AED ≠ USD, But Close Enough: Why Exporters Should Care

Author:XTransfer2025.07.10AED

The United Arab Emirates Dirham (currency code: AED) is a familiar name in international trade. Backed by a country powered by oil wealth and financial ambition, the AED isn’t a global reserve currency, nor is it considered a traditional safe haven. But does that mean it can be overlooked?

Short answer: No. Because the UAE is a country that “thinks in dirhams but settles in dollars.” For anyone engaged in trade, logistics, or investment in the Gulf, understanding the AED means understanding the financial pulse of a region that sits at the crossroads of East and West, energy and innovation.

Pegged stably to the US dollar since 1997, supported by a well-capitalized banking sector, and increasingly integrated into global trade corridors—from Chinese Belt and Road initiatives to European re-export flows—the AED functions not merely as a local currency, but as a strategic settlement tool in a dollarized yet multipolar world.

In an era where supply chains are shifting, alternative payment ecosystems are emerging, and regional financial centers like Dubai are gaining global influence, the AED deserves more than passive recognition—it requires active understanding. Whether you're an exporter, a fintech builder, or a global investor, the dirham is not just about the Gulf—it’s about how the Gulf connects to the world.

Understanding the AED Currency

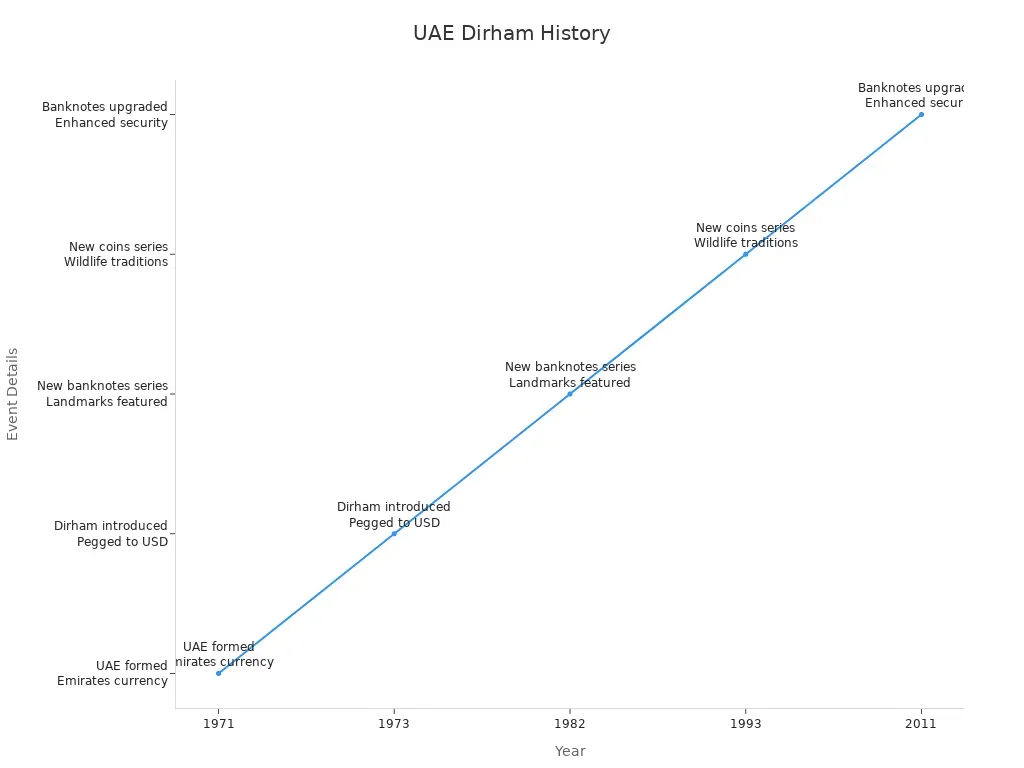

A Brief History of the UAE Dirham

The UAE dirham, also known as the Arab Emirates dirham, has a fascinating history that reflects the region's economic evolution. Before 1959, the Indian rupee served as the primary currency for trade in the region due to strong ties with India. In 1959, the Gulf rupee was introduced to prevent foreign exchange outflow, maintaining parity with the Indian rupee. However, the devaluation of the Indian rupee in 1966 led to the temporary adoption of the Saudi riyal to stabilize the economy.

