Understanding the HUF Currency in the Global Currency Landscape

Author:XTransfer2025.08.20HUF

The huf currency is weaker than the u.s. dollar and euro. One u.s. dollar is often worth more than 350 forint. One euro can be worth over 380 forint. This low value makes hungary cheaper for travelers. When the forint gets weaker, it is even more affordable. Investors pay close attention to the huf. Changes in the currency can change how much money they make. The strength of the hungarian forint affects travel and investment choices in hungary.

|

Aspect |

Impact on Travelers and Investors |

Strategies/Considerations |

|

Travel Costs |

A weak forint makes hungary good for people who want to save money. |

Watch exchange rates and use local ATMs for better deals. |

|

Investment Decisions |

Investors may find chances when the huf loses value, but they need to be careful. |

Spread out investments and use tools to lower risk. |

Highlights

-

The Hungarian Forint (HUF) is not as strong as the US dollar or euro. This makes Hungary a cheap place for people to visit. The forint's value goes up and down a lot. This happens because of Hungary's economy, energy needs, inflation, and big world events like the war in Ukraine. People should exchange money in Budapest. They should use local bank ATMs. They should not use airport exchange desks. It is best to pay in forint to get good rates. Investors have some risks from Hungary's debt, political rules, and inflation. But they can find chances in real estate and some stocks. Watching inflation, interest rates, and world events helps people make smart choices about the forint.

HUF Currency Overview

What is the Forint?

The forint is Hungary’s official currency. People use it every day to buy things and pay for rides. The huf currency has coins and paper money. Each banknote shows a famous Hungarian leader. The other side shows a place or event from Hungary. Coins and notes have special features to stop fake money. These features also help people who cannot see well.

Here is a table that lists the main types and features of the forint:

|

Currency Type |

Denominations |

Key Features |

|

Banknotes |

500, 1000, 2000, 5000, 10,000, 20,000 forints |

Famous Hungarian leaders, related places or events, advanced security features like watermarks, holographic strips, tactile lines |

|

Coins |

5, 10, 20, 50, 100, 200 forints |

Bimetallic 200-forint coin, Széchenyi Chain Bridge design, no fillér coins in use |

The 1,000 forint note is blue and shows King Matthias Corvinus. It has a shiny stripe, ink that changes color, and raised lines. There are other security features too.

History of the Hungarian Forint

The forint has been used in Hungary for a long time. The modern forint started in 1946 after World War II. Hungary had big money problems then, so they needed a new currency. The name "forint" comes from old gold coins called florins.

Hungary first used the forint from 1868 to 1892. After the war, new coins were made from copper and aluminum. The forint was once tied to gold, but this changed later. During the communist years, coins looked different to match new ideas. After 1989, Hungary changed to a market economy. The forint changed again. Fillér coins were removed in 1999 because of rising prices. Hungary joined the European Union but still uses the forint.

Current Exchange Rates

HUF vs. USD

The forint often trades at a much lower value than the u.s. dollar. As of early July 2025, one u.s. dollar equals about 338 to 339 forint. Over the past year, the huf currency has shown some strength against the dollar. In February 2025, the exchange rate reached a high of about 395 forint per dollar. By July, the rate dropped to around 338 forint per dollar. This change means the forint gained value compared to the dollar during this period. Many factors, such as economic news, central bank actions, and world events, can cause the exchange rate to move.

