Why the Kenyan Shilling is Gaining Global Attention

Author:XTransfer2025.04.28Kenyan Shilling

You might have seen the Kenyan Shillings in the news. They are gaining attention in the world currency market. This year, they have gone up by 21 percent. Right now, they are steady at 129.20 against the US dollar. Even though they have had ups and downs, they are stable now. This makes people trust Kenya's economy more. The strength of the Kenyan Shillings shows they matter more in global trade and money matters.

Recent Performance of the Kenyan Shilling

Key Trends and Statistics

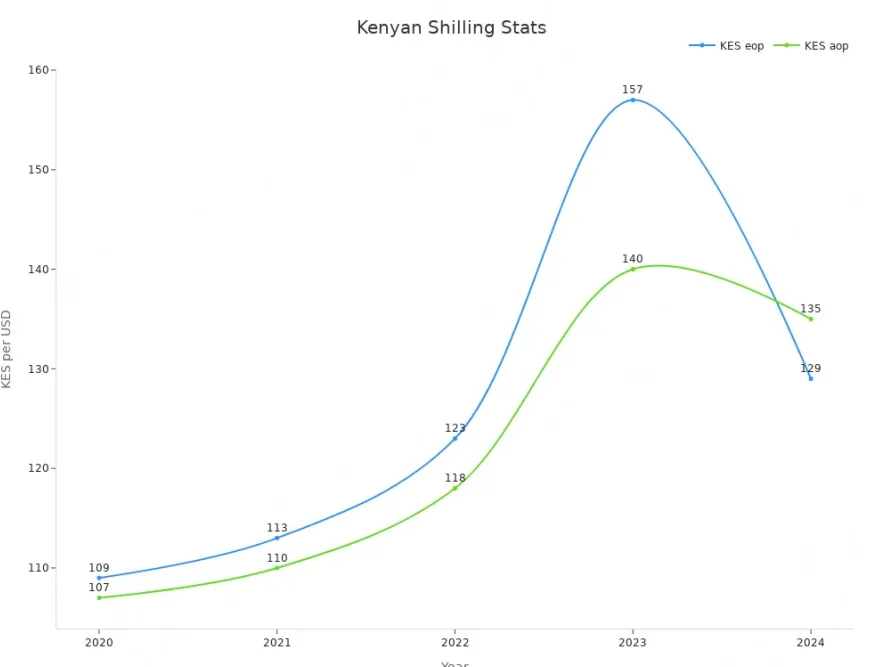

The Kenyan shilling has changed a lot in recent years. It has faced problems but also shown strength. The table below shows how its exchange rate has moved over five years:

|

Year |

KES per USD (eop) |

KES per USD (aop) |

|

2020 |

109 |

107 |

|

2021 |

113 |

110 |

|

2022 |

123 |

118 |

|

2023 |

157 |

140 |

|

2024 |

129 |

135 |

In 2023, the shilling hit its weakest point at 157 KES per USD. By 2024, it got stronger, ending at 129 KES per USD. This change has made people trust the currency more. Now, the Kenyan shilling is seen as important in global trade.

Year-to-Date Appreciation and Recovery

The Kenyan shilling has improved a lot recently. It gained 14% compared to last year. In early 2025, the average rate was 129.34 KES per USD. This is better than 149.74 KES per USD in early 2024. Lower inflation, which was 3.6% in March 2025, helped this recovery.

|

Metric |

Value |

|

Year-on-year gain |

14% |

|

Average exchange rate (Q1 2025) |

129.34 |

|

Average exchange rate (Q1 2024) |

149.74 |

|

Inflation rate (March 2025) |

3.6% |

Kenya has worked hard to make its currency stable. More money sent home by Kenyans abroad has helped a lot.

Comparison with Regional Currencies

The Kenyan shilling has done better than many nearby currencies. At the end of 2024, it grew by 17.4%. This is much better than the 26.8% drop it had in 2023. It ended 2024 at 129.3 KES per USD, improving from 157.0 KES per USD earlier that year.

-

The growth is due to better forex reserves and remittances.

-

Even with issues like debt and trade deficits, the shilling stayed strong.

-

Other regional currencies have struggled with weak economies and big rate changes.

This shows the Kenyan shilling is becoming more important in trade. It could also attract more foreign investments.

