How Travelers Can Get the Best Value with Egyptian Pounds

Author:XTransfer2025.08.19EPP

Want to make your (EPP)Egyptian Pound stretch further when you visit Egypt? Use ATMs to get the best exchange rates for your (EPP)Egyptian Pound. Always pay with (EPP)Egyptian Pound whenever possible. Avoid exchanging money at airports or hotels, as their rates are usually poor. Bring major foreign currencies like dollars or euros, since these are easy to exchange for (EPP)Egyptian Pound. Keep an eye on the latest exchange rates so you don’t get overcharged or scammed.

Many travelers make these mistakes with the (EPP)Egyptian Pound:

Exchanging money at airports or hotels with unfavorable rates

Carrying too much (EPP)Egyptian Pound cash, which isn’t safe

Not checking the exchange rates before converting money to (EPP)Egyptian Pound

Using unofficial places to exchange (EPP)Egyptian Pound

Not having small (EPP)Egyptian Pound bills for minor purchases or tips

Also, keep receipts from your (EPP)Egyptian Pound exchanges and ATM withdrawals for your records. By following these tips, your (EPP)Egyptian Pound will go further, and you’ll avoid common issues with Egyptian currency and (EPP)Egyptian Pound.

Highlights

-

Use ATMs from big banks in Egypt to get Egyptian Pounds. This helps you get good rates and avoid high fees. - Always pay in Egyptian Pounds when you are in Egypt. This gives you the best prices and stops extra charges from changing money. - Carry small bills for tips and small buys. Many places do not have change for big bills. - Do not exchange money at airports or hotels. They give bad rates and charge high fees. - Keep any leftover Egyptian Pounds safe. Exchange them at banks or online after your trip.

Money Tips

Use ATMs for Egyptian Pounds

When you travel in Egypt, using atms is the smartest way to get egyptian pounds. ATMs are everywhere in cities and tourist spots. You can withdraw cash with your Visa or Mastercard, and most machines give you the official exchange rate. Try to avoid ATMs from Euronet or Crédit Agricole, since they often charge extra fees. Most other bank ATMs let you withdraw cash with low or no fees. If you have a no-fee debit card or a travel card like Wise, you can save even more. Always decline the ATM’s currency conversion offer. This way, your home bank will handle the exchange, and you’ll get a better deal on egyptian pounds.

Avoid Airport Currency Exchange

Airport currency exchange counters look convenient, but they almost always have poor rates and high fees. If you need egyptian pounds right away, only exchange money for small expenses like a taxi or snack. Wait until you reach the city to withdraw cash from a bank ATM or visit a local currency exchange office. City banks like the National Bank of Egypt or Banque Misr usually offer better rates for egyptian pounds. Remember, airport ATMs might charge higher fees, so use them only if you have no other choice.

Pay in EGP Locally

Always pay in egp when you shop, eat, or take a taxi. Many places will let you pay in foreign currency, but you’ll get a worse rate. Insist on paying in egyptian pounds to avoid being overcharged. When you spend in egp, you also avoid scams and make sure you’re getting the real price. If a shop or restaurant offers to charge your card in your home currency, say no. Choose to pay in egyptian pounds for the best value.

Carry Small Bills

You’ll find that small bills are super helpful in Egypt. Tipping is a big part of daily life, and you’ll need 10, 20, or 50 egyptian pounds for tips and small purchases. ATMs often give out large notes, so break them into smaller bills at hotels, banks, or shops as soon as you can. Many workers and shopkeepers don’t have change for big bills. Carrying small bills makes it easy to tip and pay for things like snacks, taxis, or souvenirs. Try to avoid damaged or taped notes, since some places won’t accept them.

