SWIFT GPI vs Modern Payment Innovations: What Businesses Need to Know

Author:XTransfer2025.12.12GPI (Global Payment Innovation)

Navigating the world of cross-border transactions demands precision and efficiency. For businesses, selecting the right solution for international payments can determine financial success. Options like SWIFT GPI (Global Payment Innovation) and modern payment systems promise faster, more reliable transfers. However, understanding their unique strengths ensures you make informed choices tailored to your needs. Whether you're prioritizing speed, transparency, or cost, the right payment system can transform how you manage global transactions.

Understanding SWIFT GPI (Global Payment Innovation)

Key Features of SWIFT GPI

SWIFT GPI (Global Payment Innovation) revolutionizes international transfers by addressing speed, transparency, and security. Payments are processed in as little as 30 minutes, with 40% completed within five minutes and nearly all under 24 hours. This efficiency ensures businesses can manage cash flow effectively. Real-time tracking, enabled by the Unique End-to-End Transaction Reference (UETR), provides visibility into every stage of a swift transfer. You can monitor the status, fees, and time of delivery for each transaction. Additionally, SWIFT GPI ensures secure payments through an immutable audit trail, reducing fraud risks.

|

Feature |

Description |

|---|---|

|

Faster Payments |

Payments can be received in as little as 30 minutes, with 40% credited within 5 minutes and nearly 100% under 24 hours. |

|

Greater Transparency |

Real-time tracking of payments, allowing businesses to know the status and fees involved in each transaction. |

|

Secure Payments |

Transactions are tracked in real-time with an immutable audit trail, reducing fraud risk and enhancing security. |

How SWIFT GPI Enhances Cross-Border Transactions

SWIFT GPI simplifies cross-border payments by modernizing traditional banking systems. It processes 89% of international transfers within an hour, surpassing the G20 target of 75% by 2027. This speed is achieved through direct transactions or a single intermediary, with 84% of payments following this streamlined route. Payment Pre-validation further enhances efficiency by identifying errors before processing. These features empower businesses to complete swift cross-border transfers with minimal delays, ensuring operational continuity.

Benefits of SWIFT GPI for Receiving International Payments

For businesses receiving international payments, SWIFT GPI offers unmatched advantages. Faster processing times mean you can access funds quickly, improving liquidity. Real-time tracking ensures you know when payments will arrive, reducing uncertainty. The system also complies with global regulations, ensuring secure and transparent transactions. By leveraging SWIFT GPI, you can streamline operations and build trust with international partners.

|

Aspect |

Description |

|---|---|

|

Speed |

SWIFT GPI enables cross-border payments to be processed in minutes instead of days. |

|

Transparency |

The introduction of the Unique End-to-End Transaction Reference (UETR) allows for tracking payments. |

|

Compliance |

SWIFT GPI mandates compliance with new regulations, ensuring all banks can participate in tracking. |

|

Economic Implications |

Enhanced speed and transparency improve cash flow for businesses, especially SMEs. |

Exploring Modern Payment Innovations

Blockchain-Based Payment Systems

Blockchain technology has transformed global payments by offering decentralized, transparent, and secure solutions. Unlike traditional systems, blockchain eliminates intermediaries, reducing costs and processing times. Ripple, a prominent blockchain-based payment system, enables instant cross-border transactions with minimal fees. Its distributed ledger technology ensures transparency and security, making it a preferred choice for businesses.

Several real-world applications highlight blockchain's potential. For instance, MoneyGram partnered with Stellar to facilitate real-time currency conversions, significantly lowering transaction costs. Similarly, UBS launched a tokenized fund on Ethereum, enhancing accessibility and reducing expenses. ING Bank's collaboration with Komgo showcases blockchain's ability to improve trade finance transparency. These examples demonstrate how blockchain is reshaping the financial landscape.

|

Example |

Description |

Source |

|---|---|---|

|

MoneyGram and Stellar |

Partnership for real-time currency conversions, reducing transaction costs. |

MoneyGram and Stellar |

|

UBS Tokenized Fund |

First tokenized fund on Ethereum, improving accessibility and reducing costs. |

UBS Tokenized Fund |

|

ING Bank and Komgo |

Blockchain platform for trade finance, enhancing transparency and efficiency. |

ING Newsroom |

Local Payment Networks and Real-Time Systems

Local payment networks and real-time payment systems are revolutionizing domestic and regional transactions. These systems enable instant fund transfers, ensuring businesses can manage cash flow efficiently. For example, the UK's Faster Payments Service and India's Unified Payments Interface (UPI) have set benchmarks for speed and reliability. These networks reduce dependency on traditional banking channels, offering cost-effective solutions for businesses.

