10 Proof of Income Documents for Rental Applications

Author:XTransfer2025.04.25Proof of income

When you’re applying for a rental property, landlords often ask for proof of income. This helps them confirm that you can afford the monthly rent without trouble. Proof of income documents, like pay stubs or recent tax returns, show your financial stability and reliability as a tenant.

Landlords rely on these documents to avoid risks like missed payments or evictions. Did you know that in 2022, nearly 970,000 evictions were filed across major cities? These situations can cost landlords thousands of dollars. Verifying reliable proof of income upfront helps prevent such costly issues.

Providing accurate proof of income for an apartment is essential. It builds trust and strengthens your rental application. Whether it’s a proof of income letter or letters from an employer, make sure your documents are clear and verifiable. This way, you’ll have a better chance of securing your dream rental.

Pay Stubs

Overview of Pay Stubs

Pay stubs are one of the most common proof of income documents landlords request. These stubs provide a detailed breakdown of your earnings, including your gross income, deductions, and net pay. If you're a traditional employee, your employer likely issues these stubs with every paycheck. They’re straightforward, easy to understand, and widely accepted for rental applications.

Pay stubs are also reliable because they show consistent income over time. This consistency reassures landlords that you can meet your rent obligations. In fact, pay stubs are often used in other financial processes, like applying for loans or government assistance, because of their credibility.

Best Suited for Traditional Employees

If you’re a salaried or hourly employee, pay stubs are perfect for proving your income. They’re especially useful if you’ve been with the same employer for a while, as they demonstrate stability.

Most landlords ask for at least one month of pay stubs to verify your income. However, some may request more if they want a clearer picture of your financial situation.

Here’s a quick example of how landlords assess affordability:

This table shows why landlords often check that your income is at least three times the rent. It ensures you can comfortably afford payments without financial strain.

Verification Process for Pay Stubs

Landlords use pay stubs to confirm your income and employment. They’ll typically check the employer’s name, pay period, and total earnings listed on the stubs. Some may even contact your employer to verify the details. To make the process smoother, ensure your stubs are recent and match the information on your W-2 or form W-2 income statement. Providing clear and accurate documents helps build trust and speeds up the approval process.

Bank Statements

Overview of Bank Statements

Bank statements are a versatile way to prove your income when applying for a rental. These documents show your financial activity, including deposits, withdrawals, and balances. They provide a clear picture of your cash flow over time, which helps landlords understand your ability to pay rent.

Unlike pay stubs, bank statements work well for people with non-traditional income sources. If you’re self-employed or a freelancer, these statements can highlight your earnings from clients or projects. They’re also helpful if you receive income from multiple sources, like side gigs or investments.

Best Suited for Freelancers or Self-Employed Individuals

If you’re a freelancer or run your own business, bank statements might be your best option for proof of income. Traditional documents like pay stubs or a W-2 aren’t always available for self-employed individuals. Bank statements, however, can show consistent deposits from clients or customers.

In fact, about 30% of self-employed individuals used bank statement loans in 2023. This trend shows how important these statements are for verifying income in non-traditional jobs. If you’re a freelancer, pairing your bank statements with a form 1099-nec can strengthen your rental application even more.

Verification Process for Bank Statements

Landlords use bank statements to verify your income and spending habits. They’ll check for regular deposits that match your claimed income. They might also look at your account balance to ensure you have enough savings to cover emergencies.

To make the verification process smoother, highlight relevant transactions, like payments from clients or recurring income. Avoid submitting statements with unnecessary personal expenses. Clean, organized documents make a great impression and speed up the approval process.

Tax Returns

Overview of Tax Returns

Tax returns are one of the most comprehensive proof of income documents you can provide. These forms, like the W-2 or form 1099-nec, detail your earnings, deductions, and tax liabilities for the year. They give landlords a clear picture of your financial situation, including all income sources like employment, investments, or self-employment.

What makes tax returns so valuable is their ability to show your income history over multiple years. This long-term view helps landlords assess your financial stability and consistency. For example, if your income has remained steady or grown over time, it reassures landlords that you can handle rent payments.

