Why Every Exporter Needs a Bill of Lading

Author:XTransfer2025.05.28B/L (bill of lading)

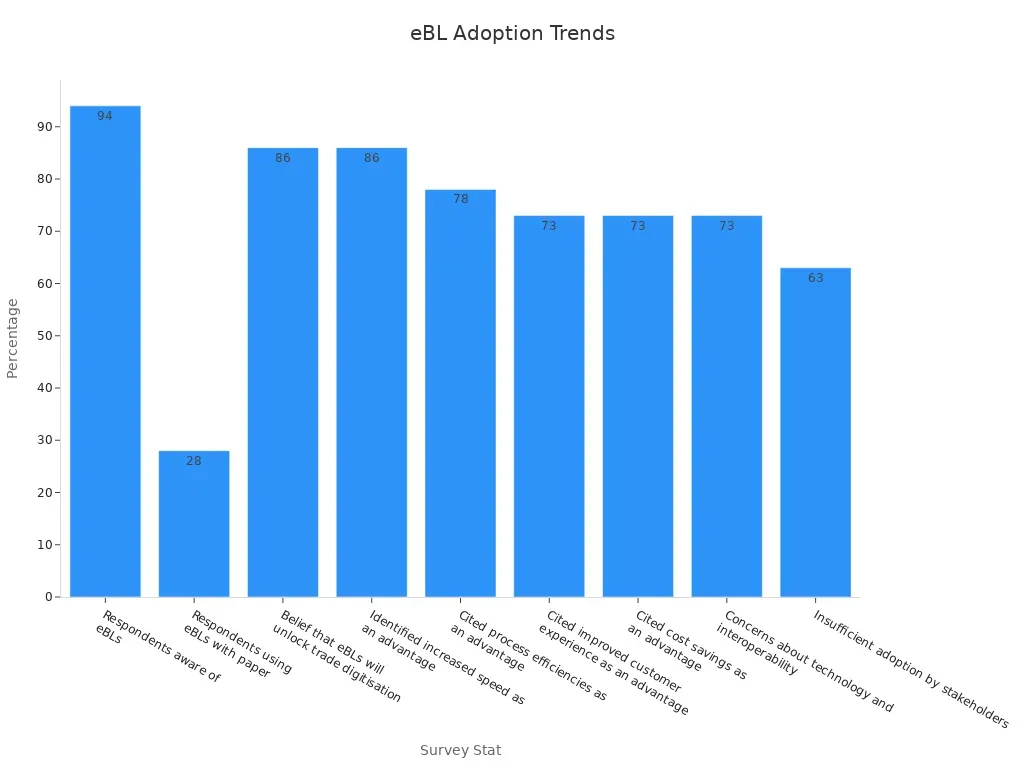

A B/L (bill of lading) plays a crucial role in ensuring smooth international trade operations. It serves as a legal document that secures the movement of goods while protecting exporters' interests. As global trade evolves, exporters are increasingly adopting electronic B/Ls (eBLs) for faster processing, enhanced security, and cost savings. Recent trends show that eBL usage surged from 33% in 2022 to 49.2% in 2024, with 94% of users acknowledging its potential to drive broader digital transformation. Whether paper-based or electronic, the B/L remains indispensable for safeguarding your shipments and mitigating risks.

What Is a Bill of Lading?

Definition and Purpose

A bill of lading is a critical shipping document in international trade that serves multiple functions. It acts as a receipt for goods, a document of title, and a contract of carriage. When you ship goods overseas, the bill of lading provides legal proof that the carrier has received your cargo and agreed to transport it under specific terms. This document also grants ownership rights to the holder, enabling the transfer of goods between parties.

Recent studies highlight its importance in international shipping. For instance, it serves as:

-

Evidence of a contract of carriage: Proof of the agreement between the shipper and the carrier.

-

Receipt of goods: Acknowledgment that the carrier has received the freight for transport.

-

Document of legal title to goods: Ownership rights granted to the holder of the bill of lading.

Key Components

Every bill of lading contains essential components that ensure its effectiveness in trade transactions. These elements provide clarity and accountability, helping you avoid misunderstandings or disputes.

Each component plays a vital role in ensuring the smooth movement of goods. For example, the description of goods helps customs officials determine admissibility, while signatures provide legal proof of agreement to the terms.

Issuers and Users

A bill of lading is issued by the carrier or their agent and is used by various parties involved in the shipping process. As an exporter, you rely on this document to protect your interests and ensure your goods reach their destination safely. The primary users include:

-

Shippers: You, as the exporter, use the bill of lading to confirm the shipment details and terms.

-

Carriers: The transport company issues the document and uses it to outline their responsibilities.

-

Consignees: The recipient of the goods uses the bill of lading to claim ownership and verify delivery.

By understanding who issues and uses this document, you can better navigate the complexities of international trade. Whether you’re shipping goods or receiving them, the bill of lading ensures accountability and transparency at every step.

