Crack the Code of Value-Added Tax in Minutes

Author:XTransfer2025.05.27value-added tax

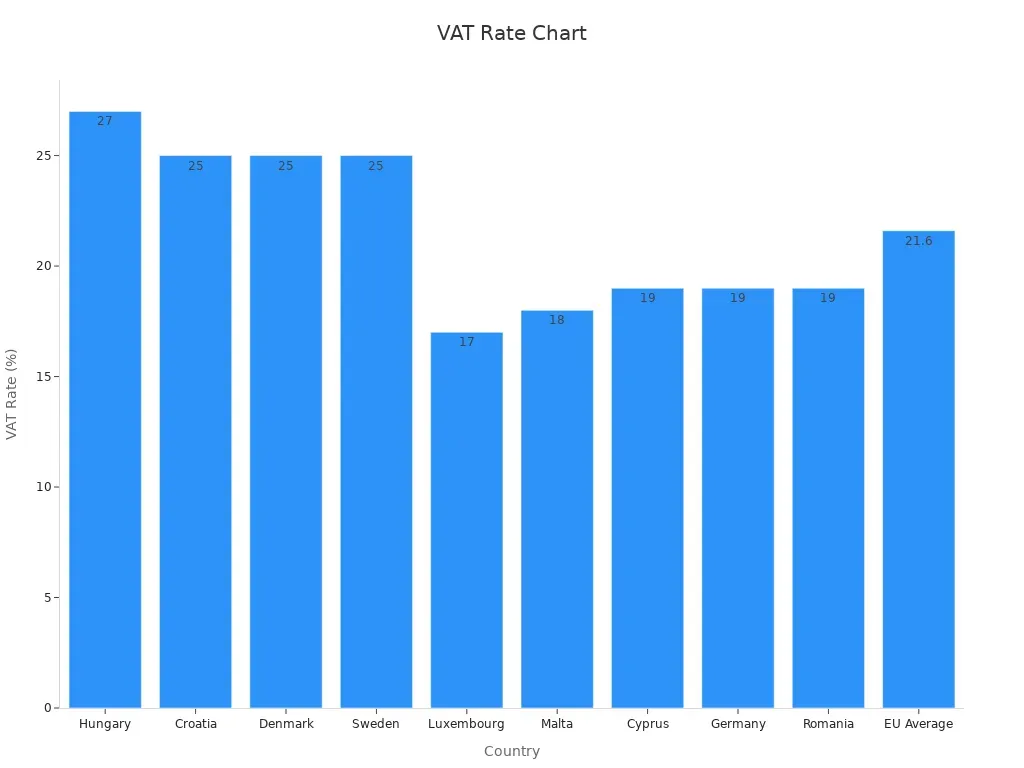

Understanding VAT doesn’t have to be complicated. You can calculate it easily using the formula: VAT = Net Price × VAT Rate. This formula helps you determine how much value-added tax applies to a product or service. For example, if the net price is $100 and the VAT rate is 20%, the VAT equals $20. Businesses add VAT to the net price to get the total price, while consumers pay this total. In Europe, VAT rates range from 0% to 27%, significantly affecting pricing for items like food, as studies show reforms have increased tax revenues by 34%.

What Is Value-Added Tax?

Definition of value-added tax

Value-added tax, or VAT, is a type of indirect tax applied to goods and services at each stage of production or distribution. Unlike sales tax, which is collected only at the final point of sale, VAT is charged incrementally as value is added to a product. For example, when a manufacturer creates a product, they pay VAT on the materials they purchase. When the product is sold to a retailer, VAT is added again. Finally, the consumer pays VAT when they buy the finished product. This system ensures that the tax burden is shared across the supply chain.

To better understand how VAT works, consider the findings of Doyle and Samphantharak (2008), who analyzed temporary fuel tax cuts. Their study revealed how VAT affects pricing at different stages. Similarly, Benzarti et al. (2020) found that prices respond differently to VAT increases and decreases, highlighting the complexity of this tax system. The table below summarizes key studies on VAT:

These studies demonstrate how VAT influences pricing and consumer behavior across various industries.

