Dominican Peso Maintains Stability Amid Global Market Fluctuations

Author:XTransfer2025.08.19Dominican Peso

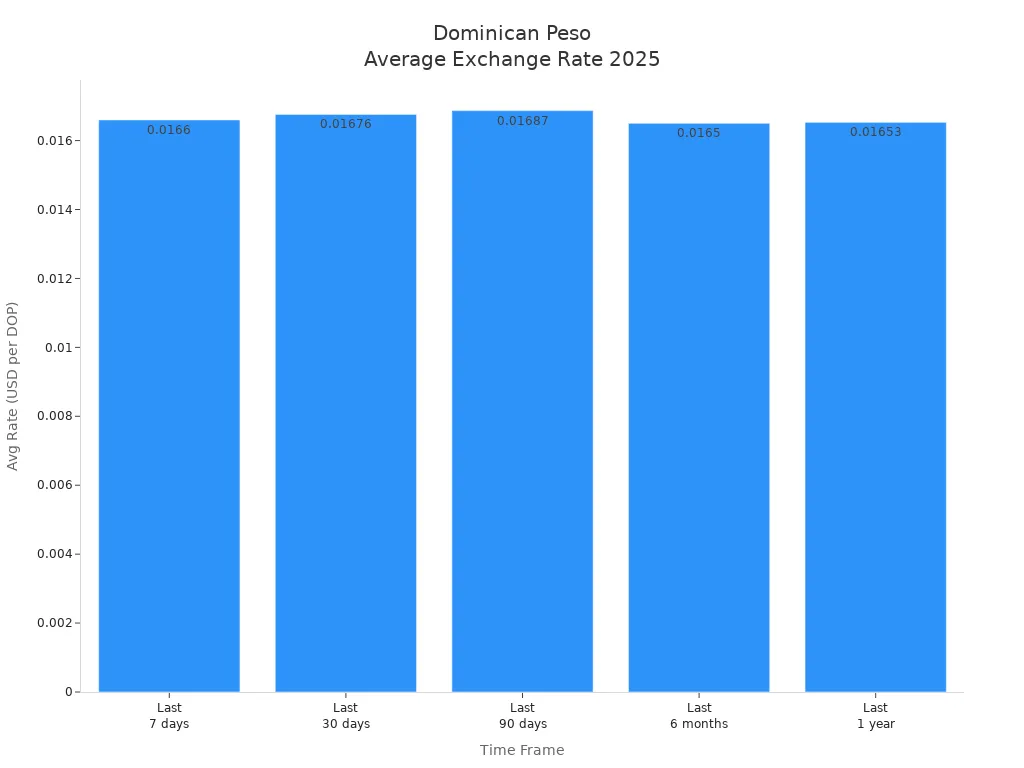

The Dominican Peso remained very steady in 2025. Even though global markets faced significant challenges, the Dominican Peso did not fluctuate much. Recent exchange rate data for the Dominican Peso shows only minor changes. Over the past year, the Dominican Peso lost about 2.14% of its value against the US Dollar.

|

Time Frame |

High Rate (USD per DOP) |

Low Rate (USD per DOP) |

Average Rate (USD per DOP) |

Percentage Change |

Volatility (%) |

|

Last 7 days |

0.017 |

0.0165 |

0.0166 |

+0.11% |

-0.207% |

|

Last 30 days |

0.01693 |

0.01657 |

0.01676 |

-2.03% |

-2.03% |

|

Last 90 days |

0.01704 |

0.01657 |

0.01687 |

-0.55% |

-0.55% |

|

Last 6 months |

0.0171 (May 2, 2025) |

0.0158 (Apr 1, 2025) |

0.0165 |

N/A |

N/A |

|

Last 1 year |

0.01704 (Apr 29, 2025) |

0.01556 (Jan 6, 2025) |

0.01653 |

-2.14% |

N/A |

Highlights

-

The Dominican Peso stayed steady in 2025. This happened even though there were problems in global markets. It only lost about 2.14% of its value against the US dollar. The Central Bank kept interest rates the same. They used smart plans to help the peso and keep people confident in the economy. Money from tourism, remittances, and investments stayed strong. This helped the peso stay strong and helped the economy grow. A steady currency made it easier for families and businesses to plan. It also helped them know what to expect with spending and prices. This meant fewer surprises from price changes. There are still risks like global uncertainty, high US interest rates, and natural disasters. But the outlook is still good because economic growth is expected.

