What to Know About GHS Currency in 2025

Author:XTransfer2025.12.04Introduce GHS currency

The Ghanaian Cedi (GHS) serves as Ghana's official currency, symbolizing the nation's economic identity. As we introduce GHS currency dynamics in 2025, understanding its implications becomes essential for managing finances, planning trips, or making investments. For instance, Ghana's GDP is projected to reach $75.76 billion, with government debt expected to account for 79.52% of GDP. These figures highlight the importance of monitoring the currency's performance. Exchange rates, such as the recent rise in USD/GHS by 24.35% over six months, further emphasize the need for accurate data. Tools like XTransfer simplify this process by offering real-time updates, empowering you to make informed decisions.

Introduce GHS Currency

What is the Ghanaian Cedi (GHS)?

The Ghanaian Cedi (GHS) is the official currency of Ghana, symbolized as GH₵. It was introduced in 1965, replacing the British West African pound. The name "cedi" comes from the Akan word for "cowry shell," which was once used as a form of money in Ghana. This currency represents Ghana's economic independence and plays a vital role in the country's financial system.

The cedi is divided into 100 smaller units called pesewas. This structure makes it easier to handle both large and small transactions. Over the years, the Ghanaian cedi has undergone several changes to improve its efficiency and stability. For example, the 2007 redenomination removed four zeros from the currency, simplifying its use in daily transactions.

Structure, Symbol, and Denominations of GHS

The Ghanaian cedi has a well-organized structure that ensures its usability in various financial activities. The currency is available in both coins and banknotes, catering to different transaction needs. Coins include denominations of 1, 5, 10, 20, and 50 pesewas, as well as 1 cedi. Banknotes are available in higher denominations, such as 2, 5, 10, 20, 50, 100, and 200 cedis.

|

Denomination Type |

Available Units |

|---|---|

|

Coins |

1, 5, 10, 20, 50 pesewas; 1 cedi |

|

Banknotes |

2, 5, 10, 20, 50, 100, 200 cedis |

The symbol for the Ghanaian cedi is GH₵, and it is often used in financial documents and transactions. This symbol helps distinguish the cedi from other currencies, ensuring clarity in both local and international dealings.

The 2007 redenomination played a significant role in shaping the current structure of the Ghanaian cedi. By removing four zeros from the old currency, the government made transactions more straightforward and reduced the risk of errors in financial calculations.

How the Ghanaian Currency is Used Locally and Internationally

The Ghanaian currency serves as the backbone of Ghana's economy. Locally, it is used for everyday transactions, such as buying goods, paying for services, and settling debts. The cedi is also essential for government operations, including tax collection and public spending.

Internationally, the Ghanaian cedi plays a growing role in trade and finance. Ghana's participation in the African Continental Free Trade Area (AfCFTA) has increased the use of the cedi in regional trade. This initiative aims to unify 55 African Union member states, creating new opportunities for the cedi to gain recognition beyond Ghana's borders.

Current financial reports highlight the cedi's improving market position. Effective central bank interventions and fiscal reforms have strengthened the currency. For instance, the Bank of Ghana's monetary policies have enhanced the cedi's value, boosting investor confidence. The business confidence index recently reached its highest level since December 2020, reflecting optimism about Ghana's economic future.

The cedi's performance is influenced by several factors, including GDP growth, inflation, and money supply. Studies show that positive GDP growth leads to currency appreciation, while high inflation and increased money supply can cause depreciation. These dynamics highlight the importance of maintaining a stable economic environment to support the cedi's value.

The History of the Ghanaian Cedi

Origins and Introduction of the Cedi

The Ghanaian cedi has a rich history that reflects Ghana's journey toward economic independence. Before modern currencies, cowries served as a medium of exchange in the region as early as the 14th century, introduced through trade with Arab merchants. By 1796, the Gold Coast began producing its first modern coins, though cowries remained in use until 1901.