Egyptian Pound Basics

EGP Denominations

You will see many types of egyptian currency when you visit Egypt. The (epp)egyptian pound comes in both coins and banknotes. Here’s a quick look at what you might get from an ATM or as change in shops:

|

Denomination Type |

Denominations in Circulation |

Usage Frequency in Daily Transactions |

|

Banknotes |

200, 100, 50, 20, 10, 5, 1 pound notes |

Larger notes (like 200 pounds) are for big purchases. The 1 pound note is back in use because people need small change. |

|

|

25 and 50 piaster notes (rarely used) |

You will not see these often. Most people use coins for these values. |

|

Coins |

1 pound, 50, 25, and 10 piasters |

Coins are common for small buys. The 1 pound coin is everywhere. |

You will probably use 10, 20, and 50 egyptian pounds the most for daily things. Keep some small notes and coins handy for tips and snacks. The 1 pound note and coin both work, so do not worry if you get either.

Where Egyptian Pounds Are Accepted

You can use egyptian pounds almost everywhere in Egypt. Local shops, markets, taxis, and small restaurants all want payment in egyptian currency. Even if you visit tourist spots, you will find that cash is king. Some big hotels and fancy stores may take cards or foreign money, but most places prefer egyptian pounds. You will not find any shop or café that refuses the (epp)egyptian pound. Always keep some cash with you, since many places do not accept cards.

Spotting Counterfeit Notes

You should always check your egyptian currency, especially larger notes. Hold the note up to the light. You will see a watermark and a security thread in real egyptian pounds. The paper feels crisp and strong, not thin or waxy. If a note looks faded or the print is blurry, do not accept it. Most shops and banks will help you check if you are unsure. Try to get your (epp)egyptian pound from ATMs or official banks to avoid fake bills.

Currency Exchange Options

When you go to Egypt, you can get Egyptian Pounds in different ways. Each way has good and bad points. Let’s look at your main choices so you can pick the best one for you.

Exchange Money at ATMs

ATMs are easy to find in big cities like Cairo and Alexandria. You will see them in banks, malls, and airports. Most ATMs take Visa and Mastercard. You can use your debit or credit card to get cash. Using ATMs is a simple way to get local money at a fair rate. Big banks like the National Bank of Egypt and Banque Misr have the best deals. Their ATMs give you a good exchange rate and charge a small fee, usually 20 to 50 EGP each time.

Some ATMs from other banks may charge high fees, up to 15%. Use well-known banks to save money. In small towns, ATMs are rare, so get enough cash before you leave the city.

Exchange Offices and Banks

You can also get money at official exchange offices or banks. These places are safe and give you a receipt every time. Exchange offices often have better rates than banks, but you should check a few places first. Both are much better than airport or hotel exchanges.