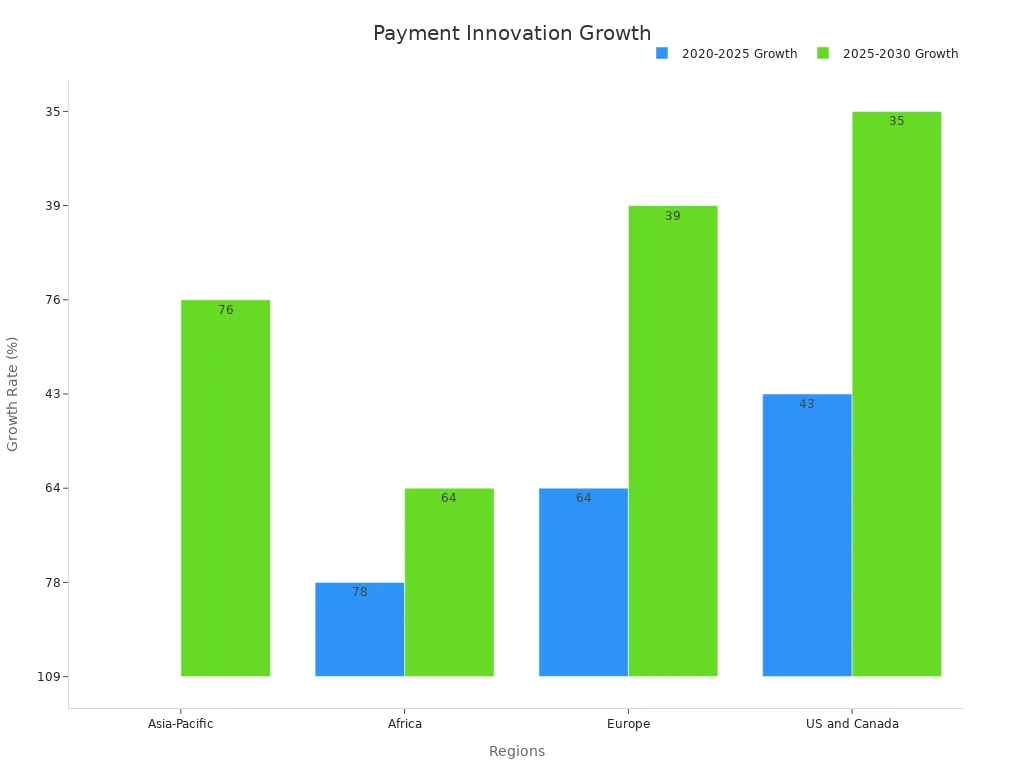

Market trends underscore the growing adoption of real-time payment systems. The Asia-Pacific region is leading the charge, with a projected growth rate of 109% between 2020 and 2025. Africa and Europe follow closely, reflecting a global shift toward faster and more efficient payment methods.

