What Every Traveler Should Know About GYD Currency in Guyana

Author:XTransfer2025.08.20GYD

You can use GYD currency in most places in Guyana. Many stores take international cards, but cash is safer, especially outside Georgetown. If you know how to use GYD currency, you will not get confused. This helps your trip go well. Guyana’s economy needs both local and foreign visitors. If you know your payment choices, your trip will be easier. Always learn about the money system before you go.

Highlights

-

Use Guyanese Dollars (GYD) for most things you buy each day. People outside Georgetown like cash more than cards.

-

Bring US dollars with you. Exchange them for GYD at banks or licensed cambios. This gives you better rates and is safer.

-

Carry both cash and a travel money card like Wise or Revolut. This helps you save on fees and pay in a safe way.

-

Use ATMs in big cities. Take out more money at one time but do it less often. This helps you avoid extra fees and keeps you safer.

-

Keep your money safe by splitting your cash into different places. Use strong passwords and tell your bank before you travel.

GYD Currency Basics

Guyanese Dollar Overview

You will use the Guyanese Dollar when you visit Guyana. The official currency of Guyana is the Guyanese Dollar. People often call it GYD currency. You will see the symbol "$" or "G$" on price tags and receipts. The abbreviation for the Guyanese Dollar is GYD. The currency also has a minor unit called the cent, which uses the symbol "¢."

Here is a quick guide to the main features of the Guyanese Dollar:

|

Attribute |

Value |

|

Currency Name |

Guyanese Dollar |

|

Official Abbreviation |

GYD |

|

Currency Symbol |

$ or G$ |

|

Minor Unit |

Cent (1/100) |

|

Minor Unit Symbol |

¢ |

The Guyanese Dollar plays a big role in the local economy. You will notice that most shops, markets, and taxis use GYD currency for daily transactions. The economy in Guyana relies on both local and foreign spending, so you will find that knowing how to use the local currency helps you blend in and avoid confusion.

GYD Currency Denominations

You will find both current banknotes and coins in Guyana. The current banknotes and coins make it easy for you to pay for things, whether you buy a snack or pay for a taxi ride. The most common banknotes are 20, 50, 100, 500, 1,000, and 5,000 GYD. You may also see coins in 1, 5, and 10 GYD values, but people use coins less often than notes.

Here is a list of the main denominations you will use:

-

Banknotes: 20, 50, 100, 500, 1,000, 2,000, and 5,000 GYD

-

Coins: 1, 5, and 10 GYD

You should keep smaller notes for daily spending. Many small shops and taxis may not have change for large bills. The local currency is easy to recognize because each note has a different color and size.

Where to Get GYD Currency

You have several options to get GYD currency when you arrive in Guyana. The most common places include banks, cambios (licensed currency exchange offices), and ATMs. You can also exchange money at some hotels, but rates may not be as good.

-

Banks: You can visit major banks in Georgetown and other cities. Banks offer secure currency conversion and usually have set hours.

-

Cambios: Licensed cambios give you a quick way to exchange foreign money for GYD currency. You will find many cambios in busy areas and near markets.

-

ATMs: You can use ATMs to withdraw Guyanese Dollar directly. Most ATMs accept international cards, but you should check with your bank before you travel.

|

Currency Pair |

Exchange Rate / Stats |

Details |

|

GYD to EUR (current) |

~0.00407 EUR per 1 GYD |

Mid-market rate from Wise |

|

30-day High |

0.0041 EUR |

Highest rate in last 30 days |

|

30-day Low |

0.0040 EUR |

Lowest rate in last 30 days |

|

30-day Average |

0.0041 EUR |

Average rate over last 30 days |

|

90-day High |

0.0043 EUR |

Highest rate in last 90 days |

|

90-day Low |

0.0040 EUR |

Lowest rate in last 90 days |

|

90-day Average |

0.0042 EUR |

Average rate over last 90 days |

You should always check the latest exchange rates before you change money. The currency conversion rate can change from day to day. Over the past five years, the Guyanese Dollar has stayed stable against the US Dollar. The average rate has been about 0.0048 USD per 1 GYD, with very small daily changes. This stability helps you plan your budget and avoid surprises.