Between 1966 and 1973, the region used the Bahraini dinar and the Qatari/Dubai riyal. Finally, in 1973, the UAE dirham was introduced as the official currency, replacing all previous currencies. This marked a significant milestone in the economic unification of the UAE. The dirham was pegged to the US dollar at a fixed rate of 3.67 AED to 1 USD, ensuring stability and fostering investor confidence.

|

Year |

Event Description |

|

1971 |

Formation of the UAE and decision for each emirate to issue its own currency. |

|

1973 |

Introduction of the UAE Dirham as the official currency, pegged to the US dollar at 1 USD to 3.67 AED. |

|

1982 |

Issuance of a new series of banknotes featuring famous landmarks. |

|

1993 |

Introduction of a new series of coins with local wildlife and traditional designs. |

|

2011 |

Release of a new series of banknotes with enhanced security features. |

The Role of AED Currency in the UAE Economy

The AED isn’t just a piece of paper people use in the UAE—it’s part of how the country keeps its economy running smoothly. It supports what the UAE does best: trade, tourism, and attracting foreign investment. And behind the scenes, the Central Bank keeps inflation in check to make sure the dirham holds its value. That’s one of the reasons global investors see the UAE as a safe, stable place to do business.

Because the AED is pegged to the US dollar, whenever the Fed moves interest rates, the UAE follows. That affects everything from real estate to the cost of borrowing—and even how much tourists spend. In a place like the UAE, where growth depends on people coming in and money flowing out, these small shifts really matter.

What’s interesting is how the UAE keeps the system open—money moves in and out freely, and businesses can settle in AED or USD. That kind of flexibility, with a stable peg, is rare. It’s not flashy, but it works.

Bottom line: The AED might not make headlines, but it’s a quiet force behind one of the most dynamic economies in the region. If you work in global trade or investment, it’s worth paying attention—not just to the currency itself, but to what it tells you about how the UAE thinks, plans, and grows.

Why the UAE Dirham is a Stable Currency

The UAE dirham is one of the most stable currencies globally, thanks to several factors. Its fixed peg to the US dollar at approximately 3.67 AED to 1 USD minimizes exchange rate volatility. This stability attracts foreign investors and supports economic growth. The Central Bank's prudent monetary policies maintain low inflation, protecting the dirham's value.

Economic diversification has also strengthened the dirham. The UAE has reduced its reliance on oil by investing in sectors like tourism, real estate, and technology. This diversification enhances economic resilience and boosts the dirham's stability. Additionally, the country's political stability and robust economic indicators, such as a GDP of $514 billion in 2023, further solidify the dirham's position.

|

Indicator |

Value |

|

GDP (2023) |

$514 billion |

|

GDP per capita (2023) |

$52,976.80 |

|

Current account status |

Surplus |

|

Currency peg |

1 USD = 3.6725 AED |

The dirham's stability benefits both residents and travelers. It ensures consistent purchasing power and simplifies financial planning. Whether you're exchanging money or making digital payments, the UAE dirham offers reliability and convenience.

AED Denominations and Design Features

Coins: Denominations and Usage

Coins in the UAE play a practical role in everyday life, especially for small-value transactions. Denominations range from 1 fils up to 1 dirham, although the smallest coins—1, 5, and 10 fils—are now rarely seen in circulation. In contrast, the 25 fils, 50 fils, and 1 dirham coins remain commonly used for routine purchases like groceries, parking, or public transport.

Many of these coins feature culturally significant symbols, such as traditional Arabic coffee pots (dallah) and palm trees, offering a visual link to the nation’s heritage. Lightweight and made from durable materials, they’re easy to carry and well-suited for daily use, even as digital payments become more popular across the country.

|

Denomination Type |

Denominations |

|

Coins |

1 fils, 5 fils, 10 fils, 25 fils, 50 fils, 1 dirham |

Banknotes: Design, Security Features, and Cultural Elements

Banknotes in the UAE come in denominations ranging from 1 dirham to 1000 dirhams. Each note showcases intricate designs that highlight the UAE’s cultural and historical landmarks. For example, the 500-dirham note features an image of the Sheikh Zayed Grand Mosque, while the 100-dirham note displays the World Trade Center in Dubai.

To ensure authenticity, UAE banknotes incorporate advanced security features. These include watermarks, metallic threads, holograms, and ultraviolet-visible elements. Security threads embedded in the paper become visible under certain lighting conditions, while watermarks appear when you hold the note up to the light. These features protect the currency from counterfeiting and maintain its reliability.

|

Security Feature |

Description |

|

Security Threads |

Embedded threads that are visible under certain conditions, enhancing authenticity. |

|

Security Fibers |

Colored fibers that are mixed into the paper, making counterfeiting more difficult. |

|

Planchettes |

Small, colored dots or shapes that are embedded in the paper, visible under UV light. |

|

Watermarks |

Images or patterns that are visible when the banknote is held up to the light, indicating authenticity. |

Unique Historical and Cultural Symbols in AED Currency

The UAE dirham reflects the nation’s rich history and culture through its design elements. Coins often feature symbols like the dhow, a traditional sailing vessel, and the falcon, which represents strength and heritage. Banknotes highlight iconic landmarks, such as the Burj Khalifa and Al Fahidi Fort, connecting you to the UAE’s architectural and historical achievements. These symbols not only enhance the aesthetic appeal of the currency but also serve as a reminder of the country’s journey and values.

