Can Yujian Group Solve Trade Risks Today?

Author:XTransfer2025.12.03Yujian Group

Global trade today faces unprecedented challenges, from economic uncertainties to complex regulations. You need solutions that simplify these complexities. Yujian Group leads the way by combining advanced technology with strategic partnerships. For example, automated tools streamline customs compliance and improve supply chain efficiency. Data analytics empowers businesses like yours to make real-time decisions, reducing risks. By integrating trade data across platforms, Yujian Group enhances operational flexibility, helping you adapt to the fast-paced world of globalization. Their approach ensures you stay ahead in an ever-changing market.

Understanding Global Trade Risks Today

Key Challenges in Global Trade

Global trade faces numerous challenges that demand your attention. Supply chain disruptions, regulatory complexities, and geopolitical tensions dominate the landscape. According to research, 74% of businesses report significant impacts from supply chain disruptions, while 81% struggle with environmental, social, and governance (ESG) considerations. Geopolitical events, such as export control laws and retaliatory tariffs, affect over half of global enterprises. These challenges highlight the intricate web of risks you must navigate to succeed in today’s interconnected world.

|

Challenge |

Percentage Impacted |

|---|---|

|

Supply Chain Disruptions |

74% |

|

ESG & Regulatory Considerations |

81% |

|

Geopolitical Events |

52% (export control laws), 41% (retaliatory tariffs) |

|

Economic Uncertainty |

45% chance of recession by 2025 |

Trade complexities also arise from cultural globalization. As businesses expand across borders, they encounter diverse regulations, languages, and customs. These factors can slow operations and increase costs. However, understanding these challenges equips you to adapt and thrive in the global marketplace.

The Impact of Geopolitical Tensions and Economic Uncertainty

Geopolitical tensions and economic uncertainty significantly influence global trade. The Geopolitical Risk Index (GPR) tracks the frequency of terms related to geopolitical events in major newspapers, offering insights into market trends. Political risk indexes and country risk scores provide additional tools to assess stability and potential conflicts. For example, the U.S. has adopted a more protectionist trade policy, increasing tariffs and restrictions. Meanwhile, China’s fiscal and monetary policies aim to boost consumption and investment, reshaping global trade dynamics.

-

Event Studies: Analyze past geopolitical events, such as the Gulf War, to understand their financial impacts.

-

Scenario Analysis: Model potential outcomes of hypothetical geopolitical events to prepare for future risks.

Economic uncertainty further complicates the landscape. The Bloomberg Eco Surprise Index measures the accuracy of economic forecasts, while indices like the NASDAQ 100 and Russell 2000 reflect market performance. These tools help you anticipate and respond to economic shifts, ensuring resilience in a volatile environment.

