Never Underestimate the Importance of IDFBINBBMUM

Author:XTransfer2025.08.15 IDFBINBBMUM

IDFBINBBMUM is a unique SWIFT code that identifies a specific financial institution in international transactions. You rely on it to ensure your money reaches the intended recipient without errors. Using the correct SWIFT code makes cross-border transfers seamless and secure.

Mistakes in SWIFT codes can cause serious issues. For example:

-

Payments may end up in the wrong bank.

-

Errors grow riskier with larger sums of money.

-

The RegTech market's $2.2 billion valuation in 2020 highlights the financial impact of transaction mistakes.

Understanding the importance of IDFBINBBMUM helps you avoid these costly risks.

Understanding IDFBINBBMUM

What IDFBINBBMUM Represents

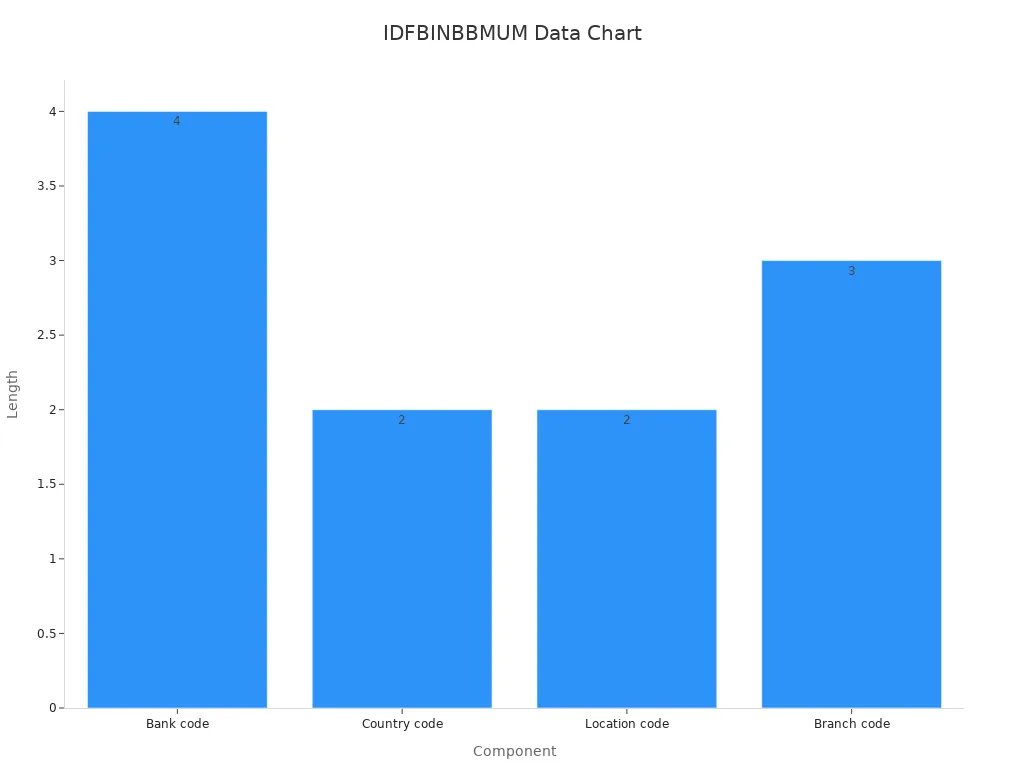

IDFBINBBMUM is a SWIFT code that plays a vital role in global financial transactions. It acts as a unique identifier for a specific bank and its branch, ensuring that funds are routed correctly. Each component of the code has a distinct purpose:

|

Component |

Description |

|

Bank code |

4 letters representing the bank, usually a shortened version of the bank's name. |

|

Country code |

2 letters representing the country where the bank is located. |

|

Location code |

2 characters (letters or numbers) indicating the bank's head office location. |

|

Branch code |

3 digits specifying a particular branch; 'XXX' indicates the bank’s head office. |

This structure ensures that every SWIFT code, including IDFBINBBMUM, provides precise details about the bank and its location.

The Importance of IDFBINBBMUM in Banking

The importance of IDFBINBBMUM lies in its ability to facilitate secure and accurate international money transfers. When you send money abroad, the SWIFT code ensures that your payment reaches the correct bank. Without it, transactions could fail or be delayed. Banks rely on this system to maintain trust and efficiency in global finance.

For individuals, using the correct SWIFT code prevents errors that could lead to financial losses. For businesses, it ensures smooth operations in global trade. The importance of IDFBINBBMUM cannot be overstated, as it underpins the reliability of cross-border banking.

