Why Do You Need the Schwab SWIFT Code?

Author:XTransfer2025.08.21Schwab

The Schwab SWIFT Code plays a vital role in international wire transfers to Charles Schwab accounts. It ensures that your funds reach the correct destination without errors or delays. When sending money internationally, you need precise information to avoid complications. The SWIFT Code acts as a unique identifier for Schwab, simplifying the process and guaranteeing accurate fund routing. This small yet crucial detail makes your cross-border transactions more reliable and secure.

What Is the Schwab SWIFT Code?

Understanding SWIFT Codes

SWIFT codes, also known as Bank Identifier Codes (BICs), are essential for international banking. These codes identify banks during international transactions, ensuring secure and efficient communication between financial institutions. Each SWIFT code is unique and consists of eight to eleven alphanumeric characters. This structure allows banks to pinpoint the exact institution and branch involved in a transaction.

The components of a SWIFT code include the following:

|

Component |

Description |

|

Bank Code |

4 letters representing the bank. |

|

Country Code |

2 letters representing the country the bank is in. |

|

Location Code |

2 characters made up of letters or numbers. |

|

Branch Code |

3 digits specifying a particular branch. |

For example, the Schwab SWIFT Code follows this format, helping you send wire transfers to Charles Schwab accounts without errors. The SWIFT system ensures that your international wire transfer reaches the correct destination quickly and securely.

How the Schwab SWIFT Code Facilitates International Transfers

The Schwab SWIFT Code plays a crucial role in international transfers. It ensures that funds are routed accurately to the correct bank and branch. Unlike traditional methods, which can be slower and more expensive, the Schwab SWIFT Code streamlines the process. This efficiency reduces the chances of delays or errors, making your international wire transfer more reliable.

When you send wire transfers to Charles Schwab accounts, the SWIFT code acts as a unique identifier. It guarantees that your funds reach the intended recipient without complications. Additionally, the SWIFT system enhances security by encrypting transaction details, protecting your financial information during the transfer process.

By using the Schwab SWIFT Code, you can avoid unnecessary wire transfer fees and ensure that your money arrives at its destination promptly. This makes it an indispensable tool for anyone managing international transactions through Schwab Bank.

Why Is the Schwab SWIFT Code Essential for International Wire Transfers?

Accurate Fund Routing

When you send money internationally, ensuring it reaches the correct destination is crucial. The Schwab SWIFT Code acts as a precise identifier for Charles Schwab, directing your funds to the right bank and branch. Without this code, your international wire transfer could face delays or even end up in the wrong account.

The SWIFT system simplifies the routing process by providing a unique combination of letters and numbers for each financial institution. This eliminates confusion and ensures your transfer moves smoothly through the global banking network. Whether you're transferring funds for personal or business purposes, the Schwab SWIFT Code guarantees accurate routing every time.

Avoiding Transaction Errors

Errors in international transfers can lead to frustration and financial loss. Using the Schwab SWIFT Code minimizes these risks. It ensures that your wire transfer contains all the necessary details for successful processing. Banks rely on SWIFT codes to verify the recipient's information, reducing the chances of mistakes during the transaction.

For example, if you forget to include the SWIFT code, your transfer might be rejected or delayed. This could result in additional wire transfer fees or complications with exchange rates. By including the Schwab SWIFT Code, you avoid these issues and ensure your funds reach their destination without unnecessary setbacks.

Enhancing Security in International Transfers

Security is a top priority when sending money internationally. The Schwab SWIFT Code enhances the safety of your transactions by encrypting sensitive information. This encryption protects your financial data from unauthorized access during the transfer process.

Charles Schwab uses the SWIFT system to maintain high security standards for international transfers. The system ensures that your wire transfer details remain confidential and secure. This added layer of protection gives you peace of mind, knowing your funds are safe throughout the transaction.

By using the Schwab SWIFT Code, you benefit from accurate routing, error prevention, and enhanced security. These advantages make it an essential tool for anyone managing international wire transfers through Schwab Bank.

How to Find the Schwab SWIFT Code

Using Schwab’s Official Resources

Finding the Schwab SWIFT Code through official resources is straightforward. Start by checking your bank statements. These often include essential details like the SWIFT code. If you don’t find it there, visit the official Charles Schwab website. Look for the SWIFT code in the FAQs or sections related to international transfers. Schwab ensures that this information is accessible to help you complete your international wire transfer without complications.

