A Beginner’s Guide to Understanding SWIFT Codes

Author:XTransfer2025.06.11SWIFT Codes

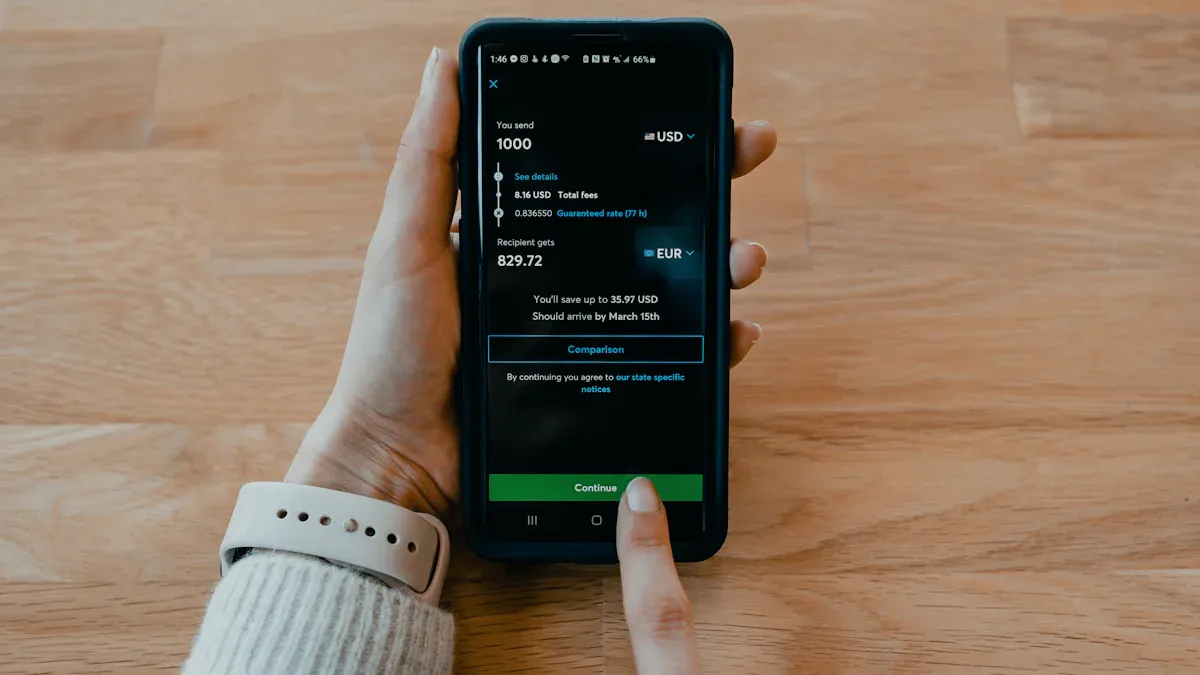

When you’re sending money across borders, accuracy and security are crucial. That’s where SWIFT codes come in. These unique identifiers ensure your funds reach the right bank, making them essential for international payments. Every year, trillions of dollars move globally through cross-border transactions, and SWIFT codes help make this process seamless.

Why does this matter? Using the correct SWIFT code prevents errors, delays, and even financial losses. It also enhances security by verifying both the sender and receiver, reducing fraud risks. For businesses, tools like Xtransfer’s SWIFT code lookup platform simplify the process, ensuring stress-free international money transfers.

What Are SWIFT Codes?

Definition and Purpose of SWIFT Codes

If you’ve ever sent money abroad, you’ve probably come across the term "SWIFT code." But what exactly is it? A SWIFT code, also known as a BIC code (Bank Identifier Code), is a unique identifier assigned to banks and financial institutions worldwide. Think of it as a global banking address that ensures your money reaches the right destination.

SWIFT codes help banks communicate securely and efficiently. They’re part of a standardized messaging system that allows financial institutions to exchange information about transactions. Whether you’re transferring funds, making international payments, or even processing securities, SWIFT codes play a vital role in keeping everything on track.