Dominican Peso Trends 2025

Exchange Rate Movements

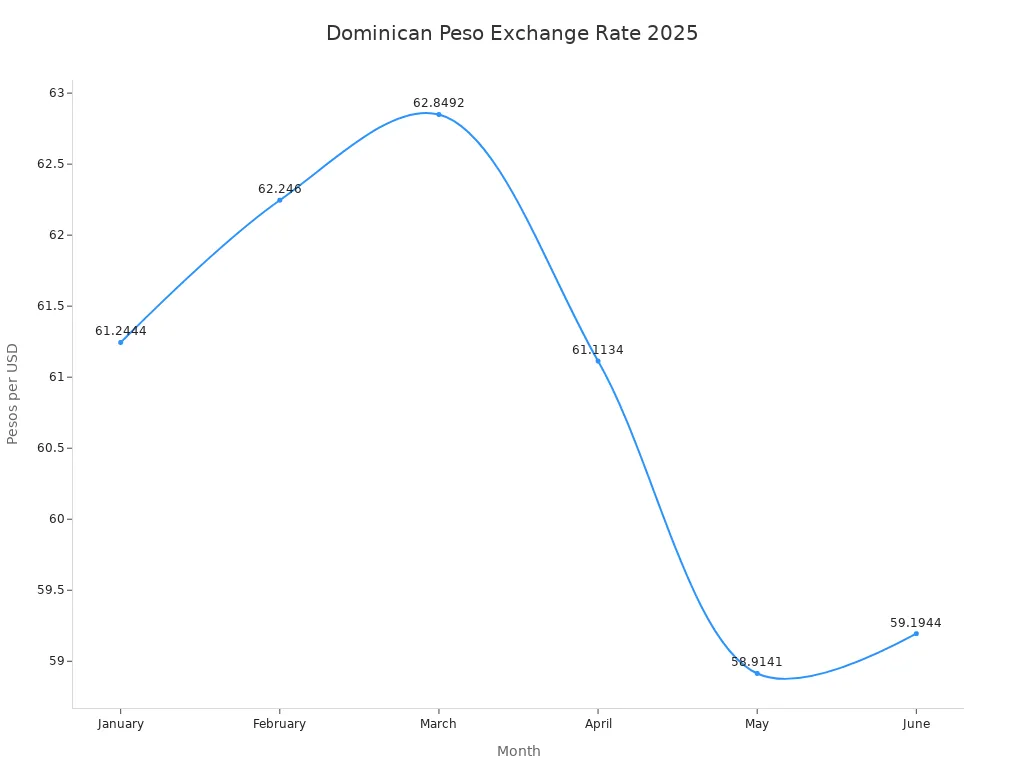

The Dominican Peso stayed strong in 2025. The average exchange rate for the year was 61.186 DOP per US dollar, based on World Bank data. This was a small drop from 59.409 DOP per US dollar in 2024. The currency went up and down during the year.

|

Metric |

Value |

|

Highest DOP to USD rate in 2025 |

1 DOP = 0.01704 USD (April 29, 2025) |

|

Lowest DOP to USD rate in 2025 |

1 DOP = 0.01556 USD (January 6, 2025) |

|

Average DOP to USD rate in 2025 |

0.01644 USD per DOP |

|

Percentage change in DOP/USD in 2025 |

+1.39% (DOP appreciated against USD) |

Looking at the US dollar, the highest rate was 64.271 DOP per USD in January. The lowest was 58.679 DOP per USD in April. The yearly average was 60.864 DOP per USD. These facts show the Dominican Peso stayed steady even when global markets changed.

Year-to-Date Performance

In 2025, the Dominican Peso got stronger as the year went on. By July 17, 2025, the USDDOP spot rate was 60.27. This was a 1.87% gain since the year began. The currency hit a high of 63.54 in April but bounced back fast.

|

Metric |

Value |

|

USDDOP spot rate |

60.27 (as of Jul 17, 2025) |

|

Year change |

+1.87% |

|

Historical high |

63.54 (Apr 2025) |

The biggest gain for the Dominican Peso happened in the second quarter. The Central Bank said that on April 17, the exchange rate dropped below RD$60.00 per US dollar. On that day, the average rates were RD$59.55 for buying and RD$59.83 for selling. This was a big moment, as it stopped the earlier drop in value.

|

Month |

Exchange Rate (Dominican Pesos per USD) |

Interpretation |

|

January |

61.2444 |

Moderate depreciation |

|

February |

62.246 |

Increasing depreciation |

|

March |

62.8492 |

Highest depreciation in 2025 |

|

April |

61.1134 |

Significant appreciation |

|

May |

58.9141 |

Most significant appreciation |

|

June |

59.1944 |

Continued appreciation |

Comparison with Regional Currencies

The Dominican Peso did better than other currencies in the region in 2025. Many Latin American currencies lost value because of global problems. The Dominican Peso kept its losses small and even gained at times. Its average exchange rate with the US dollar was more steady than the Colombian Peso and the Argentine Peso, which changed a lot.

Businesses and investors in the region saw the Dominican Peso as a safer choice. The currency’s quick recovery after early losses made people trust the Dominican Republic’s financial system. This steady value brought in foreign investment and helped the country’s economy grow.