Purpose of VAT in taxation

Governments use VAT as a reliable source of revenue. It is designed to tax consumption rather than income, making it a fairer system for many taxpayers. VAT applies to the value added at each stage of production, ensuring that businesses contribute to the tax system based on their economic activity. This approach reduces the likelihood of tax evasion and improves compliance rates.

VAT is widely used in both developed and developing countries. It plays a crucial role in funding public services like healthcare, education, and infrastructure. For instance, VAT on tourism-related goods and services generates significant revenue in countries that rely on tourism. Additionally, VAT impacts economic efficiency by encouraging businesses to maintain accurate records and streamline their operations.

By taxing consumption rather than income, VAT ensures that everyone contributes to public funds based on their spending habits.

How VAT differs from other taxes

VAT stands out from other types of taxes due to its unique structure. Unlike income tax, which is based on earnings, VAT focuses on consumption. This means you pay VAT when you buy goods or services, regardless of your income level. In contrast to sales tax, which is collected only at the final point of sale, VAT is applied at every stage of the supply chain. This incremental approach reduces the risk of tax evasion and ensures a more consistent revenue stream for governments.

For example, sales tax in the United States is added only when the consumer makes a purchase. However, VAT is charged at multiple points, from raw material suppliers to manufacturers and retailers. This system ensures that each participant in the production process contributes their fair share. Additionally, VAT is often included in the price of goods, making it less noticeable to consumers compared to sales tax, which is added at checkout.

By understanding these differences, you can see why VAT is a preferred taxation method in many countries. Its ability to generate consistent revenue while minimizing tax evasion makes it an essential tool for modern economies.

How to Calculate VAT

Identify the VAT rate

The first step in understanding how to calculate VAT is identifying the correct VAT rate. VAT rates vary by country and sometimes by product category. For example, Hungary has the highest VAT rate in the European Union at 27%, while Luxembourg applies a much lower rate of 17%. Some countries, like Germany and Romania, use a standard rate of 19%. Check the applicable VAT rate for your region or product type before proceeding.

Knowing the VAT rate ensures accuracy in your value-added tax calculation. If you’re unsure, consult your local tax authority or refer to official government resources.

Determine the net price

The net price is the cost of a product or service before VAT is added. To find this, look at the base price listed by the seller. For example, if a retailer advertises a product for $100 before tax, that amount is the net price.

Here’s a simple guide to determine the net price:

-

Determine Base Price: Identify the price of the product or service before any taxes.

-

Apply VAT Rate: Multiply the base price by the VAT rate to calculate the VAT amount.

-

Sum Up Final Price: Add the VAT amount to the base price to get the total price.

Accurate net price identification is crucial for calculating VAT correctly. Many businesses use accounting software to ensure precision and compliance with tax regulations.

Apply the formula to calculate VAT

Once you know the VAT rate and net price, apply the formula:VAT = Net Price × VAT Rate

Let’s break it down step by step:

-

Multiply the net price by the VAT rate. For example, if the net price is $100 and the VAT rate is 20%, the VAT amount is $100 × 0.20 = $20.

-

Add the VAT amount to the net price to find the total price. In this case, $100 + $20 = $120.

For businesses, maintaining accurate VAT records is essential. Follow these steps to ensure compliance:

-

Understand Digital VAT Returns: Learn how to submit VAT records electronically.

-

Prepare for Digital VAT Returns: Register for VAT and familiarize yourself with local regulations.

-

Maintain Accurate VAT Records: Keep detailed records of all VAT-related transactions.

-

Calculate VAT Liability: Use accounting tools to verify your calculations.

-

Submit Digital VAT Returns: Use authorized software to file your VAT return.

-

Benefits of Digital VAT Returns: Save time, reduce costs, and improve accuracy.

By following these steps, you can calculate VAT efficiently and avoid errors. Whether you’re a consumer or a business owner, understanding this process ensures you stay compliant with tax laws.

Calculate the total price (Net Price + VAT)

Once you know the VAT amount, calculating the total price becomes straightforward. The total price is simply the sum of the net price and the VAT. This step ensures you understand the final cost of a product or service, including the tax.