How IDFBINBBMUM Ensures Transaction Accuracy

IDFBINBBMUM ensures transaction accuracy by providing detailed information about the recipient bank. Each part of the code eliminates ambiguity, reducing the chances of errors. For example, the country code pinpoints the bank's location, while the branch code identifies the specific branch.

When you use IDFBINBBMUM, you minimize the risk of funds being sent to the wrong institution. This accuracy is crucial for both personal and business transactions. It also aligns with global banking standards, ensuring compliance and trust in the financial system.

Importance of IDFBINBBMUM

Key Benefits for International Transactions

IDFBINBBMUM simplifies international money transfers. It ensures that funds reach the correct bank and branch without confusion. This accuracy reduces the risk of errors, saving you time and money. When you use the right SWIFT code, you avoid unnecessary complications in cross-border payments.

For businesses, IDFBINBBMUM supports global trade by streamlining financial operations. It helps maintain trust between trading partners by ensuring payments are processed efficiently. For individuals, it provides peace of mind when sending money to loved ones abroad.

Avoiding Errors and Delays in Money Transfers

Errors in SWIFT codes can lead to delays or failed transactions. IDFBINBBMUM eliminates these risks by providing precise information about the recipient bank. When you use this code, you reduce the chances of funds being sent to the wrong institution.

Delays in money transfers can disrupt business operations and personal plans. By ensuring accuracy, IDFBINBBMUM keeps transactions on schedule. It also minimizes the need for costly corrections, which can arise from mistakes in international payments.

Compliance with Global Banking Standards

Global banking standards require accuracy and transparency in financial transactions. IDFBINBBMUM aligns with these standards by providing detailed information about the bank and its location. This compliance builds trust in the international banking system.

When you use IDFBINBBMUM, you meet the requirements set by financial regulators. This ensures that your transactions are secure and legally compliant. For businesses, adhering to these standards is essential for maintaining credibility in global markets.

Real-World Applications of IDFBINBBMUM

Everyday Use in Personal Transactions

You rely on IDFBINBBMUM when sending money to family or friends abroad. It ensures your funds reach the correct bank and branch without errors. Whether paying for tuition fees or supporting loved ones, using the right SWIFT code simplifies the process.

Imagine transferring money to a relative in another country. Without IDFBINBBMUM, your payment could end up in the wrong account or face delays. This SWIFT code eliminates confusion by providing precise details about the recipient bank. It gives you peace of mind, knowing your transaction will succeed.

Business Applications for Global Trade

Businesses depend on IDFBINBBMUM for smooth international operations. When paying suppliers or receiving payments from clients, accuracy matters. This SWIFT code ensures funds move efficiently between banks, supporting global trade.

For example, a company importing goods from overseas uses IDFBINBBMUM to pay its supplier. The code guarantees the payment reaches the correct bank, avoiding costly delays. It also builds trust between trading partners, as both parties know the transaction will be secure.

Using IDFBINBBMUM helps businesses maintain credibility in international markets. It aligns with global banking standards, ensuring compliance and reliability. By leveraging this SWIFT code, companies optimize their financial processes and strengthen their global presence.

How Xtransfer Supports IDFBINBBMUM Usage

Xtransfer simplifies the process of verifying SWIFT codes like IDFBINBBMUM. Its platform provides accurate information about banks worldwide, helping you avoid errors in international transactions.

When you use Xtransfer, you gain access to a reliable database of SWIFT codes. This tool ensures you enter the correct code, reducing the risk of failed payments. Whether you're an individual or a business, Xtransfer supports your financial needs by enhancing transaction accuracy.

The platform's user-friendly interface makes it easy to find and verify SWIFT codes. By incorporating Xtransfer into your financial routine, you streamline your cross-border transfers and ensure compliance with banking standards.

Risks of Underestimating IDFBINBBMUM

Common Mistakes in International Transfers

Mistakes in international transfers often stem from incorrect or incomplete SWIFT codes. You might accidentally enter the wrong branch code or misspell the bank name. These errors can misdirect your funds, causing unnecessary stress. Another common mistake involves using outdated SWIFT codes. Banks occasionally update their codes, and failing to verify them can lead to failed transactions.

Some people assume that minor errors in SWIFT codes won’t matter. This assumption is risky. Even a single incorrect character can disrupt the entire transfer process. You should also avoid relying solely on verbal communication for SWIFT codes. Misheard or misinterpreted details can result in costly delays.

