bank of china

The Bank of China (BOC; Chinese: 中国银行; pinyin: Zhōngguó Yínháng; Portuguese: Banco da China) is a state-owned Chinese multinational banking and financial services corporation headquartered in Beijing, China. It is one of the "big four" banks in China. As of 31 December 2019, it was the second-largest lender in China overall and ninth-largest bank in the world by market capitalization value,[7] and it is considered a systemically important bank by the Financial Stability Board. As of the end of 2020, it was the fourth-largest bank in the world in terms of total assets, ranked after the other three Chinese banks.[8]

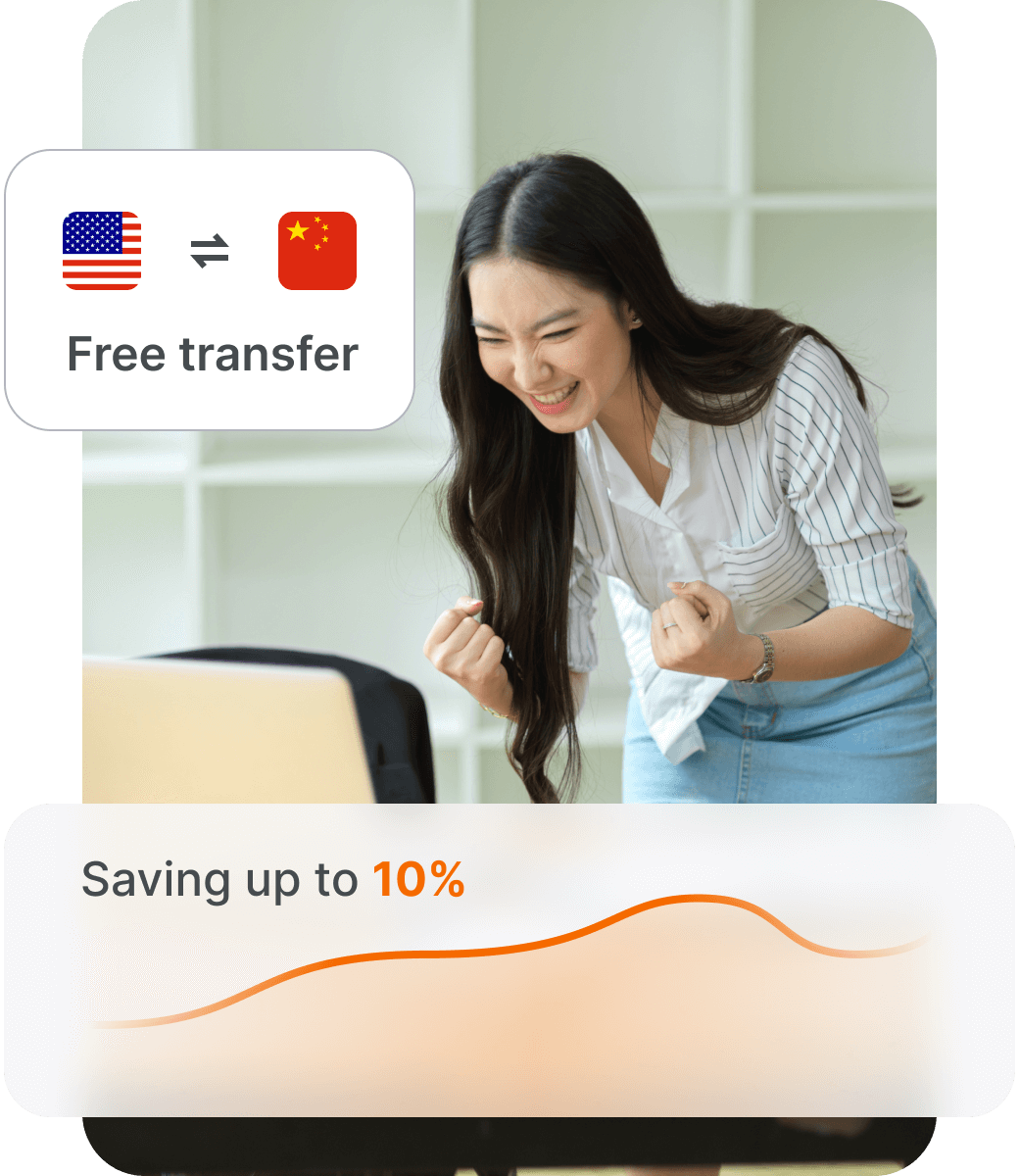

Use XTransfer for cheaper international bank transfers

About bank of china

- Company typePublic State-owned

- IndustryFinancial services

- Founded1905 ; 120 years ago ( 1905 ) (as Da-Qing Bank ) 1912 ; 113 years ago ( 1912 ) (as Bank of China) 1979 ; 46 years ago ( 1979 ) (re-established)

- HeadquartersBeijing , China [ 1 ]

- Key peopleGe Haijiao ( Chairman & President )

- ProductsConsumer banking corporate banking investment banking insurance private banking private equity mortgage loans credit cards investment management wealth management asset management mutual funds exchange-traded funds index funds

- RevenueCN¥ 503.81 billion $73.23 billion [ 2 ] (2018)

- Number of employees306,322 [ 4 ] (2021)

- Websiteboc.cn bankofchina.com bank-of-china.com bocusa.com

What is a SWIFT code?

A SWIFT code is an 8 or 11 character code used in banking to facilitate transactions and identify the bank.

What is the purpose of a SWIFT code in international transactions?

SWIFT codes are used to route international financial transactions to the correct bank and branch. It facilitates the smooth and accurate transfer of funds between different banks and countries, ensuring that the transactions are processed correctly and securely.

How do I find my bank's SWIFT code?

You can find your bank's SWIFT/BIC code in the statements of your bank account. You can also use our SWIFT/BIC finder to get the right code for your transfer.