You can manage your money better if you know where to get GYD currency and how to check the currency conversion rates. This knowledge will help you enjoy your trip and support the local economy in Guyana.

Payment Methods in Guyana

Cash or Cards

Most people in Guyana use cash to pay for things. In Georgetown, you can use both cash and cards at big stores and hotels. Many restaurants and shops in the city take international cards. You should always ask if cards are accepted before you buy something. Outside Georgetown, you will need cash almost everywhere. Small shops, markets, and taxis in the countryside do not take cards.

US dollars are used for big payments like hotels or car rentals. For daily spending, you should use Guyanese Dollars. Most sellers want local money for small buys. Using GYD helps you avoid mistakes and makes paying easier.

Using Travel Cards

A travel money card can help you spend safely in Guyana. You can use a travel card to pay in GYD at many places in Georgetown. The wise multi-currency card is a favorite for travelers. It lets you keep and spend different currencies, including GYD, with low fees. You can skip high conversion costs and pay in local money.

Here are some good and bad things about using a travel money card in Guyana:

-

Advantages:

-

You get cheap currency conversion and good exchange rates.

-

Your money is safe, so you do not need to carry lots of cash.

-

You can pay in GYD without going to a bank or cambio.

-

You can control your travel budget and avoid surprise costs.

-

-

Disadvantages:

-

Some small shops and places do not take cards, so you still need cash.

-

The wise multi-currency card is only for visitors, not people who live in Guyana.

-

You might pay ATM fees when you take out cash.

-

You should always have some cash with your travel card. This helps you pay where cards are not taken. Always pay in local money to skip extra fees. If you use ATMs, pick a card with low withdrawal fees.

Here is a table that shows popular travel money cards and their fees for Guyana:

|

Travel Money Card Provider |

Foreign Transaction Fees |

Notes |

|

Wise Multi-Currency Card |

None (on held currencies) |

Supports spending in GYD, low ATM fees |

|

Revolut |

None (on held currencies) |

Multi-currency, competitive exchange rates |

|

Chime |

None |

No foreign transaction fees, ATM fees apply |

|

Monzo |

None |

No foreign transaction fees, ATM fees apply |

|

Netspend |

~4% |

High transaction fees, less recommended |

You can see that the wise multi-currency card, Revolut, Chime, and Monzo have the lowest fees for Guyana. Netspend costs more, so it is not a good choice for travelers.

Digital Payments

Digital payments are getting more common in Guyana. You can use mobile wallets like MMG, WiPay, and OnePAY to pay people, shops, or buy things online. Many people use debit cards, bank transfers, and cash-on-delivery, but more shops now take digital payments. NFC and QR code payments are growing, showing that Guyana’s fintech sector is getting bigger.

Payment gateways like TransFi let you use mobile wallets, cards, bank transfers, and even cryptocurrencies. This makes it easier to shop online and send money across borders. The government and companies are working to make payment systems better, which helps people trust online shopping and digital payments.

Local shops want more customers, so they are starting to take digital payments. You will see more digital payment options in cities, but cash and bank transfers are still important, especially outside the city. Guyana is moving toward using less cash, but you should always keep some cash just in case.

ATMs in Guyana

ATM Locations

You will find ATMs in most major cities in Guyana. Georgetown has the highest number of ATMs, making it easy for you to get cash. Other cities like Linden, New Amsterdam, Bartica, and Parika also have ATMs, but you will see fewer machines there. Most ATMs in Guyana accept international cards, including Visa and Mastercard. If you use a travel money card, you can make atm withdrawals at these machines.