Here’s a quick look at how SWIFT has evolved over the years:

|

Year |

Milestone |

Significance |

|

1970s |

Concept of SWIFT Emerged |

Addressed the need for secure communication between banks. |

|

1977 |

First Message Processed |

Marked the operational launch of a system for international transactions. |

|

1987 |

Expansion to Securities Transactions |

Solidified SWIFT's role in a broader range of financial activities. |

This system has grown to connect over 11,000 financial institutions in more than 200 countries. It’s no wonder SWIFT codes are considered the backbone of international banking.

Why SWIFT/BIC Codes Are Essential for International Banking

When it comes to international payments, accuracy and security are non-negotiable. SWIFT/BIC codes ensure that your money gets to the right place without delays or errors. They act as a universal language for banks, simplifying complex transactions and reducing the chances of miscommunication.

Here’s why SWIFT codes are indispensable:

|

Benefit |

Description |

|

Global connectivity |

SWIFT connects over 11,000 financial institutions across 200+ countries, facilitating seamless transactions. |

|

Standardization & security |

Utilizes a standardized messaging system to ensure clarity and minimize fraud risks through encryption. |

|

Efficient cross-border transactions |

Streamlines money transfers, reducing delays and ensuring timely settlements for businesses and individuals. |

Without SWIFT codes, international banking would be chaotic. Imagine trying to send money to a bank in another country without a standardized system. It would take longer, cost more, and increase the risk of errors.

SWIFT codes also enhance security. They use encryption to protect sensitive information, making it harder for fraudsters to intercept or manipulate transactions. This is especially important for businesses that rely on international payments to keep their operations running smoothly.

In comparison to traditional methods, SWIFT codes simplify the process of transferring money across borders. They use standardized message formats, which unify communication between banks in different countries. This not only speeds up transactions but also ensures they’re processed securely.

So, the next time you’re making an international payment, remember that SWIFT codes are working behind the scenes to make it all possible.

How Are SWIFT Codes Structured?

Components of a SWIFT/BIC Code

A SWIFT code might seem like a random string of letters and numbers, but it’s actually a well-organized identifier. Each part of the code has a specific purpose, helping banks pinpoint the exact institution and branch involved in a transaction.

Here’s how a SWIFT code breaks down:

|

Characters |

Type |

Meaning |

|

1-4 |

Mandatory |

Bank code (institution code) |

|

5-6 |

Mandatory |

Country code |

|

7-8 |

Mandatory |

Location/city code |

|

9-11 |

Optional |

Branch code (if applicable) |

To make it even clearer, take a look at this chart that visualizes the character count for each component:

Each part of the code plays a role. The bank code identifies the institution. The country code tells you where the bank is located. The location code narrows it down further, and the branch code (if included) pinpoints the exact branch.

How to Interpret a SWIFT Code

Let’s say you come across a SWIFT code like BOFAUS3NXXX. What does it mean? Breaking it down makes it simple:

-

BOFA: This is the bank code for Bank of America.

-

US: The country code shows the bank is in the United States.

-

3N: This location code indicates the bank’s New York office.

-

XXX: The branch code is optional, and "XXX" usually means it’s the main office.

By understanding these components, you can easily interpret any SWIFT number. It’s like reading a global address for banks!

Examples of Common SWIFT Codes

Here are a few examples of SWIFT codes from well-known banks:

-

HSBC Bank (UK): HBUKGB4B

-

Deutsche Bank (Germany): DEUTDEFF

-

Citibank (USA): CITIUS33

Each code follows the same structure, making it easy to identify the bank, country, and location. The consistency of SWIFT codes ensures smooth communication between banks worldwide.

How Are SWIFT Codes Used in International Banking?

Role of SWIFT Codes in Cross-Border Transactions

When you’re sending or receiving money internationally, SWIFT codes are your best friend. They act as a universal language for banks, ensuring that your funds reach the right destination without any hiccups. Whether it’s a personal transfer or a business payment, SWIFT codes streamline the process, making international bank transfers faster and more reliable.

Here’s how SWIFT codes help:

-

Increased Efficiency: SWIFT has revolutionized cross-border transactions by enabling banks to settle payments quickly and accurately.