Best Suited for Comprehensive Income Verification

If you’re self-employed, a freelancer, or someone with multiple income streams, tax returns are perfect for proving your income. They cover everything from wages to side gigs, making them a versatile option. Even if you’re a traditional employee, tax returns can complement other proof of income documents like pay stubs or a W-2 income statement.

Landlords often prefer tax returns when they want a deeper understanding of your financial health. These forms go beyond showing just your monthly income. They reveal patterns and trends that other documents might miss.

Verification Process for Tax Returns

Landlords use tax returns to verify your income and assess your financial reliability. They’ll check for consistency in your reported earnings and compare it with other documents you’ve submitted. For example, they might match the income on your tax returns with deposits in your bank statements.

To make the process easier, ensure your tax returns are complete and accurate. Highlight key sections, like your total income and deductions, to help landlords quickly find the information they need. If you’re self-employed, pairing your tax returns with a form 1099-nec can strengthen your application even further.

Employment Verification Letter

Overview of Employment Verification Letters

An employment verification letter is a formal document that confirms your job status and income. Typically issued by your HR department or employer, this letter outlines details like your job title, salary, and length of employment. It’s a straightforward way to show landlords that you have a stable income and can afford rent.

These letters are widely used in professional and financial situations. For example:

-

Landlords request them during rental applications to confirm steady income.

-

Lending institutions use them to assess risk before approving loans or mortgages.

-

Government agencies may require them for visa applications to verify sufficient income.

Because they’re official and come directly from your employer, employment verification letters are highly reliable. They’re especially useful if you don’t have other proof of income documents, like a W-2 or pay stubs.

Best Suited for Employees with Stable Jobs

If you have a steady job, an employment verification letter is one of the best ways to prove your income. It’s ideal for full-time employees who’ve been with the same company for a while. Landlords value these letters because they provide clear evidence of your financial reliability.

For example, if you’re starting a new lease but don’t have recent pay stubs, this letter can fill the gap. It reassures landlords that your income is consistent, reducing their concerns about missed rent payments. Plus, it speeds up the rental process by giving them the information they need upfront.

Verification Process for Employment Verification Letters

Landlords use employment verification letters to confirm your job and income details. They’ll check the letter for key information, like your employer’s name, your position, and your salary. Some landlords might even contact your employer to double-check the details.

To make the process smoother, ensure the letter is on official company letterhead and includes accurate information. If possible, ask your employer to include their contact details for easy follow-up. This proactive approach builds trust and shows you’re serious about securing the rental.

Social Security Benefits Statement

Overview of Social Security Benefits Statements

Social Security benefits statements are essential documents for verifying income, especially for retirees or individuals receiving government assistance. These statements detail your monthly payment amount, any cost-of-living adjustments, and the duration of benefits. They provide a clear and reliable snapshot of your financial situation, making them a trusted option for rental applications.

For landlords, these statements offer reassurance. They show consistent income, which is crucial when assessing your ability to pay rent. Plus, they’re official documents issued by the government, so they’re highly credible.