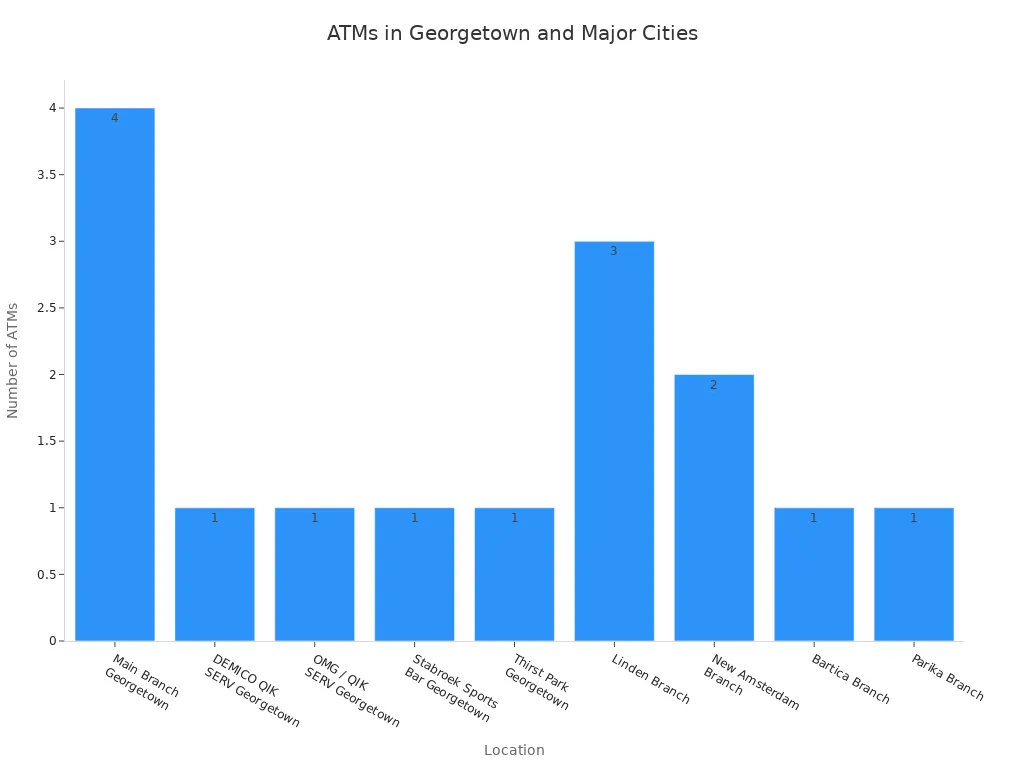

Here is a table showing where you can find ATMs in Georgetown and other cities:

|

Location |

Number of ATMs |

|

Main Branch, Georgetown |

3 ATMs + 1 Drive-Through |

|

DEMICO QIK SERV, Georgetown |

1 ATM |

|

OMG / QIK SERV, Georgetown |

1 ATM |

|

Stabroek Sports Bar |

1 ATM |

|

Thirst Park, Georgetown |

1 ATM |

|

Linden Branch |

3 ATMs |

|

New Amsterdam Branch |

2 ATMs |

|

Bartica Branch |

1 ATM |

|

Parika Branch |

1 ATM |

Avoid ATM Fees

You should always try to avoid atm fees when you travel. Many banks in Guyana charge transaction fees for atm withdrawals, especially if you use an international card or a travel money card. The wise multi-currency card helps you avoid atm fees in guyana because it offers low-cost atm withdrawals and good exchange rates. You can also use the wise multi-currency card to check your balance and manage your spending. Always choose ATMs that belong to major banks, as they are more reliable and may have lower transaction fees. If you use a travel money card, check the terms to see how many free atm withdrawals you get each month.

ATM Safety Tips

You must stay safe when you use ATMs in Guyana. Follow these steps to protect your money and your travel money card during atm withdrawals:

-

Keep your PIN secret and never write it down.

-

Do not use easy-to-guess PINs like your birthday.

-

Change your PIN if you think someone knows it.

-

Always keep your travel money card in sight.

-

Check the amount before you finish the transaction.

-

Take your card and receipt after every atm withdrawal.

-

Never share your account number unless you start the call.

-

Check your statements often for strange charges.

-

Tell your bank you are traveling to Guyana.

-

Never leave your wise multi-currency card in your bag or car.

-

Do not keep your checkbook with your cards. 12. Use cards with chip and PIN for extra security.

The wise multi-currency card gives you extra protection with chip and PIN technology. You can use your travel money card for atm withdrawals and daily spending, but always stay alert and follow these safety tips.