After Ghana gained independence in 1957, the country transitioned from the British West African pound to its own currency. The Ghanaian pound was introduced in 1958, marking the first step toward monetary sovereignty. In 1965, the cedi replaced the Ghanaian pound, symbolizing a new era for the nation's economy.

|

Year |

Event Description |

|---|---|

|

14th century |

Cowries began to be used as currency in what is now Ghana through trade with Arab merchants. |

|

1796 |

The first modern coins were produced in the Gold Coast. Cowries were still used alongside coins until 1901. |

|

1957 |

Ghana gained independence and separated from the British West African pound. |

|

1958 |

The Ghanaian pound was introduced as the first independent currency. |

|

1965 |

The Cedi was introduced to replace the Ghanaian pound, with notes and coins issued in July. |

Key Milestones in the Evolution of GHS

The evolution of the Ghanaian cedi reflects the country's economic challenges and resilience. After its introduction in 1965, the cedi underwent significant changes to address inflation and currency management issues. In 1966, the new cedi was introduced to stabilize the economy. By 2007, Ghana implemented a major revaluation to simplify transactions and restore confidence in the currency.

Economic historians note that these milestones highlight Ghana's efforts to adapt to changing financial conditions. The transition from the Ghanaian pound to the cedi marked a shift toward independence, while subsequent reforms aimed to strengthen the currency's value. Despite these efforts, inflation and external economic pressures have continued to shape the cedi's trajectory.

The 2007 Re-denomination and Its Impact

The 2007 re-denomination marked a turning point for the Ghanaian cedi. By removing four zeros from the currency, the government simplified transactions and reduced the risk of errors in financial calculations. This move also aimed to restore public confidence in the cedi and stabilize the economy.

The impact of this reform is evident in inflation statistics. Before the re-denomination, the average inflation rate stood at 24.93%. Afterward, it dropped to 12.52%, representing a 49.77% reduction. Fluctuations in inflation rates also decreased, with the standard deviation falling from 14.56 to 4.15. These improvements reflect the success of Ghana's economic policies during this period.

-

Before the redenomination, the average inflation rate was 24.93%.

-

After the redenomination, the average inflation rate decreased to 12.52%, indicating a 49.77% reduction.

-

The minimum and maximum inflation rates before redenomination were 10.92% and 59.46%, respectively, while after redenomination, they were 7.13% and 19.28%.

-

The standard deviation of inflation rates decreased from 14.56 to 4.15, showing reduced fluctuations post-redenomination.

The re-denomination not only improved the cedi's stability but also enhanced its usability in both local and international transactions. It remains a key milestone in Ghana's economic history.

