Global Payment Transfers Explained for Businesses

Author:XTransfer2025.09.08global payment Transfers

Global payment transfers involve the movement of funds across countries, enabling businesses to pay suppliers, receive payments, and manage international operations. These transfers play a crucial role in connecting markets, fostering trade, and supporting the global economy.

For businesses, efficient global payment systems reduce barriers to cross-border capital flows. They enhance trade connections and improve access to international markets. With the B2B payments market projected to grow at a CAGR of 11.8%, the demand for streamlined solutions continues to rise.

Xtransfer stands out as a trusted fintech partner for SMEs. Its platform simplifies international transfers, offering fast processing, competitive FX rates, and secure transactions. By leveraging AI-driven compliance tools, Xtransfer ensures businesses can navigate global payments seamlessly.

Understanding Global Payment Transfers

What are global payment transfers?

Global payment transfers refer to the process of moving money from one country to another. These transfers allow businesses to pay suppliers, receive funds from customers, and manage international operations. According to the Better than Cash Alliance, this involves transferring value between accounts using digital devices like mobile phones or computers. Examples include bank transfers, mobile money, and digital wallets.

Several systems have revolutionized global payments. For instance, Kenya’s M-Pesa transformed its economy into a cashless society, with 80% of transactions becoming digital by 2017. Similarly, India’s Unified Payments Interface (UPI) enables real-time fund transfers between bank accounts through mobile platforms. These innovations highlight how global payment systems simplify transactions and improve accessibility for businesses worldwide.

Why are global payments essential for businesses?

Global payments play a critical role in helping businesses thrive in today’s interconnected world. They enable you to engage in cross-border transactions, expand your market reach, and accept multiple currencies. For example, platforms like MercadoPago have allowed businesses in Latin America to grow by offering seamless payment solutions.

The demand for global payment systems continues to rise. A PYMNTS Intelligence report found that 42% of consumers across countries like the U.S., Singapore, and the U.K. prefer digital wallets for international payments. This preference stems from their speed, convenience, and efficiency compared to traditional methods. By adopting modern payment solutions, you can stay competitive and meet customer expectations.

Benefits of efficient global payment processing

Efficient global payment processing offers numerous advantages for businesses. It eliminates excessive fees, enhances security, and streamlines cross-border payments. For instance, advanced systems like Ripple provide real-time tracking and lower costs compared to traditional methods like SWIFT.

|

Feature |

Ripple |

SWIFT |

|

Speed of Transaction |

Settlement within seconds |

1 to 5 business days |

|

Cost |

Approximately $0.50 per transaction |

Higher due to multiple intermediaries |

|

Transparency |

Real-time tracking and clear fee structure |

Lack of transparency in fees and status |

Efficient systems also protect your funds and data by detecting fraud and ensuring compliance with international standards. As businesses increasingly rely on digital solutions, adopting a reliable payment processing partner can help you save time and resources while improving customer satisfaction.

How Global Payment Processing Works

Steps involved in global payment processing

Global payment processing involves a series of steps to ensure funds move securely and efficiently across borders. Here’s a simplified breakdown of the process:

-

You initiate a payment by providing the necessary details, such as the recipient’s account information and the amount to transfer.

-

The payment processor forwards this information to the acquiring bank, which acts on behalf of the merchant.

-

The acquiring bank sends the transaction details to the relevant card network or payment system.

-

The issuing bank, which holds the payer’s account, verifies the transaction and checks for sufficient funds.

-

Once approved, the issuing bank notifies the card network and the acquiring bank.

-

The acquiring bank confirms the transaction with the payment processor, completing the cycle.

This streamlined process ensures that payments are authorized, verified, and settled efficiently. Flowcharts often help businesses visualize these steps, making it easier to identify bottlenecks and improve workflows.

Key players in the process (banks, payment processors, etc.)

Several key players contribute to the success of global payment processing:

-

Banks: Acquiring and issuing banks handle the authorization and settlement of transactions.

-

Payment Processors: These intermediaries, like Xtransfer, facilitate the transfer of funds between parties.

-

Card Networks: Systems like Visa and Mastercard connect banks and enable secure transactions.

-

Regulatory Bodies: Organizations such as the Financial Action Task Force (FATF) and the International Monetary Fund (IMF) ensure compliance with global standards.

-

Merchants and Customers: Businesses and their clients are the end users of the global payments system.

Each player has a specific role, ensuring that payments are processed securely and efficiently.

Common methods for global payments

Businesses use various methods to complete global payments. Some of the most common include:

-

Wire Transfers: A traditional method where banks transfer funds directly between accounts. While reliable, it can be slow and costly.

