Analyzing the GTQ Currency’s Stability Against the US Dollar and Euro

Author:XTransfer2025.08.19GTQ Currency

The gtq currency stays steady when compared to big currencies. On July 21, 2025, one guatemalan quetzal is worth 0.1304 US Dollar. This is a small increase over the past six months.

|

Date |

GTQ to USD Exchange Rate |

Change/Trend |

|

2025-07-21 |

0.1304 USD per 1 GTQ |

+0.79% increase over last 6 months |

|

2025-07-17 |

0.1305 USD per 1 GTQ |

Highest rate in last 6 months |

|

2025-01-29 |

0.1292 USD per 1 GTQ |

Lowest rate in last 6 months |

People who travel, invest, or trade forex trust the guatemalan quetzal. The gtq is known as one of the most steady currencies in Latin America. Things like inflation, interest rates, and political stability affect the quetzal.

Highlights

-

The Guatemalan quetzal does not change much against the US dollar and euro. This makes it a good currency for travel and investment. Strong remittances from other countries help keep the quetzal steady. The central bank in Guatemala also works hard to keep its value stable. The quetzal has changed less than most other Latin American currencies in recent years. This shows that it is strong and people can trust it. Travelers like that prices are easy to guess and they can get quetzals easily. Investors and traders have less risk because the currency is steady. People should watch economic news, political changes, and remittance trends. This helps them make smart choices when using or trading the quetzal.

GTQ Currency Stability

Exchange Rate Overview

The gtq is very steady compared to the us dollar and euro. In 2025, 1 gtq is worth 0.1304 USD. This number is almost the same as earlier this year. Many experts think this means the currency is strong. The guatemalan quetzal does not change a lot.

Here are some numbers that show this:

|

Month |

GTQ to USD |

GTQ to EUR |

|

January |

0.1292 |

0.1190 |

|

April |

0.1300 |

0.1202 |

|

July |

0.1304 |

0.1205 |

The gtq stays about the same against both big currencies. People who travel or invest like the quetzal because its value is easy to guess. The exchange rate does not move much, even when the world market is unsure.

Historical Patterns

The guatemalan quetzal has stayed steady for a long time. Guatemala used to tie its money to the us dollar. This made the exchange rate stay the same for years. In the late 1990s, the country let the gtq move on its own. Since then, the gtq has not dropped or jumped a lot.

In the last ten years, the quetzal has kept its value better than many other Latin American currencies. The central bank of Guatemala watches the market all the time. They help the gtq if it needs support. This careful work keeps the currency steady.

-

The gtq almost never loses more than 1% in one month.

-

The quetzal’s rate with the euro also does not change much.

-

Many experts think the gtq is a safe pick in the area.

The guatemalan quetzal has shown it can handle hard times. Even when the world has big problems, the currency does not get much weaker. This makes people feel good about using the gtq for trade, travel, or investing.

Value of the Quetzal

Yearly Exchange Rate Trends

The value of the quetzal has stayed very steady in recent years. Every year, the gtq does not change much against big currencies. This happens because the market is strong. How much foreign money people want or need is important for the quetzal’s value. Family remittances are a big part of Guatemala’s GDP. These remittances bring in more US dollars. More dollars help keep the quetzal’s value steady. The Central Bank of Guatemala only helps if there are big changes. Most of the time, the market decides the quetzal’s value by looking at real economic activity.

If we look at the last five years, the gtq has not lost much value. Inflation, interest rates, and trade balances all matter for the quetzal’s value. These things help explain why the gtq is one of the most steady currencies in Latin America.

Notable Fluctuations

The gtq has not had big ups and downs like other currencies nearby. In the last five years, the quetzal’s value actually went up by about 2.11%. This is special because many other Latin American currencies lost value. The main reason for this was that import prices dropped more than export prices. Import prices went down by 31.7%. Export prices fell by 11.3%. This helped Guatemala save money and made its current account balance better. Because of this, the quetzal’s value went up against the US dollar.

-

The gtq’s higher value did not come from central bank moves or fast economic growth.

-

Changes in world prices for traded goods made this happen.

-

The quetzal stayed strong even when export earnings went down.

These facts show that the quetzal’s value comes from real market forces. The gtq stays strong because of remittances, trade, and the central bank watching closely. People who invest or travel can trust that the quetzal’s value will not change fast or for no reason.

Exchange Rate Factors

Remittances

Remittances are very important for the gtq’s stability. Many families in Guatemala get money from relatives who work in other countries. These remittances now make up almost 20% of Guatemala’s GDP. This money helps families buy what they need and save for the future. When more remittances come in, more dollars enter Guatemala. This extra money helps the gtq stay steady. Even during hard times like the COVID-19 pandemic, remittances went up by over 20%. Many Guatemalans work jobs without official protections. Remittances help these families when they need support. They also help increase the country’s foreign exchange reserves. Because of this, remittances are one of the biggest reasons the gtq stays strong.

