with stakeholders. Evidence-based compliance strengthens governance and accountability by creating a verifiable process. It confirms that controls are in place and functioning, holding individuals and departments responsible. Staying updated with evolving regulations, like the Foreign Exchange Administration Declaration Code, empowers you to remain compliant and avoid unnecessary penalties. By mastering these rules, you protect your operations and build credibility in the international market.

Overview of Foreign Exchange Administration Rules and Declarations

Understanding the Foreign Exchange Administration Declaration Code

The foreign exchange administration declaration code plays a vital role in ensuring smooth operations in the forex market. It acts as a standardized system for reporting and tracking foreign exchange transactions. By using this code, you can provide accurate information to the regulatory authority, which helps maintain transparency and trust. This guidance ensures that all parties involved in forex transactions follow the same rules, reducing the risk of errors or fraud.

The declaration code also simplifies the process of compliance. It allows you to meet the requirements set by regulations without unnecessary complications. For example, when you use the correct code, you can avoid delays in processing transactions or penalties for non-compliance. This system is especially important for businesses and individuals who engage in frequent forex activities. It ensures that your operations align with the recommendations provided by global financial organizations.

Key Regulatory Changes in 2025

In 2025, several regulatory updates aim to improve the efficiency and security of the forex market. These changes focus on enhancing compliance measures and addressing emerging risks. One significant update involves stricter requirements for reporting foreign exchange transactions. You must now provide detailed information about each transaction, including the purpose and parties involved. This ensures that the regulatory authority can monitor activities more effectively.

Another key change involves the adoption of advanced technology for compliance. New tools allow you to automate the process of submitting declarations and tracking transactions. This reduces the risk of human error and ensures that you meet the latest regulations. Additionally, the updated guidance emphasizes the importance of risk assessment. You are now required to conduct regular assessments to identify potential vulnerabilities in your forex operations.

Importance of Declarations in Forex Compliance

Declarations are a cornerstone of forex compliance. They provide the information needed to ensure that all transactions adhere to the rules set by the regulatory authority. By submitting accurate declarations, you demonstrate your commitment to following the regulations. This builds trust with stakeholders and protects your business from legal or financial penalties.

The importance of declarations becomes clear when you consider the functions of the foreign exchange market. The table below highlights how these functions support global trade and why compliance is essential:

By understanding these functions, you can see how declarations contribute to the overall stability of the forex market. They ensure that all activities align with the recommendations provided by international organizations. This not only protects your operations but also supports the broader goals of global financial stability.

Registration and Compliance Essentials

Entities and Individuals Required to Register

Understanding who needs to register is the first step toward achieving forex compliance. Both entities and individuals involved in foreign exchange transactions must adhere to the regulatory requirements. If you operate as a forex trader, account manager, or pool operator, you fall under the category of those required to register. Businesses engaging in cross-border transactions or managing foreign currency accounts must also comply with these rules.

The National Futures Association (NFA) enforces forex requirements to ensure transparency and accountability. You must register if you manage client funds, provide forex trading services, or act as an intermediary in currency exchanges. This process establishes your legitimacy and aligns your operations with global recommendations. By registering, you demonstrate your commitment to following the guidance provided by regulatory authorities.

Step-by-Step Guide to Registration

A structured registration process simplifies compliance and ensures you meet all regulatory requirements. Following a step-by-step guide can help you navigate this process efficiently. Historical trends show that businesses adhering to such processes gain greater legitimacy in the forex market. Here’s how you can register:

-

Determine Your Eligibility: Identify whether you or your entity falls under the NFA's forex requirements. This step ensures you understand your obligations.

-

Gather Necessary Documentation: Prepare essential documents, including identification, financial statements, and proof of business operations.

-

Submit Your Application: Use the online portal provided by the regulatory authority to complete your registration. Ensure all information is accurate and up-to-date.

-

Pay Applicable Fees: Fulfill the financial obligations associated with registration. This step confirms your commitment to compliance.

-

Complete Training or Certification: Some jurisdictions require you to complete training programs to understand forex regulations better.

-

Receive Approval: Once your application is reviewed and approved, you will receive confirmation of your registration.

By following this guide, you can avoid delays and ensure your operations align with the recommendations of global financial organizations.

Avoiding Common Compliance Pitfalls

Even with a clear guide, you may encounter challenges during the registration process. Common pitfalls include incomplete documentation, failure to meet capital requirements, and misunderstanding regulatory guidance. Learning from past case studies can help you overcome these obstacles.