Factors Behind the Kenyan Shilling's Strength

Stable Politics and Good Leadership

A calm political scene helps the Kenyan shilling stay strong. When a country is peaceful, it attracts investors and builds trust. Kenya has had peaceful elections and smooth leadership changes recently. This has lowered worries that often cause currency changes.

|

Evidence Type |

Description |

|

Major Political Events |

Elections can cause market worries due to unknown results. |

|

Government Policies |

Changes in money rules affect financial health and currency. |

|

Political Leadership |

New leaders can bring uncertainty, affecting currency markets. |

Kenya's government has also made smart money rules. They have fought corruption and fixed financial problems. These actions have made people trust the Kenyan shilling more. This trust has helped the shilling grow stronger against the US dollar.

Central Bank's Role

The Central Bank of Kenya (CBK) has helped keep the shilling steady. It steps in when the currency moves too much. The CBK sells foreign money to meet dollar demand and changes interest rates to control money flow.

|

Intervention Strategy |

Outcome |

Evidence Type |

|

Foreign exchange market intervention in BRICS |

Helped keep the currency steady |

Studies and examples |

|

Comparison with advanced economies |

Found different success reasons |

Research and country studies |

The CBK's actions have built trust in the market. For example, raising interest rates to fight inflation has brought in foreign investors. These investors want better returns, which has made the shilling stronger.

Trade and World Economy Effects

Trade with other countries affects the Kenyan shilling's value. Selling more goods like farm products and tourism services increases demand for the shilling. Buyers need to exchange their money for the shilling, raising its value. Money sent home by Kenyans abroad also helps keep the shilling steady.

-

The shilling's value depends on:

-

Selling goods, which raises demand for the shilling.

-

Foreign investments and money sent home, which affect its value.

-

Economic factors like interest rates and inflation, which guide money flows.

-

A study showed how these factors connect. It found that things like GDP, money supply, and job rates affect inflation in Kenya. Together, these shape the shilling's performance.

Kenya's trade deals with nearby countries have also helped. These deals make it easier to sell goods, boosting exports. This has made the shilling a trusted currency in the region, improving its position in the market.

Role of Remittances and Foreign Investments

Money sent home by Kenyans abroad helps the economy grow. These remittances add to Kenya's foreign exchange reserves. With more reserves, the Central Bank of Kenya (CBK) can manage foreign currency needs. This keeps the Kenyan shilling steady.

Kenya's foreign exchange reserves grew 28% in one year. They went from $7.2 billion to $9.26 billion. In February 2025, the shilling stayed stable at KSh 128.5–129.5 per USD. This was due to remittances and CBK actions like selling U.S. dollars and changing interest rates.

Foreign investments also help the shilling stay strong. Kenya's growing economy attracts investors from around the world. When companies invest in Kenya, they exchange their money for shillings. This raises demand for the shilling, making it stronger.

The CBK lowered interest rates to 10.75%, making borrowing easier. This encouraged more investments and supported growth. By managing these factors, Kenya has created a good place for investors.

Implications of the Kenyan Shilling's Performance

Impact on Inflation and Cost of Living

The stronger shilling affects inflation and living costs in Kenya. When the shilling gains value, imports like fuel and goods cost less. This lowers inflation, making daily items cheaper for people. For example, inflation was 3.6% in March 2025, up slightly from 3.5% in February. Inflation stayed below 5% for nine months, showing the shilling's stability.

Inflation in Kenya depends on many factors. Global prices for oil and food are important. Local farming problems, like bad weather and high costs, also add pressure. To help, the government gave subsidies for fertilizers and fuel. Better roads and transport have also reduced costs, keeping prices steady.

The Central Bank of Kenya (CBK) helps control inflation. It changes interest rates and uses smart money rules. These actions keep inflation low and support the shilling's strength.

Effects on National Debt and Foreign Reserves

The shilling's performance affects Kenya's debt and foreign reserves. A stronger shilling makes paying foreign debt cheaper. This lets Kenya spend more on projects instead of debt payments. A stable currency also attracts foreign investors, helping the economy grow.

Foreign reserves are key to keeping the shilling steady. Kenya's reserves grew 28% in one year, reaching $9.26 billion by February 2025. These reserves help the CBK handle currency changes and protect the economy. Studies show strong reserves reduce trade problems caused by currency shifts. This proves how important reserves are for the shilling's value.

Export Competitiveness and Trade Balance

The shilling's value affects exports and trade balance. A steady shilling makes Kenyan goods better for global buyers. Farm products and tourism services benefit from good exchange rates. This raises demand for exports and boosts Kenya's income.

Imports are also affected by the shilling's strength. A stronger shilling makes imported goods cheaper for buyers. But it can make exports cost more, hurting their appeal. Kenya is working to fix this by selling more types of goods and improving trade deals. These steps improve the trade balance and Kenya's global market position.