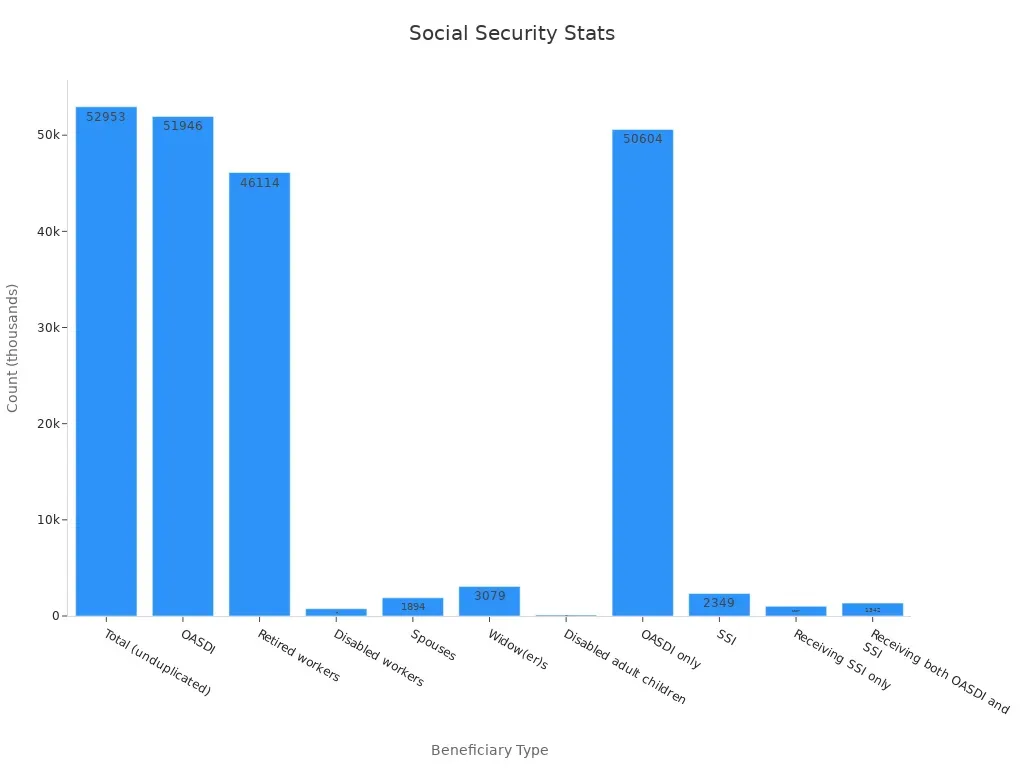

Here’s a quick look at the number of people relying on Social Security benefits:

Best Suited for Retirees or Individuals Receiving Government Assistance

If you’re retired or receiving government assistance, Social Security benefits statements are perfect for proving your income. They’re especially helpful if you don’t have traditional income sources like pay stubs or tax returns. These statements show landlords that you have a steady income stream, even if it’s not from employment.

For example, retirees often rely on Social Security as their primary income. These statements highlight the stability of that income, which can make your rental application stronger. If you’re receiving disability benefits or spousal support, these documents can also demonstrate your financial reliability.

Verification Process for Social Security Benefits Statements

Landlords use Social Security benefits statements to verify your income details. They’ll check the monthly payment amount and look for any adjustments or changes. These statements also indicate how long you’ve been receiving benefits, which helps landlords assess your financial stability.

To make the process easier, provide the most recent statement. Highlight the key details, like your monthly income, so landlords can quickly find the information they need. This proactive approach shows you’re organized and serious about securing the rental.

Pension Distribution Statement

Overview of Pension Distribution Statements

A pension distribution statement is a document that shows the income you receive from your retirement plan. It includes details like the amount distributed, the frequency of payments, and any taxes withheld. These statements are issued by your pension provider and serve as official proof of income. For retirees, they’re a reliable way to demonstrate financial stability when applying for a rental.

Pension distribution statements are especially valuable because they show consistent income. This consistency reassures landlords that you can handle monthly rent payments. According to research, 42-60% of households face challenges with retirement savings. However, pension income often provides a steady financial foundation, making these statements a trusted option for rental applications.

Best Suited for Retirees with Pension Income

If you’re retired and rely on a pension, these statements are perfect for proving your income. They’re especially helpful if you don’t have other documents like pay stubs or tax returns. Pension distribution statements highlight your financial reliability, which landlords value when reviewing applications.

For example, retirees from the 1956-1965 cohort have shown improved income replacement rates compared to earlier generations. This trend demonstrates how pensions can provide a stable income stream for retirees.

Verification Process for Pension Distribution Statements

Landlords use pension distribution statements to verify your income. They’ll check the payment amounts, frequency, and issuing institution. These details help them confirm that your income is consistent and sufficient to cover rent. To make the process smoother, provide the most recent statement and ensure it’s clear and easy to read.

Unemployment Benefits Statement

Overview of Unemployment Benefits Statements

Unemployment benefits statements are official documents that show the income you receive while temporarily out of work. These statements come from your state’s unemployment office and include details like your weekly benefit amount and how long you’ll receive payments. They’re a reliable way to prove you have a steady, though temporary, income stream.

