MYR Currency Explained: What Drives the Strength of the Malaysian Ringgit?

Author:XTransfer2025.08.19MYR

Malaysia’s myr currency has become much stronger in 2025. It has gone up by 8.31% against the US dollar this year. The malaysian ringgit is doing well because of strong changes in the country and good things happening around the world. The country is more stable now. More people from other countries are investing money in Malaysia. This has helped the currency get stronger. The US has lower inflation now. Experts think the Federal Reserve will lower interest rates. These things have also helped the myr currency. Experts believe the myr will keep getting stronger. They think it will be worth more than other big currencies. They expect it to reach MYR4.00/USD by the end of the year.

Highlights

-

Malaysia’s economy is doing well in 2025. More people have jobs and are spending money. Investments are going up too. This helps the ringgit become stronger.

-

The government uses money wisely. They put money into projects and digital technology. This keeps the currency steady and makes it good for investors.

-

Foreign investments and exports are important. Electronics and palm oil are big exports. These things make more people want the ringgit. This helps keep it strong.

-

Things happening around the world also matter. The US dollar is weaker now. Oil prices are not changing much. These things help the Malaysian ringgit get stronger.

-

People and investors can stay safe from currency risks. They can use tools like forward contracts. They can also choose safe local investments.

MYR Currency Drivers

Economic Growth

Malaysia’s economy is doing well in 2025. The country’s GDP will grow between 4.0% and 5.5%. This is better than the 3.5% growth in 2023 and 5.1% in 2024. Many things are helping the economy get stronger:

-

People are spending more money, with a 5% rise.

-

More people have jobs, and unemployment is low at 3.1%.

-

Investments are going up by 9.7% in 2025.

-

Services and manufacturing are growing by 5% and 4.1%.

Malaysia’s economy is strong, but there are some risks. Problems in global trade and US tariffs could slow things down later this year. Still, the government is working on good policies and reforms. This keeps the outlook good. These things help the myr currency by bringing in investors and keeping the economy stable.

Fiscal Policy

Malaysia’s government is spending money to help the country grow. In 2025, the budget is MYR 421 billion. MYR 86 billion is for new projects. MYR 335 billion is for running the country. The government wants to lower the fiscal deficit to 3.8% of GDP. This shows better money management.

|

Investment Area |

Amount (MYR) |

Description and Expected Impact |

|

Developmental Projects |

86 billion |

Important infrastructure projects to help the economy and improve lives. |

|

Total Budget Allocation |

421 billion |

Includes 335 billion for running costs and 86 billion for new projects. |

|

Fiscal Deficit Projection |

3.8% of GDP |

Lower deficit means better money management and a stable economy. |

|

GDP Growth Projection (2025) |

4.5% - 5.5% |

Shows steady economic growth that helps the currency stay strong. |

Big investments in digital technology are important. The Malaysia Digital plan brought in MYR 42.58 billion by June 2025. Much of this money goes to data centers and cloud services. These projects give people jobs and show Malaysia is ready for the digital world. Digital investments went up 125% in Q2 2025. This shows investors trust Malaysia. These actions make the myr currency stronger by making the economy tougher and bringing in money from other countries.

Investment Flows

Foreign direct investment is very important for Malaysia’s economy and the myr currency. The government wants both local and foreign investments. This helps keep the currency steady. Lately, Malaysia sends more money out than it gets, but foreign investment is still very important.

Malaysia’s rules help bring in smart investments in important areas. The Special Strategic Investment Fund is worth $450 million. It helps industries that create jobs and sell more goods to other countries. These investments help Malaysia compete and make the myr currency stronger by raising demand for local things.

Selling goods to other countries also helps the currency. Malaysia has a big trade surplus. From January to April 2025, the surplus was MYR 46.2 billion. Electrical and electronics exports are 42.4% of all exports and grew by 7%. The digital economy and green energy projects help Malaysia sell more things and get new investments.

Investors trust Malaysia because it focuses on new ideas, selling many kinds of goods, and working with other countries. All these things help keep the myr currency strong in 2025.

Global Influences

US Dollar Trends

The us dollar is very important for the malaysian ringgit. In 2025, the us dollar got weaker against many big currencies. This made the malaysian ringgit go up by 5.5% against the us dollar. Many things caused this change:

-

The Federal Reserve did not change interest rates and kept tightening money.

-

The US and China had fewer trade fights, so there was less worry.

-

The Chinese yuan stayed steady, and Asia’s economy looked good.

OCBC Bank thinks the malaysian ringgit will be about 4.20 MYR/USD in 2025 and get stronger to 4.10 by the end of the year. But some experts say that trade problems and world issues could slow down this growth.

Commodity Prices

Commodity prices like crude oil and palm oil affect Malaysia’s exports and currency. In 2025, crude oil sold for $74 to $78 per barrel. When oil prices go up, palm oil prices usually rise too because of biodiesel needs. If crude oil goes up by 10%, palm oil can go up by 3–5%. This helps Malaysia earn more money from exports and keeps the malaysian ringgit strong.

