Why CHATS Matters for Hong Kong's Economy

Author:XTransfer2025.05.27CHATS(Clearing House Automated Transfer System)

CHATS (Clearing House Automated Transfer System) serves as Hong Kong's real-time gross settlement system, enabling banks to process transactions instantly. Acting as the backbone of the city's financial infrastructure, CHATS ensures the seamless flow of money between banks. By securely managing large-value payments, CHATS minimizes risks and bolsters financial stability. This system is essential for maintaining the efficiency and reliability of Hong Kong's economy.

What is CHATS(Clearing House Automated Transfer System)?

Definition and Overview

CHATS, or the Clearing House Automated Transfer System, is Hong Kong's real-time gross settlement system. It allows banks to process payments instantly and securely. This system plays a critical role in ensuring the smooth operation of financial transactions within the city. By enabling real-time settlements, CHATS reduces the risk of payment delays and enhances the reliability of the financial system.

The development of CHATS reflects Hong Kong's commitment to maintaining its position as a global financial hub. Since its launch in 1996, CHATS has evolved to support multiple currencies, including the Hong Kong dollar (HKD), U.S. dollar (USD), euro (EUR), and renminbi (RMB). This multi-currency capability strengthens Hong Kong's role in international trade and finance. Over the years, CHATS has also established links with other regional and global systems, further enhancing its functionality.

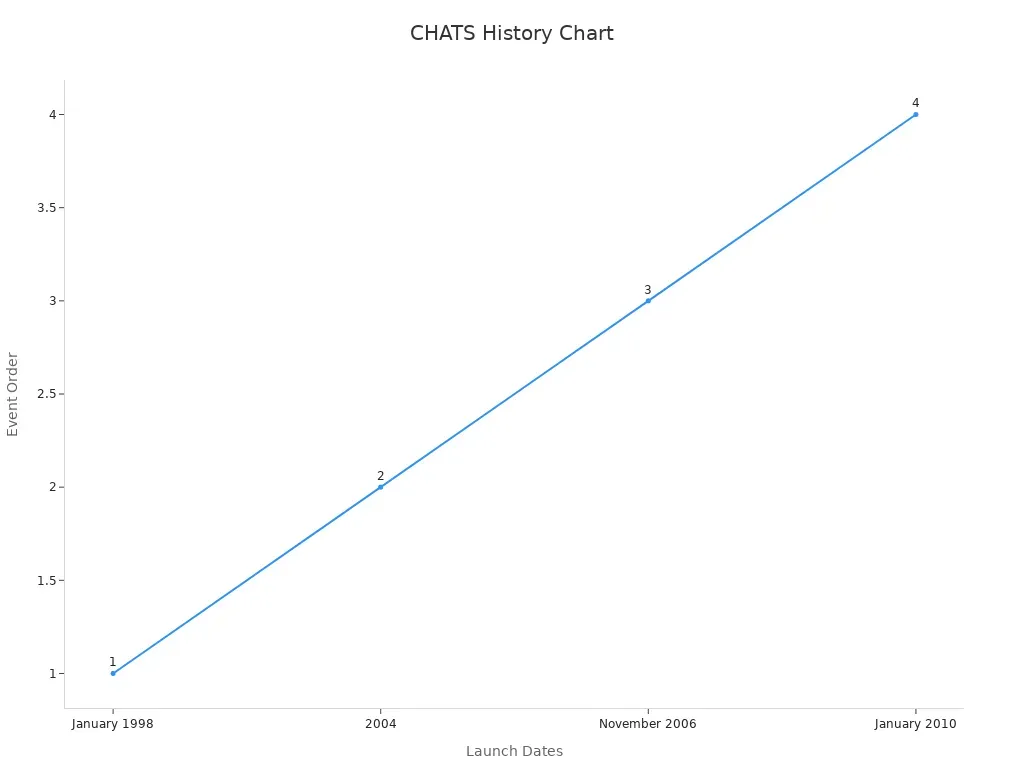

Here’s a quick look at some key milestones in CHATS' development:

Key Features of CHATS

CHATS offers several features that make it indispensable for Hong Kong's financial system. These features ensure efficiency, security, and global connectivity in financial transactions.