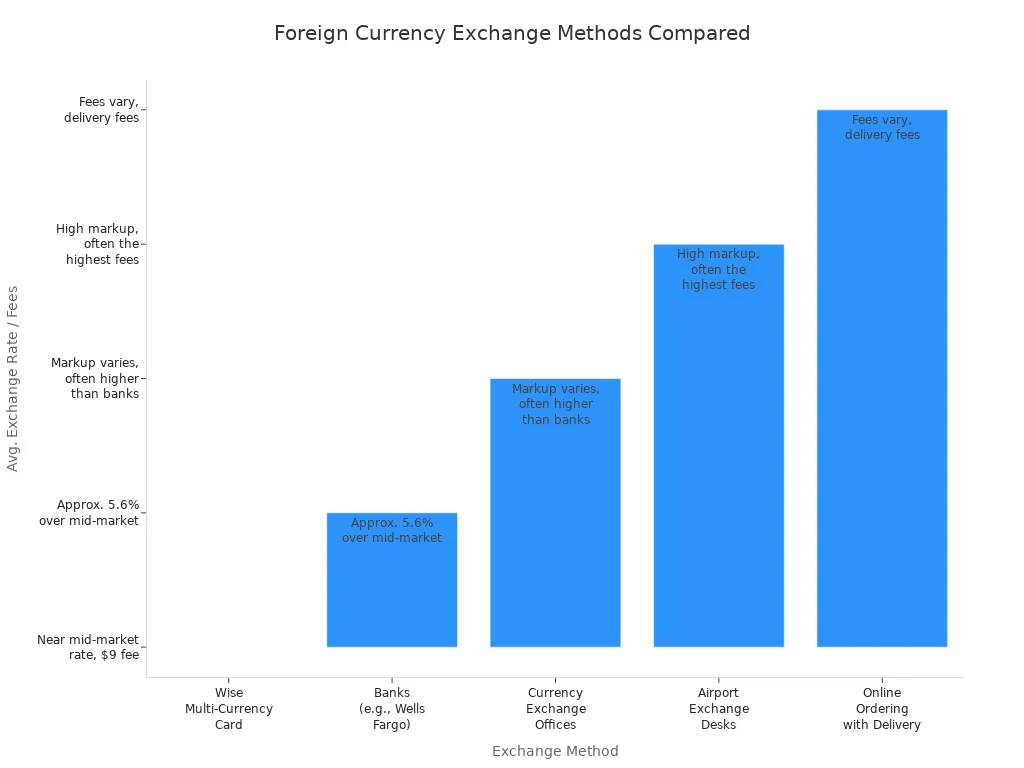

Here’s a quick look at how the different ways compare:

|

Method |

Description |

Average Exchange Rate / Fees |

Convenience / Notes |

|

Wise Multi-Currency Card |

Travel money card, top up in USD, spend and withdraw abroad with mid-market rates and low fees |

Near mid-market rate, one-time $9 fee |

Can be used in 150+ countries, virtual card available instantly, physical card delivery 7-21 days |

|

Banks (e.g., Wells Fargo) |

Order in advance, may require account, physical cash pickup at branch |

Approx. 5.6% margin over mid-market rate |

May take 2-7 days for order and collection, reliable but less flexible |

|

Currency Exchange Offices |

Instant cash exchange, rates vary by provider, fees included in markup |

Markup varies, often higher than banks |

Instant cash if currency in stock, must shop around for best rates |

|

Airport Exchange Desks |

Convenient for last-minute exchange, limited competition |

High markup, often the highest fees |

Instant cash if EGP in stock, but limited availability and higher cost |

|

Online Ordering with Delivery |

Order currency online for home delivery, fees and delivery times vary |

Fees vary, some expedited delivery available |

Convenient, but delivery can take 1-5 days depending on currency and payment method |

Banks and exchange offices are safe and have fair rates. Never use black-market currency exchange, even if the rate looks good. It is risky and against the law.

Hotel and Airport Currency Exchange

Hotel and airport exchange desks are easy to use, but they cost more. These places charge higher fees and give worse rates than banks or ATMs. At the airport, you might pay up to 15% more than at a city bank. Hotels also add extra fees.

If you need cash right away, just get enough for a taxi or snack. Wait until you reach the city for a better deal.

Travel Money Cards and Apps

Travel money cards and apps are getting more popular. Cards like Wise, Revolut, and Monzo let you load money in your home currency and spend or get cash in Egyptian Pounds. These cards use the mid-market rate, which is usually the best. They also have low or no extra fees.

|

Aspect |

Details |

|

Widely Accepted Cards |

Visa and Mastercard are widely accepted in Egypt, supporting Chip and PIN, contactless, Apple Pay, Google Pay. |