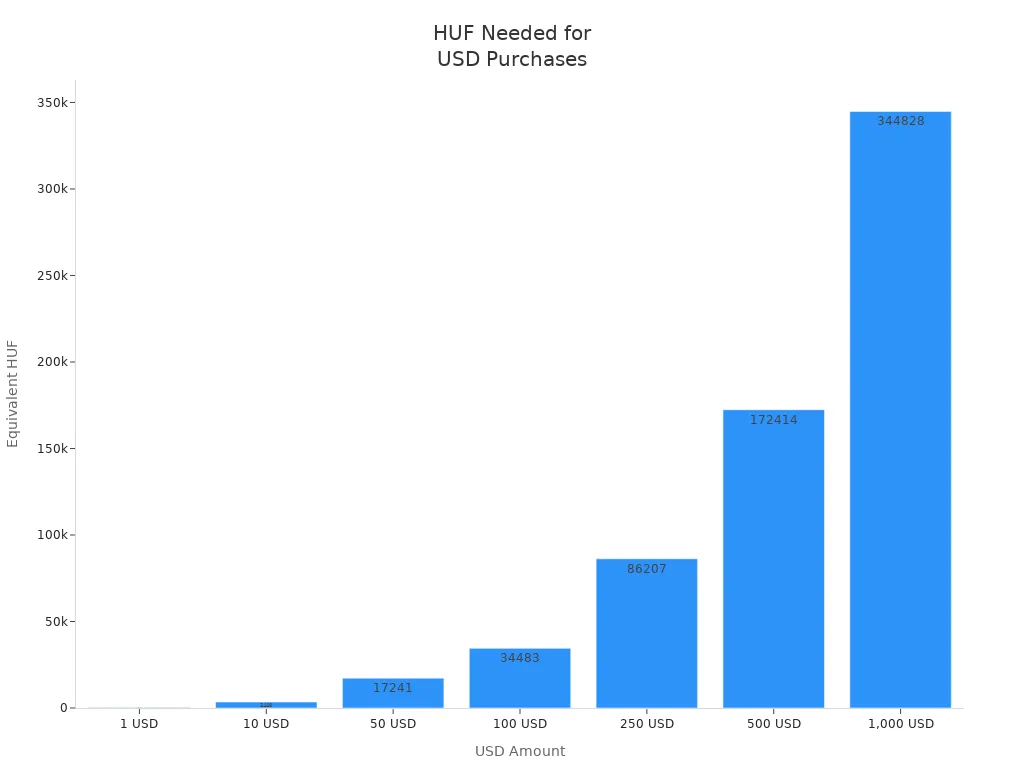

Travelers and investors often look at the value of the dollar when planning trips or making business decisions. The huf exchange rates affect how much forint someone needs to buy goods or services in the United States. For example, a meal that costs 10 dollars in the U.S. would require about 3,448 forint. If someone wants to buy a 100-dollar item, they would need about 34,483 forint.

|

USD Amount (approximate cost of goods/services) |

Equivalent Hungarian Forint (HUF) |

|

1 USD |

~345 HUF |

|

10 USD |

~3,448 HUF |

|

50 USD |

~17,241 HUF |

|

100 USD |

~34,483 HUF |

|

250 USD |

~86,207 HUF |

|

500 USD |

~172,414 HUF |

|

1,000 USD |

~344,828 HUF |

The value of the dollar compared to the forint can change quickly. People who travel or invest in Hungary should watch these changes to get the best deal.

