How the Bulgarian Lev Shapes Bulgaria’s Economy in 2025

Author:XTransfer2025.08.19BGN

The (BGN) Bulgarian Lev plays a crucial role in Bulgaria’s economy in 2025. The (BGN) Bulgarian Lev has been pegged to the euro for nearly thirty years, which has helped maintain low inflation and keep government debt under control. Bulgaria’s GDP is expected to reach around USD 117 billion, reflecting steady growth and sound financial management. For many, the (BGN) Bulgarian Lev represents stability. However, there are concerns among some about transitioning to the euro, with ongoing discussions about price changes, investment impacts, and confidence in the government’s economic strategy.

Highlights

-

The Bulgarian Lev’s fixed rate to the euro keeps prices steady. This helps control inflation. It lets families and businesses plan their money with confidence.

-

Bulgaria’s currency board system builds trust. It backs every Lev with euros. But it makes it hard to react fast to economic problems.

-

The Lev helps trade and brings in foreign investment. It does this by being a steady currency. It also has strong banking connections.

-

Many Bulgarians see the Lev as a symbol of national pride. This makes people feel mixed about switching to the euro. Some see economic benefits, but others worry about losing tradition.

-

Bulgaria is getting ready to use the euro in 2026. The country is trying to balance tradition with new digital tools. This will help the economy and future growth.

(BGN) Bulgarian Lev and Stability

Currency Board System

Bulgaria uses a currency board system to control its money. This system connects the (BGN) Bulgarian Lev to the euro at a set rate of 1.95583 BGN for 1 euro. The Bulgarian National Bank holds enough euros to match all the levs people use. This rule makes sure every lev has real value. The currency board began in 1997 after a big financial crisis. It helped people trust the country’s money and banks again.

The currency board has strict rules for making money. It also needs full support from foreign currency reserves. Commercial banks are watched closely. Bulgaria cannot set its own interest rates or print more money when times are hard. The country must follow the European Central Bank’s rules. This system brings stability and stops high inflation.

But the currency board also means Bulgaria cannot react quickly to sudden economic problems. The country cannot use its own money rules to fight recessions or help the economy grow. Still, the system has helped Bulgaria get closer to the European Monetary Union. It has made the economy steadier than in many nearby countries.

Inflation and Interest Rates

The fixed exchange rate between the (BGN) Bulgarian Lev and the euro helps control inflation. Since 1999, Bulgaria has kept inflation low and steady. In April 2025, inflation was just 2.8%. This meets the rules for joining the eurozone. The stable rate helps families and businesses know what to expect with prices.

Interest rates in Bulgaria dropped fast after the currency board started. Before 1997, inflation was very high and interest rates changed a lot. After the currency board, both inflation and interest rates went down quickly. This made it easier for people to borrow money and for businesses to invest. The steady rates have stayed, even when other countries had problems.

-

The fixed exchange rate keeps money valuable and stops high inflation.

-

Consumer protection laws and dual pricing stop prices from rising too fast.

-

Bulgaria’s stable system has made investors and the public feel confident.

The currency board system has given Bulgaria strong money stability. It has made the (BGN) Bulgarian Lev a trusted part of daily life and important for the country’s growth.

Trade and Investment

Exports and Imports

Bulgaria’s trade has changed a lot over time. Before, Bulgaria traded mostly with the Soviet Union and Eastern Europe. These trades did not use hard currency. After 1990, Bulgaria started trading with Western countries. They began using hard currency for deals. The Bulgarian Lev’s steady value helped make this change happen. Now, Bulgaria’s main trade partners are Germany, Romania, Italy, and Turkey. The Lev helps Bulgarian companies do business with these countries. Local banks connect to global networks. This helps companies get money for trading.