Peso Stability Factors

Central Bank Policy

The Central Bank helped keep the peso steady in 2025. It kept its interest rate at 5.75% for three times in a row by March. This happened because inflation stayed between 3.0% and 5.0% for over a year. The Bank saw that people and businesses were borrowing less money. At the same time, high U.S. interest rates and problems with world trade made things harder for the peso.

The Central Bank was careful with its choices. It did not lower rates, even though some people thought it would. The Bank wanted to keep things safe during a risky time for the world’s money markets. By not changing the rate, the Bank showed it wanted to keep prices steady. This helped people trust the peso and made investors feel better.The Central Ban

k’s smart moves and clear messages helped the peso stay strong, even when the world was unsure.

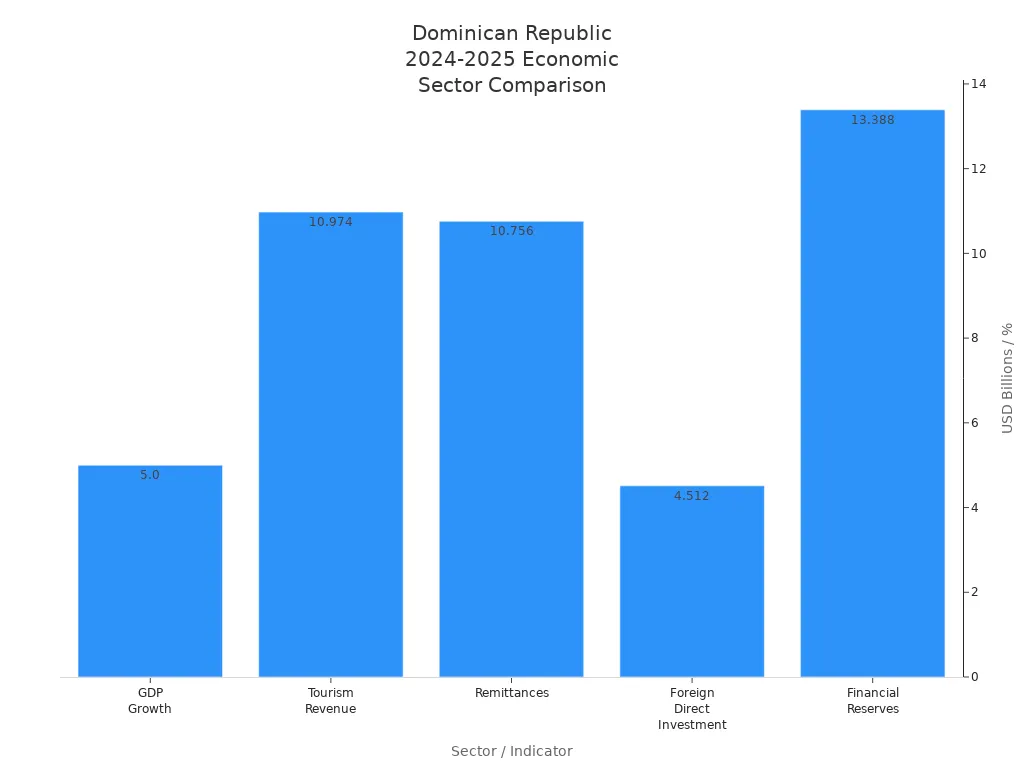

Foreign Inflows

Money from other countries helped the Dominican Peso in 2025. Tourism brought in a lot of foreign money. Almost half of the tourists came from the United States, bringing in dollars. This money helped the country pay for things from other countries and kept the peso strong. The Central Bank also stepped in to help the peso when needed.

Dominicans living in other countries sent money home too. In 2024, they sent a record $10.76 billion, and most of it came from the United States. This money helped families and small businesses buy things and invest. People from other countries also put money into the country, with over $4.5 billion going into tourism, real estate, and clean energy.

Tourism, remittances, and investments kept the country’s savings high. These savings could pay for 3.5 months of imports, which is a good amount and helped protect the peso.

Economic Growth

The Dominican Republic’s economy grew well in 2025. The GDP growth rate was 4%. This happened because people spent more, invested more, and the government made changes. Inflation stayed low, at 3.84% in May. This matched the Central Bank’s goal and showed the economy was stable.

Many parts of the economy helped it grow. Tourism brought in over 11 million visitors in 2024, making the country very popular. Hotels grew by 9.6%, and remittances and exports also went up. Free trade zones, mining, and building projects helped too. Exports grew by 7%, with gold, cacao, and farm products leading.

Banks stayed strong, with good profits and few bad loans. The banking system’s return on equity was 22.8%, and only 1.4% of loans were not paid back. These things, along with lots of cash in banks, helped keep the peso steady and the economy growing.