Here’s how you can calculate the total price:

-

Start with the net price: Identify the base price of the product or service before any tax is applied.

-

Add the VAT amount: Use the formula

Total Price = Net Price + VAT. For example, if the net price is $100 and the VAT is $20, the total price will be $120. -

Double-check your calculation: Ensure the VAT amount and total price are accurate by reviewing your math.

Why is this step important?

Understanding the total price helps you make informed purchasing decisions. It also ensures you’re aware of how much tax you’re paying. For businesses, this step is crucial for accurate invoicing and compliance with tax regulations. By mastering this simple value added tax calculation, you can avoid errors and maintain transparency in your transactions.

Common scenarios for total price calculation

-

Retail purchases: When shopping, the price tag may or may not include VAT. Knowing how to calculate the total price ensures you’re not caught off guard at checkout.

-

Service invoices: Service providers often list the net price and VAT separately. Adding these together gives you the total amount payable.

-

International transactions: VAT rates vary by country. Calculating the total price helps you compare costs across regions.

By following these steps, you can confidently calculate the total price for any product or service. This skill is essential for both consumers and businesses, ensuring clarity and accuracy in all financial dealings.

Examples to Calculate Value-Added Tax

Adding VAT to a price

Adding VAT to a price is straightforward when you follow the correct methods. Start by identifying the net price and the VAT percentage. Multiply the net price by the VAT rate to find the VAT amount. Then, add this amount to the net price to get the total price.

For example, imagine a product with a base price of €10. If the seller offers a 10% discount, the price after the discount becomes €9. With a VAT rate of 20%, the VAT amount is €9 × 0.20 = €1.50. The total price, including VAT, is €9 + €1.50 = €10.50.

This method ensures you calculate VAT accurately, whether you're shopping or preparing invoices.

Extracting VAT from a total price

Sometimes, you need to break down VAT from a total price. To do this, divide the total price by (1 + VAT rate). Subtract the result from the total price to find the VAT amount.

For instance, if the total price of a product is $120 and the VAT rate is 20%, divide $120 by 1.20. The net price is $100, and the VAT amount is $120 - $100 = $20. This method helps you calculate VAT on an invoice when the total price is already known.

Real-life examples: Retail, services, and invoices

VAT plays a significant role in various industries. In retail, a bike manufacturer might purchase raw materials for $5.50, which includes a 10% VAT. When the manufacturer sells the parts to an assembler for $11, the VAT included is $1. The manufacturer pays $0.50 to the government, keeping the VAT already paid on raw materials.

In services, imagine a consultant charging $200 for their work. With a VAT rate of 15%, the VAT amount is $200 × 0.15 = $30. The total invoice amount becomes $230. Understanding these examples helps you calculate VAT on an invoice and ensures compliance with tax regulations.

By mastering these methods, you can confidently calculate value-added tax in any scenario, whether you're adding VAT, extracting it, or dealing with real-life transactions.

Common Mistakes When You Calculate VAT

Misidentifying the VAT rate

One of the most common errors in VAT calculation is using the wrong VAT rate. Each country has its own standard VAT rate, and some products or services may qualify for reduced or zero rates. For example, Hungary applies a 27% VAT rate, while Luxembourg uses a much lower rate of 17%. Misidentifying the correct rate can lead to overcharging customers or underpaying taxes, both of which can result in financial penalties.

Businesses often face challenges when tax codes are overly complex or incorrectly mapped. This issue becomes even more pronounced in organizations with multiple systems, where consolidating data for accurate VAT determination can be difficult. A lack of clarity in tax rules, such as those seen in the UAE regarding dividends and management fees until 2022, further complicates the process.

To avoid these mistakes, always verify the VAT rate for your region and product category. Staying updated on regulatory changes is equally important.

Forgetting to check if the price includes VAT

Another frequent mistake is failing to confirm whether a price already includes VAT. This oversight can lead to double taxation or incorrect invoicing. For instance, if a product’s total price is $120 and you assume it excludes VAT, you might add an additional tax amount unnecessarily. This error not only affects your customers but also complicates your tax filings.