Supply Chain Disruptions and Regulatory Complexities

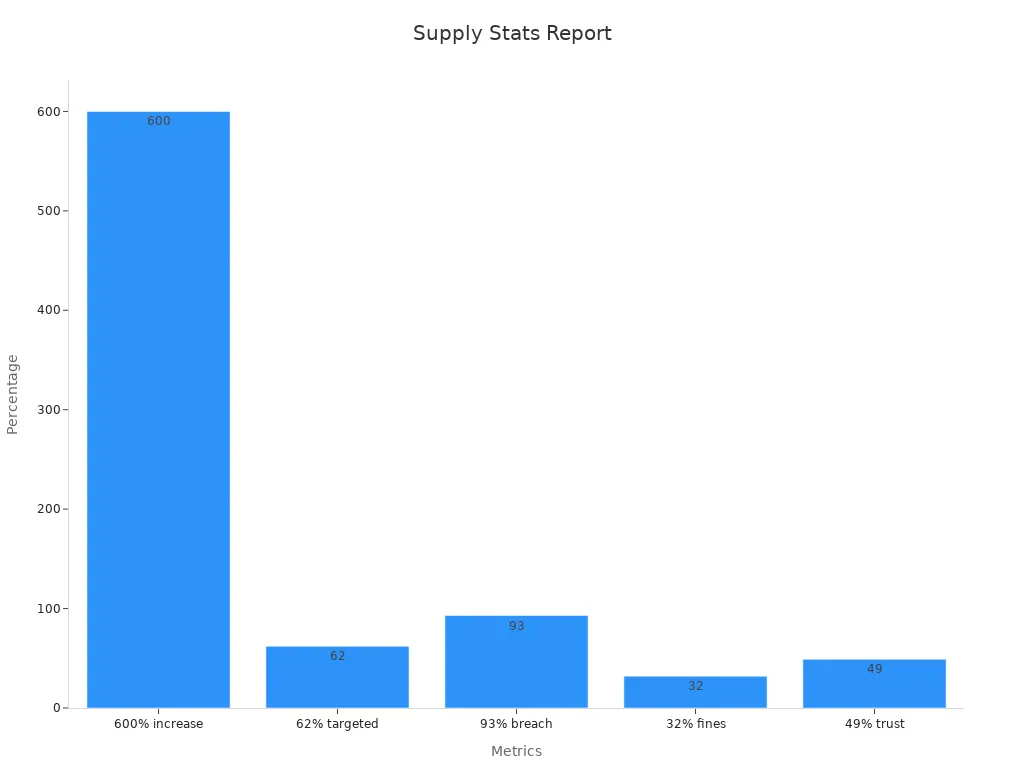

Supply chain disruptions and regulatory complexities pose significant risks to your business. A recent report revealed a 600% increase in supply chain attacks in 2021, with 62% of organizations targeted in 2022. These disruptions often lead to direct breaches, regulatory fines, and loss of customer trust. The interconnected nature of globalization amplifies these risks, as a single weak link can impact the entire chain.

Regulatory complexities add another layer of difficulty. Navigating diverse legal frameworks across countries requires careful planning and compliance. Cultural globalization further complicates this process, as businesses must adapt to varying norms and expectations. By staying informed and proactive, you can mitigate these risks and maintain operational efficiency.

Yujian Group's Strategies for Mitigating Trade Risks

Leveraging Technology to Enhance Supply Chain Resilience

Technology plays a vital role in strengthening supply chains and reducing trade risks. Yujian Group uses advanced tools like artificial intelligence (AI) and machine learning to improve supply chain resilience. These technologies help you predict disruptions, optimize logistics, and ensure smooth operations. For example, AI-enabled systems analyze data to identify potential risks before they occur, allowing you to take proactive measures.

-

AI enhances supply chain resilience in the agri-food industry by reducing food waste and improving performance.

-

A survey of 151 participants showed that AI-enabled information processing significantly boosts supply chain efficiency.

-

Structural equation modeling confirmed the positive relationship between AI technology and supply chain resilience.

By leveraging technology, Yujian Group empowers you to adapt quickly to challenges, ensuring your business remains competitive in the era of globalization.

Building Strategic Partnerships to Navigate Geopolitical Challenges

Strategic partnerships are essential for overcoming geopolitical challenges in global trade. Yujian Group collaborates with trusted organizations worldwide to create a network of support for businesses like yours. These partnerships provide access to local expertise, helping you navigate complex regulations and cultural globalization. For instance, Yujian Group works with regional trade associations to stay updated on changing policies and market trends.

Partnerships also foster trust and cooperation, enabling you to build long-term relationships with suppliers and customers. This approach minimizes risks associated with geopolitical tensions, such as export restrictions or retaliatory tariffs. By aligning with reliable partners, Yujian Group ensures you can focus on growth without worrying about unexpected disruptions.