For rental applications, these statements can be a lifesaver. They help landlords understand your financial situation even if you’re between jobs. Since they’re issued by the government, they’re highly credible and easy to verify. If you’re relying on unemployment benefits, providing these statements can strengthen your application and show you’re still financially stable.

Best Suited for Individuals Receiving Temporary Benefits

If you’re currently receiving unemployment benefits, these statements are perfect for proving your income. They’re especially helpful if you don’t have other documents like pay stubs or tax returns. Landlords often look for proof that you can cover rent, and these statements show you have a consistent income source, even if it’s temporary.

For example, unemployment benefits statements outline your weekly payment amount and the duration of your benefits. This gives landlords a clear picture of your financial stability. If you’re actively searching for a job, pairing these statements with an offer letter or employment contract can make your application even stronger.

Verification Process for Unemployment Benefits Statements

Landlords use unemployment benefits statements to verify your income and assess your ability to pay rent. They’ll check the weekly payment amount and the length of time you’ll receive benefits. These details help them determine if your income is sufficient and reliable.

To make the process smoother, highlight the key information on your statement, like your payment amount and benefit duration. This makes it easier for landlords to review your documents quickly. Always ensure the statements are clear and free of errors. Providing accurate and organized documents shows you’re serious about securing the rental.

Offer Letter or Employment Contract

Overview of Offer Letters or Employment Contracts

An offer letter or employment contract can be a lifesaver when you're applying for a rental but don’t have pay stubs yet. These documents confirm your new job and outline key details like your salary, job title, and start date. They’re official papers issued by your employer, making them a reliable way to prove your income.

Landlords often accept offer letters because they provide clear evidence of your financial situation. These letters show that you have a steady income lined up, even if you haven’t started working yet. They’re especially helpful for new hires who might not have other proof of income.

-

Landlords use these documents to verify that tenants can afford rent.

-

Offer letters include essential details like income and job stability, which landlords value during tenant screening.

-

Proof of income letters, like offer letters, help landlords assess your financial reliability.

If you’re starting a new job, an offer letter can make your rental application much stronger. It shows landlords that you’re financially prepared, even if you’re in a transition period.

Best Suited for New Hires or Recently Employed Individuals

Offer letters are perfect for anyone who’s just landed a new job. If you’ve recently been hired and don’t have pay stubs yet, this document can fill the gap. It’s also ideal for people relocating for work, as it proves you’ll have a stable income once you start your new role.

For example, imagine you’ve just accepted a job in a new city and need to secure housing before your first paycheck. An offer letter reassures landlords that you’ll have the income to cover rent. It’s a great way to show financial stability, even if you’re in between jobs or moving to a new area.

Verification Process for Offer Letters or Employment Contracts

Landlords use offer letters to verify your employment and income details. They’ll check for important information like your start date, salary, and employer’s contact details. Some landlords might even reach out to your employer to confirm the information.

To make the process smoother, ensure your offer letter is on official company letterhead and includes all the necessary details. Highlight key sections, like your salary and start date, to make it easier for landlords to review. Providing a clear and complete document speeds up the approval process and shows you’re serious about renting the property.

Profit and Loss Statement

Overview of Profit and Loss Statements

A profit and loss statement (P&L) is a financial document that summarizes your income and expenses over a specific period. It shows how much money you’ve earned and spent, helping you calculate your net profit. If you’re self-employed or run a business, this document is a great way to prove your income when applying for a rental.

P&L statements are straightforward and easy to create. They typically include details like revenue, operating costs, and net income. These details give landlords a clear picture of your financial health. Plus, they’re especially useful if your income fluctuates throughout the year.

Best Suited for Self-Employed Individuals or Business Owners

If you’re self-employed or own a small business, a P&L statement is one of the best ways to prove your income. Traditional documents like pay stubs or W-2 forms might not apply to you. A P&L statement, however, shows landlords that you have a steady income, even if it comes from multiple sources.