When dealing with invoices, always check if the VAT amount is listed separately. Many service providers and retailers include VAT in the total price to simplify transactions for consumers. However, businesses must ensure transparency by clearly stating whether VAT is included or excluded.

Using the wrong formula for extraction

Using the incorrect formula to extract VAT from a total price is another common pitfall. The correct method involves dividing the total price by (1 + VAT rate). For example, if the total price is $120 and the VAT rate is 20%, dividing $120 by 1.20 gives you the net price of $100. Subtracting this from the total price reveals the VAT amount of $20.

Mistakes in this step can have serious consequences. Overclaiming or underclaiming input VAT may lead to financial losses or audits. Misclassifying supplies as standard, zero-rated, or exempt can result in penalties or loss of input VAT recovery. Additionally, failing to apply the reverse charge mechanism on imports can lead to non-compliance.

To ensure accuracy, always double-check your formulas and calculations. Using reliable accounting software can help you avoid these errors and maintain compliance.

Tips for ensuring accuracy in VAT calculations

Ensuring accuracy in VAT calculations is essential for avoiding costly errors and maintaining compliance. By following a few best practices, you can simplify the process and reduce the risk of mistakes.

Start by gaining a thorough understanding of VAT regulations in your region. Each country has unique rules, rates, and exemptions. Familiarizing yourself with these details ensures you apply the correct VAT rate to every transaction. For example, some goods may qualify for reduced or zero rates, while others fall under the standard rate.

Organized record-keeping is another critical step. Keep detailed records of all transactions, including invoices, receipts, and tax filings. This practice not only helps during audits but also makes it easier to reconcile your accounts. Regular reconciliation ensures that your VAT calculations match your financial records, reducing discrepancies.

Using modern tools and software can significantly improve accuracy. Automated systems simplify VAT calculations by applying the correct rates and generating reports. These tools also help you file returns on time, avoiding penalties. For instance, many businesses use accounting software to categorize transactions correctly and claim input tax credits without errors.

Here’s a step-by-step guide to ensure accuracy:

-

Understand your VAT obligations and stay updated on regulations.

-

Maintain organized financial records for all transactions.

-

Categorize transactions correctly based on VAT applicability.

-

Reconcile your accounts regularly to identify discrepancies.

-

Automate VAT calculations and filing using reliable software.

-

Set up alerts to avoid missing deadlines or notices.

-

Collaborate with tax experts for complex cases.

By following these steps, you can handle VAT calculations with confidence and precision. Accurate calculations protect your business from penalties and ensure smooth financial operations.

Mastering VAT calculations is simpler than you might think. The formula, VAT = Net Price × VAT Rate, provides a straightforward way to determine tax amounts. By following the outlined steps, you can confidently calculate VAT, whether you're adding it to a price or extracting it from a total.

Apply these steps in your daily transactions to avoid errors and ensure compliance. Accuracy matters, as the EU loses over EUR 310 billion annually due to reduced VAT rates and exemptions. By staying precise, you contribute to better financial management and smoother operations.

FAQ

What is the difference between VAT and sales tax?

VAT applies at every stage of production, while sales tax is charged only at the final sale. VAT ensures businesses contribute based on their activities, while sales tax focuses solely on consumer purchases.

How do I know if a price includes VAT?

Check the invoice or receipt. Sellers often specify whether VAT is included. If unclear, ask the seller directly or calculate using the formula: Net Price = Total Price ÷ (1 + VAT Rate).

Can VAT rates change?

Yes, governments adjust VAT rates based on economic needs. Stay updated by checking official tax authority websites or consulting local regulations.

Is VAT refundable for businesses?

Businesses can claim VAT refunds on purchases related to their operations. Keep accurate records and submit claims during tax filings to recover eligible amounts.

What happens if I calculate VAT incorrectly?

Incorrect VAT calculations can lead to penalties or audits. Use reliable accounting software and double-check your formulas to ensure compliance and avoid costly mistakes.

Related content