|

Region |

Growth Rate (2020-2025) |

Growth Rate (2025-2030) |

|---|---|---|

|

Asia-Pacific |

109% |

76% |

|

Africa |

78% |

64% |

|

Europe |

64% |

39% |

|

US and Canada |

43% |

35% |

Digital Wallets and Mobile Payment Platforms

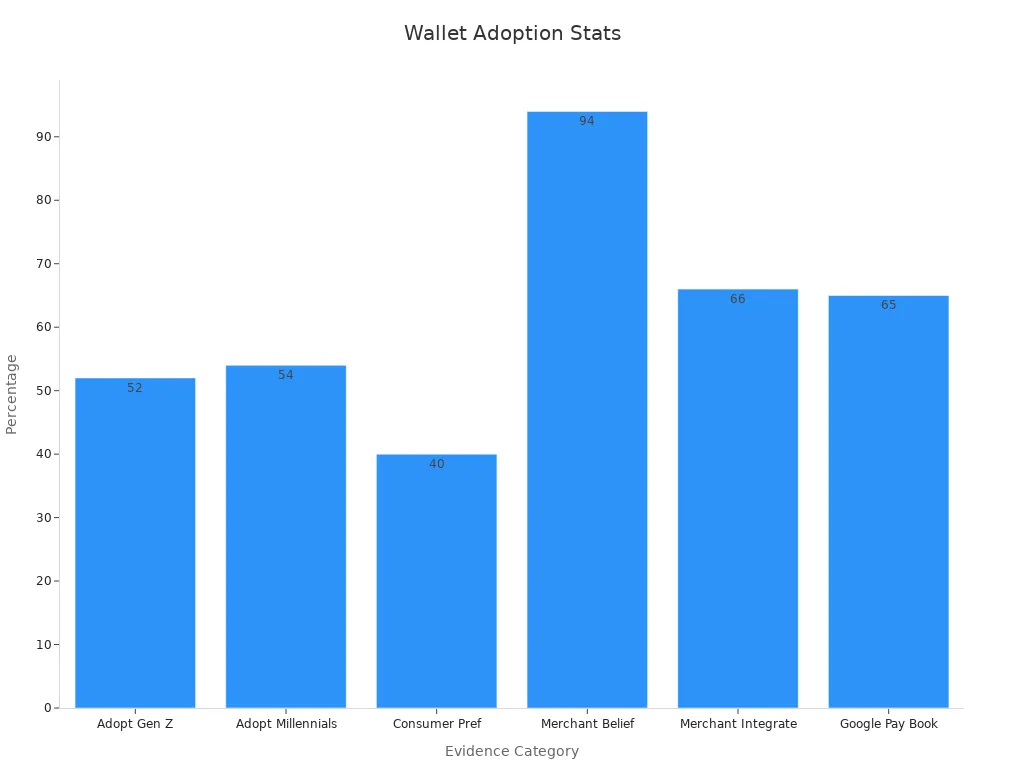

Digital wallets and mobile payment platforms have become indispensable in today's digital economy. These tools offer convenience, speed, and security, making them popular among consumers and businesses. Platforms like Google Pay, Apple Pay, and PayPal allow users to make seamless transactions without the need for physical cards or cash.

Research highlights the widespread adoption of digital wallets. Over half of respondents have used digital wallets more than once in the past 90 days, with Millennials and Gen Z leading the charge. Businesses also benefit significantly, as 94% of merchants believe digital wallets positively impact their operations. These platforms improve checkout speed, reduce fraud, and increase customer loyalty.

Xtransfer’s Role in Modern International Payments

Xtransfer has emerged as a game-changer in the realm of international payments, particularly for small and medium-sized enterprises (SMEs). By addressing the unique challenges SMEs face in cross-border transactions, Xtransfer simplifies global trade and ensures seamless payment experiences.

One of Xtransfer's standout features is its 24/7 payment settlement capability. This ensures uninterrupted fund circulation, enabling businesses to maintain smooth operations throughout the trade process. Whether you are managing supplier payments or receiving funds from international clients, Xtransfer's system guarantees efficiency and reliability.

The introduction of the Global Multi-Currency Account further enhances its appeal. In partnership with OCBC Hong Kong, Xtransfer allows businesses to handle transactions in over 20 major currencies, including the Renminbi, US Dollar, British Pound, Euro, and ASEAN currencies. This flexibility empowers you to expand your operations across ASEAN and other global markets without worrying about currency limitations.

Xtransfer also prioritizes security and compliance. Its AI-driven anti-money laundering (AML) system ensures that every transaction adheres to international regulations. This reduces the risk of fraud and builds trust with your global partners. Additionally, partnerships with leading banks like JPMorgan and Deutsche Bank reinforce its credibility and provide access to robust financial networks.

For SMEs, Xtransfer offers a comprehensive solution that combines speed, security, and cost-effectiveness. By leveraging cutting-edge technology and strategic partnerships, Xtransfer enables you to navigate the complexities of international payments with ease. Whether you are scaling your business or entering new markets, Xtransfer provides the tools you need to succeed in the global economy.

Comparing SWIFT GPI and Modern Payment Innovations

Speed: Real-Time vs Near Real-Time Payments

The speed of payment processing plays a critical role in cross-border transactions. Real-time payment systems transfer funds almost instantly, typically in under 10 seconds. This capability ensures businesses can access funds immediately, which is essential for urgent transactions. In contrast, near real-time systems, such as SWIFT GPI, process payments within minutes or hours. While SWIFT payments may not match the instant nature of real-time systems, they still offer a quick settlement time, with most transactions completed within 24 hours.