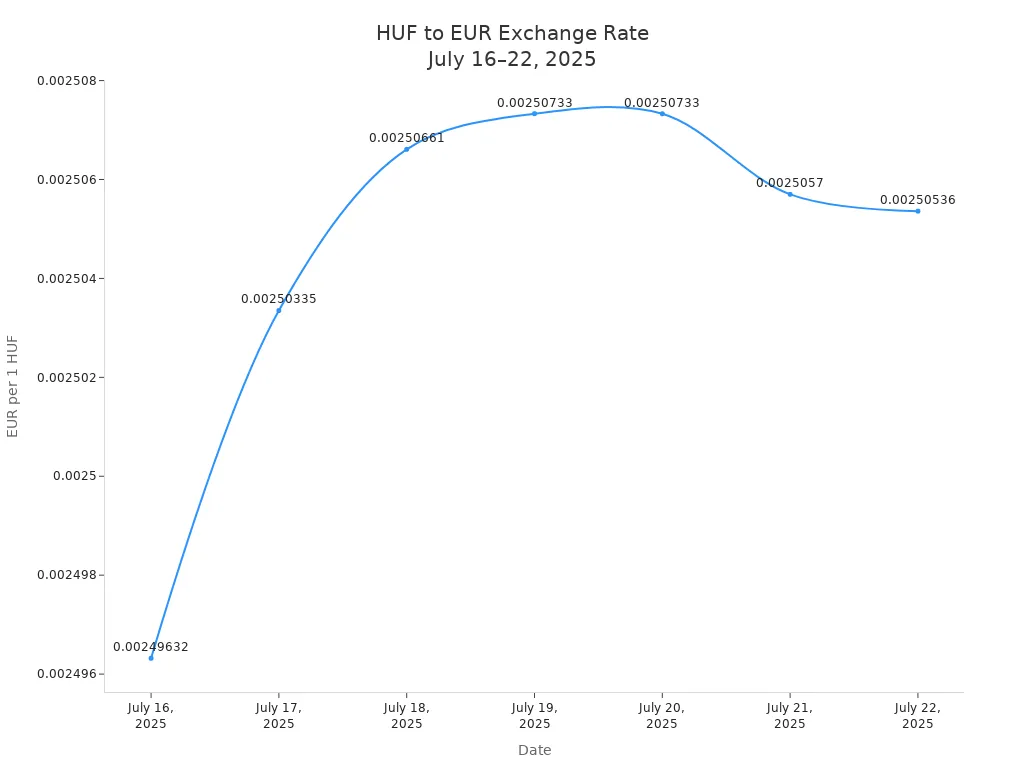

HUF vs. EUR

The euro is the main currency in the eurozone. Hungary does not use the euro, so people must exchange their money when they visit or do business. The forint has stayed mostly stable against the euro in recent weeks. On July 23, 2025, one euro equaled about 399.3 forint. The exchange rate moved only a little, staying between 398.71 and 400.33 forint per euro over the past week. The average rate was about 399.17 forint per euro.

|

Date |

Exchange Rate (HUF per 1 EUR) |

|

July 23, 2025 |

399.3 |

|

Past week range |

398.71 - 400.33 |

|

Average (past week) |

~399.17 |

The exchange rate between the forint and the euro affects both travel and business. Since Hungary is not in the eurozone, people must exchange euros for forint. The amount of forint received depends on the current exchange rates. When the forint loses value, travelers get more forint for each euro, making Hungary cheaper to visit. For businesses, changes in the exchange rate can make imports and exports more expensive or cheaper. This can make it harder to plan for costs.

HUF vs. GBP

The British pound (GBP) is another major currency. The forint usually has a lower value than the pound. One pound often equals more than 450 forint. The exchange rate between the forint and the pound can move up or down based on changes in the British and Hungarian economies. When the pound gets stronger, travelers from the UK can buy more with their money in Hungary. If the forint gains value, it costs more pounds to buy the same amount of forint.

For example, if a British traveler wants to spend 100 pounds in Hungary, they would need about 45,000 to 46,000 forint, depending on the current exchange rate. The value of the pound compared to the forint can change quickly, so travelers should check the latest rates before exchanging money.

HUF vs. Other Currencies

The forint also trades against other regional currencies, such as the Polish zloty (PLN) and the Czech koruna (CZK). The exchange rate between the forint and the Czech koruna has shown a slight drop in the forint's value recently. The 30-day average rate is about 16.20 forint per koruna. Over 90 days, the rate stayed close to 16.21 forint per koruna, showing only a small change.

|

Metric |

Value (CZK to HUF) |

Change |

|

30-day average |

16.1953 HUF |

-0.03 |

|

90-day average |

16.2112 HUF |

-0.42 |

The forint remains mostly stable against the Polish zloty. For example, 500,000 forint equals about 5,330 zloty. One million forint equals about 10,660 zloty. These rates help travelers and businesses compare costs between Hungary and its neighbors.

|

Amount (HUF) |

Equivalent (PLN) |

|

500,000 HUF |

5,330.05 PLN |

|

1,000,000 HUF |

10,660.10 PLN |

|

10,000,000 HUF |

106,601.00 PLN |

The eurozone's main currency, the euro, also affects the forint's value. When the euro gets stronger, the forint may lose value, making imports more expensive for Hungary. The huf currency often shows more movement than the euro, the dollar, or the pound. People who travel or invest in Hungary should always check the current exchange rates before making decisions.

Strength and Weakness

Why HUF is Among the Weakest Currencies

The forint is one of the weakest currencies in Europe. Many experts say there are several reasons for this. Hungary’s economy got smaller in the second quarter. Fewer people in Europe wanted to buy from Hungary, which hurt the forint. Other countries nearby also have problems like high inflation and trouble making goods. These problems put more stress on the currency. People worry about possible rate cuts and global money problems. This makes things even harder for the forint. The region’s weak economy and slow return of shoppers also make the currency less stable.

Financial experts say Hungary depends a lot on loans from other countries and has a lot of debt. These things make the forint weaker. Some of Hungary’s rules, like special taxes on some businesses, worry investors from other countries. This makes people trust the currency less.