|

Popular Travel Cards |

Wise, Revolut, Chime, Monzo, Netspend. |

|

Exchange Rates |

Generally close to the mid-market rate, recommended for cost efficiency. |

|

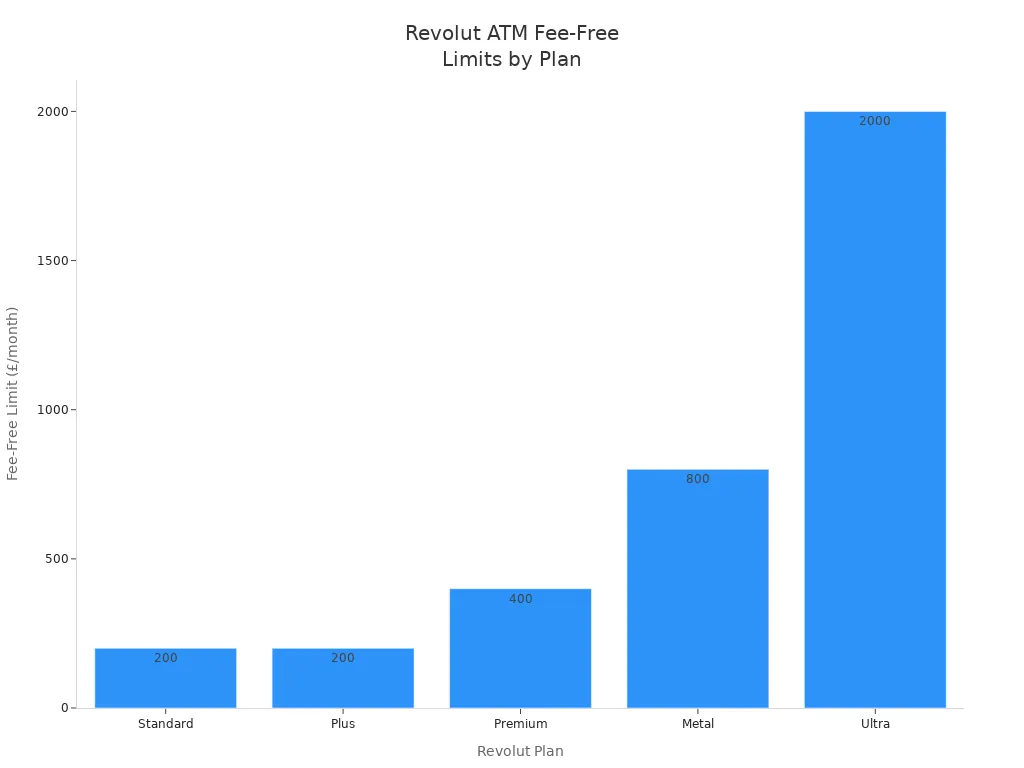

Fees - ATM Withdrawals |

Revolut offers no fees on ATM withdrawals up to monthly limits (£200-£2000 depending on plan), then 2% fee applies; third-party ATM fees may also apply. Wise and Revolut typically avoid foreign transaction fees. |

|

Fees - Foreign Transaction |

Travel cards usually avoid foreign transaction fees, unlike regular debit cards. |

|

Payment Methods Accepted |

Card payments common; cash still useful for small purchases or tipping. |

|

Security Features |

Two-factor authentication, instant transaction notifications, ability to freeze/unfreeze cards via app. |

|

Recommendations |

Avoid currency exchange at airports due to high fees; always pay in Egyptian Pounds to avoid dynamic currency conversion fees. |

|

Card Management |

Mobile apps allow easy management, currency holding, and conversion either before travel or at point of payment. |

|

Additional Benefits |

Some cards offer travel insurance, airport lounge access, emergency cash. |

Travel money cards help you track spending and keep your money safe. You can freeze your card if you lose it and get alerts for every purchase. Some cards have monthly limits for free ATM withdrawals. After you reach the limit, you may pay a small fee.

Travel money cards and apps work well in cities and tourist spots. You still need cash for small shops, tips, or places outside the city.

In summary:

You have many ways to exchange money in Egypt. Using ATMs and travel money cards gives you the best rates and lowest fees. Exchange offices and banks are safe and reliable, but always compare rates. Avoid airport and hotel exchanges unless you have no other choice. Always plan ahead so you have enough cash for your trip.