Contacting Charles Schwab Customer Support

If you cannot locate the Schwab SWIFT Code through online resources, contacting Charles Schwab customer support is a reliable option. Schwab provides multiple communication channels, including phone, email, and live chat. When you reach out, provide details about your international transfer to ensure accurate assistance. The support team can guide you through the process and confirm the correct SWIFT code for your transaction. This step minimizes the risk of errors and ensures your wire transfer proceeds smoothly.

Leveraging Xtransfer’s SWIFT Code Lookup Tool

Another efficient way to find the Schwab SWIFT Code is by using Xtransfer’s SWIFT Code Lookup Tool. This platform offers a comprehensive database of SWIFT codes for banks worldwide. Simply enter “Charles Schwab” into the search bar, and the tool will display the relevant SWIFT code. This method is particularly useful if you’re managing multiple international transfers and need quick access to accurate information. By leveraging this tool, you can save time and avoid unnecessary delays in your transactions.

Tips for Successful International Bank Transfers with Schwab

Verifying the SWIFT Code and Account Details

Before initiating an international wire transfer, double-check the SWIFT code and account details. Accuracy is critical when transferring funds internationally. A single mistake in the SWIFT code or account number can delay your transfer or send it to the wrong destination. Always confirm the SWIFT code for Charles Schwab through official resources or customer support.

Additionally, ensure the recipient’s account details match the information provided by Schwab. This includes the account name, number, and any additional identifiers required for international transfers. Taking a few extra minutes to verify these details can save you from unnecessary complications.

Understanding Fees and Processing Times

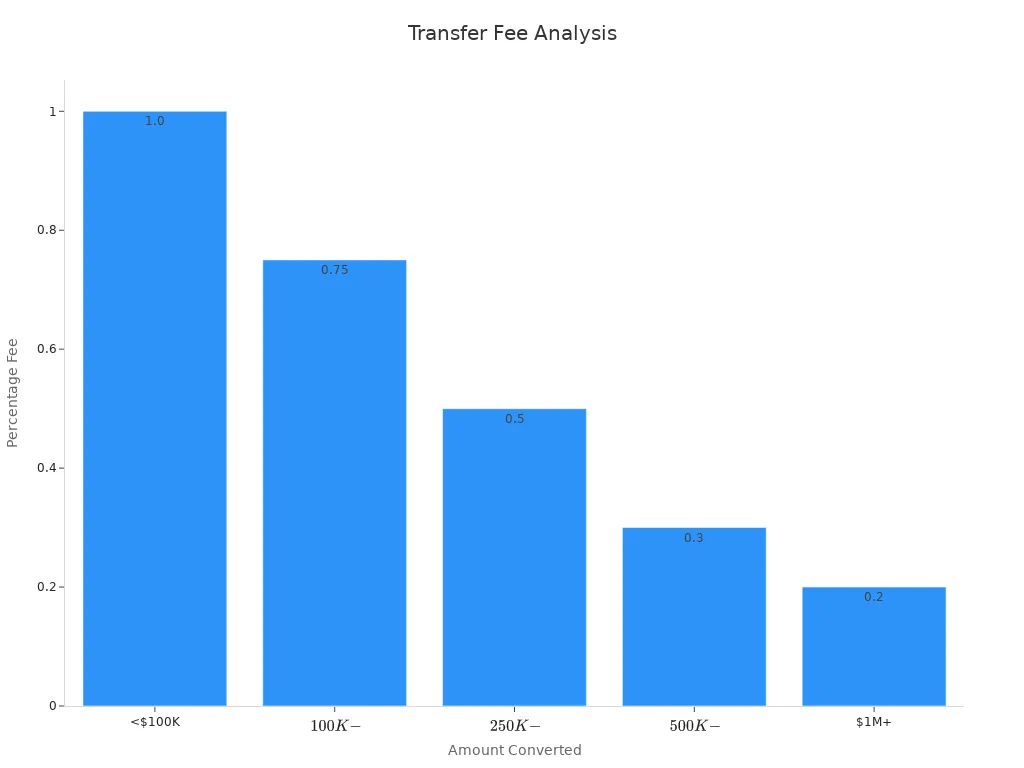

International transfers often involve fees and varying processing times. Schwab applies currency conversion fees based on the amount you transfer. For smaller amounts under $100,000, the fee is 1.00%. Larger transfers benefit from reduced fees, with rates dropping to 0.20% for amounts over $1 million.

|

Amount Converted |

Currency Conversion Fee % |

|

<$100K |

1.00% |

|

$100K - $249K |

0.75% |

|

$250K - $499K |

0.50% |

|

$500K - $999K |

0.30% |

|

$1M+ |

0.20% |

Processing times for Schwab international transfers can vary. Most transfers take one to five business days, depending on the destination country and intermediary banks. Understanding these timelines helps you plan your transactions effectively.