Exchanging Money

Best Currency to Take to Guyana

You should bring US dollars when you visit Guyana. US dollars are the best choice for travelers. You will get a good exchange rate with them. Most banks and cambios like US dollars more than other foreign money. It is easier to swap US dollars for Guyanese dollars than other money. If you bring other currencies, you might pay higher fees or get worse rates.

Where to Exchange

You can change money at different places in Guyana. The main options are:

-

Banks: Big banks in Georgetown and other cities let you exchange money. Banks are safe and show clear rates. You may need your passport.

-

Cambios: Licensed cambios are fast and easy for exchanges. Cambios often give good rates and lower fees than hotels.

-

Hotels: Some hotels let you exchange money, but their rates are not as good. Only use hotels if you cannot find a bank or cambio.

Here is a table to help you compare your choices:

|

Place |

Good Exchange Rate |

Low Transaction Fees |

Convenience |

|

Banks |

✅ |

✅ |

Moderate |

|

Cambios |

✅ |

✅ |

High |

|

Hotels |

❌ |

❌ |

High |

Never change money on the street. Street exchanges can be risky. You might get scammed or get a bad rate.

Exchange Rates

Always check the latest exchange rates before you swap money. In Guyana, the rate for US dollars to Guyanese dollars does not change much. Over the last 30 days, the average rate was about 209.18 GYD for 1 USD. The rate stays steady, so you can plan your spending. Most banks and cambios show their rates clearly. You can also look online for the newest rates.

If you want the best deal, check rates at a few places first. A good rate and low fees help you get more Guyanese dollars. Always keep your receipts after you change money. This helps you track what you spend and makes it easier if you need to swap money back before you leave Guyana.

Managing Money Safely

Budgeting Tips

You can manage your travel budget in Guyana by planning ahead. Start by booking your flights early to avoid high prices. Choose affordable places to stay, such as hostels or AirBnB, to keep your budget on track. Pack everything you need so you do not have to buy extra items during your trip. Travel on less expensive days, like Tuesdays, and use budget airlines when possible. Public transport, such as buses, costs less than taxis. Buy food from local markets or cook your own meals to save on travel expenses. If you want to stretch your budget, you can even look for ways to earn money while traveling, like freelancing.

-

Book flights in advance, especially return tickets.

-

Pick budget-friendly accommodation.

-

Pack well to avoid extra purchases.

-

Travel on cheaper days and use budget airlines.

-

Use public transport instead of taxis.

-

Buy food from markets and cook when possible.

-

Consider earning money while traveling.