To avoid these pitfalls, ensure you follow the recommendations provided by regulatory authorities. Double-check your documentation, conduct regular audits, and seek professional guidance when needed. These steps will help you maintain compliance and protect your operations from unnecessary risks.

Key Obligations for Entities and Individuals

Responsibilities of Account Managers and Pool Operators

Account managers and pool operators play a critical role in ensuring forex compliance. You must oversee transactions and maintain accurate records to meet regulatory requirements. Your primary responsibility includes implementing a robust risk management program. This program should document all internal reviews, testing dates, and corrective actions. By doing so, you align your operations with the guidance provided by the regulatory authority.

Transparency is another key obligation. As an account manager or pool operator, you must disclose significant risks and legal complaints on your website. This builds trust with clients and demonstrates your commitment to compliance. Additionally, you should establish anti-money laundering (AML) programs. These programs must include internal policies, appointing a compliance officer, and conducting independent audits. Following these recommendations ensures your operations meet global standards.

Compliance Requirements for Individual Forex Traders

As an individual forex trader, you must adhere to specific regulations to maintain compliance. Your first step involves implementing a customer identification program. This program helps verify the identity of beneficial owners and ensures transparency in your transactions. You should also follow the guidance on risk-based customer due diligence. This involves assessing the potential risks associated with each client and taking appropriate measures to mitigate them.

Recordkeeping is another essential requirement. You must document all your forex activities, including transaction details and risk assessments. This not only helps you stay compliant but also protects you during audits. Public disclosures are equally important. Sharing accurate information about your trading activities fosters trust and aligns with the recommendations of the regulatory authority.

Adhering to the Foreign Exchange Management Regulations

Adhering to foreign exchange management regulations is crucial for both entities and individuals. These regulations provide clear guidance on how to conduct forex transactions while minimizing risks. You must follow the recommendations on AML programs, customer identification, and public disclosures. By doing so, you ensure your operations comply with the latest requirements.

The table below highlights key obligations defined by the regulations:

By understanding these obligations, you can align your operations with global recommendations. This not only ensures compliance but also strengthens your position in the forex market.

Customer Information and Risk Disclosure Requirements

Collecting and Verifying Customer Data

Collecting accurate customer data is a fundamental step in forex compliance. You must gather essential details such as the customer's name, address, occupation, income, and net worth. This information helps you verify their identity and assess their financial background. According to NFA Rule 2-36, verifying customer identities ensures transparency and reduces the risk of fraudulent activities.

To streamline this process, you can adopt automated onboarding systems. These tools enhance efficiency and minimize errors. Additionally, you should implement a risk-based approach to customer verification. This involves prioritizing high-risk customers for more thorough checks. Regular monitoring of data quality is also crucial. By using data validation tools, you can identify and correct inconsistencies, ensuring compliance with forex regulations.

Mandatory Risk Disclosures for Transparency

Risk disclosure is a critical component of forex compliance. You must provide clear and comprehensive information about the risks associated with forex trading. This includes explaining the potential for financial loss and the volatile nature of the forex market. NFA Rule 2-36 mandates that you deliver these disclosures at the time of account opening and verify them annually.

Transparency builds trust with your customers. It ensures they understand the risks before engaging in forex transactions. You can also educate your customers about trading risks through ongoing programs. This proactive approach not only fulfills regulatory requirements but also enhances customer confidence in your services.

Ensuring Compliance with FATF Recommendations

Adhering to FATF recommendations is essential for maintaining forex compliance. These recommendations provide guidance on combating money laundering and terrorist financing. You must implement robust customer identification programs and risk-based due diligence procedures. This ensures you can identify and mitigate potential risks effectively.

FATF recommendations also emphasize the importance of ongoing monitoring. You should regularly review customer data and trading activities to detect unusual patterns. By following these guidelines, you align your operations with global standards and strengthen your position in the forex market.

Reporting and Recordkeeping Standards

Reporting Obligations Under the 2025 Regulatory Guide

The 2025 regulatory guide introduces enhanced reporting obligations to improve transparency and accountability in forex operations. You must report all forex transactions accurately and on time to the relevant authority. This includes providing detailed information about transaction parties, amounts, and purposes. These requirements ensure that your operations align with global standards and reduce the risk of non-compliance.