-

Digital Platforms: Modern solutions like Xtransfer offer faster and more cost-effective alternatives. These platforms use automation and AI to reduce processing times and enhance security.

-

Mobile Payments: Systems like M-Pesa and UPI allow businesses to send and receive payments via mobile devices, making them ideal for regions with limited banking infrastructure.

-

Cryptocurrencies: Emerging as a global payment option, cryptocurrencies like Bitcoin enable decentralized and borderless transactions.

By choosing the right method, you can optimize your payment processes and reduce costs.

Challenges in Global Payment Transfers

High transaction fees and hidden costs

High transaction fees and hidden costs can significantly impact your business's profitability. Many traditional global payment methods, such as bank transfers, charge excessive fees. For example, banks charge an average of 11.99% for cross-border payments, making them the most expensive option. In contrast, mobile payment providers offer a more affordable alternative, with an average cost of 4.35%.

|

Statistic |

Value |

Description |

|

Average cost of sending an international remittance |

6.39% |

The average cost of sending an international remittance. |

|

Average cost of bank cross-border payments |

11.99% |

Banks charge the highest fees for cross-border payments. |

|

Average cost of mobile payment providers |

4.35% |

Mobile payment providers are the least expensive option. |

Hidden costs, such as currency conversion fees, can also add up. These costs often go unnoticed, reducing the transparency of the global payments system. Addressing these issues can help you save money and improve your financial planning.

Currency exchange rate risks

Currency exchange rate fluctuations pose another challenge in global payment transfers. When you send or receive international payments, the exchange rate can change between the time of initiation and settlement. This volatility can lead to unexpected losses, especially for small and medium-sized businesses (SMBs).

For instance, if your business operates in multiple markets, you may face difficulties predicting the exact amount you will receive after conversion. Using a payment solution with competitive and real-time exchange rates can help you mitigate these risks. Platforms like Xtransfer offer 24/7 FX rates, ensuring you get the best value for your transactions.

Delays in processing and settlement

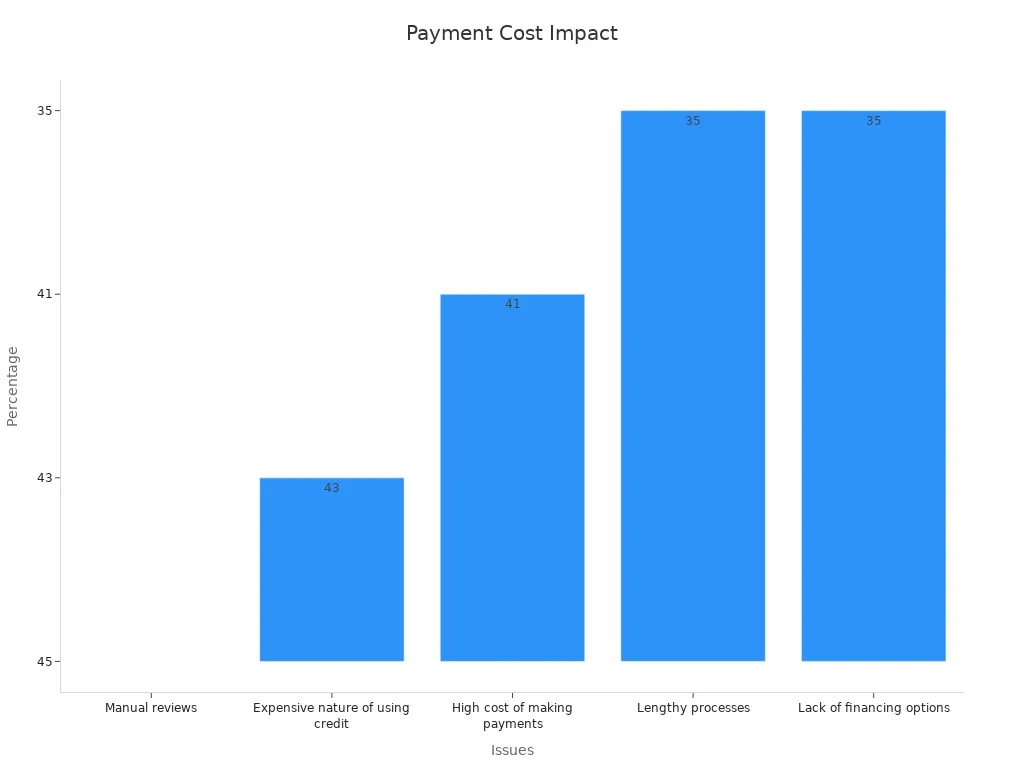

Delays in processing and settlement can disrupt your cash flow and strain relationships with suppliers. Traditional methods, such as wire transfers, often take several days to complete. Lengthy processes and manual reviews contribute to these delays.