Opportunities for Local Businesses and Investors

The Kenyan Shilling's strength brings new chances for businesses and investors. A steady currency helps businesses grow, innovate, and earn more. Here’s how you can benefit:

-

Lower Costs for Imports: A stronger shilling makes imported goods cheaper. If your business uses foreign materials or tools, you’ll save money. For example, lower fuel costs can reduce transport expenses, improving efficiency.

-

Better Export Opportunities: A strong currency might raise export prices slightly. However, Kenya’s trade deals and quality products keep demand high. If you work in farming, manufacturing, or tourism, you can expand globally.

-

More Investor Confidence: A stable shilling attracts global investors. If you need funding, now is a great time to present your ideas. Investors prefer countries with strong and reliable currencies.

-

Growth in Real Estate and Infrastructure: Foreign investments are boosting real estate and construction. You can explore property development or related services. These sectors grow well in a stable economy.

|

Opportunity Area |

Benefit for You |

|

Imports |

Save money on goods and materials |

|

Exports |

Demand stays strong for quality products |

|

Foreign Investments |

Easier to get funding |

|

Real Estate |

Growth in property and construction |

-

Help for Small Businesses (SMEs): The government supports SMEs with lower loan rates and grants. You can also join training programs to improve your business skills.

By using these opportunities, you can grow in Kenya’s changing economy. Whether you’re a local business owner or an investor, the Kenyan Shilling’s performance offers a strong base for success.

Expert Insights and Future Projections

Short-Term and Long-Term Predictions

Experts use tools to predict the Kenyan Shilling's future. These tools track spending and economic activity in Kenya. For example:

-

Consumption Indicators: Show how much people spend, reflecting the economy's health.

-

Monitoring Trends: Help experts understand market conditions and buying power.

-

Forecasting Techniques: Use models like ARIMA to predict Kenya's market changes.

In the short term, the shilling will likely stay steady. This is due to strong remittances and better foreign reserves. Long-term performance depends on economic growth and good government policies. Watching these factors helps predict the currency's future.

Risks and Challenges Ahead

The Kenyan Shilling faces risks despite recent improvements. Political stability is key. For example, the 2017 election caused big currency changes. A strong economy helps the shilling, but weak times can hurt it.

Inflation and exchange rate changes are also challenges. High inflation, like 19% in 2011, weakens the shilling. Big changes against currencies like the US dollar create instability. Managing these risks is crucial to keep the shilling stable.

Comparison with Other African Currencies

The Kenyan Shilling reacts differently to market problems than other African currencies. During the global financial crisis, it showed stronger reactions to bad events. Models like GARCH explain this unique behavior.

While other African currencies face extreme changes, the shilling stays strong. It recovers well from global problems, making it reliable for trade and investment. This sets it apart in Africa's financial markets.

Using the XTransfer Exchange Rate Platform for Insights

The XTransfer Exchange Rate Platform is a helpful tool. It lets you understand how the Kenyan Shilling is doing. The platform gives live updates and useful information. It makes hard financial data simple to understand.

Main Features of the XTransfer Platform

Here’s why XTransfer is great for tracking exchange rates:

-

Real-Time Updates: See live exchange rates instantly. Track the Kenyan Shilling against big currencies like the US Dollar or Euro.

-

Historical Data: Look at past exchange rates to see how the shilling has changed.

-

Customizable Alerts: Get alerts when rates hit your chosen levels. This helps you act fast when the market changes.

-

Easy-to-Use Design: The platform is simple to use. Even beginners can navigate it easily.

Advantages for Everyone

XTransfer isn’t just for experts. It’s useful for businesses, investors, and regular users:

|

User Type |

How XTransfer Helps You |

|

Business Owners |

Plan imports and exports with correct rates. |

|

Investors |

Find the best times to invest in Kenya. |

|

Travelers |

Get good exchange rates for your trips. |

|

Students |

Learn about currency trends for studies. |

Using XTransfer gives you an advantage. For example, business owners can save money by importing when the shilling is strong. Investors can use trends to find good opportunities.

Why Pick XTransfer?

XTransfer is trusted because it’s accurate and reliable. It uses smart systems to give up-to-date data. It also connects with global financial networks for a full view of the market.

Whether you’re running a business, traveling, or investing, XTransfer helps you stay ahead. Try it today to keep up with the changing currency market.

Lessons for Emerging Markets

Currency Management Strategies

Emerging markets can learn from Kenya's smart currency management. Quick actions help keep currencies stable and protect economies. Delaying important steps can cause bigger problems later. Acting early gives policies time to work and reduces risks.