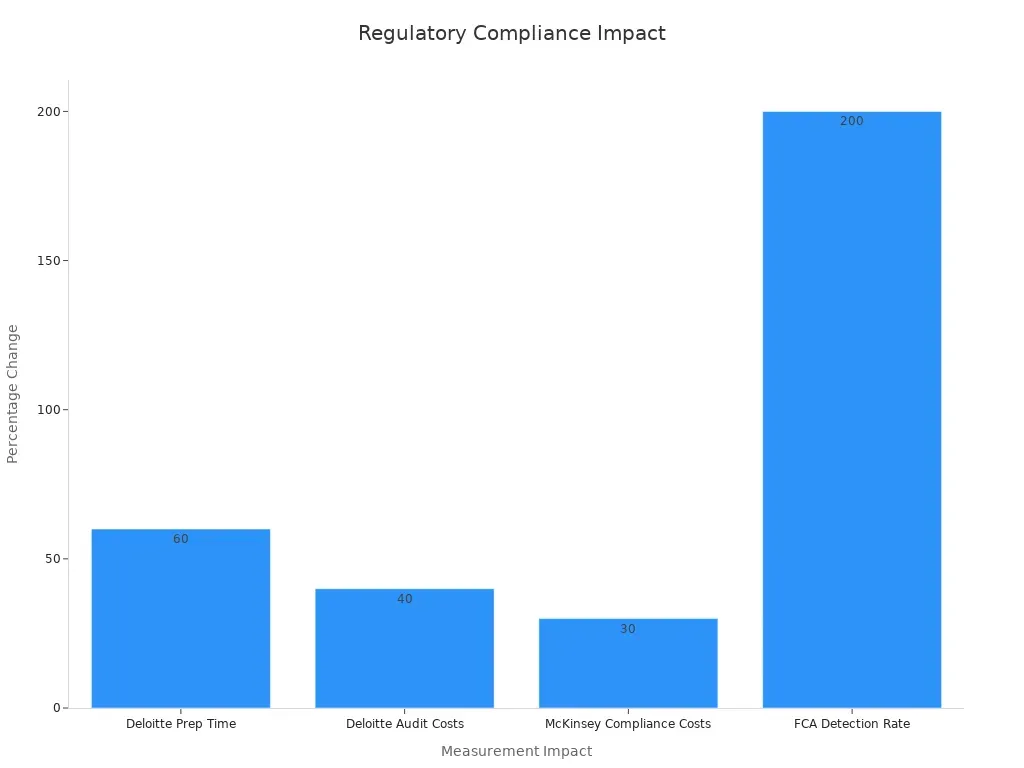

Proper reporting also streamlines audits and improves operational efficiency. A Deloitte study revealed that companies adhering to reporting obligations experienced a 60% reduction in audit preparation time and a 40% decrease in audit costs. Additionally, the Financial Conduct Authority reported a 200% improvement in detecting suspicious activities after upgrading reporting systems.

Best Practices for Recordkeeping

Effective recordkeeping is essential for meeting forex compliance requirements. You should maintain accurate records of all transactions, customer data, and risk assessments. Automated solutions can simplify this process. A McKinsey survey found that companies using automated recordkeeping systems reduced compliance-related costs by up to 20%. Furthermore, 67% of these companies reported improved operational efficiency.

To ensure compliance, follow these best practices:

-

Use digital tools to store and organize records securely.

-

Conduct regular audits to verify the accuracy of your records.

-

Retain records for the duration specified by regulations, typically five years or more.

Adopting these practices not only helps you meet regulatory requirements but also enhances your ability to respond to audits and investigations.

Penalties for Non-Compliance with Reporting Standards

Failing to comply with reporting standards can result in severe penalties. Regulatory authorities may impose fines, revoke licenses, or restrict your operations. Non-compliance also damages your reputation and erodes trust with stakeholders. For example, under the European Market Infrastructure Regulation (EMIR), firms must report all forex derivatives to trade repositories. Failure to do so can lead to significant financial and legal consequences.

To avoid penalties, adhere to the guidance provided by regulatory authorities. Implement robust reporting systems and ensure your team understands the latest regulations. By doing so, you protect your business and maintain credibility in the forex market.

Risk Management and Anti-Money Laundering Programs

Developing a Comprehensive Risk Management Framework

A strong risk management framework is essential for navigating the complexities of forex transactions. You need to identify potential risks, assess their impact, and implement strategies to mitigate them. This framework ensures your operations remain stable even during market fluctuations. For example, forward contracts and options can help you hedge against currency risks, protecting your profit margins.