According to recent data, 35% of SMBs cite lengthy processes as a major obstacle in cross-border payment processing. Manual reviews, which affect 45% of transactions, further slow down the system. By adopting modern solutions that leverage automation, you can reduce processing times and ensure timely payments.

Compliance with international regulations

Navigating international regulations is crucial for businesses involved in global payment transfers. Regulatory bodies enforce strict rules to prevent money laundering, fraud, and other financial crimes. Non-compliance can lead to severe penalties, reputational damage, and operational disruptions.

You must ensure that your payment processes align with anti-money laundering (AML) and counter-terrorism financing (CTF) standards. These regulations require businesses to verify customer identities, monitor transactions, and report suspicious activities. For example, the Financial Action Task Force (FATF) sets global AML guidelines that countries adopt to maintain financial integrity.

Failing to comply with these regulations can have costly consequences. Here are some notable examples:

|

Institution |

Breach Description |

Fine Amount |

Regulatory Body |

|

Deutsche Bank |

Violated the Foreign Corrupt Practices Act and engaged in a commodities fraud scheme. |

$130 million |

SEC |

|

BitMEX |

Failed to meet anti-money laundering standards and traded cryptocurrency without authorization. |

$100 million |

FinCEN and CFTC |

|

HSBC |

Deficient transaction monitoring systems leading to AML process failures. |

$85 million |

FCA |

|

NatWest |

Failed to prevent money laundering amounting to £365 million. |

£265 million |

FCA |

|

Binance |

Ineffective anti-money laundering program leading to a guilty plea. |

$4.3 billion |

U.S. Justice Department |

These cases highlight the importance of robust compliance measures. You can avoid similar pitfalls by adopting advanced tools and technologies. Platforms like Xtransfer use AI-driven compliance systems to monitor transactions and detect risks in real time. This proactive approach ensures your business stays compliant while maintaining smooth payment operations.

Staying updated on regulatory changes is equally important. Laws and standards evolve frequently, and failing to adapt can expose your business to unnecessary risks. By prioritizing compliance, you safeguard your operations and build trust with global partners.

Optimizing Global Payment Processes

Selecting the right global payment solution (e.g., Xtransfer)

Choosing the right global payment solution is crucial for streamlining your international transactions. A reliable platform ensures secure, fast, and cost-effective payments while minimizing risks. For small and medium-sized enterprises (SMEs), solutions like Xtransfer offer tailored features that simplify global payment processing. With multi-currency accounts supporting over 20 currencies, Xtransfer allows you to manage international payments efficiently. Its AI-driven compliance tools also help you meet regulatory requirements, reducing the risk of penalties.

When evaluating global payment processors, consider factors like fees, processing times, and security measures. For example, platforms such as PayPal, Stripe, and Helcim provide high efficiency, but their costs vary. Helcim stands out for its low fees, making it an excellent choice for cost-conscious businesses. Comparing these options helps you identify the best fit for your needs.

Negotiating better exchange rates and fees

Reducing costs in global payment processing often starts with negotiating better exchange rates and fees. High fees and unfavorable rates can erode your profits, especially when dealing with frequent international payments. To optimize costs, you can:

-

Minimize interchange fees by using tokenization technology.

-

Avoid higher-fee keyed transactions by adopting automated processing systems.

-

Use your payment processor's gateway to eliminate third-party fees.

-

Monitor transaction data regularly to identify and address high-fee transactions.

Automation plays a significant role in cost reduction. For instance, Allterra Solar achieved a 51% cost reduction by automating their payment processes with Paystand. Similarly, Thumbtack reduced their Days Sales Outstanding (DSO) by 40%, improving cash flow. These examples highlight the importance of leveraging technology and negotiating terms with your payment provider.

Leveraging technology for secure and fast transactions

Technology has revolutionized global payment processing, making transactions faster and more secure. Advanced tools like AI and blockchain enhance efficiency while reducing risks. AI applications detect fraud in real time, strengthen authentication with biometric recognition, and automate payment workflows. For example, Xtransfer uses AI to analyze transaction data, ensuring compliance and minimizing fraud.

Blockchain technology offers another layer of security and speed. It enables decentralized transactions, eliminating intermediaries and reducing costs. Countries like India have seen significant growth in instant payments through their Unified Payment Interface (UPI), driven by regulatory support. Contactless payment systems also provide a fast and convenient way to process payments, gaining popularity in modern transactions.