The State of GHS Currency in 2025

Current Value and Strength of the Ghanaian Cedi

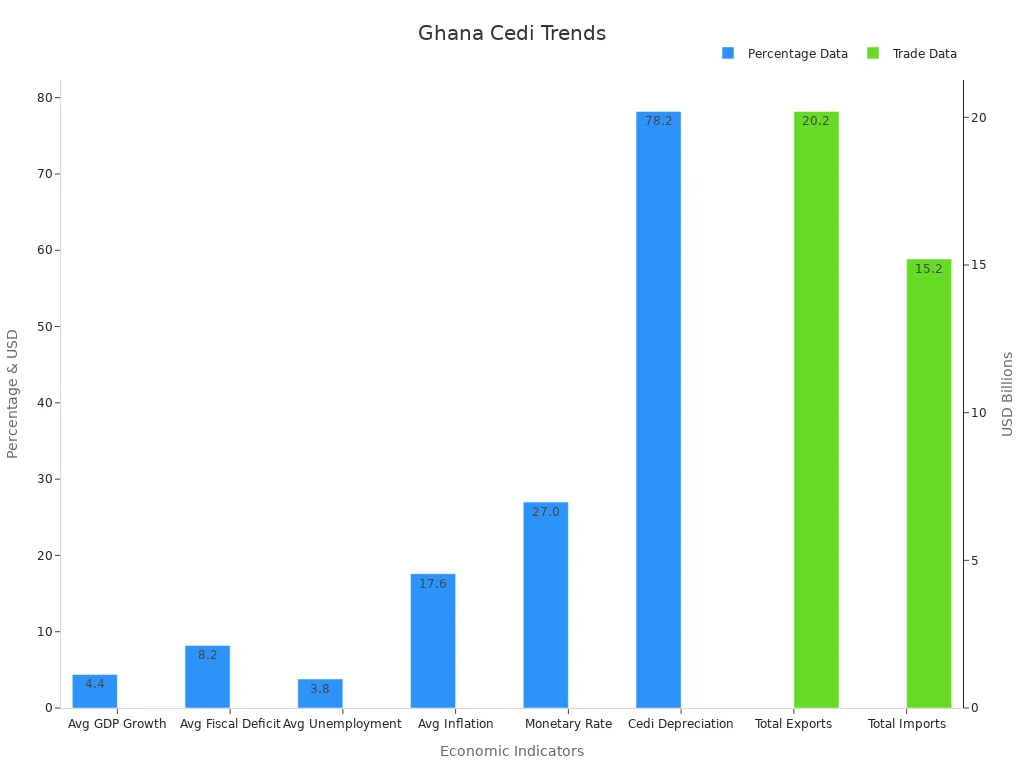

The Ghanaian cedi continues to face challenges in 2025, reflecting the country's ongoing economic adjustments. As of January 1, 2025, the cedi was valued at 0.068 USD. This valuation highlights the currency's struggle against major global currencies. Political stability following the December 2024 elections has brought optimism, suggesting potential recovery in the cedi's value. However, the first two months of 2025 showed increased depreciation rates, signaling persistent hurdles for the Ghanaian currency.

In 2024, the cedi depreciated significantly against the USD, GBP, and EUR, with rates of 19.2%, 17.8%, and 13.7%, respectively. These figures indicate higher import costs and inflationary pressures, which could affect Ghana's economic outlook. The 2025 budget statement ties the cedi's performance to political events, emphasizing the importance of stable governance in maintaining its value.

|

Indicator |

FY2024 Value |

FY2025 Target |

Notes |

|---|---|---|---|

|

Overall Budget Deficit |

7.9% of GDP |

5.4% of GDP |

Indicates a significant fiscal adjustment aimed at improving the cedi's stability. |

|

Primary Balance (Commitment) |

-3.9% of GDP |

1.5% of GDP |

A shift from deficit to surplus is crucial for restoring fiscal health. |

|

Total Revenue and Grants |

GHS 186.6B |

GHS 177.2B |

Exceeded target due to higher oil & gas receipts, supporting economic performance. |

|

Inflation Rate |

Overshot |

Target TBD |

Triggered discussions with the IMF, indicating pressure on the cedi's value. |

These fiscal adjustments aim to stabilize the Ghanaian currency and restore confidence among investors and consumers.

Factors Influencing GHS Exchange Rates in 2025

Several factors shape the official exchange rate of the Ghanaian cedi in 2025. Ghana's recovery from a debt crisis and high inflation remains a central theme. The IMF bailout has played a critical role in stabilizing the economy, with tighter fiscal and monetary policies introduced to address currency instability.

|

Aspect |

Description |

|---|---|

|

Focus |

Monetary and exchange rate policies in Ghana |

|

Insights |

Factors influencing GHS exchange rates in the current monetary environment |

|

Economic Context |

Ghana's recovery from a debt crisis and high inflation |

|

Policy Response |

IMF bailout and tightening fiscal and monetary policies to stabilize the GHS |

|

Current Challenges |

High inflation and currency instability |

|

Future Outlook |

IMF support and policy tightening to address economic issues |

High inflation continues to exert pressure on the cedi's value, while external economic conditions, such as global commodity prices, influence exchange rates. The Bank of Ghana's interventions, including interest rate adjustments, aim to mitigate these challenges. Political stability following the recent elections has also contributed to a more favorable outlook for the cedi, underscoring the importance of governance in currency performance.

Comparing GHS to Other Global Currencies

When comparing the Ghanaian cedi to other global currencies, the economic challenges faced by Ghana become evident. The cedi has experienced a 1,300% depreciation against the US Dollar, significantly more than the Nigerian Naira, which saw an 850% depreciation. This stark contrast highlights the need for sound economic policies to address the cedi's vulnerabilities.