Utilizing Financial Tools Like XTransfer for Secure Cross-Border Transactions

Cross-border transactions often involve risks related to security, efficiency, and cost. Yujian Group addresses these challenges through XTransfer, a financial tool designed to simplify global trade payments. XTransfer connects businesses with trusted financial institutions, ensuring secure transactions and reducing costs for small and medium-sized enterprises (SMEs).

|

Metric |

Before XTransfer |

After XTransfer |

Improvement |

|---|---|---|---|

|

Transaction Security |

N/A |

Improved |

Significant |

|

Transaction Efficiency |

N/A |

Improved |

Significant |

|

Cost Reduction for SMEs |

N/A |

Reduced |

Significant |

|

Customer Service Response Rate |

13% |

84.2% |

71.2% increase |

With XTransfer, you gain access to financial services typically reserved for large multinational corporations. This tool enhances your ability to manage payments in the foreign exchange market, ensuring smooth operations in the fast-paced world of globalization. Yujian Group’s commitment to innovation ensures that your cross-border transactions remain secure and efficient, allowing you to focus on expanding your business.

Success Stories: How Yujian Group is Solving Trade Risks

Case Study: Overcoming Supply Chain Disruptions in Southeast Asia

Supply chain disruptions can cripple your business operations. Yujian Group tackled this challenge head-on in Southeast Asia, where natural disasters and logistical bottlenecks frequently disrupt trade. By leveraging advanced technology, they helped businesses like yours predict and mitigate risks. For instance, their AI-driven tools analyzed weather patterns and port congestion data to optimize shipping routes. This proactive approach reduced delays and ensured goods reached their destinations on time.

Yujian Group also collaborated with local partners to strengthen supply chain resilience. These partnerships provided access to regional expertise, enabling you to navigate cultural globalization and regulatory requirements effectively. As a result, businesses in Southeast Asia experienced fewer disruptions and improved operational efficiency. This case demonstrates how Yujian Group's innovative strategies can help you overcome supply chain challenges in a globalized world.

Example: Mitigating Financial Risks with XTransfer

Cross-border transactions often expose you to financial risks, including currency fluctuations and payment delays. Yujian Group addresses these challenges through XTransfer, a financial tool designed to simplify global trade payments. One example highlights how a small business in Europe used XTransfer to manage transactions in the foreign exchange market. The tool connected the business with trusted financial institutions, ensuring secure and cost-effective payments.

XTransfer also streamlined the payment process, reducing transaction times and fees. This efficiency allowed the business to allocate resources to growth initiatives rather than worrying about financial risks. By using XTransfer, you can enjoy the same level of financial services as large multinational corporations, making it easier to compete in the global marketplace.

Partnership-Driven Solutions in Navigating Regulatory Hurdles

Navigating regulatory hurdles can be daunting, especially when dealing with diverse legal frameworks across countries. Yujian Group has proven that strategic partnerships are key to overcoming these challenges. By working with regional trade associations and government agencies, they stay updated on changing regulations. This knowledge helps you comply with local laws and avoid costly penalties.

For example, Yujian Group partnered with a trade association in South America to assist businesses in meeting new environmental standards. This collaboration provided you with the resources and guidance needed to adapt to regulatory changes. Additionally, these partnerships foster trust and cooperation, enabling you to build long-term relationships with stakeholders in the global trade ecosystem.

Limitations and Areas for Improvement

Challenges in Fully Predicting and Mitigating Geopolitical Risks

Geopolitical risks remain one of the most unpredictable factors in global trade. You face challenges such as shifting economic power centers, evolving trade alliances, and protectionist policies. These changes make it difficult to forecast and mitigate risks effectively. For example, new trade hubs and investment shifts complicate global power dynamics, while fragmented regulations create uncertainty.

|

Challenge Description |

Details |

|---|---|

|

Tectonic shifts in power and trade |

New alliances redefine global dynamics, complicating predictions. |

|

Complex regulatory and tax environment |

Evolving rules create uncertainty in risk mitigation strategies. |

|

Fast-moving technology landscape |

National security concerns hinder effective responses. |

|

Multiple threats to supply chains |

Rivalries and protectionism strain global supply chains. |

|

Demographic and cultural pressures |

Aging populations and workforce changes add to trade complexities. |

To navigate these risks, you need tools that adapt to rapid changes and provide real-time insights. Yujian Group’s strategies address many of these issues, but the unpredictable nature of geopolitics requires continuous refinement.