Using Cards vs. Cash

Card Acceptance in Egypt

You will find that most hotels, big restaurants, and shops in Egypt accept credit cards. Visa and Mastercard are the most common, and you can use them in many places, especially in Cairo and other tourist cities. Some high-end hotels and stores also take American Express and Diner’s Club, so you have options if you carry those cards. In upscale spots, you can even use contactless payments like Apple Pay or Google Pay.

However, cash is still king in many parts of Egypt. Local markets, small shops, and street vendors often do not take cards. In Upper Egypt and rural areas, you will need cash for almost everything. Even in cities, you might find that some places have card machines that do not work or have a minimum spend for card payments.

When to Use Cash

You should use cash for small purchases, tips, and shopping at local markets. Many travelers say that cash is a must for street food, souvenirs, and taxis. You will also need cash for entrance fees at some attractions and for tipping hotel staff or guides.

-

Exchange your money after you arrive in Egypt for better rates.

-

Use your card for big purchases or meals in established venues.

-

Keep cash handy for:

-

Local markets and bazaars

-

Tipping (which is expected in many places)

-

Small shops and street vendors

-

Rural areas where cards are rarely accepted

-

American Express works in top hotels like the Ritz Carlton in Cairo, but you will not see it accepted in most shops. Always check before you order or buy something.

Card Safety Tips

Keeping your cards safe in Egypt is important. Here are some easy ways to protect yourself from fraud or theft:

-

Use ATMs inside banks or hotels for extra security.

-

Always cover your PIN when you enter it.

-

Check your card for a chip and use chip readers when possible.

-

Sign up for purchase alerts with your bank or card app.

-

Never share your card details with anyone.

-

Review your account statements often to spot any strange charges.

-

Use secure Wi-Fi or a VPN when shopping online.

-

Report lost or stolen cards right away to your bank.

By following these tips, you can enjoy your trip and keep your money safe, whether you use cards or cash in Egypt.

Avoiding Fees & Pitfalls

Dynamic Currency Conversion

When you pay with your card in Egypt, you might see a message asking if you want to pay in your home currency instead of Egyptian Pounds. This is called Dynamic Currency Conversion (DCC). It sounds helpful, but it actually costs you more. Merchants and ATMs often add extra fees and use poor exchange rates. You could end up paying 5% or more on every transaction. Always choose to pay in Egyptian Pounds. Let your bank or card company handle the conversion. You’ll get a better rate and avoid hidden markups.

Black Market Risks

You might hear about the black market offering better exchange rates. It can seem tempting, but it’s risky and illegal. The black market works outside government rules. You could get fake bills, lose your money, or even face jail time. In Egypt, exchanging money outside banks or licensed offices can lead to fines up to EGP 5 million and prison for up to three years. Stick to banks, licensed exchange offices, or trusted digital platforms. These places give you fair rates, receipts, and peace of mind.

-

Black market exchanges are illegal and unsafe.

-

Legal options like banks and licensed bureaus protect you from scams.

-

Digital apps like Wise or Revolut offer safe, real-time rates.

ATM and Bank Fees

ATMs are handy, but you need to watch out for fees. Some ATMs charge extra for withdrawals, especially those not linked to big banks. You might also face withdrawal limits, like 3,000 EGP per transaction. If you try too many times and fail, your card could get locked. Use ATMs from well-known banks, like Banque du Caire, to keep fees low. Start with a small withdrawal to test your card. Bring more than one card, just in case.

-

Use ATMs from recognized banks to avoid high fees.

-

Notify your bank before your trip to prevent card blocks.

-

Carry a backup card for emergencies.

Safe Money Handling

Keeping your money safe in Egypt is simple if you follow a few steps:

-

Withdraw cash from bank ATMs, not random machines.

-

Carry small bills for markets and tips.

-

Use credit cards in big hotels and restaurants.

-

Compare exchange rates before you swap money.

-

Don’t accept help from strangers at ATMs or exchange offices.