If we look closer, we see many reasons for the forint’s weakness:

-

Hungary spends a lot on energy from other countries. This makes its current account deficit bigger. When investors get nervous or the US dollar is strong, Hungary is at more risk.

-

The central bank stopped raising rates even though inflation was over 20%. Many experts thought rates should be higher to help the forint.

-

The National Bank of Hungary tried to take money out of the system instead of raising rates. Some experts did not think this would help the forint.

-

Hungary needs loans from other countries and has a lot of debt. This adds more risk.

-

Special taxes on some industries make investors and banks worry.

-

Fights with the European Union and money problems add more doubt.

-

The economy got smaller, and weak demand from Europe made things worse for the forint.

These points show why the forint is seen as one of the weakest currencies in the area.

Factors Affecting the Forint

Hungary buys most of its energy from other countries. This is a big reason the forint is weak. When energy prices go up, Hungary’s current account deficit gets bigger. Hungary then needs more foreign money to pay for imports. The forint reacts quickly to changes in how investors feel. If the forint loses value, it costs more to pay back loans from other countries. This can also make prices rise faster in Hungary. The central bank may need to raise interest rates to help the currency. Hungary’s need for energy from other countries makes the forint unstable and easy to lose value.

Inflation and what the central bank does also matter for the forint. Inflation in Hungary recently hit the central bank’s goal of 3% for the first time in years. The National Bank of Hungary kept interest rates high at 6.50% to fight inflation. This helped slow the forint’s fall but made borrowing money harder. If the central bank moves too slowly or faces political pressure, investors may lose trust. High inflation and Hungary’s budget and trade deficits put more stress on the forint. If inflation slows and real interest rates go up, the forint could get stronger. What the central bank does, plus things like EU funds and world risks, are important for the currency’s future.

World events also affect the forint. Big problems in the world, like the war in Ukraine, make things harder for Hungary. Hungary needs Russian energy, so it feels the effects of world energy price changes. When energy prices go up, inflation rises, and the forint can lose value. Investors lose confidence when things are uncertain, which hurts the currency. Hungary is close to conflict areas and needs energy, so the forint is more sensitive to world events.

-

Risks from wars, like the Russia-Ukraine war, affect the forint and other nearby currencies.

-

Countries near the fighting and those that need Russian energy see their currencies get weaker.

-

Changes in world prices, especially for energy, cause higher inflation and unstable exchange rates.

-

Investor confidence and market mood can change fast during world crises, which affects the forint’s value.

The forint is weak because of many local and world reasons. Hungary’s choices, its need for energy, high inflation, and world events all matter. The huf currency will likely stay sensitive to these things as Hungary’s economy changes.

HUF in the Global Market

International Use of the Forint

The forint is Hungary’s main currency, but it is not used much in world trade. Most big companies and banks do not use the forint for large deals. They usually pick euros or US dollars instead. Both local and foreign banks can work in Hungary. Since 2001, people can change the forint into other money without limits. This means anyone can swap it for other currencies.

-

The forint works with the SWIFT system, which helps send money to other countries.

-

Most payments in Hungary use wire transfers.

-

Letters of credit are often used for new or big deals.

-

Banks from the EU can offer cross-border services in Hungary.

-

The Hungarian National Bank controls the forint and makes money rules.

Even with these things, the forint is not a big part of world trade. Most businesses use euros or dollars when sending money to other countries. Hungary is still working to join the SEPA system. This would make sending euros inside the EU easier.

Liquidity and Forex Trading

Liquidity shows how easy it is to buy or sell a currency without changing its price a lot. The forint is traded on the world currency market, but it is not as easy to trade as the euro or dollar. Studies say that liquidity is important for Central European currencies like the forint. It affects how fast the forint’s price can move when people trade it.

The forint’s liquidity links it to other nearby currencies, like the Czech koruna and Polish zloty. Experts do not know the exact numbers for the forint’s liquidity compared to these currencies. The forint is still important in Central Europe, but it is not traded as much as the biggest world currencies.

|

Currency |

Liquidity Level |

Main Use in Forex Market |

|

Forint |

Moderate |

Regional trading, Hungary |

|

Euro |

High |

Global and regional trading |

|

US Dollar |

Very High |

Global trading |

|

Czech Koruna |

Moderate |

Regional trading |

|

Polish Zloty |

Moderate |

Regional trading |

Practical Implications

For Travelers

People who visit Hungary see both good and bad sides with the forint. The forint’s value compared to the u.s. dollar and euro can make Hungary cheaper. When the forint gets weaker, things cost less for visitors. Prices for food, hotels, and fun places look high because the numbers are big. But these prices are usually lower than in Western Europe. For example, a meal at a nice place costs about 4,000–6,000 forint. That is about 10–15 euro or 11–16 dollar.