The Dominican Republic’s smart money rules, strong money from other countries, and healthy businesses all worked together to keep the peso steady in 2025.

Global Market Impact

International Volatility

In 2025, global financial markets were very unstable. Many countries saw their money lose value. This happened because investors worried about interest rates and news. Latin American currencies dropped by about 5% this year. The U.S. Federal Reserve kept interest rates high for longer than people thought. Because of this, money left emerging markets and went to safer places.

The Dominican Peso stayed strong during these changes. Careful planning and good risk control helped avoid big losses. The Central Bank watched closely and made plans for hard times. This kept the economy safe from sudden problems.

U.S. Policy Effects

The U.S. dollar stayed strong in 2025. High interest rates in the U.S. made it popular with investors. Many emerging markets had trouble with rising inflation. The Dominican Republic faced these problems too but kept inflation in the Central Bank’s target. The government and Central Bank worked together to keep prices steady and help the economy grow.

A steady exchange rate helped businesses make future plans. Shoppers also benefited because import prices did not go up fast. The Dominican Republic’s smart policies helped during a year when the world was unsure.

Emerging Market Comparison

Other emerging markets had bigger problems. Many saw their money lose value quickly against the U.S. dollar. Weak rules and poor planning made these countries less safe. The Dominican Republic did things differently. Its economy grew because tourism, small businesses, and building projects were strong. The government spent money on digital services and new roads. Banks gave both online and in-person help, so more people could use them.

Having many strong parts of the economy, using technology, and helping everyone join banks made the Dominican economy stronger. These ideas show that good planning and new ideas help keep prices low and the economy steady.

Dominican Republic Economy & Outlook

Consumer Impact

A steady currency in 2025 helped many families. People saw prices for imported goods stay the same. This made it easier to plan how to spend money. Food and transportation did not get more expensive fast because inflation was low. Money sent from other countries went up by almost 12% early in 2025. This gave families more money to use. Many spent this extra money on school, health, and fixing their homes. Tourists liked that prices did not change much. This made more people want to visit the Dominican Republic.

Business Environment

Different businesses felt changes from the currency.

-

The IT and BPO sector had to pay more to workers because of higher wages and currency changes. Most workers still made more than minimum wage, so payroll costs did not go up a lot.

-

The tourism industry watched the currency closely. Changes could affect how many people visit and what they pay.

-

Real estate in Punta Cana saw more foreign buyers when the U.S. dollar or euro got stronger. This made homes cheaper for them, so more people bought and prices went up. When the dollar or euro got weaker, homes cost more, so fewer people bought.

-

Other businesses like nearshoring and construction worried that a weak U.S. dollar could make them less able to compete.

Many companies changed their prices and plans to deal with these changes.

Risks Ahead

Experts see some risks for the rest of 2025.

-

The Dominican Republic could have problems because the world is uncertain. This includes wars and changing oil prices.

-

High U.S. interest rates and higher prices from tariffs could hurt the economy.

-

Hurricanes and bad weather could damage roads and buildings. These disasters cost about 0.5% of GDP each year.

-

If people in the U.S. buy less, the country may sell less, get fewer tourists, and get less money from remittances. This could make the country owe more money to others.

Even with these risks, the outlook is still good. The Central Bank thinks the economy will grow by 3.5% to 4.0% in 2025. Inflation should stay in the target range. Strong investment from other countries and good savings help keep the peso steady through 2025 and into 2026.

The Dominican Peso stayed steady in 2025 because of good rules and a growing economy. Knowing about exchange rate changes helps people and businesses get ready for the future. Some important things to watch are:

-

Problems in the world economy and more tourists visiting

-

Money sent from other countries and people investing at home

-

Keeping prices under control and changes in prices of goods

-

Changes in government spending and money rules

Watching these things can help keep the Dominican Peso safe and help it grow later.

FAQ

What keeps the Dominican Peso stable in 2025?

The Central Bank makes careful choices and does not change interest rates. Lots of money comes from remittances, tourism, and people investing from other countries. These things help the peso stay steady and not change a lot.

How does the exchange rate affect daily life?

When the exchange rate does not change much, families can plan how to spend money. Prices for things from other countries and basic needs do not jump up and down. Shoppers and travelers do not get big surprises when they buy things or change money.

Why do businesses watch the peso’s value?

Businesses pay attention to the peso so they can control costs and set prices. If the exchange rate changes, it can change how much money they make, especially if they buy things from other countries or work with tourists. When the rate is steady, it is easier for them to plan.

What risks could hurt the peso’s stability?

Big problems in the world, like wars or higher oil prices, can cause trouble. Hurricanes and other disasters can hurt the economy. High interest rates in the U.S. or less money from tourists and remittances can also be risky.

How can people stay informed about exchange rates?

Related content