-

Learn typical prices to avoid overpaying.

-

Ask hotel staff or guides if you’re unsure about costs.

Tipping & Small Payments

Tipping with Egyptian Pounds

Tipping is a big part of daily life in Egypt. You will notice that many people expect a small tip for good service. Most locals and tourists use egyptian pounds for tipping, and small bills make it easy. Here are some common tipping amounts:

-

Tour guides: $10–$15 per day for full-day tours, or $5 per person for small groups.

-

Hotel staff:

-

Bellhops: $2 per bag, or $5 for several bags.

-

Housekeeping: $1–$3 each day, left in your room.

-

Concierge: $5 for booking help.

-

-

Drivers: $5–$10 per day for day trips, $3–$5 for airport rides.

-

Restaurants: Most add a 10–12% service charge, but you should still leave a little extra in cash. At casual places, just round up or leave a few egyptian pounds.

-

Delivery services: 5–10 egyptian pounds for small orders, 15–20 for big ones.

-

Local experiences: Camel rides or photos, 5–10 egyptian pounds. Market vendors may get 1–2 pounds as a thank you.

Handling Small Transactions

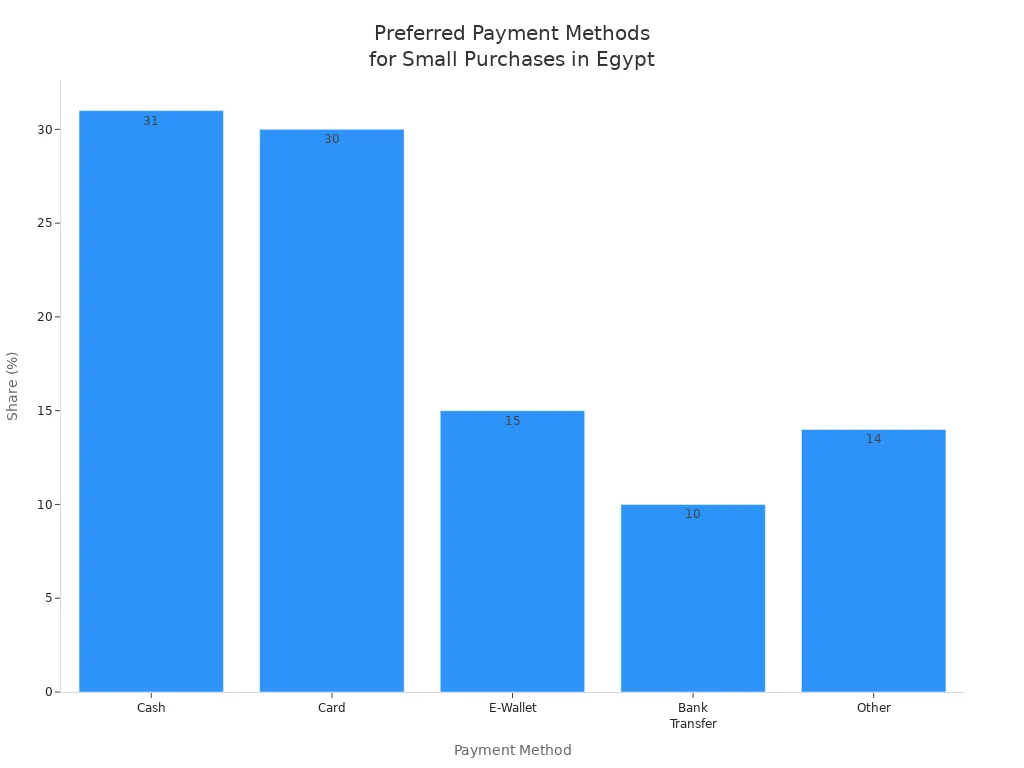

You will use cash for most small purchases in Egypt. Locals prefer egyptian pounds for snacks, street food, and souvenirs. Even though cards are common in big stores, cash is still king for minor buys. Here’s how people usually pay for small things:

-

Cash is the top choice for street vendors, taxis, and markets.