Real-time payments also provide enhanced precision and transparency. These features make them highly attractive for businesses managing treasury payments. However, SWIFT GPI's near real-time processing remains a reliable option for companies prioritizing secure and tracked international payments. By understanding the transaction speed of each system, you can choose the best solution for your business needs.

Cost: Transaction Fees and Hidden Charges

Cost efficiency is another critical factor when comparing payment methods. Traditional SWIFT payments often involve multiple intermediary banks, which can lead to higher transaction fees and hidden charges. These costs can accumulate, especially for businesses handling frequent cross-border payments. Modern payment innovations, such as blockchain-based systems, eliminate intermediaries, significantly reducing fees. Local payment networks and digital wallets also offer cost-effective solutions by streamlining processes and minimizing overhead.

For businesses operating on tight margins, understanding the cost structure of each payment method is essential. Modern systems often provide transparent pricing, allowing you to predict expenses accurately. In contrast, SWIFT GPI offers greater transparency than traditional SWIFT payments but may still involve additional costs due to intermediary banks. Evaluating these factors will help you optimize your payment strategy and reduce unnecessary expenses.

Transparency: Tracking and Visibility of Payments

Transparency in tracking payments is vital for businesses managing cross-border transactions. SWIFT GPI excels in this area by offering end-to-end tracking through its Unique End-to-End Transaction Reference (UETR). This feature allows you to monitor the status, fees, and delivery time of each payment. The ease of tracking funds builds trust with international partners and ensures compliance with regulatory requirements.

Modern payment innovations also prioritize transparency. Blockchain-based systems provide a decentralized ledger, enabling real-time visibility into transactions. Digital wallets and local payment networks enhance cash flow visibility and improve the accuracy of cash flow forecasts. These systems often include advanced metrics to measure efficiency, cost, and control. For example:

|

KPI Type |

Examples of Metrics |

|---|---|

|

Efficiency Metrics |

Transaction processing times, Number of manual interventions required |

|

Cost Metrics |

Reduction in transaction fees, Cost savings from optimized bank relationships |

|

Control Metrics |

Rate of compliance with regulatory requirements, Number of fraud incidents detected and prevented |

|

Visibility Metrics |

Real-time cash flow visibility, Accuracy of cash flow forecasts |

|

Performance Metrics |

Straight-through processing (STP) rates, Error rates in payment processing |

By comparing the tracking capabilities of SWIFT GPI and modern payment systems, you can select the option that aligns with your operational priorities. Whether you value real-time cash flow visibility or the security of end-to-end tracking, understanding these features will guide your decision-making process.

Security: Fraud Prevention and Data Protection

Security remains a cornerstone of any payment system, especially for cross-border transactions. Both SWIFT GPI and modern payment innovations prioritize fraud prevention and data protection, but they achieve this through different mechanisms.

SWIFT GPI employs robust security protocols to safeguard transactions. End-to-end encryption ensures that sensitive data remains protected throughout the payment process. Integrated compliance checks further enhance security by verifying transactions against regulatory requirements. These measures reduce the risk of fraud and ensure transparency. For example:

|

Challenge |

SWIFT Solution |

Outcome |

|---|---|---|

|

Complex Routing |

Standardized messaging formats |

Reduced errors and faster processing |

|

Regulatory Compliance |

Integrated compliance checks |

Increased transparency |

|

Security Risks |

End-to-end encryption |

Enhanced data security |

Modern payment systems, such as blockchain-based platforms, also excel in fraud prevention. Blockchain's decentralized ledger provides an immutable record of transactions, making it nearly impossible to alter or tamper with data. This transparency builds trust and reduces the likelihood of fraudulent activities. Additionally, digital wallets and mobile payment platforms incorporate multi-factor authentication and biometric verification, adding extra layers of security.

Both SWIFT GPI and modern systems offer traceability, allowing you to monitor transactions in real time. This feature ensures certainty of funds, confirming that recipients will receive payments as intended. Several international banks have reported significant improvements in fraud detection and compliance since adopting these advanced systems. By leveraging these technologies, you can protect your business from financial losses and maintain trust with global partners.