Tourists should remember these tips:

-

ATMs are not easy to find in small towns.

-

Exchange desks at airports, hotels, and tourist spots give bad rates and charge more.

-

Changing money on the street is not allowed and is dangerous.

-

Dynamic Currency Conversion at ATMs gives a worse deal; always pick to pay in forint.

-

Use ATMs from banks like OTP Bank or K&H Bank. Do not use Euronet or other independent ATMs because they charge more.

-

Exchange your money in Budapest for better rates, not at home or at the airport.

-

Take out more money at once so you pay fewer fees.

-

Good exchange offices are on the Grand Boulevard or in District V.

-

Always ask for a receipt and keep it safe.

-

Do not try to change coins back, as it is hard outside Hungary.

-

“No Commission” signs can still mean bad rates.

-

Paying in euro in Budapest is not a good idea; forint is better.

-

Check the Hungarian National Bank’s rates online to compare.

Tourists should also check exchange rates, use good currency converter apps, and say no to DCC when paying by card. Booking hotels early and going to less busy places can help save money, especially when it is crowded.

For Investors

People who invest in the forint face both risks and chances. The forint has changed a lot against the euro and u.s. dollar. In 2025, it dropped 8% against the euro. Inflation is high, over 4%, and the central bank’s interest rate is 10.25% since March 2024. The strong dollar and Hungary’s big current account deficit, at 4.5% of GDP, make things harder for the forint.

Main risks are:

-

New rules in real estate, especially for short-term rentals.

-

High loan costs and strict rules in energy and banking.

-

Risks in government bonds, as foreign investors are leaving.

-

Delays in EU funds and possible lower ratings could cause people to sell.

-

Political controls and price rules limit what the central bank can do.

There are also chances in:

-

Real estate outside Budapest, where more people want to live because of moving and EU green plans.

-

Stocks in areas that are not hurt much by local inflation, like exporters and factories.

-

Some high-yield bonds if inflation slows down and EU funds come in.

Investors should protect themselves from losing money if the forint drops more. Spreading out investments and picking strong sectors can help lower risk. Watching what the central bank says and planning for different outcomes is smart, since the forint can change fast with local or world news.

Future Outlook

Trends for the HUF Currency

The forint has many problems ahead. Experts see both risks and chances for it. Some think the forint will keep losing value. They say Hungary’s old money rules kept real interest rates low. This made the forint weaker than the Czech koruna or Polish złoty. Others say new moves by the Hungarian National Bank helped the forint. The bank raised interest rates higher than in the United States. This made the forint get stronger for a while. Most experts agree that outside events are a big risk. The war in Ukraine and Hungary’s ties to Russia worry investors. These things can make the forint drop fast.

Hungary needs energy from other countries. If oil stops coming, prices go up. This can cause inflation and hurt the forint. The central bank must act to keep the forint steady. If it raises rates too much, loans cost more. If it does nothing, the forint may get weaker against the dollar and euro.

What to Watch

People who want to know about the forint’s future should watch these signs:

-

Inflation in Hungary

-

Interest rate changes by the Hungarian National Bank and the European Central Bank

-

Hungary’s GDP growth compared to the Eurozone

-

Trade balance numbers

-

Capital flows in and out of Hungary

-

Political and geopolitical risks, such as energy supply issues

-

Market mood and technical signals

Ukraine stopped sending oil through the Druzhba pipeline. This shows how energy problems can hurt the forint. Higher energy costs can cause more inflation and a bigger trade deficit. This puts stress on the forint and may make money leave Hungary. The central bank may need to act to stop inflation, but this may not be enough.

Experts do not always agree on what will happen next. Some say the new central bank leader helped the forint. Others think outside events matter more. Political changes that hurt the central bank’s freedom could weaken the forint for a long time. Investors and travelers should watch these trends and compare the forint to the dollar and other big currencies.