Financial Losses Due to Incorrect SWIFT Codes

Using the wrong SWIFT code can lead to significant financial losses. When funds are sent to the wrong bank, retrieving them becomes a lengthy and expensive process. You may face additional fees for reversing the transaction or correcting the error. In some cases, the recipient bank may charge penalties for handling misdirected payments.

For businesses, these errors can disrupt cash flow and damage relationships with international partners. Imagine paying a supplier overseas, only to discover the funds never arrived. This situation could delay shipments and harm your reputation. For individuals, the stakes are equally high. Sending money to support family members abroad becomes stressful when errors occur.

Case Studies of Transaction Failures

Real-world examples highlight the risks of underestimating SWIFT codes like IDFBINBBMUM. In one case, a small business in the U.S. lost $10,000 due to a single typo in the SWIFT code. The funds were sent to the wrong bank, and it took weeks to recover them. The delay caused the company to miss a critical payment deadline, straining its relationship with a key supplier.

Another example involves a student paying tuition fees to a university abroad. The student used an outdated SWIFT code, resulting in a failed transaction. The funds were eventually returned, but the delay caused the student to miss the enrollment deadline.

These cases emphasize the importance of accuracy. By taking the time to verify SWIFT codes, you can avoid similar setbacks.

Leveraging IDFBINBBMUM Effectively

Tips for Individuals to Ensure Accuracy

Ensuring accuracy in international transfers starts with verifying the SWIFT code. Double-check IDFBINBBMUM before entering it into your payment system. Even a small typo can misdirect your funds. Use reliable sources to confirm the code, such as your bank’s official website or trusted platforms like Xtransfer.

Keep a record of frequently used SWIFT codes. This helps you avoid errors when sending money to the same recipient multiple times. If you’re unsure about the code, contact your bank for assistance. They can provide the correct details and guide you through the process.

Strategies for Businesses to Optimize Transfers

Businesses can optimize international transfers by integrating SWIFT code verification into their payment workflows. Train your finance team to use tools like Xtransfer for accurate code validation. This reduces errors and saves time.

Set up a centralized database of SWIFT codes for your regular trading partners. This ensures consistency and prevents mistakes. Automate your payment processes to include SWIFT code checks. Automation improves efficiency and reduces human error.

When dealing with new suppliers or clients, verify their SWIFT codes thoroughly. Cross-check the information with multiple sources to ensure accuracy. This builds trust and avoids costly delays in transactions.

Using Xtransfer for Reliable SWIFT Code Verification

Xtransfer simplifies SWIFT code verification for individuals and businesses. Its platform provides accurate and up-to-date information about banks worldwide. You can search for IDFBINBBMUM and confirm its details in seconds.

The user-friendly interface makes it easy to navigate. You don’t need technical expertise to use the platform effectively. By relying on Xtransfer, you reduce the risk of errors and ensure your transactions succeed.

IDFBINBBMUM plays a crucial role in international financial transactions. It ensures your money reaches the correct bank and branch, reducing errors and delays. Neglecting its importance can lead to costly mistakes, including misdirected funds and compliance issues.

Adopting best practices for SWIFT code verification protects your finances and builds trust in global banking. Make IDFBINBBMUM a priority in your financial routine.

FAQ

What is IDFBINBBMUM, and why is it important?

IDFBINBBMUM is a SWIFT code that identifies a specific bank and branch for international transactions. It ensures your funds reach the correct destination, reducing errors and delays. Using the right SWIFT code protects your money and supports compliance with global banking standards.

How can I verify IDFBINBBMUM before making a transfer?

You can verify IDFBINBBMUM using trusted tools like Xtransfer. This platform provides accurate and up-to-date SWIFT code information for banks worldwide. Double-check the code with your bank or recipient to ensure accuracy before initiating a transfer.

What happens if I use the wrong SWIFT code?

Using the wrong SWIFT code can misdirect your funds to the wrong bank. Retrieving them may involve lengthy processes and additional fees. For businesses, this can disrupt operations and harm relationships. Always verify the code to avoid costly mistakes.

Can IDFBINBBMUM be used for both personal and business transactions?

Yes, IDFBINBBMUM works for personal and business transactions. Whether you're sending money to family abroad or paying international suppliers, this SWIFT code ensures accuracy and compliance. It simplifies cross-border payments for individuals and companies alike.

How does Xtransfer simplify SWIFT code verification?

Xtransfer offers a user-friendly platform to search and verify SWIFT codes like IDFBINBBMUM. It provides reliable information about banks worldwide, helping you avoid errors in international transfers. Using Xtransfer ensures your transactions succeed with minimal effort.

Related content