Scalability: Global vs Local Transactions

Scalability is a critical factor when evaluating payment solutions for cross-border payments. SWIFT GPI operates on a global scale, connecting over 11,000 financial institutions worldwide. This extensive network enables businesses to process payments across multiple countries and currencies. However, SWIFT's reliance on legacy systems can limit its ability to handle increasing transaction volumes efficiently. For instance:

|

Aspect |

SWIFT GPI Challenges |

Ripple Solutions |

|---|---|---|

|

Settlement Cycles |

Slow, can take up to five days |

Fast, near-instant transactions |

|

Technical Complexity |

High, requires substantial resources |

Low, streamlined integration |

|

Scalability |

Limited by legacy systems |

High, can handle thousands of transactions per second |

Modern payment innovations, such as blockchain-based systems and local payment networks, offer greater scalability. Blockchain platforms like Ripple can process thousands of transactions per second, making them ideal for businesses with high transaction volumes. Local payment systems, such as India's UPI or the UK's Faster Payments Service, excel in handling regional transactions. These systems provide near-instant settlement times and require fewer resources for integration.

When choosing between global and local solutions, consider your business's operational needs. If you manage international trade across multiple markets, SWIFT GPI's global reach may be advantageous. However, if your focus is on regional transactions, local payment networks can offer faster and more cost-effective solutions.

By understanding the scalability of SWIFT GPI and modern payment systems, you can select a solution that supports your growth objectives. Whether you prioritize global connectivity or regional efficiency, the right payment system will enable you to scale your operations seamlessly.

Choosing the Right Solution for Your Business

When SWIFT GPI is the Best Option

SWIFT GPI stands out as a reliable choice for businesses that prioritize global reach and secure cross-border transactions. If your operations involve dealing with multiple international partners or managing payments across various currencies, SWIFT GPI offers unmatched connectivity. Its network spans over 11,000 financial institutions worldwide, ensuring seamless integration with banking systems in nearly every country.

The system's transparency and tracking capabilities make it ideal for businesses that require detailed visibility into their payment processes. With the Unique End-to-End Transaction Reference (UETR), you can monitor the status of your payments in real time, reducing uncertainty and enhancing trust with your partners. Additionally, SWIFT GPI's compliance with international regulations ensures that your cross-border transactions meet the highest security standards.

When Blockchain-Based Solutions Are Ideal

Blockchain-based payment systems are perfect for businesses operating in high-security environments or those seeking decentralized transaction solutions. These systems eliminate intermediaries, reducing costs and processing times while maintaining robust security. Blockchain's cryptographic principles ensure trust in every transaction, making it an excellent choice for industries like finance, supply chain, and e-commerce.

The decentralized nature of blockchain allows for participation across a distributed network, eliminating single points of failure. This structure enhances reliability and ensures that your payments remain secure even in the face of cyber threats. Additionally, blockchain's consensus mechanism validates transactions with accuracy and integrity, providing a transparent and tamper-proof record.

|

Evidence |

Description |

|---|---|

|

Inherent Security Qualities |

Blockchain technology is built on cryptographic principles, ensuring trust in transactions. |

|

Decentralization |

The structure allows for participation across a distributed network, eliminating single points of failure. |

|

Consensus Mechanism |

Transactions are validated by consensus, ensuring accuracy and integrity. |

If your business handles sensitive data or operates in regions with limited banking infrastructure, blockchain-based solutions offer a modern, secure alternative. They also support cryptocurrency payments, enabling you to cater to niche markets and tech-savvy customers.

When Local Payment Systems Work Best

Local payment systems and real-time networks are ideal for businesses focusing on regional transactions. These systems provide instant fund transfers, allowing you to manage cash flow efficiently and meet local market demands. For example, the UK's Faster Payments Service and India's Unified Payments Interface (UPI) enable businesses to process payments within seconds, ensuring operational continuity.

If your business operates in a specific region or caters to local customers, these systems offer cost-effective solutions. They reduce dependency on traditional banking channels and minimize transaction fees, making them suitable for small and medium-sized enterprises (SMEs). Additionally, local payment systems often integrate with digital wallets and QR code payments, enhancing customer engagement and convenience.

|

Payment Solution |

Description |

Suitable For |

|---|---|---|

|

Payments by QR Code |

Uses QR codes for transactions, enhancing customer engagement. |

In-person and online sales |

|

ACH Transfers |

Bank-to-bank payments suitable for direct transactions. |

US-based marketplaces |

|

Pay by Link |

Allows customers to pay via a web link without sharing credit card details. |

Various online sales channels |

How Xtransfer Simplifies Cross-Border Payments for SMEs

Xtransfer has revolutionized the way small and medium-sized enterprises (SMEs) handle cross-border transactions. By addressing the unique challenges SMEs face, Xtransfer provides tailored solutions that streamline global trade and enhance operational efficiency.