-

Higher Liquidity: The system processes large volumes of transactions daily, boosting liquidity in global financial markets.

-

Enhanced Transparency: Standardized messaging reduces confusion, ensuring that every transaction is clear and traceable.

For example, a European bank that adopted SWIFT’s message validation system saw a 40% drop in errors and a 20% reduction in settlement times. This shows how SWIFT codes help improve the overall efficiency of international payments.

Ensuring Accuracy and Security with SWIFT/BIC Codes

Accuracy and security are critical when you’re dealing with international wire transfers. SWIFT/BIC codes play a key role in ensuring that your money reaches the right place without delays or errors. These codes act like a GPS for your funds, guiding them to the correct bank and branch.

SWIFT’s standardized messaging system also enhances security. It uses encryption to protect sensitive information, making it nearly impossible for fraudsters to intercept or manipulate transactions. In fact, a trade finance institution in the Asia-Pacific region used SWIFT’s secure messaging system to reduce fraud cases significantly and build trust with its clients.

By using SWIFT/BIC codes, you can rest assured that your international payments are accurate, secure, and efficient.

How Xtransfer Simplifies SWIFT Code Usage for SMEs

If you’re running a small or medium-sized business (SME), managing international payments can feel overwhelming. That’s where Xtransfer comes in. With its SWIFT code lookup platform, Xtransfer makes it easy for you to find the correct SWIFT number for any bank worldwide.

Here’s how Xtransfer helps SMEs:

-

Quick and Easy Lookup: You can search for SWIFT codes in seconds, saving time and reducing stress.

-

Error Prevention: By providing accurate SWIFT/BIC codes, Xtransfer helps you avoid costly mistakes in your transactions.

-

Seamless Integration: Xtransfer’s platform simplifies the process of sending and receiving money internationally, so you can focus on growing your business.

Whether you’re making international wire transfers or receiving money internationally, Xtransfer ensures that your payments are smooth and hassle-free. It’s a game-changer for SMEs navigating the complexities of global banking.

How to Find or Verify a SWIFT Code

Using Xtransfer’s SWIFT Code Lookup Platform

If you need a SWIFT code but aren’t sure where to start, Xtransfer’s SWIFT code lookup platform is here to help. It’s designed to make your search quick and hassle-free. Whether you’re sending international payments or receiving funds, this tool ensures you find the correct SWIFT/BIC code for any bank worldwide.

Here’s why it’s so effective:

-

Ease of Use: The platform is user-friendly. You can search for a SWIFT code in just a few clicks.

-

Global Coverage: It provides access to SWIFT codes for banks across the globe, so you’re never left guessing.

-

Accuracy: By using verified data, Xtransfer helps you avoid errors that could delay your international wire transfers.

This tool is especially useful for businesses managing frequent international money transfers. It saves time and reduces the stress of navigating complex banking systems.

Other Methods to Locate a SWIFT Code

If you don’t have access to Xtransfer’s platform, there are other reliable ways to find a SWIFT code. These methods are straightforward and widely used:

-

Visit your bank’s official website. Most banks list their SWIFT/BIC codes on their contact or FAQ pages.

-

Call your bank’s customer service. A quick phone call can provide you with the exact code you need.

-

Use a SWIFT code search tool. Many financial services offer online tools to help you locate SWIFT codes.

Each of these options is effective, but some may take longer than others. For example, calling customer service might involve waiting on hold, while online tools can give you instant results. Choose the method that works best for your situation.

Tips to Avoid Common Errors with SWIFT Codes

When dealing with SWIFT codes, accuracy is everything. A small mistake can lead to delays or even failed transactions. To avoid common errors:

-

Double-check the SWIFT/BIC code before submitting it.

-

Ensure the code matches the recipient’s bank and branch.

-

Use trusted platforms like Xtransfer or your bank’s official resources to verify the code.

By taking these steps, you can ensure your international payments go through smoothly. A little extra care upfront can save you time and money later.