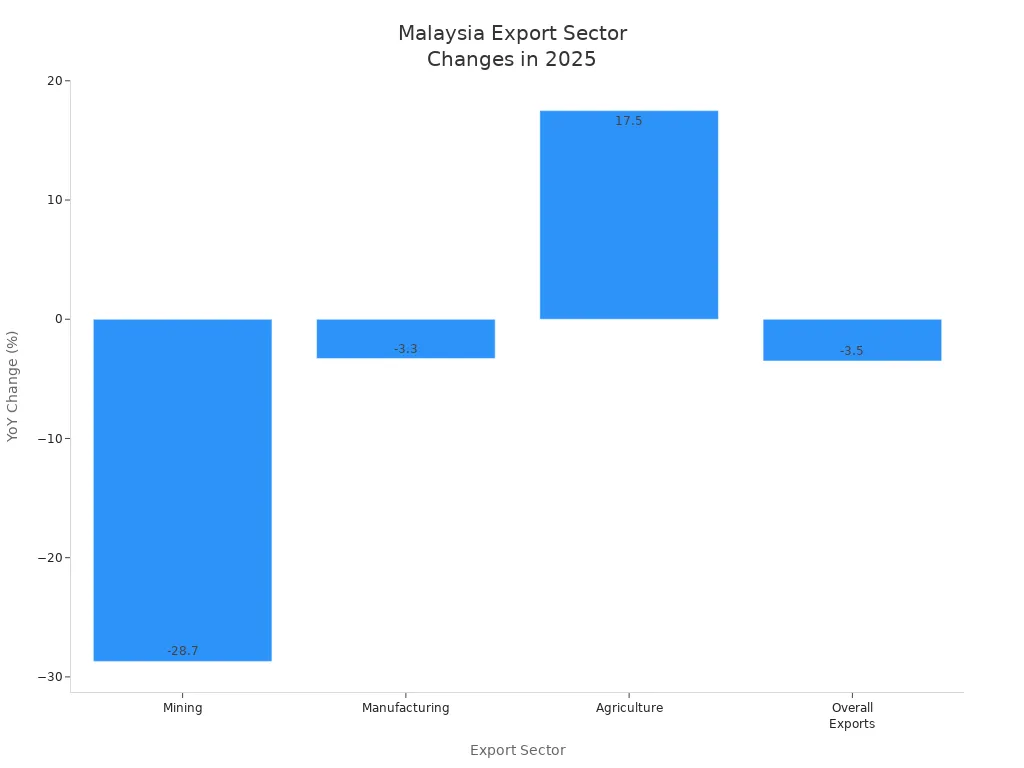

But in 2025, mining and manufacturing exports went down. This made the trade surplus smaller and put pressure on the currency. Agriculture exports, like palm oil, grew by 17.5% and helped make up for some losses.

Regional Economy

The malaysian ringgit is also shaped by the region’s economy. Asia-Pacific is a big place for semiconductor and AI exports, which helps Malaysia grow. Trade fights, like new us dollar tariffs, made things cost more and brought worry for exporters. Some important products got special rules, but there are still risks.

Malaysia’s central bank lets the exchange rate move but steps in if it changes too much. Trade deals like RCEP and CPTPP help keep currency ties strong between countries. This makes the malaysian ringgit tougher. Even though GDP growth was slower early in 2025, strong local investment and working with ASEAN partners help the currency stay strong.

Malaysian Ringgit Performance 2025

Exchange Rate Trends

The MYR got stronger in 2025. Its value went up by about 5.69% against the US dollar. The exchange rate stayed in a clear range all year.

-

The lowest value was 1 MYR = 0.2216 USD on January 6, 2025.

-

The highest value was 1 MYR = 0.2382 USD on July 1, 2025.

-

The monthly averages kept going up:

-

January: 0.223 USD

-

February: 0.2251 USD

-

April: 0.2267 USD

-

May: 0.2343 USD

-

July: 0.2361 USD

-

Some days, the rates changed fast, but the main trend was up. This rise showed people trusted Malaysia’s economy and investors felt good about it.

Analyst Forecasts

Experts think the MYR will stay strong until the end of 2025. MIDF Research says the average rate will be about 4.34 MYR for each US dollar this year. In April 2025, the ringgit hit 4.434 MYR/USD, showing it kept getting stronger. IMF data from July 2025 shows the MYR traded around 5.76 to 5.79 for each Special Drawing Rights (SDR), which is another key level.

Analysts say the MYR will keep rising because the US dollar is weaker and Malaysia’s economy is strong. MIDF Research thinks the MYR will end the year near 4.34 per US dollar. The Trade Weighted Ringgit Index should go up to 95. They say steady trade surpluses and a healthy current account help this good outlook.