Central Bank Actions

The Central Bank of Guatemala watches the gtq very closely. Since 2006, the bank has used a system to control inflation. The bank steps in when the exchange rate changes too quickly. For example, from 2008 to 2012, the bank acted on 148 days to calm the market. The bank does not set the exact value of the gtq. It tries to stop sudden changes that could hurt the economy. The bank uses special tools to decide when to act. These steps help keep the gtq steady for businesses and travelers.

-

The bank mainly tries to stop big changes.

-

Monetary policy and exchange rate actions work together but are mostly separate.

-

The bank’s careful work helps people trust the gtq.

Economic Pressures

Guatemala’s economy affects how strong the gtq is. The country’s economy grew by 3.7% in 2024. But high poverty and many people working informal jobs make things hard. Political problems and weak government can make investors worry. Relying on remittances shows both strength and weakness. Careful money and spending rules help the gtq. Foreign investment helps growth, but the main support comes from the market and the central bank. The table below shows important economic facts:

|

Indicator |

Impact on gtq Stability |

|

Growth Rate (2024) |

3.7% supports macroeconomic stability |

|

Remittances |

20% of GDP, major foreign currency source |

|

Poverty Rate |

57.3%, limits broad economic strength |

|

Informal Labor Sector |

80%, reduces sustainable income |

|

Political Challenges |

Undermine investor confidence |

GTQ vs Major Currencies

GTQ and US Dollar

The Guatemalan quetzal does well against other currencies. It is especially strong when compared to the US dollar. In the last 90 days, the exchange rate barely changed. The highest rate was 0.1304 USD for one quetzal. The lowest rate was 0.1298 USD. The average rate was 0.1301 USD. There was a small rise of 0.33%. This means people can count on the quetzal for trading or travel. Old numbers show the USD to GTQ rate stays near 7.68 GTQ per USD. It does not move much. This makes businesses and investors feel safe.

GTQ and Euro

The quetzal acts differently with the euro. In the last 90 days, the rate with the euro went down by 2.79%. The highest rate was 0.1172 EUR for one quetzal. The lowest rate was 0.1102 EUR. The average rate was 0.1135 EUR. The table below shows these changes:

|

Currency Pair |

Period |

High |

Low |

Average Rate |

% Change |

|

GTQ to EUR |

Last 30 days |

0.1131 EUR |

0.1102 EUR |

0.1113 EUR |

-1.45% |

|

GTQ to EUR |

Last 90 days |

0.1172 EUR |

0.1102 EUR |

0.1135 EUR |

-2.79% |

|

GTQ to USD |

Last 30 days |

0.1304 USD |

0.1300 USD |

0.1302 USD |

+0.18% |

|

GTQ to USD |

Last 90 days |

0.1304 USD |

0.1298 USD |

0.1301 USD |

+0.33% |

The quetzal is steadier with the US dollar than with the euro. The euro changes more because of world events. People who travel or invest should watch these numbers.