Importance of a Bill of Lading in International Trade

Receipt for Goods

A bill of lading serves as a vital receipt for goods in international trade. It confirms that the carrier has received the shipment in the agreed condition and quantity. This document provides exporters like you with undeniable proof that your goods have been handed over for transportation. Without it, disputes over the condition or quantity of goods could arise, jeopardizing your business relationships.

The importance of a bill of lading as a receipt has been reinforced in legal cases. For example:

-

In Ogwuru v. Co-op bank of E/N Ltd., the court recognized the bill of lading as a receipt, proving its evidential value in disputes about the quantity or condition of shipped goods.

-

The electronic format of a bill of lading further enhances its reliability. It ensures data consistency and reduces errors, minimizing the risk of disputes and fraud.

By using a bill of lading, you can ensure accurate documentation and avoid costly misunderstandings in your trade operations.

Document of Title

The bill of lading also acts as a document of title, granting ownership rights to the holder. This feature is crucial in international trade, where goods often change hands multiple times before reaching their final destination. As an exporter, you can transfer ownership of your shipment by endorsing the bill of lading to another party, such as a buyer or consignee.

This legal function is supported by laws like Section 375(1) of the Merchant Shipping Act, which gives the consignee named in the bill of lading the right to sue. This ensures that ownership rights are protected and disputes can be resolved efficiently. Additionally, the document of title simplifies the process of securing payment, as banks often require it before releasing funds under a letter of credit.

By understanding the importance of a bill of lading as a document of title, you can safeguard your interests and maintain control over your shipments until payment is secured.

Contract of Carriage

The bill of lading serves as the primary contract of carriage between you and the carrier. It outlines the terms and conditions under which your goods will be transported, including the carrier's responsibilities and liabilities. This contract ensures that both parties are legally bound to fulfill their obligations, reducing the risk of disputes.

Courts have consistently upheld the bill of lading as the binding contract of carriage. For instance, in Leduc v. Ward, the court ruled that terms outside the bill of lading do not apply to the buyer, emphasizing its legal authority. This highlights the importance of a bill of lading in providing clarity and accountability in international trade.

By relying on the bill of lading as a contract of carriage, you can protect your shipments and ensure that carriers adhere to the agreed terms. This document not only facilitates smooth trade operations but also strengthens your position in case of legal disputes.

Types of Bills of Lading

Understanding the different types of bills of lading is essential for navigating international trade effectively. Each type serves a unique purpose, offering varying levels of flexibility and security.

Straight Bill of Lading

A straight bill of lading is a non-negotiable document used for shipments directed to a specific consignee. This type ensures that only the named recipient can claim the goods upon arrival. It is commonly used when you have already received payment or when the shipment is part of an internal transfer within your organization.

Key characteristics of a straight bill of lading include:

-

Non-negotiable nature: Ownership cannot be transferred to another party.

-

Direct delivery: Goods are delivered exclusively to the named consignee.

This type is ideal for straightforward transactions where no transfer of ownership is required during transit.

Order Bill of Lading

An order bill of lading offers greater flexibility by allowing the transfer of ownership through endorsement. This negotiable document is widely used in international trade, especially when goods are sold during transit or when payment is secured through a letter of credit.

The growing adoption of electronic order bills of lading (eBLs) highlights their advantages, such as faster processing, improved efficiency, and enhanced customer experience. These benefits make order bills of lading a preferred choice for many exporters.

Clean vs. Claused Bill of Lading

The condition of the goods at the time of shipment determines whether a bill of lading is classified as clean or claused.

A clean bill of lading confirms that the goods were received in good condition, making it a fully negotiable document. In contrast, a claused bill of lading includes notations about damages or discrepancies, protecting carriers from liability for pre-existing issues. As an exporter, you should strive for a clean bill of lading to ensure smooth transactions and avoid complications.

Negotiable vs. Non-Negotiable Bills of Lading

Understanding the difference between negotiable and non-negotiable bills of lading is essential for managing trade risks effectively. Each type serves a distinct purpose and offers unique advantages depending on your shipping needs.

A negotiable bill of lading provides flexibility and security. It allows you to transfer ownership of goods by endorsing the document to another party. This feature is particularly useful when goods are sold during transit or when payment is secured through a letter of credit. The negotiable bill of lading also acts as proof of ownership, giving you control over your shipment until the buyer fulfills their obligations. Its transferability reduces the risk of fraud and disputes, making it a preferred choice in complex trade transactions.

In contrast, a non-negotiable bill of lading is more restrictive. It specifies a named consignee who is the only party authorized to receive the goods. While this type simplifies the delivery process, it does not confer ownership rights or allow for transferability. As a result, it offers less flexibility and security compared to its negotiable counterpart. However, it is suitable for straightforward transactions where ownership does not change hands during transit.

The table below highlights key differences between these two types:

Choosing the right type of bill of lading depends on your trade requirements. If you prioritize flexibility and security, a negotiable bill of lading is the better option. For simpler transactions, a non-negotiable bill of lading may suffice. By understanding these differences, you can make informed decisions that protect your interests and streamline your shipping process.