|

Aspect |

Details |

|

Top Export Partners 2022 |

Germany, Romania, Italy |

|

Top Import Partners 2022 |

Germany, Romania, Turkey |

|

Major Export Categories |

Manufactures, Fuels and mining products, Machinery and transport equipment |

|

Major Import Categories |

Manufactures, Machinery and transport equipment, Fuels and mining products |

|

Role of the Lev |

The Lev helps with trade deals and finance. Local banks link to global networks. This gives companies money for trade and helps lower risks. The Lev’s steady value made it easier to move from Comecon’s old system to hard currency trade. |

|

Trade Finance Institutions |

Local banks like BNP Paribas S.A - Sofia, Bulgarian Postbank AD - Sofia, Citibank Europe plc - Sofia, UniCredit Bulbank AD - Sofia, and United Bulgarian Bank AD - Sofia join IFC’s Global Trade Finance Program. This helps with international trade finance. |

Foreign Direct Investment

Foreign direct investment is very important for Bulgaria’s economy. After the currency board started in 1997, Bulgaria made changes to attract investors. The government cut the budget deficit, made banks better, and sold state-owned companies. These steps made Bulgaria a better place for foreign companies.

Many areas bring in foreign investment:

-

Electronics and information technology

-

Sustainable energy and health-life sciences

-

Manufacturing and automotive parts

-

Tourism, construction, and software development

The Trakia Economic Zone is a big center for investment. It brings in billions of euros from global companies. The Lev’s steady value, tied to the euro, lowers risk for investors. Bulgaria’s flat tax rate of 10% also helps. As Bulgaria plans to use the euro soon, experts think more investment will come. The Lev’s strong base keeps helping Bulgaria grow and connect with the world.

Daily Life and Public Confidence

Purchasing Power

The Bulgarian Lev affects how families spend money each day. In the last ten years, Bulgaria had many money problems. People learned to be careful with spending. They borrow less and often get help from family. The Lev is tied to the euro, so its value does not change much. This makes people feel safe when they plan their money.