Countries should check how businesses handle foreign exchange (FX) risks. Companies that import or export are affected by currency changes. Adjusting prices is one way to manage these risks. Teaching businesses these methods makes the economy stronger and more prepared.

Economic data can become outdated fast. This means countries must watch real-time trends and act quickly. Kenya shows how being ready and flexible helps in a fast-changing world.

Role of Technology in Currency Stability

Technology is key to keeping currencies steady. It helps track exchange rates and make quick decisions. Tools like XTransfer give live updates and show past trends. These tools help businesses and leaders make smarter choices.

Automation reduces mistakes in managing FX risks. For example, software can set up automatic plans to avoid losses. Using such tools gives emerging markets an advantage in global trade.

Modern technology builds trust with investors. They prefer economies that use smart tools for stability. By adopting these technologies, countries can attract more investments and grow stronger.

Staying Updated on the Kenyan Shilling

Using the XTransfer Exchange Rate Platform for Real-Time Updates

To know how the Kenyan Shilling is doing, use helpful tools. The XTransfer Exchange Rate Platform gives live updates on exchange rates. It makes hard financial data easy to understand for everyone. Whether you own a business, invest, or travel, you can check the shilling's value against big currencies like the US Dollar or Euro.

The platform also shows past data to spot trends over time. For example, you can see how the shilling performed during different times. You can set alerts to know when rates change. These alerts help you act quickly, especially for international transactions.

Monitoring Key Economic Indicators

Watching economic factors helps you understand the Kenyan Shilling's value. Some important factors include:

-

Foreign Currency Inflows: Selling goods like tea and coffee brings in money. This raises demand for the shilling and makes it stronger.

-

Reduced Demand for US Dollars: Smart financial plans and fewer imports have lowered the need for US Dollars. This helps the shilling grow in value.

-

Monetary Policies: The Central Bank of Kenya controls interest rates and money supply. These actions keep the shilling steady.

By tracking these factors, you can see what affects the shilling's value. For example, more export earnings often mean a stronger currency. Good policies also create a stable economy, which helps the shilling.

Engaging with Financial Experts and Analysts

Experts and analysts can explain currency trends clearly. Their advice helps you understand the Kenyan Shilling better. Platforms like Bloomberg, Reuters, and LSEG's FX Pricing Data share expert opinions and live updates. Here’s a quick look at these tools:

|

Platform |

What It Offers |

|

LSEG's FX Pricing Data |

Special Foreign Exchange data, including live and past pricing. |

|

Bloomberg |

Financial news, analysis, and live data for smart decisions. |

|

Reuters |

Trusted updates on market trends and financial news. |

These tools help you study data and understand trends. Experts also explain how events or policies affect the shilling. For example, global issues or local rules can change its value.

By using XTransfer, watching economic factors, and learning from experts, you can stay informed about the Kenyan Shilling. These steps help you make smart financial choices for personal or business needs.

The Kenyan Shilling shows strength and importance in global finance. Its steady value helps Kenya's economy and trade grow. This creates chances for success but also brings challenges. Using tools like the XTransfer Exchange Rate Platform helps you stay updated. The shilling looks strong, but smart actions are needed to keep it stable.

FAQ

What makes the Kenyan Shilling special compared to other African currencies?

The Kenyan Shilling is strong and steady. It bounces back fast from global problems. This makes it a trusted currency for trade and investment.

How does the Central Bank of Kenya help the Shilling?

The Central Bank adjusts interest rates and manages foreign money. These steps keep the Shilling stable and attract investors.

Why are remittances important for the Kenyan Shilling?

Remittances bring in foreign money, increasing Kenya's reserves. This lowers pressure on the Shilling and helps families and businesses.

How does the Shilling's strength help local businesses?

A strong Shilling makes imports cheaper, saving businesses money. It also attracts investors, helping companies grow.

What role does technology play in tracking the Shilling?

Tools like XTransfer show live exchange rates. They help you follow trends and make smart money decisions.

Can the Kenyan Shilling's strength lower inflation?

Yes, a stronger Shilling makes imports like fuel cheaper. This lowers inflation, so goods cost less for you.

How can you stay informed about the Shilling's performance?

Use tools like XTransfer for updates. Read reports and expert advice to understand changes and plan wisely.

What problems might the Kenyan Shilling face in the future?

Issues like political troubles, inflation, or global changes could hurt it. Watching these helps you prepare for shifts in its value.

Related content