Incorporating these strategies into your risk management program strengthens your ability to handle forex challenges. Regular reviews of your framework ensure it aligns with updated guidance and recommendations.

Implementing FATF-Compliant Anti-Money Laundering Policies

Adopting FATF-compliant AML policies is crucial for combating money laundering and terrorist financing in forex operations. You must establish clear procedures for customer identification, transaction monitoring, and reporting suspicious activities. These measures align with consolidated FATF standards and help you meet global compliance requirements.

AML policies should include robust risk-based approaches. For instance, high-risk customers require enhanced due diligence to prevent money laundering. Stop-loss orders and hedging strategies also support disciplined risk management by limiting losses and reducing exposure to adverse market movements. By following FATF recommendations, you protect your business and contribute to global financial security.

Monitoring and Auditing Forex Transactions

Monitoring and auditing forex transactions are vital components of a risk management program. You must track all transactions to detect unusual patterns and ensure compliance with AML and CFT measures. Automated tools simplify this process, allowing you to identify discrepancies quickly and take corrective actions.

Regular audits strengthen your risk management framework by verifying the effectiveness of your policies. They also ensure your operations align with FATF recommendations and other regulatory guidance. Transparent reporting and accurate recordkeeping further enhance your ability to meet compliance standards.

By prioritizing monitoring and auditing, you reduce the risk of money laundering and terrorist financing. These practices build trust with stakeholders and reinforce your commitment to maintaining a secure forex environment.

Financial Requirements and Capital Standards

Minimum Capital Standards for Forex Entities

Meeting minimum capital standards is essential for forex entities to operate securely. These standards ensure that businesses have enough financial resources to handle risks and maintain stability. Regulatory authorities set these requirements to protect the market from potential disruptions caused by undercapitalized entities. You must comply with these standards to demonstrate your financial strength and commitment to responsible operations.

Capital standards vary depending on the size and nature of your forex activities. For example, larger entities managing significant trading volumes often face higher requirements. Maintaining sufficient capital also helps you absorb unexpected losses, ensuring your operations remain unaffected during market fluctuations. By adhering to these standards, you align with global recommendations and build trust with stakeholders.

Financial Safeguards to Ensure Stability

Financial safeguards play a critical role in maintaining stability within forex operations. These measures help you identify and mitigate risks associated with currency fluctuations. For instance, analyzing cash flow to detect currency mismatches allows you to understand your exposure to financial risks. Implementing tools like currency swaps or forward contracts can protect your business from unfavorable exchange rate movements. Sensitivity analysis further strengthens your risk management by simulating various scenarios to evaluate vulnerabilities.

-

Currency mismatches: Identifying mismatches in cash flow helps you assess financial risks.

-

Currency swaps: These tools mitigate the impact of adverse exchange rate changes.

-

Sensitivity analysis: Simulating scenarios allows you to prepare for potential risks.

By incorporating these safeguards, you enhance your ability to navigate the forex market effectively. Following regulatory guidance ensures your operations remain compliant and resilient.

Liquidity Management in Forex Operations

Effective liquidity management is vital for ensuring smooth forex operations. You need to monitor key financial metrics to assess market conditions and maintain operational efficiency. Metrics like bid-ask spreads, trading volume, and market depth provide valuable insights into liquidity levels. Narrow bid-ask spreads and high trading volumes indicate a liquid market, while low slippage reflects strong liquidity.

Monitoring these metrics helps you make informed decisions and maintain compliance with regulatory requirements. Adopting best practices for liquidity management ensures your forex operations remain stable and efficient.

Technology and Security in Forex Transactions

Leveraging Technology for Regulatory Compliance

Technology plays a pivotal role in simplifying compliance with forex regulations. Advanced monitoring tools and data analytics enable real-time tracking of forex transactions, reducing the risk of fraud. These tools streamline compliance processes, transforming them from resource-heavy tasks into efficient operations. Financial institutions have reported a 50-70% reduction in compliance processing time after adopting modern monitoring systems.

Real-time compliance checks further enhance your ability to meet regulatory requirements. These systems continuously update their databases to align with the latest guidance and recommendations. By leveraging technology, you can ensure your forex operations remain compliant while minimizing errors and delays. Automated solutions also allow you to focus on strategic activities, improving overall efficiency.

Cybersecurity Measures to Protect Forex Transactions

Protecting the integrity of forex transactions requires robust cybersecurity measures. Encryption ensures that data remains secure, whether in motion or at rest. AI tools predict and prevent cyberattacks by analyzing patterns and identifying vulnerabilities. Blockchain technology adds an extra layer of security by maintaining transaction integrity and transparency. Two-factor authentication strengthens access controls, while secure internet connections prevent unauthorized access.