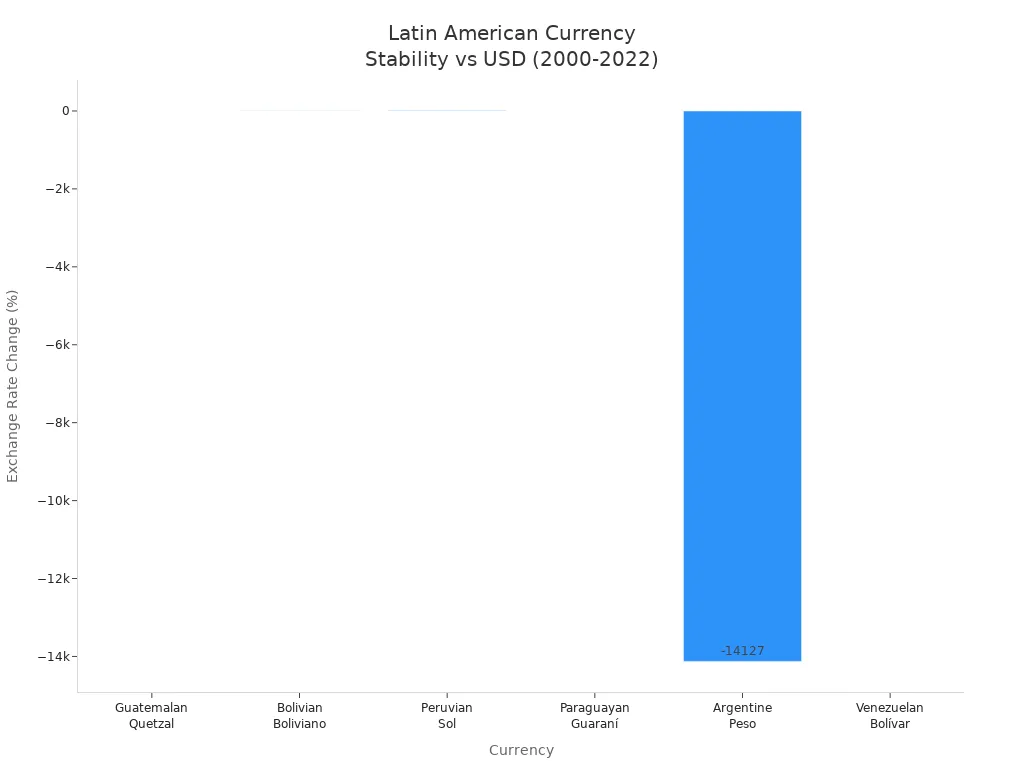

Regional Currency Comparison

The quetzal is different from other Latin American currencies. From 2000 to 2022, it changed only about 1.5% against the US dollar. Most other currencies lost more value. The Argentine peso and Venezuelan bolívar lost a lot. The Bolivian boliviano and Peruvian sol also stayed pretty steady. But the quetzal moved the least. The table below shows the differences:

|

Currency |

Exchange Rate Change vs USD (2000-2022) |

Exchange Rate Range / Notes |

Stability Factors / Comments |

|

Guatemalan Quetzal |

~1.5% increase (from ~7.68 to 7.8 Q/USD) |

Narrow fluctuation between Q7.5 and Q8 |

Most stable in Latin America; remittances and central bank actions support stability |

|

Bolivian Boliviano |

~8.6% increase |

Around 6.9 bolivianos per USD |

Second most stable; low inflation; calm exchange rate |

|

Peruvian Sol |

~9.42% increase |

From 3,525 to 3,883 soles per USD |

Maintains value; inflation targeting policy |

|

Paraguayan Guaraní |

~3% appreciation |

From 7,150 to 6,936 guaraníes per USD |

Solid currency despite earlier fluctuations |

|

Argentine Peso |

~14,127% official devaluation |

From 1 to over 142 ARS per USD |

Severe devaluation; high inflation; instability |

|

Venezuelan Bolívar |

Extreme devaluation (14 zeros removed) |

Multiple redenominations |

Currency crisis; hyperinflation |

Implications

For Travelers

People who visit Guatemala like the quetzal’s steady value. They can plan what they spend because the rate does not change a lot. Hotels, restaurants, and stores sometimes take US dollars. But using quetzals helps avoid extra costs. Many ATMs in Guatemala give good rates. Travelers should look at the rates before they change money. Most cities let people use credit cards. The quetzal’s steady value means prices do not jump fast when you visit.

For Investors

Investors think the quetzal is a safe choice in Latin America. The currency does not change much, so it is less risky. The central bank in Guatemala works to keep things calm. Investors look at remittances and how the economy grows before they decide. The country’s steady growth and strong remittances help the quetzal. But investors should watch for political changes and world market shifts. Spreading out investments can help if things change suddenly.

|

Factor |

Impact on Investors |

|

Stable exchange rate |

Lower risk |

|

Strong remittances |

Supports currency value |

|

Economic growth |

Encourages investment |

|

Political changes |

May affect confidence |

For Forex Traders

Forex traders think the quetzal’s floating rate system is special. The Bank of Guatemala can change the value to keep it steady. Traders need to think about a few things:

-

The central bank steps in to stop big changes.

-

Market forces matter, but the bank can limit big moves.

-

Guatemala has problems like poverty, inequality, and many people with informal jobs.

-

Natural disasters and government issues can also affect the quetzal.

Traders should watch economic news and what the central bank says. Knowing these things helps them make better choices when trading the quetzal with other big currencies.

The Guatemalan Quetzal is one of the most stable currencies in Latin America. Good government rules and steady remittances help keep it strong. This helps travelers because they know what prices to expect. Investors have less risk, and forex traders see only small changes.

-

Travelers will see steady prices. They should check rates on trusted sites like Wise.com or Exchange-rates.org.

-

Investors and traders need to watch for political changes, new building projects, and remittance patterns. These things can change the currency’s value later.

FAQ

What makes the Guatemalan quetzal stable?

The quetzal is steady for a few reasons. Remittances from other countries are strong. The central bank acts carefully when needed. The economy grows at a steady pace. The central bank helps if there are problems. Remittances bring in foreign money. These things stop the quetzal from changing a lot.

Can travelers use US dollars in Guatemala?

Many hotels and stores take US dollars. Most small shops and markets want quetzals. Travelers get better deals with local money. ATMs in cities make it easy to get quetzals.

How does the central bank support the quetzal?

The central bank checks the exchange rate every day. It uses special tools to stop quick changes. The bank does not set the rate but helps when needed. This makes people trust the currency more.

Why do remittances matter for the GTQ?

Remittances bring US dollars into Guatemala. Families spend this money on daily needs. The extra dollars help keep the quetzal steady. Remittances are now almost 20% of the country’s GDP.

Is the quetzal a good choice for forex traders?

The quetzal does not change a lot. Traders see fewer big moves than with other Latin American currencies. The central bank and strong remittances help keep it steady.

Related content