The cedi's depreciation impacts Ghana's trade and investment prospects. Higher import costs and reduced purchasing power make it difficult for businesses and consumers to thrive. In contrast, countries with more stable currencies, such as South Africa's Rand, benefit from stronger economic fundamentals.

Despite these challenges, Ghana's participation in regional trade initiatives, such as the African Continental Free Trade Area (AfCFTA), offers opportunities for the cedi to gain recognition. By fostering economic integration, Ghana can leverage its currency to strengthen trade relationships and boost its market position.

Practical Tips for Using or Converting GHS

How to Convert GHS to Other Currencies

Converting the Ghanaian cedi to other currencies can be straightforward if you use the right tools. Online platforms and APIs provide real-time currency exchange rates, ensuring accurate conversions. For instance, the Convert Currency Rate API offers live global exchange rate data. It supports the Ghanaian cedi and allows you to input parameters like the amount and target currency. The output includes the converted amount and the new currency.

|

Feature |

Description |

|---|---|

|

API Name |

Convert Currency Rate API |

|

Purpose |

Live Global Foreign Exchange Rate Conversion |

|

Input Parameters |

License Key, From (currency code), To (currency code), Amount |

|

Output Parameters |

Converted (amount), Currency (converted currency) |

|

Supported Currencies |

GHS - Ghanaian Cedi |

|

Use Cases |

Localized pricing for e-commerce, currency conversion, global accounting, international price analysis |

You can also use mobile apps or visit local banks and forex bureaus in Ghana for currency exchange. Always compare rates to get the best value for your cedi.

Best Practices for Travelers Using Ghanaian Currency

When traveling in Ghana, understanding how to use the Ghanaian currency effectively can save you time and money. Cash remains the most widely accepted form of payment. Carry enough cash for daily expenses, as many small businesses and markets do not accept cards. ATMs are available in major cities, but connectivity issues can sometimes disrupt card transactions.

Be cautious when using credit or debit cards. Fraud is a concern in some areas, so monitor your accounts regularly. Additionally, familiarize yourself with the current exchange rates to avoid overpaying when converting your money.

Using XTransfer for Real-Time Exchange Rates and Conversions

XTransfer simplifies currency exchange by providing real-time updates on exchange rates. This tool is particularly useful for travelers and businesses dealing with the Ghanaian cedi. With XTransfer, you can monitor fluctuations in the currency market and make informed decisions. Its user-friendly interface allows you to convert GHS to other currencies quickly and accurately.

For example, if you plan to shop in Ghana or pay for services, XTransfer ensures you know the exact value of your cedi in another currency. This transparency helps you avoid hidden fees and unfavorable rates.

The Ghanaian Cedi reflects Ghana's economic journey and resilience. Its history, from cowry shells to modern currency, showcases the nation's efforts to adapt to changing financial needs. By 2025, the cedi faces challenges like depreciation, yet it remains vital for daily transactions and international trade.

Understanding the cedi helps you plan finances, travel, or invest wisely. For example, the GH₵18 premium charged in 2008, once valued at USD17.13, now equals USD2.53 due to depreciation. This highlights the importance of monitoring exchange rates. Tools like XTransfer simplify this process, offering real-time updates to support informed decisions.

FAQ

1. What is the best way to check the current exchange rate for GHS?

Use tools like XTransfer for real-time updates. These platforms provide accurate rates and help you make informed decisions when converting or using the Ghanaian cedi.

2. Can you use credit cards in Ghana?

Credit cards are accepted in major cities and hotels. However, cash remains the preferred payment method in local markets and small businesses.

3. How can you avoid losing money during currency conversion?

Compare rates at banks, forex bureaus, and online platforms. Always use trusted services like XTransfer to ensure fair and transparent conversions.

4. Are smaller denominations of GHS useful?

Yes, smaller denominations simplify transactions in local markets. Vendors often lack change for larger bills, so carrying coins and smaller notes is practical.

5. Is the Ghanaian cedi stable in 2025?

The cedi faces challenges like inflation and depreciation. However, fiscal reforms and IMF support aim to stabilize its value over time.

Related content