Regular software updates are essential for addressing vulnerabilities and improving functionality. Using a VPN on public Wi-Fi further safeguards your forex activities. These measures align with FATF recommendations, helping you meet compliance requirements while protecting sensitive data. By implementing these strategies, you create a secure environment for forex transactions.

Ensuring Data Security in Customer Interactions

Data security is critical when interacting with customers in the forex market. Real-time monitoring systems identify unusual transaction patterns, flagging suspicious activities. Advanced analytics process vast datasets to detect anomalies, while machine learning predicts threats based on historical data. Integrating KYC and CDD procedures ensures consistent data validation, aligning with FATF recommendations.

Visual analytics tools simplify decision-making by presenting transaction data in digestible formats. Fraud detection systems enhance scrutiny, while biometric security adds layers of identity verification. These technologies not only meet compliance requirements but also build trust with your customers. By prioritizing data security, you protect your operations and foster confidence in your forex services.

Practical Tips for Staying Compliant

Staying Updated on Regulatory Changes

Staying informed about evolving forex regulations is essential for maintaining compliance. Regulatory authorities frequently update their guidance to address new risks and challenges. You should monitor official announcements and subscribe to industry newsletters to stay ahead. Attending webinars and conferences can also provide valuable insights into upcoming changes. These events often feature experts who explain complex requirements in simple terms.

Using technology can simplify this process. Automated tools can track updates to FATF recommendations and notify you of relevant changes. This ensures you remain compliant without dedicating excessive time to manual research. Staying updated not only protects your operations but also demonstrates your commitment to following global recommendations.

Training Programs for Employees

Employee training is a cornerstone of effective compliance. Well-trained employees understand the importance of adhering to forex regulations and FATF recommendations. You should implement regular training programs that cover key topics like forex transactions, risk management, and anti-money laundering requirements. Scenario-based exercises can help employees apply their knowledge in real-world situations.

The table below highlights key metrics for evaluating the effectiveness of training programs:

By focusing on these metrics, you can ensure your training programs meet regulatory requirements and improve overall compliance.

Partnering with Regulatory Compliance Experts

Collaborating with compliance experts can significantly enhance your ability to meet forex requirements. These professionals offer specialized guidance on adhering to FATF recommendations and navigating complex regulations. They can also help you develop robust policies for managing forex transactions and mitigating risks.

Partnering with experts ensures you receive tailored solutions that align with your business needs. They can conduct audits, identify gaps in your compliance framework, and provide actionable recommendations. This proactive approach not only strengthens your operations but also builds trust with stakeholders.

Mastering foreign exchange rules and declarations equips you with the tools to navigate the complexities of the forex market. By understanding foreign exchange risk and implementing hedging techniques, you protect your profits and minimize the impact of currency fluctuations. Regularly reviewing strategies ensures alignment with market conditions and business goals. Proactive compliance fosters trust and shields your operations from penalties. Staying informed about updated guidance and recommendations strengthens your ability to adapt to regulatory changes. These steps not only safeguard your business but also position you for long-term success in the global market.

FAQ

What is the purpose of the Foreign Exchange Administration Declaration Code?

The declaration code ensures accurate reporting of forex transactions. It helps you comply with regulations by standardizing the process. This system reduces errors, enhances transparency, and builds trust with regulatory authorities and stakeholders.

Who needs to register for forex compliance?

Entities like forex dealers, account managers, and businesses handling cross-border transactions must register. Individual forex traders also need to comply if they engage in significant forex activities. Registration demonstrates your commitment to following regulatory standards.

How can you avoid penalties for non-compliance?

You can avoid penalties by staying updated on regulations, maintaining accurate records, and submitting timely reports. Use automated tools to streamline compliance processes. Regular audits and professional guidance also help you meet requirements effectively.

Why are risk disclosures important in forex trading?

Risk disclosures educate customers about potential losses and market volatility. They ensure transparency and build trust. Providing clear, simple explanations of risks aligns your operations with regulatory requirements and enhances customer confidence.

What role does technology play in forex compliance?

Technology simplifies compliance by automating processes like transaction monitoring and reporting. It reduces errors and improves efficiency. Tools like real-time compliance checks and data analytics help you meet regulatory standards while focusing on strategic goals.

Related content