-

Cards (Visa and Mastercard) work in many shops, but not for tiny purchases.

-

Digital wallets like Fawry and Meeza are growing, but most people still use cash for everyday needs.

You might find it hard to get change for large bills. Try to break big notes into smaller egyptian pounds at hotels or shops. Buy a bottle of water or a snack to get change. This makes it easier to pay for tips and small items.

|

Payment Method |

Approximate Share (%) |

|

Cash |

31 |

|

Card |

30 |

|

E-Wallet |

15 |

|

Bank Transfer |

10 |

|

Other |

14 |

Leftover Egyptian Pounds

Exchanging EGP After Your Trip

You might leave Egypt with some Egyptian Pounds in your wallet. Don’t worry—you have a few ways to exchange them once you get home. Here are your main options:

-

Visit your local bank. Many banks in the U.S. or Europe will exchange Egyptian Pounds for your home currency. Banks usually offer better rates than airport kiosks, but you may pay a small fee.

-

Try online services like Wise. These platforms let you exchange currency at the mid-market rate with low fees. You can do it from your phone or computer.

-

Use ATMs from major international banks. Some ATMs abroad allow you to deposit foreign cash and convert it to your account currency. This works best if you have an account with a global bank like HSBC or Citibank.

-

Check for buyback programs. Some currency exchange services buy back unused foreign currency, sometimes at better rates than banks.

-

Avoid airport kiosks. These counters are easy to find but usually give you poor exchange rates and charge high fees.

-

Save your leftover cash for your next trip to Egypt. It can be handy for taxis or snacks when you return.

Donating or Spending Leftover Money

If you have only a small amount of Egyptian Pounds left, you can put it to good use. Here are some smart ways to spend or donate your leftover cash:

|

Method |

Description |

Examples/Organizations Accepting Small Donations |

|

Donate to charity |

Give your leftover Egyptian Pounds to charities that accept foreign currency. |

UNICEF (Change for Good), airport donation boxes for animal rescues and child hospitals |

|

Convert it |

Exchange your leftover cash at a bank or airport counter, but check the rates and fees first. |

Banks usually offer better rates than airport counters |

|

Save for future travel |

Keep your Egyptian Pounds for your next trip. They are useful for taxis, tips, or snacks when you return. |

N/A |

You can also spend your last bills at airport shops or duty-free stores before you leave Egypt. Many airports have donation boxes for small bills and coins. Every little bit helps, and you can make a difference for local causes.

Getting the best value with Egyptian Pounds is easy when you know what to do. Here are the top three tips travelers recommend:

-

Use ATMs in Egypt to get local currency. You get fair rates and avoid big fees.

-

Only exchange what you need. It’s hard to change Egyptian Pounds back after your trip.

-

Carry both foreign cash and Egyptian Pounds. Use local money for shopping and tips.

Keep an eye on exchange rates and plan for leftover cash. Got questions or stories? Drop them in the comments!

FAQ

Can I use US dollars or euros in Egypt?

Most places want Egyptian Pounds. Some hotels or tourist shops might take dollars or euros, but you will get a bad rate. Always pay in Egyptian Pounds for the best value.

What should I do if an ATM keeps my card?

Stay calm. Go inside the bank branch if it is open and ask for help. If the bank is closed, call your bank’s customer service right away to report the problem.

Is it safe to use credit cards in Egypt?

You can use credit cards in big hotels, restaurants, and shops. Always use ATMs inside banks. Watch your card during payments. Check your statements for any strange charges.

How much cash should I carry each day?

Carry enough for small purchases, tips, and taxis. Most travelers keep 500–1,000 Egyptian Pounds for daily use. Use your card for bigger expenses.

What if I get a damaged or fake bill?

Related content