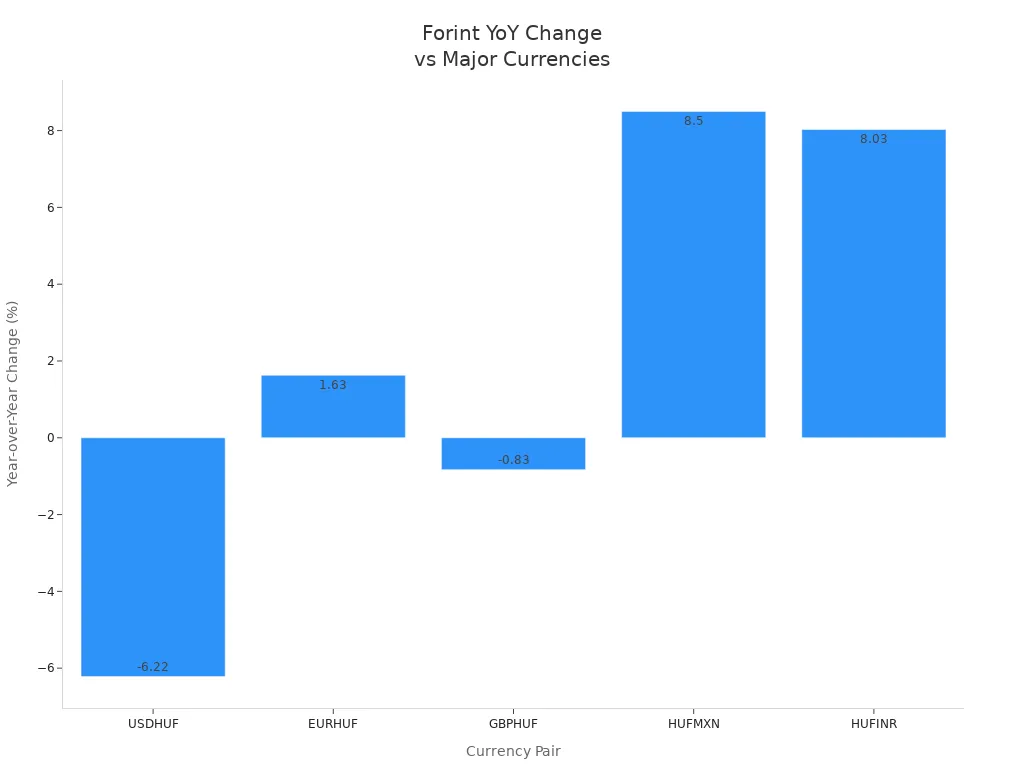

The Hungarian forint is not as strong as other big currencies.

|

Currency Pair |

Current Rate (Jul 2025) |

Year-over-Year Change (%) |

|

USDHUF |

~340.24 |

-6.22% |

|

EURHUF |

399.25 |

+1.63% |

|

GBPHUF |

460.06 |

-0.83% |

|

HUFMXN |

0.0548 |

+8.50% |

|

HUFINR |

0.2528 |

+8.03% |

Hungary’s economy, rising prices, and central bank choices all matter for the forint. Experts say travelers should watch for price changes. Investors might look at banks in Hungary, like OTP Bank, for chances. Good websites like Wise.com and FocusEconomics help people check exchange rates and news. Learning about these things helps people make smart choices with money.

FAQ

What does HUF stand for?

HUF means Hungarian Forint. People in Hungary use this money. The code "HUF" uses the first letters of "Hungarian Forint." Banks and exchange places show this code when listing rates.

Can travelers use euros or dollars in Hungary?

Most stores and places to eat in Hungary take only forint. A few hotels in tourist spots might take euros, but the rate is not good. Travelers should change their money to forint before they shop or eat.

Why does the forint have a low value compared to the dollar or euro?

Hungary’s economy is smaller than those using the dollar or euro. The country needs to buy many things from other countries and has rising prices. These things make the forint weaker. Investors also look at Hungary’s debt and money rules.

Is it safe to exchange money at the airport in Hungary?

It is safe to change money at the airport, but the rates are not as good as in the city. Travelers get more forint if they use ATMs or go to exchange offices in Budapest.

How can someone check the latest HUF exchange rates?

People can look up the newest rates on the Hungarian National Bank’s website or use trusted apps like Wise. Many banks and news websites also show the latest exchange rates. Rates change every day, so checking before changing money is smart.

Related content