By adopting these technologies, you can optimize your global payment processes. Automation reduces manual errors, accelerates payment cycles, and enhances overall efficiency. Whether you choose AI-driven platforms or blockchain-based solutions, leveraging technology ensures your payments are secure, fast, and reliable.

Staying updated on compliance requirements

Compliance regulations in global payment transfers evolve constantly. Staying informed ensures your business avoids penalties, maintains smooth operations, and builds trust with international partners. Monitoring updates and adapting your processes to meet new standards is essential for long-term success.

Why compliance updates matter

Regulatory bodies worldwide enforce strict rules to prevent financial crimes like money laundering and fraud. These rules often change to address emerging risks or improve transparency. Ignoring updates can lead to fines, operational disruptions, or reputational damage. For example, failing to comply with anti-money laundering (AML) standards could result in hefty penalties. Staying updated allows you to align your payment processes with current requirements and avoid costly mistakes.

Key global regulations to monitor

Different regions enforce unique compliance standards for payment transfers. Understanding these regulations helps you navigate international markets effectively. Some notable examples include:

-

Europe: The PSD2 regulation strengthens consumer protection and requires robust customer authentication.

-

Singapore: The Payment Services Act introduces a framework to manage risks in payment services.

-

China: Stricter currency controls and new payment license options for foreign businesses are reshaping compliance requirements.

These regulations highlight the importance of tailoring your payment processes to meet regional standards.

Practical steps to stay compliant

You can take proactive measures to ensure your business remains compliant with global payment regulations. Here are some strategies:

-

Subscribe to regulatory updates: Many governments and financial institutions publish newsletters or updates on compliance changes. Subscribing to these resources keeps you informed.

-

Invest in compliance tools: Platforms like Xtransfer use AI-driven systems to monitor transactions and detect risks in real time. Leveraging such tools simplifies compliance management.

-

Train your team: Educating employees about compliance requirements ensures they understand their roles in maintaining regulatory standards. Regular training sessions help reinforce this knowledge.

-

Consult experts: Partnering with legal or financial advisors familiar with international regulations can provide valuable insights and guidance.

Benefits of staying updated

Keeping up with compliance requirements offers several advantages. It reduces the risk of penalties, enhances operational efficiency, and builds trust with global partners. Businesses that prioritize compliance also gain a competitive edge by demonstrating reliability and integrity in their payment processes.

By staying informed and adopting advanced tools, you can navigate the complexities of global payment transfers with confidence. This proactive approach safeguards your business and ensures seamless international transactions.

Features of an Ideal Global Payment Solution

Low fees and competitive exchange rates

An ideal global payment solution minimizes costs while offering competitive exchange rates. High fees and unfavorable rates can erode profits, especially for businesses handling frequent international transactions. Multi-currency platforms reduce foreign exchange fees by providing real-time rates, ensuring you save on every transaction. These solutions also eliminate intermediary fees, making cross-border payments faster and more affordable.

For small and medium-sized businesses (SMBs), evaluating transaction fees is essential. Lower fees for high-volume transactions can significantly benefit businesses with frequent international sales. Platforms like Xtransfer excel in this area, offering cost-effective solutions tailored to your needs.

-

Reduced foreign exchange fees through competitive rates.

-

Elimination of intermediary fees for faster and cheaper payments.

-

Transparent pricing structures that simplify financial planning.

By choosing a solution with low fees and competitive rates, you can optimize your global payment processes and improve profitability.

Fast and reliable processing times

Speed and reliability are critical for global payment systems. Delays in processing can disrupt cash flow and damage relationships with suppliers or customers. An ideal solution ensures transactions are completed quickly and accurately, enhancing business performance. Metrics like transaction success rate and processing speed validate the efficiency of payment platforms.

|

Metric |

Description |

|

Transaction Success Rate |

Reflects the percentage of successful payments versus failed ones. |

|

Authorization Rate |

Indicates the percentage of transactions approved by banks, showcasing system credibility. |

|

Processing Speed |

Measures the time taken to complete transactions, impacting customer satisfaction. |

|

System Uptime and Reliability |

Represents the operational time of the payment system, ensuring uninterrupted business operations. |

Platforms like Xtransfer leverage automation and advanced technology to deliver fast and reliable payments. By reducing manual errors and streamlining workflows, these systems ensure your transactions are processed efficiently.