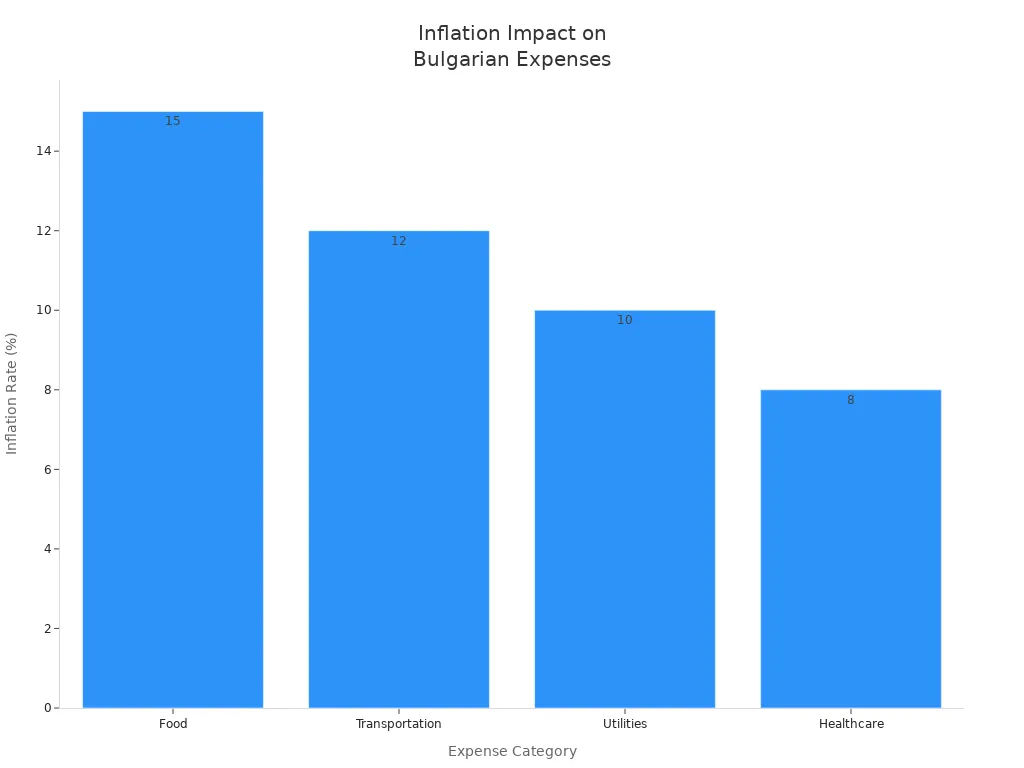

Wages in Bulgaria are going up. Fewer workers means higher pay for many people. This helps families buy more things. But prices are still rising. In 2022, food cost 15% more. Transportation got 12% more expensive. Utilities and healthcare also cost more now. These price jumps make it hard for families to save money.

|

Category |

Typical Cost or Change |

Notes and Examples |

|

Housing (Sofia) |

One-bedroom apartment: ~€330-€370/month |

Central locations like Lozenets or Vitosha have higher rents; outskirts can reduce costs by 20-30% |

|

Housing (Plovdiv) |

One-bedroom apartment: ~€220-€260/month |

Affordable for students and families |

|

Housing (Varna) |

One-bedroom apartment: ~€320-€360/month |

Sea view apartments cost more, popular with lifestyle seekers |

|

Inflation on Food |

+15% increase over past year |

Grocery bills rise significantly, e.g., a family of four in Sofia sees an increase of ~37.5 BGN/month |

|

Inflation on Transportation |

+12% increase |

Public transport ticket prices increased, affecting commuting costs |

|

Inflation on Utilities |

+10% increase |

Electricity and water bills have risen, impacting monthly budgets |

|

Inflation on Healthcare |

+8% increase |

Medical costs and medications have become more expensive |

|

Monthly Budget Example |

Living expenses ~50% of income |

Includes rent, utilities, groceries; practical budgeting advice provided |

Even with these problems, the Lev’s steady value helps people save. It also helps them plan for the future. EU help and social payments make it easier for families to pay for what they need.

Public Trust

Most people in Bulgaria trust the Lev. But not everyone agrees about switching to the euro. Many see the Lev as a sign of their country and safety. About half of Bulgarians do not want to use the euro. Some worry that changing money will make prices go up. Others fear losing control of their savings.

-

Older people and those in villages worry the euro will hurt their savings.

-

Some political groups and protesters say “no to Euro colonialism.”

-

Surveys show only 43% of people want the euro, but 50% do not.

The Lev’s fixed rate with the euro helps people feel safe. Even if prices rise or politics change, the Lev stays steady. This makes people trust the money and helps them in daily life.

Euro Adoption Debate

Economic Readiness

Bulgaria has tried for years to join the eurozone. In July 2020, Bulgaria joined ERM-2. This showed the country wants its money to stay steady. The lev and euro exchange rate has barely changed. It moves less than 1%. Bulgaria keeps inflation low. Government debt is only 24.1% of GDP. These facts show Bulgaria manages money well.

The European Commission says Bulgaria meets all euro rules. These rules are about stable prices, good budgets, and steady interest rates. Bulgaria plans to switch from the (BGN) Bulgarian Lev to the euro on January 1, 2026. Leaders think using the euro will help Bulgaria in many ways:

-

Businesses and the government can borrow money for less.

-

There will be fewer risks when trading with EU countries.

-

Investors will trust Bulgaria more and credit ratings may go up.

-

Trade and the economy could grow stronger.

But there are still some risks. Bulgaria will not control its own money rules anymore. Problems like corruption and money laundering must be fixed. Leaders say Bulgaria must keep managing money carefully and keep making improvements.

Political and Social Factors

Bulgaria is ready for the euro, but people still argue about it. Many people are split on the issue. Polls show almost half want the euro and half do not. Young, city, and educated people mostly support the euro. Older and rural people often do not. Many worry prices will go up and they will lose their national identity.

|

Group |

Tends to Support Euro |

Tends to Oppose Euro |

|

Younger, urban, educated |

✔ |

|

|

Older, rural |

|

✔ |

Big protests have happened in Sofia and other cities. Protesters fear prices will rise and the (BGN) Bulgarian Lev will disappear. Some political parties, like the Revival party, lead the protests. They want a national vote on the euro. Social media has spread false stories, making people more worried.