-

Real-Time Gross Settlement (RTGS): CHATS processes payments in real time, ensuring that funds are transferred instantly. This eliminates the risk of settlement delays and enhances trust between financial institutions.

-

Multi-Currency Support: The system supports transactions in HKD, USD, EUR, and RMB. This capability allows businesses and banks to handle international payments seamlessly.

-

Payment Versus Payment (PvP) Mechanism: CHATS incorporates a PvP mechanism for foreign exchange transactions. This feature minimizes settlement risks by ensuring that payments in different currencies occur simultaneously.

-

Integration with Global Systems: CHATS connects with international systems like the CLS system and regional platforms. These links facilitate cross-border transactions and strengthen Hong Kong's position in global finance.

-

High Security Standards: The system employs advanced security measures to protect against fraud and cyber threats. This ensures that all transactions are safe and reliable.

These features make CHATS a cornerstone of Hong Kong's financial infrastructure. By providing a secure and efficient platform for transactions, CHATS supports the city's economy and its role as a global financial center.

How CHATS Supports Hong Kong's Financial System

Operational Mechanism

CHATS operates as a real-time gross settlement system, ensuring that payments are processed instantly and securely. When you initiate a transaction, CHATS immediately transfers funds between financial institutions without delay. This system eliminates the need for batch processing, which can cause delays in clearing. By settling each transaction individually, CHATS minimizes risks and ensures that funds are available for use right away.

The system uses advanced technology to handle high volumes of transfers efficiently. It processes transactions in multiple currencies, including the Hong Kong dollar, U.S. dollar, euro, and renminbi. This multi-currency capability allows CHATS to support both domestic and international payments seamlessly. Additionally, CHATS incorporates a Payment versus Payment (PvP) mechanism, which ensures that currency exchanges occur simultaneously. This feature reduces the risk of settlement failures in foreign exchange transactions.

To better understand CHATS's operational efficiency, consider the following metrics:

These metrics highlight how CHATS maintains its reliability and efficiency, ensuring that financial institutions can depend on it for secure and timely transfers.

Types of Transactions Processed by CHATS

CHATS handles a wide range of transactions, making it a versatile tool for Hong Kong's financial system. It processes large-value interbank payments, which are critical for maintaining liquidity among financial institutions. For example, when banks need to settle debts or transfer funds to one another, CHATS ensures these transactions occur without delays.

The system also supports retail clearing, which includes smaller transactions like checks and electronic payments. This capability allows businesses and individuals to transfer money quickly and securely. Additionally, CHATS facilitates cross-border payments, enabling seamless international trade and financial operations. Its integration with global systems ensures that transfers between countries are efficient and reliable.

By processing these diverse types of transactions, CHATS plays a vital role in keeping Hong Kong's financial system running smoothly. Whether you are a business owner, a bank, or an individual, CHATS ensures that your payments are processed with speed and security.

The Role of CHATS in Economic Stability

Supporting Financial Stability

CHATS plays a vital role in maintaining financial stability in Hong Kong. By processing payments in real time, it ensures that funds move seamlessly between financial institutions. This reduces the risk of delays, which can disrupt the financial system. When you initiate a transfer, CHATS settles it instantly, ensuring that the funds are available for immediate use. This reliability builds trust among banks and businesses.

The system's Payment versus Payment (PvP) mechanism further enhances stability. It ensures that currency exchanges occur simultaneously, reducing the risk of settlement failures. For example, if you are involved in a foreign exchange transaction, CHATS guarantees that both sides of the payment are completed at the same time. This feature minimizes risks, especially in high-value transfers.

CHATS also supports the clearing of large-value interbank payments. These transactions are critical for maintaining liquidity in the financial system. When banks need to settle debts or transfer funds to one another, CHATS ensures these payments are processed without delays. This smooth operation prevents financial bottlenecks and keeps the economy running efficiently.

Facilitating Economic Growth

CHATS contributes significantly to Hong Kong's economic growth by enabling efficient and secure financial operations. Its ability to process payments in multiple currencies, including the Hong Kong dollar, U.S. dollar, euro, and renminbi, makes it a key player in international trade. If you are a business owner, CHATS allows you to handle cross-border payments with ease, ensuring that your transactions are completed quickly and securely.