How a Bill of Lading Protects Exporters

Resolving Disputes

A bill of lading plays a pivotal role in resolving disputes by serving as a legal record of the shipment's condition and terms of transportation. It documents the transfer of goods from you, the exporter, to the carrier, clearly defining responsibilities. This clarity minimizes risks and ensures accountability.

For example, a consignee once documented damages on a Claused Bill of Lading, holding the shipping company liable for fragile goods damaged during transit. This allowed them to successfully claim compensation. Similarly, a shipper used a Claused Bill of Lading to prove a carrier's breach of contract when delicate electronics were damaged, securing reimbursement.

Ensuring Payment Security

The bill of lading enhances payment security by acting as a document of title. You can retain ownership of your goods until payment is received, ensuring control over the transaction. Electronic Bills of Lading (eBLs) further improve security by enabling instant title transfers, reducing delays and supply chain issues.

📌 Did you know? The global container shipping industry could save up to $4 billion annually if half of all bills of lading were processed electronically.

eBLs also utilize blockchain technology to safeguard data integrity, ensuring that information cannot be altered without authorization. This feature minimizes fraud risks and strengthens trust between trading partners.

Facilitating Insurance Claims

A bill of lading is indispensable for facilitating insurance claims. It verifies that your goods were shipped in good condition, a requirement for most freight insurance policies. In cases of loss, damage, or theft, the bill of lading serves as proof of ownership and provides detailed records of the shipment's condition.

-

A clean bill of lading is often required by insurers to confirm that goods were undamaged at the time of shipment.

-

In the event of damage, the bill of lading outlines responsibilities, helping you claim compensation efficiently.

-

The original bill of lading acts as a critical document for proving ownership and delivery, ensuring successful claims.

By using a bill of lading, you can protect your financial interests and streamline the claims process, reducing potential losses from unforeseen incidents.

Preventing Fraud

Fraud in international trade can disrupt your business and lead to significant financial losses. A bill of lading (B/L) acts as a safeguard against fraudulent activities by providing a secure and verifiable record of your shipment. By understanding common fraud tactics and implementing preventive measures, you can protect your interests and ensure the integrity of your transactions.

Fraudsters often exploit weaknesses in shipping documentation. Common types of B/L fraud include:

-

Issuing multiple original B/Ls for the same shipment.

-

Altering the description or quantity of goods.

-

Falsifying ports of loading or discharge.

-

Using forged endorsements to claim ownership.

To mitigate these risks, you should adopt robust verification practices. Always cross-check B/L numbers and container details with the shipping line. Look for inconsistencies or alterations in the document, as these may indicate tampering. Confirm that endorsements match the documented chain of title to prevent unauthorized claims. Whenever possible, use electronic bills of lading (eBLs). These digital documents reduce the risk of forgery by utilizing secure platforms and encryption technologies.

The success of these measures is evident in the growing adoption of eBLs. They have significantly reduced fraud cases by eliminating opportunities for document manipulation. By leveraging these tools and practices, you can minimize risks and maintain trust with your trading partners. A vigilant approach to fraud prevention ensures that your shipments remain secure and your business thrives in the competitive world of international trade.

A bill of lading is essential for exporters in international trade. It provides legal proof of shipment, ensures accurate documentation, and protects your financial interests. By using this document, you can prevent delays during customs inspections and secure cargo insurance. A clean bill of lading also serves as collateral for financing, reducing financial risks. Additionally, it facilitates the transfer of ownership and acts as a legal safeguard in disputes.

This document ensures goods are shipped in good condition, preventing operational losses and enhancing your reputation in the global market. Understanding its functions and types allows you to mitigate risks and streamline trade operations. Prioritizing the proper use of a bill of lading strengthens your position in international trade and fosters trust with business partners.

FAQ

What happens if I lose the original bill of lading?

You must immediately notify the carrier and request a replacement. Most carriers require a letter of indemnity to issue a duplicate. This ensures that no unauthorized party claims your shipment.

Can I use an electronic bill of lading (eBL) for all shipments?

Yes, but only if the carrier and trading partners accept eBLs. Many industries now support eBLs due to their efficiency and security. Always confirm compatibility before proceeding.

Is a clean bill of lading better than a claused one?

A clean bill of lading is preferable because it confirms that goods were received in good condition. It simplifies transactions and reduces disputes. A claused bill, however, protects carriers from liability for pre-existing damages.

How does a bill of lading differ from an invoice?

A bill of lading serves as a receipt, document of title, and contract of carriage. An invoice, on the other hand, details the financial transaction, including the price and payment terms for the goods.

Can I transfer ownership of goods using a non-negotiable bill of lading?

No, a non-negotiable bill of lading does not allow ownership transfer. It specifies a named consignee who is the only party authorized to receive the goods. Use a negotiable bill of lading for ownership transfers.

Related content