Practical Usage of AED Currency

Currency Exchange Tips for Travelers and Residents

Navigating currency exchange in the UAE can be straightforward if you follow a few key strategies. Whether you're a traveler or a resident, understanding the nuances of exchanging AED currency ensures you get the best value for your money.

-

Plan Ahead: Always check the exchange rates before your trip. Rates fluctuate daily, so timing your exchange can save you money.

-

Avoid Airport Exchanges: Currency exchange counters at airports often charge higher fees. Opt for banks or authorized exchange centers instead.

-

Use Local Banks: If you're a resident, local banks typically offer competitive rates for exchanging the UAE dirham.

-

Monitor Currency Risks: Regularly assess your exposure to currency risks. This helps you identify vulnerabilities early and make informed decisions.

-

Leverage Technology: Integrated treasury management systems provide real-time visibility into currency exposures, aiding in monitoring and decision-making.

For travelers, using the dirham in daily life becomes seamless when you familiarize yourself with its denominations and value. Carrying smaller denominations like coins can be helpful for minor purchases, while larger banknotes are ideal for significant transactions.

Digital Payments and the Cashless Economy in the UAE

The UAE is rapidly transitioning into a cashless society, driven by advancements in technology and government initiatives. Digital payments, including the digital dirham, are reshaping how you interact with money.

A recent survey revealed fascinating insights into this shift:

|

Statistic |

Value |

|

Percentage of UAE residents using digital wallets |

48% |

|

Expected shift to cashless society in a decade |

48% |

|

Percentage of residents maintaining or increasing eCommerce spending |

83% |

|

Cash-on-delivery usage in online purchases |

20% (down from 40% in 2020) |

|

Percentage using digital wallets for bill payments |

58% |

|

Percentage using digital wallets for groceries |

55% |

|

Percentage using wallets for peer-to-peer transactions |

28% |

|

Percentage using digital wallets for remittances |

33% |

The adoption of digital payments offers several advantages:

-

Biometric payments using fingerprint recognition enhance security.

-

QR codes enable faster transactions without cash.

-

NFC-enabled cards simplify tap payments for everyday purchases.

Younger generations prefer mobile payments directly from smartphones or smartwatches. This trend promotes financial inclusion and efficiency across public and private sectors. The pandemic accelerated this adoption, pushing businesses to adapt to cashless options.

Mo Ali Yusuf, Regional Manager for MENAP at Checkout.com, emphasized the inevitability of this trend, stating, "With more and more people embracing the convenience of digital wallets coupled with the reassurance of their transactions being safe and secure, digitization of the payment system is unstoppable."

How XTransfer Exchange Rate Platform Simplifies Currency Exchange

Managing currency exchange can be challenging, especially when rates fluctuate. XTransfer simplifies this process by offering real-time exchange rates and seamless transactions.

Here’s how XTransfer benefits you:

-

Transparency: The platform provides accurate and up-to-date exchange rates, ensuring you make informed decisions.

-

Convenience: You can exchange AED currency from the comfort of your home using their user-friendly interface.

-

Cost Efficiency: Competitive rates and minimal fees help you save money on every transaction.

For residents and businesses, XTransfer integrates advanced features like scenario planning and stress testing. These tools simulate various market conditions, preparing you for potential losses and helping you optimize your currency exchange strategies.

Whether you're exchanging the UAE dirham for international travel or managing business transactions, XTransfer offers reliability and efficiency. Its innovative approach aligns with the UAE's vision of a digital dirham and a cashless economy.

The AED currency stands as a symbol of stability and economic strength. Its peg to the US dollar ensures minimal volatility, fostering confidence among investors and businesses. The Dirham's role extends beyond trade, supporting tourism and daily transactions across the UAE.

Future trends highlight the Dirham's evolution in a digital economy. Projections for 2025 reveal promising growth:

|

Metric |

Value |

|

Projected revenue in 2025 |

US$254.3 million |

|

Average revenue per user in 2025 |

US$67.3 |

|

Expected number of users in 2025 |

3.78 million users |

|

User penetration rate in 2025 |

39.13% |

像人工智能和模拟仿真这样的创新技术将塑造迪拉姆的未来。这些工具可以用于模拟政策影响、评估风险,并为数字货币的推广提供决策支持。随着阿联酋不断推动经济多元化、吸引全球投资,迪拉姆将在这个高度互联的世界中持续扮演可靠且稳定的货币角色。

常见问答(FAQ)

1. 迪拉姆的新符号是什么?为什么它很重要?

新的迪拉姆符号以统一的方式代表阿联酋货币。它简化了交易流程,并在全球市场中强化了迪拉姆的识别度和货币形象。

2. 阿联酋迪拉姆如何助力数字经济的发展?

迪拉姆支持数字支付和金融创新,在推动阿联酋迈向无现金经济的过程中发挥着关键作用。

3. AED货币上的符号有什么意义?

AED货币上的图案象征着阿联酋的文化与历史,它们将人们与国家的传统和核心价值观紧密相连。

Related content