Providing Complete Recipient Information

Complete recipient information ensures your international transfer reaches the right person. Include the recipient’s full name, address, and bank account details. For transfers to Charles Schwab accounts, provide the SWIFT code, account number, and any additional reference numbers required.

Incomplete or incorrect information can lead to delays or additional fees. Double-check all details before submitting your wire transfer request. This step guarantees a smooth process and avoids unnecessary setbacks.

By following these tips, you can make your international transfers with Schwab more efficient and secure.

Exploring Alternatives to Charles Schwab for International Transfers

Why Consider Xtransfer for Business Transactions

If you manage international business transactions, Xtransfer offers a compelling alternative to Charles Schwab. This platform specializes in cross-border payments, providing tailored solutions for businesses. Unlike traditional banks, Xtransfer focuses on reducing costs and improving efficiency. Businesses often face high fees and slow processing times with conventional methods. Xtransfer addresses these challenges by offering competitive rates and faster transaction speeds.

For example, businesses using global account providers like Xtransfer have reported saving up to 40% on transaction fees compared to traditional banks. This cost-saving advantage can significantly impact your bottom line, especially if you handle frequent international payments. Additionally, Xtransfer ensures compliance with international regulations, operating in over 160 countries. This global reach makes it a reliable choice for businesses seeking secure and efficient payment solutions.

Comparing Xtransfer and Schwab for International Bank Transfers

When comparing Xtransfer and Schwab for international transfers, each has unique strengths. Schwab provides a trusted platform for personal banking and investment needs. However, Xtransfer excels in meeting the demands of businesses requiring frequent cross-border payments.

Consider the following case study: Shareholders Service Group (SSG) demonstrated superior service compared to TD Ameritrade (TD) in resolving issues promptly. SSG clarified regulatory concerns within 48 hours and handled urgent requests efficiently. Similarly, Xtransfer’s focus on business needs mirrors this level of responsiveness. While Schwab offers reliable services, Xtransfer’s specialized approach makes it a better fit for businesses managing complex international transactions.

Benefits of Xtransfer for Cross-Border Payments

Xtransfer provides several benefits for cross-border payments, making it a strong alternative to Schwab Bank.

|

Performance Indicator |

Description |

|

Cost Savings |

Businesses using global account providers saved up to 40% on transaction fees compared to traditional banks. |

|

Efficiency in Transaction Processing |

WISE EUROPE S.A. reported a 25% increase in local payments, indicating improved transaction efficiency. |

|

Compliance with International Regulations |

WISE EUROPE S.A. operates in over 160 countries, demonstrating adherence to global financial regulations. |

These advantages highlight Xtransfer’s ability to streamline international payments while maintaining security and compliance. If you prioritize cost savings, efficiency, and global reach, Xtransfer offers a practical solution for your business needs.

The Schwab SWIFT Code simplifies your international wire transfer by ensuring secure and accurate fund routing. It eliminates errors and delays, making your transactions more reliable. By understanding its role and following best practices, you can avoid common issues when transferring money internationally. For businesses, Xtransfer provides a practical alternative to Charles Schwab. It offers cost-effective and efficient solutions for cross-border payments, helping you manage international transactions with ease.

FAQ

What is the purpose of a SWIFT code in banking?

A SWIFT code identifies banks during international transactions. It ensures your funds reach the correct bank and branch securely and efficiently. Without it, your transfer might face delays or errors.

Can I use the Schwab SWIFT Code for all international transfers?

Yes, you can use the Schwab SWIFT Code for international wire transfers to Charles Schwab accounts. It ensures accurate routing of your funds to the intended recipient.

How long does an international wire transfer take with Schwab?

Most international wire transfers with Schwab take 1 to 5 business days. The exact time depends on the destination country and intermediary banks involved.

Is the Schwab SWIFT Code the same for all branches?

No, the Schwab SWIFT Code may vary depending on the branch. Always verify the correct code through Schwab’s official resources or customer support before initiating a transfer.

What happens if I use the wrong SWIFT code?

Using the wrong SWIFT code can delay your transfer or send funds to the wrong account. Double-check the code to avoid errors and ensure your money reaches the right destination.

Related content