Simplified Account Setup for SMEs

Opening an account for cross-border transactions often involves complex procedures and lengthy approval processes. Xtransfer eliminates these barriers by offering an easy account issuance process. You can set up a global multi-currency account quickly, enabling you to manage payments in over 20 currencies, including USD, GBP, EUR, and RMB. This flexibility allows you to expand your business into international markets without worrying about currency limitations.

Efficient Currency Exchange Services

Currency exchange can be a costly and time-consuming aspect of international trade. Xtransfer simplifies this process by providing competitive foreign exchange rates tailored to SMEs. Its 24/7 FX services ensure you can convert currencies at optimal rates, reducing costs and improving cash flow. Whether you're paying suppliers or receiving funds from overseas clients, Xtransfer's efficient currency exchange services help you maximize profitability.

Streamlined Fund Collection and Payment Solutions

Managing cross-border payments often involves navigating multiple banking systems and intermediaries. Xtransfer addresses this issue by offering simplified solutions for fund collection and payments. You can collect payments from international clients and pay suppliers seamlessly, all while benefiting from real-time tracking and secure transactions. This streamlined approach reduces delays and ensures your business operates smoothly.

|

Feature |

Description |

|---|---|

|

Account Issuance |

Xtransfer provides easy account setup for SMEs, facilitating cross-border payments. |

|

Currency Exchange Services |

Efficient currency exchange services tailored for SMEs involved in international trade. |

|

Fund Collection and Payment |

Simplified solutions for cross-border fund collection and payments, addressing specific SME needs. |

Real-World Success Stories

Xtransfer's impact on SMEs is evident through documented success stories. Benjamin, a user, shared his experience: "XTransfer is incredibly useful. It has made payments in China much easier and solved a lot of issues for me." This testimonial highlights how Xtransfer's solutions address real-world challenges, enabling businesses to focus on growth rather than administrative hurdles.

By leveraging Xtransfer's innovative platform, you can simplify cross-border transactions, reduce costs, and enhance security. Its partnerships with major banks like JPMorgan and Deutsche Bank further ensure reliability and compliance, making it a trusted choice for SMEs navigating the complexities of international trade.

Choosing the right international payment solution depends on your business priorities. SWIFT GPI excels in global reach, transparency, and security, while modern payment innovations like blockchain and local systems offer speed and cost efficiency. To decide, consider these factors:

-

Understand your target market and customer needs.

-

Ensure compliance with international legal and security standards.

-

Identify required capabilities and potential partnerships.

Xtransfer simplifies cross-border payments for SMEs with secure, fast, and cost-effective solutions. Its global multi-currency accounts and AI-driven compliance make it a trusted partner for navigating international trade.

FAQ

What is the main difference between SWIFT GPI and blockchain-based payment systems?

SWIFT GPI focuses on secure, near real-time international payments with end-to-end tracking. Blockchain-based systems eliminate intermediaries, offering decentralized, instant transactions with lower fees. Choose SWIFT for global reach and compliance or blockchain for speed and cost efficiency.

Can SMEs benefit from SWIFT GPI?

Yes, SWIFT GPI helps SMEs manage international payments with transparency and security. Its real-time tracking ensures predictable cash flow, while compliance with global regulations builds trust with partners. It’s ideal for businesses expanding into multiple markets.

How does Xtransfer simplify cross-border payments?

Xtransfer provides SMEs with global multi-currency accounts, competitive FX rates, and AI-driven compliance. Its streamlined payment solutions reduce costs and improve efficiency, enabling you to focus on growth rather than administrative challenges.

Are local payment systems suitable for international transactions?

Local payment systems excel in regional transactions but may lack global scalability. They offer instant transfers and lower fees, making them ideal for businesses focused on domestic markets or nearby regions.

Which payment solution offers the best security?

Both SWIFT GPI and blockchain-based systems prioritize security. SWIFT uses encryption and compliance checks, while blockchain employs decentralized ledgers and cryptographic principles. Choose based on your business needs and risk tolerance.

Related content