The system's integration with global clearing platforms strengthens Hong Kong's position as a global financial hub. By linking with systems like the CLS system and regional platforms, CHATS facilitates seamless international transfers. This connectivity attracts foreign investors and businesses, boosting economic activity in the region.

A historical analysis of Hong Kong's economic growth highlights the importance of systems like CHATS. For instance, tourism spurred short-term economic growth between 2003 and 2019. However, the long-term benefits of tourism have diminished, showing signs of stagnation. This indicates that relying solely on tourism for growth is not sustainable. Instead, robust financial infrastructure, such as CHATS, provides a more stable foundation for economic development.

By supporting efficient financial operations and fostering global connectivity, CHATS ensures that Hong Kong remains competitive in the global economy. Its role in facilitating payments and transfers strengthens the city's financial system and drives sustainable economic growth.

Benefits of CHATS for Hong Kong's Economy

Efficiency and Speed

CHATS enhances the efficiency of financial operations in Hong Kong by processing payments instantly. When you initiate a transaction, CHATS ensures that the funds are transferred without delay. This real-time processing eliminates the waiting period often associated with traditional systems. Whether you are a business owner or an individual, this speed allows you to manage your finances more effectively.

The system also handles a high volume of transactions daily. Its advanced technology ensures that even during peak times, payments are processed smoothly. For example, if you need to make large-value money transfers, CHATS guarantees that these transactions are completed quickly and securely. This reliability reduces the risk of financial bottlenecks and keeps the economy running efficiently.

By streamlining financial operations, CHATS saves time for businesses and individuals. You can focus on other important tasks instead of worrying about delayed payments. This efficiency strengthens Hong Kong's position as a global financial hub.

Global Connectivity

CHATS plays a crucial role in connecting Hong Kong to the global financial system. Its integration with international platforms allows you to make cross-border payments seamlessly. For instance, if your business involves international trade, CHATS ensures that your transactions are completed without complications.

The system supports multiple currencies, including the Hong Kong dollar, U.S. dollar, euro, and renminbi. This feature makes it easier for you to handle foreign exchange transactions. Additionally, CHATS incorporates a Payment versus Payment (PvP) mechanism, which ensures that currency exchanges occur simultaneously. This reduces the risk of settlement failures and builds trust in international dealings.

By linking with global systems like the CLS system, CHATS strengthens Hong Kong's role in international finance. It attracts foreign investors and businesses, boosting economic activity. This global connectivity ensures that Hong Kong remains competitive in the ever-evolving financial landscape.

CHATS serves as the backbone of Hong Kong's financial system. It ensures that payments are processed efficiently, contributing to the stability of the economy. You benefit from its ability to handle large-value transactions and cross-border payments with ease. By supporting financial stability and fostering economic growth, CHATS strengthens Hong Kong's position as a global financial hub. Its integration with international systems ensures seamless connectivity, making it an essential tool for businesses and individuals alike.

FAQ

What is the main purpose of CHATS?

CHATS enables real-time settlement of payments between banks. It ensures transactions are processed instantly and securely, reducing risks and maintaining financial stability. You benefit from its efficiency in handling both domestic and international payments.

How does CHATS support multiple currencies?

CHATS processes payments in Hong Kong dollars, U.S. dollars, euros, and renminbi. This multi-currency feature lets you handle international transactions seamlessly. It also strengthens Hong Kong’s role in global trade and finance.

Why is CHATS important for businesses?

CHATS ensures fast and secure payment processing, helping businesses manage cash flow efficiently. Its global connectivity allows you to handle cross-border transactions without delays, boosting your competitiveness in international markets.

Can individuals use CHATS directly?

No, CHATS is designed for interbank transactions. However, you indirectly benefit from its efficiency when banks process your payments, such as checks or electronic transfers, through this system.

How does CHATS minimize risks in foreign exchange transactions?

CHATS uses a Payment versus Payment (PvP) mechanism. It ensures both sides of a currency exchange occur simultaneously. This feature reduces settlement risks and builds trust in international financial operations.

Related content