For example, if you’re a freelance graphic designer, your income might vary from month to month. A P&L statement can show your total earnings over a year, giving landlords confidence in your ability to pay rent. It’s also helpful for business owners who reinvest profits, as it highlights your overall financial stability.

Verification Process for Profit and Loss Statements

Landlords use P&L statements to verify your income and assess your financial reliability. They’ll check for consistency in your earnings and look at your net profit to ensure you can afford rent. Some landlords might also compare your P&L statement with other documents, like bank statements, to confirm the details.

To make the verification process smoother, keep your P&L statement organized and accurate. Include clear labels for income and expenses, and highlight your net profit. If possible, provide supporting documents, like invoices or receipts, to back up your numbers. This shows landlords that your financial information is trustworthy and complete.

Court-Ordered Agreements

Overview of Court-Ordered Agreements

Court-ordered agreements are legal documents that outline financial obligations between two parties, such as alimony or child support. These agreements specify the amount, frequency, and source of payments, making them a reliable way to prove supplemental income. If you’re receiving alimony or child support, these agreements can help you demonstrate your ability to pay rent.

What makes court-ordered agreements so effective is their enforceability. Courts require both parties to comply with the terms, including income verification and reporting any changes. This ensures the information remains accurate and up-to-date.

These agreements are not just about legal obligations. They also provide landlords with clear and trustworthy proof of your financial stability.

Best Suited for Individuals Receiving Alimony or Child Support

If you rely on alimony or child support as part of your income, court-ordered agreements are perfect for proving it. They’re especially helpful if you don’t have traditional income sources like pay stubs or tax returns. These agreements show landlords that you have a consistent income stream, even if it’s supplemental.

For example, a court-ordered agreement can validate the amount and frequency of payments you receive. This reassures landlords that you’ll have the funds to cover rent. Whether you’re a single parent or recently divorced, these documents can strengthen your rental application by providing detailed income information.

Verification Process for Court-Ordered Agreements

Landlords use court-ordered agreements to verify your supplemental income. They’ll check the payment details, including the amount and frequency, to ensure you can afford rent. These agreements also include the source of payments, which adds another layer of reliability.

To make the process smoother, provide the most recent agreement and highlight key details like payment amounts. This helps landlords quickly find the information they need. Court-ordered agreements are dependable because they’re backed by legal enforcement, making them one of the most trustworthy proof of income documents.

Proof of income documents play a vital role in rental applications. They help landlords verify income and ensure tenants can meet their rent obligations. For renters, combining multiple ways to show proof of income, like pay stubs and bank statements, can strengthen your application. If traditional documents like tax returns aren’t available, consider seeking a co-signer to boost your chances.

Landlords should stay vigilant when reviewing applications. With 93% of property managers encountering fraud attempts in 2023, careful verification is key. Bad debt write-offs averaged $4.2 million last year, highlighting the risks of overlooking income verification. Evictions, which cost thousands in legal fees and lost income, can often be avoided by verifying accurate documents upfront.

Accurate proof of income benefits everyone. Renters gain trust and secure housing, while landlords reduce risks and maintain steady rental income. It’s a win-win for both parties.

FAQ

What is the best proof of income document for freelancers?

Bank statements are often the best choice for freelancers. They show consistent deposits from clients and provide a clear picture of your cash flow. Pairing them with a profit and loss statement can make your rental application even stronger.

Can I combine multiple proof of income documents?

Yes, combining documents like pay stubs and tax returns can strengthen your application. This approach gives landlords a more complete view of your financial stability and reliability as a tenant.

How do landlords verify proof of income documents?

Landlords typically check for consistency and accuracy. They may contact employers, review bank transactions, or compare documents like tax returns and pay stubs. Providing clear and organized documents speeds up the process.

What if I don’t have traditional proof of income?

If you lack traditional documents like pay stubs, consider using alternatives like bank statements, offer letters, or court-ordered agreements. You can also ask a co-signer to support your application.

Are unemployment benefits accepted as proof of income?

Yes, unemployment benefits can be used as proof of income. Provide your most recent benefits statement to show your weekly payment amount and benefit duration. This reassures landlords that you have a temporary income source.

Related content