The Need for Continuous Innovation in Technology and Processes

Globalization demands constant innovation to stay competitive. You must address performance gaps and streamline operations to meet industry benchmarks. For instance, comparing production costs against industry averages helps identify inefficiencies. Key performance indicators (KPIs) also provide valuable insights into the effectiveness of innovation efforts.

|

Metric/Benchmark |

Description |

Importance for Innovation |

|---|---|---|

|

Production Costs |

Comparison against industry averages |

Identifies opportunities for operational efficiency. |

|

Performance Gaps |

Analysis of current vs. benchmark performance |

Helps prioritize innovation and resource allocation. |

-

KPIs measure progress toward strategic goals.

-

They highlight areas needing improvement and guide data-driven decisions.

Yujian Group’s use of AI and machine learning demonstrates their commitment to innovation. However, staying ahead in the fast-paced world of globalization requires ongoing advancements in technology and processes.

Opportunities to Expand Partnerships and Financial Tools

Expanding partnerships and financial tools offers significant potential for growth. You can align with partners who share your goals and help you reach untapped markets. For example, analyzing competitors and market demand can guide your partnership strategies. Financial tools like XTransfer also play a crucial role in managing risks in the foreign exchange market.

|

Step |

Description |

|---|---|

|

Define audience |

Identify your target market and its characteristics. |

|

Conduct research |

Estimate market size and analyze external factors. |

|

Analyze competitors |

Assess competitor strategies and market share. |

|

Align partnership strategies |

Choose partners that align with your goals and target market. |

|

Run financial projections |

Estimate revenue and sales volume under different scenarios. |

By leveraging these strategies, Yujian Group can enhance its ability to support businesses like yours. Expanding partnerships and refining financial tools will ensure you remain competitive in the global trade ecosystem.

Yujian Group has redefined how you navigate the complexities of globalization. Their innovative strategies, such as leveraging tools like XTransfer, empower you to manage trade risks effectively. By fostering collaboration and embracing technological advancements, they help you adapt to the challenges of cultural globalization and the foreign exchange market. National initiatives like Made in China 2025 further highlight the benefits of their commitment to innovation. These efforts position Yujian Group as a leader in global trade, ensuring you remain resilient in an ever-evolving marketplace.

FAQ

What makes Yujian Group stand out in managing trade risks?

Yujian Group combines advanced technology, strategic partnerships, and tools like XTransfer to address trade risks. Their proactive approach ensures you can navigate challenges like supply chain disruptions, geopolitical tensions, and regulatory complexities with greater confidence and efficiency.

How does XTransfer simplify cross-border payments?

XTransfer connects your business with trusted financial institutions, ensuring secure and cost-effective transactions. It reduces payment delays, lowers fees, and provides financial services typically reserved for large corporations, empowering you to compete globally.

Can Yujian Group help small businesses with global trade?

Yes, Yujian Group supports businesses of all sizes. Their tools and strategies, including AI-driven supply chain solutions and financial services like XTransfer, level the playing field for small enterprises, enabling you to thrive in international markets.

How does Yujian Group address supply chain disruptions?

Yujian Group uses AI and predictive analytics to identify potential risks in your supply chain. By optimizing logistics and collaborating with local partners, they help you minimize delays and maintain operational efficiency.

Why are strategic partnerships important in global trade?

Strategic partnerships provide access to local expertise, helping you navigate regulations and cultural differences. Yujian Group’s collaborations with trade associations and government agencies ensure you stay compliant and competitive in diverse markets.

Related content