Leaders have different ideas about what to do. Some, like President Rumen Radev, want a vote to slow down euro adoption. Others promise to protect people who might be hurt by the change. They say the exchange rate will not change during the switch.

Problems in the eurozone, like the Greek debt crisis, also worry people. Some fear Bulgaria could have the same problems. But Bulgaria spends carefully and has low debt. This makes it different from countries that had trouble. Still, old memories and low trust in leaders make people unsure.

-

Many people have protested, saying the lev means freedom.

-

Some leaders say Bulgaria would lose control of its money and budget.

-

False stories have made people more afraid of money problems.

Even with these problems, Bulgaria is still working to join the euro. Many leaders think it will help Bulgaria be stronger in Europe and have a safer economy. The debate shows that money is not just about math. It is also about how people feel, what they trust, and what they hope for.

Future of the (BGN) Bulgarian Lev

Digital Currency Trends

Digital technology is changing how people use money in Bulgaria. The government spends money on digital tools and online banks. Many people in Bulgaria now pay bills and shop with their phones. The EU Recovery and Resilience Plan gives Bulgaria over 6 billion euros. This money helps with digital growth and green projects. It helps the country build stronger systems for the future.

Bulgaria’s leaders look at what is happening with digital currency around the world. The European Central Bank wants to start a digital euro. If this happens, Bulgaria will need to update its banks. The country is already making progress with digital changes. This makes Bulgaria ready for new things. Digital payments can make trade faster and safer. They also help people in the countryside get better banking.

A table below shows some things that shape the future of the currency:

|

Factor |

Description |

Impact on Lev Stability |

|

Digital Transformation |

Investments in digital tools and services |

Makes the economy stronger |

|

EU Integration |

Plans to join the Eurozone in 2026 |

Increases trust and lowers borrowing |

|

Global Economic Trends |

Conflicts and inflation affect energy and prices |

Can create risks for the Lev |

National Identity and Strategy

The (BGN) Bulgarian Lev is a symbol of national pride. Many people see the Lev as a sign of Bulgaria’s history and freedom. The name “Lev” means “lion,” which stands for strength and courage. Some people worry that switching to the euro could hurt their national identity.

Leaders must balance old ways with new ideas. They want to keep the country strong and join the Eurozone. Bulgaria’s plan is to think ahead and be careful. The government uses smart money rules and invests in digital growth. These steps help protect the economy from outside problems, like the Russia-Ukraine conflict.

-

The Lev connects people to their past.

-

New digital tools help Bulgaria get ready for the future.

-

Joining the Eurozone can bring new chances.

The (BGN) Bulgarian Lev helped Bulgaria keep prices steady. It also made it easier to follow EU rules for joining the euro. Many people think the Lev stands for national pride and being independent. Bulgaria will soon start using the euro. This should make trading and traveling simpler.

FAQ

What is the currency board system in Bulgaria?

The currency board system links the Bulgarian Lev to the euro at a fixed rate. The Bulgarian National Bank holds enough euros to back every Lev. This system keeps the currency stable and helps control inflation.

Why do some Bulgarians want to keep the Lev?

Many people see the Lev as a symbol of national pride. They trust its stability. Some worry that switching to the euro could raise prices or reduce Bulgaria’s control over its own economy.

How does the Lev affect daily life in Bulgaria?

The Lev helps people plan their spending. Its steady value protects savings from big changes. Most families use the Lev for shopping, paying bills, and saving money.

When will Bulgaria adopt the euro?

Bulgaria plans to adopt the euro after 2025. The government works to meet all requirements. Leaders want to make sure the change is smooth and safe for everyone.

Related content