SWIFT Codes vs. Other Banking Codes

Differences Between SWIFT Codes and IBANs

When you’re making international payments, you’ll often encounter both SWIFT codes and IBANs. While they might seem similar, they serve different purposes.

-

SWIFT/BIC Code: This identifies the bank involved in the transaction. It’s like a global address for banks, ensuring your payment reaches the right institution.

-

IBAN: This pinpoints the specific account within a bank. It reduces errors significantly, making it ideal for transactions requiring precise account details.

Here’s an interesting fact: IBANs can reduce transaction errors by up to 99.9%. On the other hand, over 72% of international payments fail due to formatting mistakes or incorrect account details. That’s why understanding the difference between these two codes is crucial for smooth transactions.

SWIFT/BIC Codes vs. Routing Numbers

If you’ve ever sent money domestically, you’ve probably used routing numbers. These are different from SWIFT/BIC codes, which are designed for international transactions.

Routing numbers are used within a single country, like the United States, to identify banks during domestic transfers. SWIFT/BIC codes, however, connect banks globally. They ensure secure communication between institutions across borders.

Think of it this way: routing numbers are like local street addresses, while SWIFT/BIC codes are like international zip codes. Both are essential, but they’re used in different contexts.

When to Use Each Type of Code

Knowing when to use SWIFT codes, IBANs, or routing numbers can save you time and prevent errors. Here’s a quick comparison to help you decide:

|

Criteria |

SWIFT Code |

IBAN |

|

Geographic Availability |

Used by over 11,000 financial institutions in 200+ countries |

Used in over 85 countries, primarily in Europe and parts of the Middle East |

|

Structure and Format |

8 or 11 characters identifying bank and location |

Up to 34 characters including country code and account number |

|

Role in Financial Transactions |

Facilitates communication between banks |

Directs funds to specific accounts |

|

Requirement for Transfers |

Requires SWIFT code and possibly other identifiers |

Requires IBAN and SWIFT code for transfers to IBAN countries |

|

Transaction Speed and Accuracy |

No built-in validation, may require additional verification |

Enhances accuracy through check digits and standardized format |

|

Cost Implications |

May involve intermediary banks with fees |

Can be processed more efficiently, potentially reducing costs |

For international payments, you’ll often need both a SWIFT code and an IBAN. If you’re transferring money domestically, routing numbers will usually suffice. By understanding these distinctions, you can ensure your payments are accurate and efficient.

Understanding SWIFT is key to navigating international payments with confidence. These codes ensure your transactions are accurate, secure, and efficient, making them indispensable for global banking. Whether you're sending money abroad or receiving funds, SWIFT codes simplify the process and reduce risks.

For businesses, Xtransfer offers a reliable solution to streamline cross-border payments. With a 95% customer satisfaction rate and partnerships with over 20 global banks, Xtransfer has earned the trust of thousands of clients. Its platform has facilitated over $1 billion in transactions, cutting trade costs by up to 10%. By choosing Xtransfer, you can focus on growing your business while leaving the complexities of international payments to the experts.

FAQ

What happens if I use the wrong SWIFT code?

Using the wrong SWIFT code can delay your transaction or send funds to the wrong bank. Always double-check the code with the recipient or use a trusted tool like Xtransfer’s SWIFT code lookup platform to avoid errors.

Can I find a SWIFT code on my bank statement?

Not usually. SWIFT codes are often not included on bank statements. You can find them on your bank’s website, by contacting customer service, or by using Xtransfer’s lookup tool for quick results.

Are SWIFT codes the same for all branches of a bank?

No, they’re not. Some banks have unique SWIFT codes for each branch, while others use a general code for all locations. Check with the recipient’s bank to confirm the correct code for your transaction.

Do I need both a SWIFT code and an IBAN for international transfers?

Yes, in many cases. The SWIFT code identifies the bank, while the IBAN pinpoints the specific account. Together, they ensure your payment reaches the right destination without errors.

How can I verify a SWIFT code before sending money?

You can verify a SWIFT code by using Xtransfer’s SWIFT code lookup platform. It’s fast, accurate, and covers banks worldwide. Alternatively, contact the recipient’s bank directly for confirmation.

Related content