Strong security and compliance measures

Security and compliance are non-negotiable in global payment systems. Robust measures protect sensitive data, prevent fraud, and ensure adherence to international regulations. Frameworks like GDPR, PCI DSS, and ISO 27001 set the standard for secure payment processing.

|

Framework |

Description |

Importance in Payment Systems |

|

GDPR |

Protects customer data and privacy in the EU. |

Ensures compliance and safeguards sensitive information. |

|

PCI DSS |

Secures credit card data during transactions. |

Reduces risks of data breaches and fraud. |

|

ISO 27001 |

Establishes an information security management system. |

Demonstrates commitment to security best practices. |

Platforms like Xtransfer integrate AI-driven compliance tools to monitor transactions and detect risks in real time. These systems adapt to evolving regulations, ensuring your business remains compliant while maintaining smooth operations. By prioritizing security, you build trust with partners and customers, safeguarding your reputation.

User-friendly platform and customer support

A user-friendly platform is essential for businesses managing global payments. It simplifies complex processes, reduces errors, and enhances the overall experience. Studies show that 70% of users expect payments to process in under two seconds. Delays can reduce conversions by up to 20%, highlighting the importance of speed and efficiency. Additionally, long checkout processes and security concerns often discourage users from completing transactions. A platform that addresses these issues can significantly improve customer satisfaction.

Digital payment platforms are valued for their convenience, speed, and security. Businesses benefit from streamlined workflows, while customers enjoy a seamless experience. Future trends may include AI-driven personalized shopping experiences, further enhancing usability. To meet these expectations, a global payment solution must prioritize intuitive design, fast processing, and robust security features.

Customer support also plays a critical role in ensuring a smooth payment experience. Businesses often encounter challenges such as transaction delays or compliance issues. A responsive support team can resolve these problems quickly, minimizing disruptions. Multilingual support and 24/7 availability are particularly valuable for businesses operating across different time zones. By offering reliable assistance, a payment platform builds trust and fosters long-term relationships with its users.

How Xtransfer meets these criteria

Xtransfer excels in providing a user-friendly platform tailored to the needs of small and medium-sized enterprises (SMEs). Its intuitive interface simplifies global payment processes, allowing you to manage transactions effortlessly. With multi-currency accounts supporting over 20 currencies, Xtransfer ensures that you can handle international payments with ease. The platform also offers fast processing times, meeting the expectations of users who value speed and efficiency.

In addition to its user-friendly design, Xtransfer provides exceptional customer support. Its team is available around the clock to assist with any issues, ensuring that your business operations remain uninterrupted. Whether you need help with compliance requirements or transaction tracking, Xtransfer’s support team is ready to assist. This commitment to customer service sets Xtransfer apart as a reliable partner for global payments.

Xtransfer also addresses security concerns effectively. By leveraging AI-driven compliance tools, it monitors transactions in real time and detects potential risks. This proactive approach ensures that your payments are secure and compliant with international regulations. For businesses seeking a comprehensive solution, Xtransfer combines usability, speed, and security to deliver an unparalleled experience.

Optimizing global payment processes is essential for your business's success. Streamlined payments improve cash flow, reduce costs, and enhance customer satisfaction. Studies show that digital payment systems directly contribute to business growth by simplifying transactions and increasing efficiency.

Choosing the right solution, such as Xtransfer, ensures secure and fast payments while meeting compliance requirements. By adopting advanced tools and staying proactive, you can navigate international markets confidently and unlock new opportunities for growth.

FAQ

What is a global payment solution?

A global payment solution helps businesses send and receive money across borders. It simplifies international transactions by offering features like multi-currency accounts, competitive exchange rates, and secure processing. These solutions are essential for businesses operating in multiple countries.

How can you reduce fees for international payments?

You can reduce fees by choosing platforms with transparent pricing and competitive rates. Avoid intermediaries and negotiate better terms with your payment provider. Using automated systems also helps minimize hidden costs and processing fees.

Why is compliance important in global payment transfers?

Compliance ensures your business follows international laws and regulations. It prevents financial crimes like money laundering and fraud. Staying compliant protects your reputation, avoids penalties, and builds trust with global partners.

What are the benefits of using Xtransfer for global payments?

Xtransfer offers fast, secure, and cost-effective solutions. It supports over 20 currencies, provides competitive FX rates, and uses AI-driven compliance tools. These features make it ideal for small and medium-sized businesses managing international transactions.

How do currency exchange rates affect global payments?

Exchange rate fluctuations impact the final amount received or paid in international transactions. Unfavorable rates can reduce profits. Using a platform with real-time, competitive rates helps you mitigate these risks and optimize your payments.

Related content