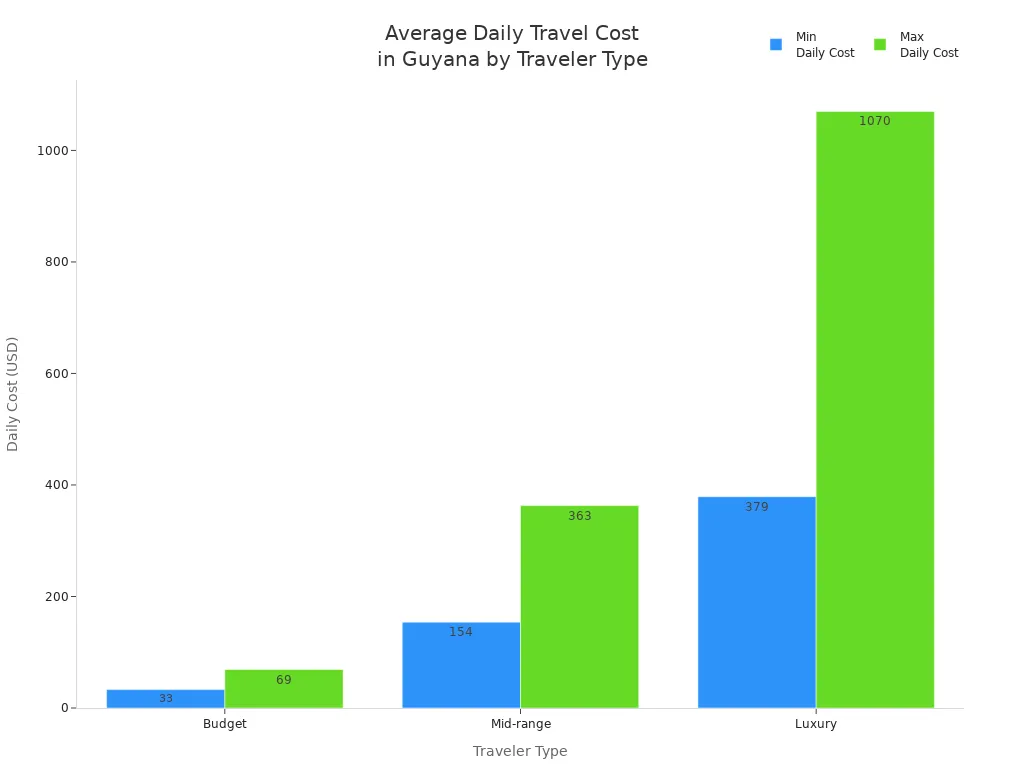

You can see how much you might spend each day in Guyana:

|

Traveler Type |

Daily Cost Range (per person) |

Food, Travel, and Sightseeing Cost Range (per person) |

|

Budget |

Approximately $33 to $69 |

Included in lower range |

|

Mid-range |

Approximately $154 to $363 |

$33 to $69 (solo travelers) |

|

Luxury |

$379 to $1,070 |

$66 to $290 |

Keeping Money Secure

You should always keep your cash and cards safe. Use real-time notifications to watch your card activity. Set strong passwords for your card apps. Carry backup cards or cash in case you lose your main card. The wise multi-currency card lets you freeze or unfreeze your card instantly if needed. Keep your cash in a money belt or wallet and do not show large amounts in public. Split your cash in different places so you do not lose everything at once. Withdraw cash only in safe, well-lit areas during the day. Tell your bank about your travel plans to avoid card blocks. Use contactless payments, chip & PIN, or mobile wallets for extra security. When sending money to Guyana, always use trusted services.

-

Enable real-time transaction alerts.

-

Use strong passwords for online accounts.

-

Carry backup cards or cash.

-

Use travel money cards with security features.

-

Keep cash hidden and split in different places.

-

Withdraw cash in safe areas.

-

Notify your bank before your trip.

-

Prefer secure payment methods like the wise multi-currency card.

What to Do If You Lose Your Card

If you lose your card in Guyana, act fast. Contact your card issuer right away to report the loss and request a replacement. Keep your card issuer’s contact details separate from your card. Before you travel, write down the toll-free emergency number for your destination. For Visa cards, you can call Visa’s Global Customer Assistance Services at +1 303 967 1090 any time. These steps help you stay safe and avoid problems with sending money to Guyana or accessing your funds.

-

Call your card issuer to report the loss.

-

Keep card issuer contact info in a safe place.

-

Note the emergency number before your trip.

-

Contact Visa GCAS at +1 303 967 1090 for help.

You can manage your money in Guyana with confidence if you plan ahead. Use travel money cards like Wise or Monzo for low fees and easy app management. Carry both cash and cards for flexibility. Modern payment methods such as contactless payments and mobile wallets work well in many places.

-

Choose cards with low ATM fees and withdraw larger amounts to save money.

-

Use exchange rate calculators and mobile apps to track your spending.

-

Keep a backup card or some cash for emergencies.

FAQ

Can you use US dollars in Guyana?

You can use US dollars for big purchases like hotels or tours. Most small shops and taxis want Guyanese dollars. Always carry some local cash for daily needs.

Are credit cards widely accepted in Guyana?

You can use credit cards in many hotels, restaurants, and stores in Georgetown. In rural areas, most places only take cash. Always ask before you pay.

Where can you exchange money safely in Guyana?

You can exchange money at banks and licensed cambios. These places offer safe service and fair rates. Avoid street money changers to protect yourself from scams.

What should you do if an ATM keeps your card?

Stay calm. Visit the bank branch linked to the ATM right away. Bring your ID and explain what happened. The staff can help you get your card back.

Related content