Some experts, like Robert Petrucci, are more careful. He talks about support and resistance levels for the USD/MYR pair. He also says world events and US news can make short-term changes. Petrucci thinks the MYR might face some pressure soon, but the big picture is still good.

Central Bank Actions

Bank Negara Malaysia (BNM) helps keep the MYR steady. In 2025, BNM promised to stop big swings in the exchange rate. The central bank works with the government to help money move in and out and keep markets calm.

BNM kept its policy rate at 3 percent for most of the year. Other countries felt pressure to cut rates, but BNM waited. In July 2025, BNM made a small cut of 0.25% to help with slow growth. This was the first cut in five years. The bank also tells companies to bring foreign money back to Malaysia and change export money into MYR.

BNM’s governor said that monetary policy alone cannot fix world trade problems. The bank uses many tools, like reforms, to help the MYR and keep the economy strong.

These steps show BNM acts early. By changing interest rates, helping money flows, and stepping in when needed, the central bank keeps the MYR steady and strong even when things are uncertain.

Impact and Outlook

For Malaysians

In 2025, Malaysian families see both good and bad effects from the MYR being strong. Inflation is low at 1.1% in the middle of 2025. This keeps most daily prices steady. Food prices only went up by 2.1%. Transport and fun activities cost a bit more, but not much. But house prices are rising fast. This is because the economy is growing and more people have jobs. Many families now find it hard to buy homes. The government stopped some help for fuel, sugar, and rice. They also added new taxes on expensive goods and sugary drinks. These changes make it harder for families to manage their money. To help, the government gave higher pay to 1.6 million workers. These actions show that a strong MYR can help keep prices low. But it does not always stop living costs from going up.

For Investors

A strong MYR in 2025 brings new chances for investors from Malaysia and other countries. The government wants people to invest in high-tech areas. These include artificial intelligence, smart cities, and electric cars. These fields can give safe and steady profits. The MYR is stronger because exporters change their foreign money into MYR. More foreign money is coming into Malaysia. This makes the country a better place to invest. Bond funds in MYR are popular because they are steady. This is important when world interest rates are not clear. Many investors now like local mixed asset funds. These funds help keep their money safe and give steady returns. But there are still risks. Exporters may have problems with new US tariffs and supply chain issues. Investors need to watch out if the MYR suddenly gets weaker because of world events.

|

Investment Trend |

Impact in 2025 |

|

High-tech sectors |

Strong government support, stable returns |

|

MYR bond funds |

Popular for stability and local currency exposure |

|

Export sector |

Faces tariff risks and possible depreciation if global demand weakens |

|

Domestic mixed assets |

Defensive strategy, focus on capital preservation |

Practical Tips

People and businesses can do things to handle currency risk in 2025. Forward contracts help set exchange rates ahead of time. This gives safety for future payments and stops sudden losses. Investors can use futures or ETFs to protect against MYR changes. Moving money from export areas like electronics and palm oil to local areas like healthcare and utilities can lower risk. Malaysia also has special financial tools like binary options and NDIRS for those who want more ways to protect their money. These tools help people and companies plan and keep their money safe.

-

Use forward contracts to keep exchange rates steady.

-

Put money in safe local areas.

-

Try MYR bond funds for steady profits.

-

Look at special financial tools for extra safety.

The MYR is strong in 2025 for a few reasons. The economy is growing well. The government has good rules and plans. More people from other countries are investing money in Malaysia. Things happening around the world also matter. The US dollar and prices of things like oil are important. Watching how the currency changes can help people make better choices. Malaysians and investors should look at some main signs:

-

GDP growth and inflation

-

Trade balance and monetary policy

-

Political stability

-

Global oil prices and US interest rates

Having the right facts helps people make safer choices when things change.

FAQ

What makes the Malaysian ringgit stronger in 2025?

Malaysia’s economy is growing fast. The government spends money wisely. More people are investing in Malaysia. These things help the myr currency get stronger. The us dollar is weaker now. Prices for things like oil are going up. This also helps the malaysian ringgit gain value.

How does the exchange rate affect daily life in Malaysia?

When the myr is strong, imported goods cost less. Families pay less for food and electronics. If the malaysian ringgit gets weaker, imports cost more. This can make living in Malaysia more expensive.

Why do investors watch the myr currency closely?

Investors want to know if the myr will go up or down. Changes in the exchange rate can change how much money they make. This is important for people trading in us dollars or buying things in Malaysia.

Can the malaysian ringgit continue its appreciation?

Experts think the myr will keep getting stronger. This will happen if Malaysia’s economy stays good and the us dollar stays weak. But big world events or trade problems could make the myr lose value.

What risks could cause depreciation of the myr?

Trade fights or lower prices for things Malaysia sells can hurt the myr. If the government changes its rules suddenly, this can also hurt the currency. If the us dollar gets stronger or Malaysia sells less to other countries, the malaysian ringgit could get weaker.

Related content